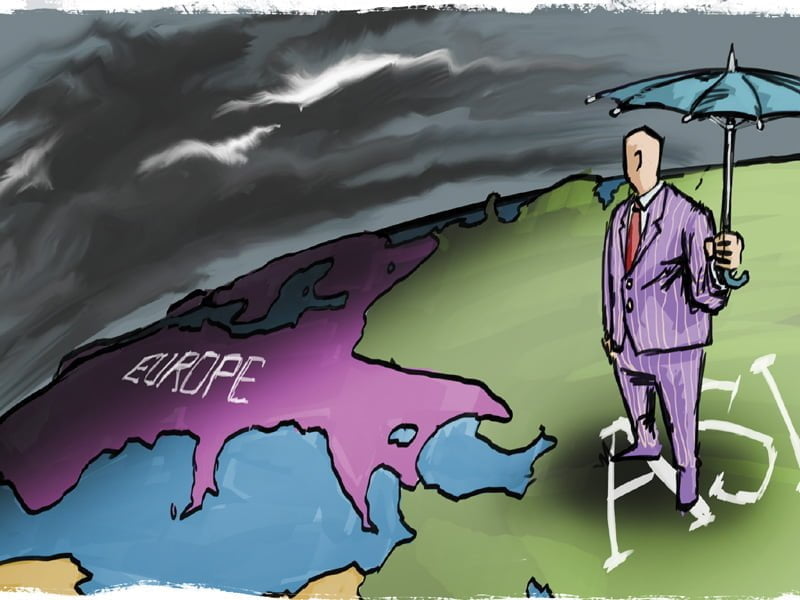

Bubble trouble: The spectre of speculation haunts the ruling class

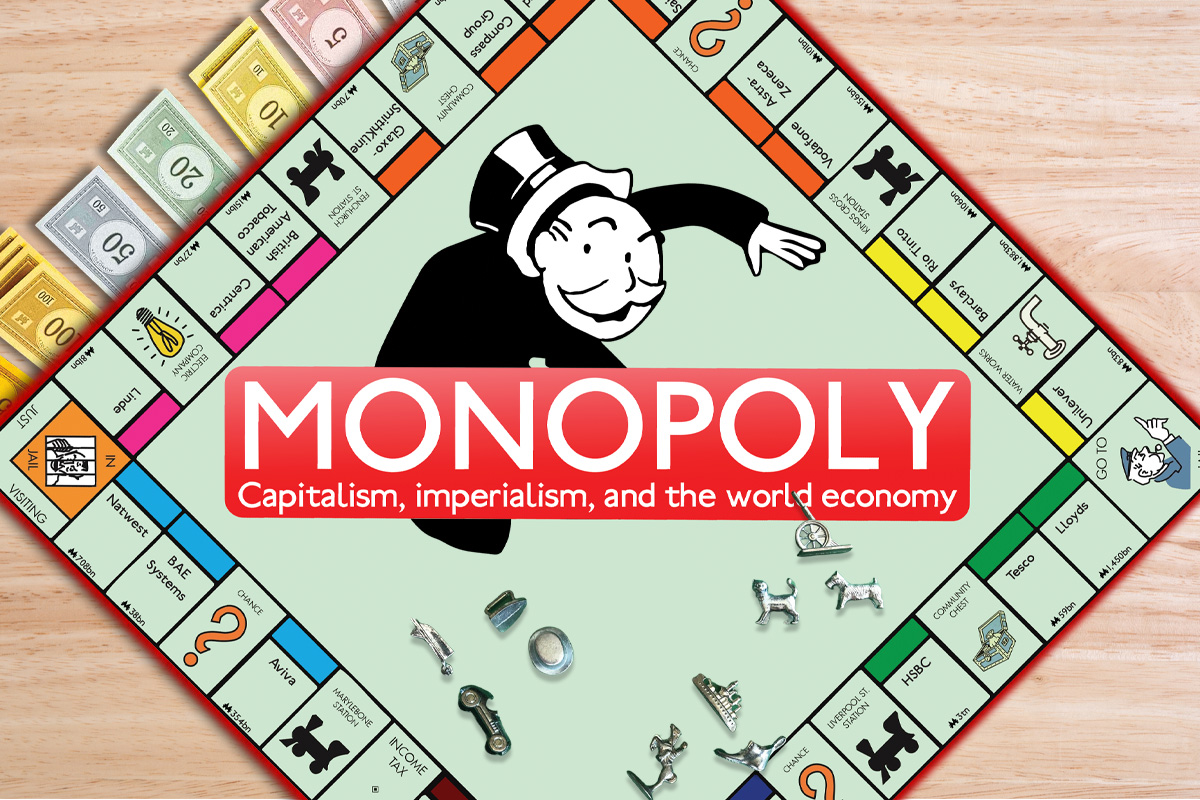

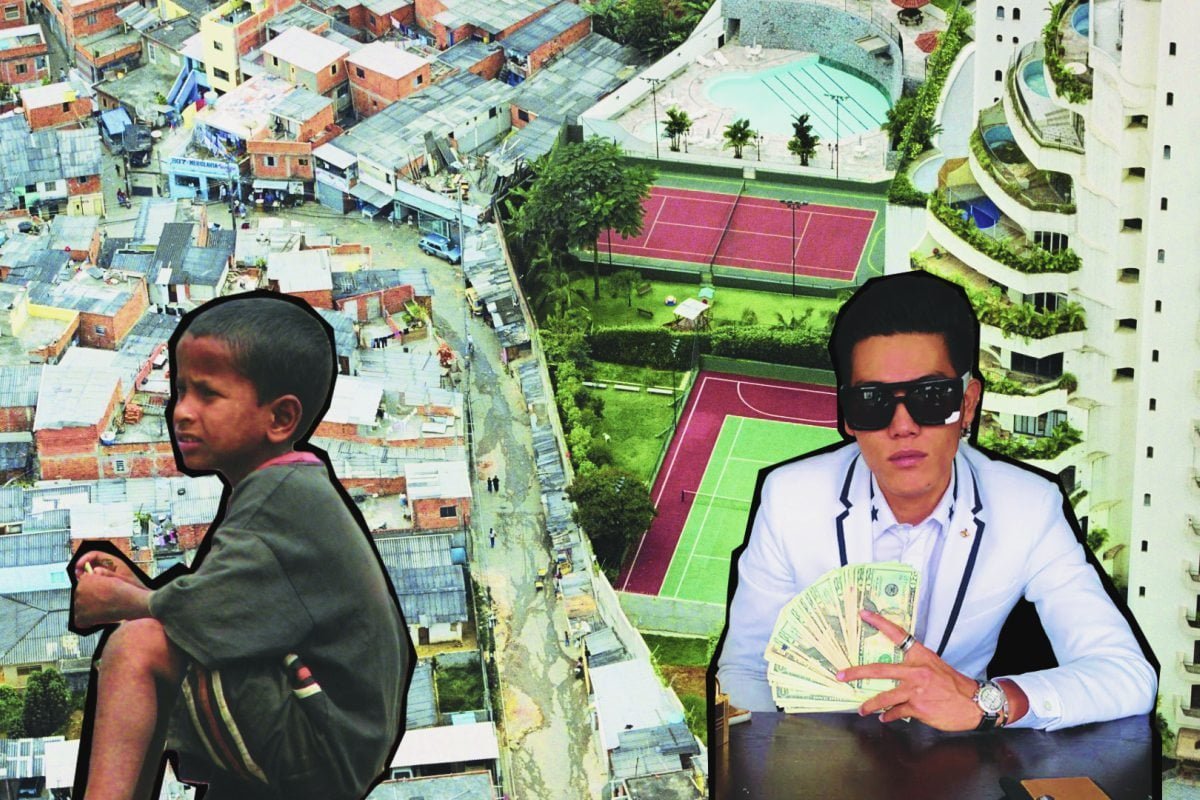

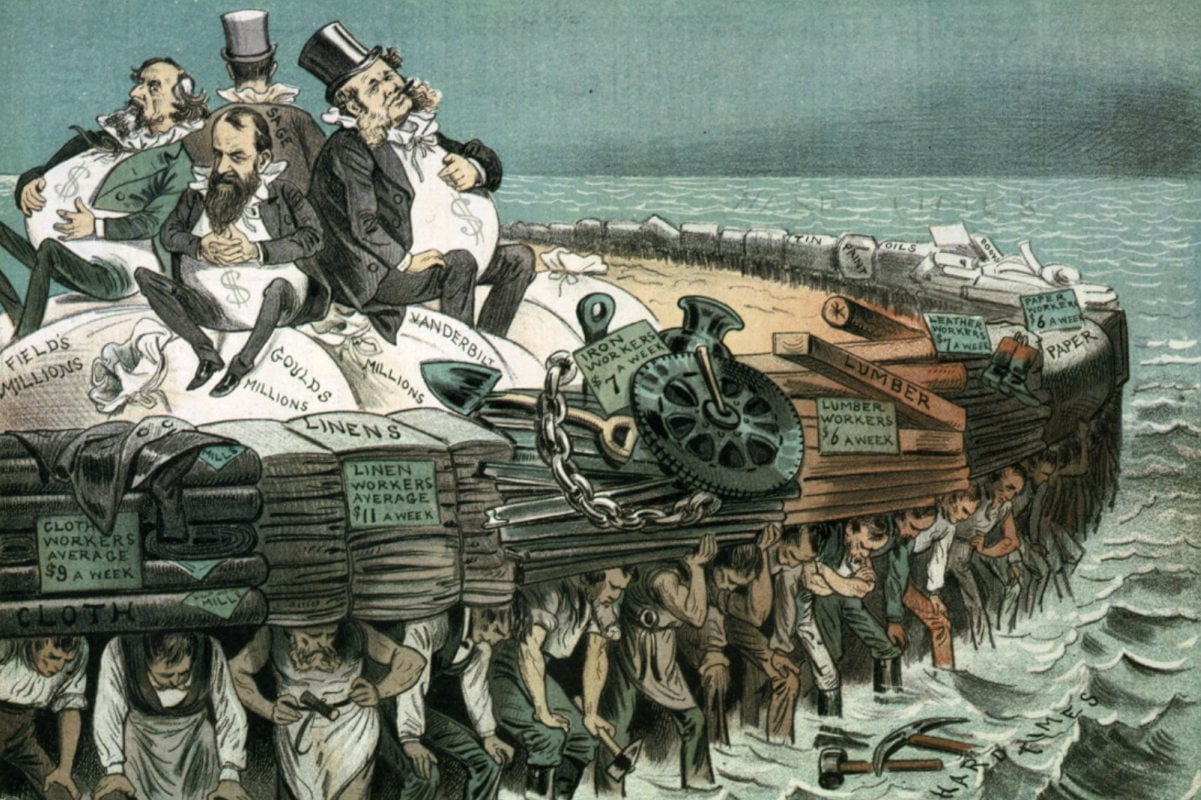

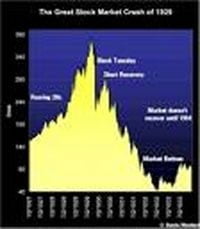

Wobbles on the stock market are intensifying fears that the bubble around AI could burst at any moment, with cataclysmic consequences for the whole world economy. To end this casino capitalism, we need a revolution against the billionaires.