From time to time, governments charged with managing the crisis-ridden capitalist system like to pretend that they have something called an industrial strategy: a grand universal plan for managing and developing production in the so-called ‘national interest’. But, as Steve Jones explains, there is no way forward within the confines of capitalism.

From time to time, governments charged with managing the crisis-ridden capitalist system like to pretend that they have something called an industrial strategy: a grand universal plan for managing and developing production in the so-called ‘national interest’.

Even in recent decades, where arguments against state intervention and in favour of the freedom of the market (to exploit and steal) have become the dominant economic paradigm for capitalist governments, this belief in the value of an industrial strategy has persisted, even if the evidence for its existence seems somewhat tenuous.

Indeed, it appears that there have been three industrial strategies just in the last ten years. According to Larry Elliott in the Guardian on April 16:

“…Britain’s problem has never been the lack of a plan. There have been plenty of those down the decades. Nor were all the plans useless, although some of them were. Rather, there has been too much chopping and changing, a failure to stick at anything for long. Ministers regularly deliver lectures about the need to eschew short-termism but hardly lead by example.”

In 2015, the Tory minister responsible for industry, Sajid Javid, undertook a plan which, as Larry Elliott explains, involved “setting out a far more deregulatory and small-state role for government”. Javid became known for always being at a drinks party or junket holiday when yet another industrial disaster was being announced.

No more business as usual

Given the problems that now lie ahead for UK industry, it was inevitable that the government would decide to revisit this question, even though the Business, Energy and Industrial Strategy select committee quickly warned (in March of this year) that something fundamental was needed and that “business as usual” was not an option.

As a result, after her unelected rise to the office of prime minister last year, Theresa May announced that it was time to look at developing a new industrial strategy, and a grandly-named Industrial Strategy Commission was formed to look at this, staffed by academics – dames, doctors and professors – all united by the single fact that few (if any) of them have ever worked or possibly even visited an actual factory or workshop.

As we shall see, the whole concept of an industrial strategy under capitalism is based on a number of falsehoods: that the interests of “the country” and big business are one and the same; that just tampering with a system will resolve fundamental problems; and, in particular, that industry will triumph over finance capital in “the common good”.

No doubt the commission members were keen to look on the bright side of things. Its interim report (“laying the foundation”), published in June, set the ball optimistically rolling, starting with the introduction by its chair, Dame Kate Barker:

“The business sector is…supportive of a long-term, clear and ambitious industrial strategy. This view is shared by firms of all sizes, and by new innovative entrepreneurs as well as established firms. There is a big shift in thinking about the weaknesses of the UK economy, the challenges now facing us, and how the role of the state should develop to tackle these issues; triggering welcome recognition of the need for fresh ideas.”

Well that is a bold claim to make.

Let’s assume that for the moment the business sector (i.e. British and international capitalism) is in some way now keen to see an industrial strategy for the common good. But then what does this mean?

“Industrial strategy refers to the strategic, long-term co-ordination of all interactions between the state and the economy. It should become the organising principle for UK supply-side economic policy across all government departments.”

The foreword then continues:

“After a decade when growth has generally disappointed, and facing the uncertainty following the EU referendum, policymakers should grasp the opportunity this consensus provides. The Government must quickly set out a clear timetable for the development and implementation of the new industrial strategy.”

“Generally disappointed”? This is something of an understatement.

Disappointment and shortcomings

The first section of the report sets the scene for what all this “disappointment’” has involved:

“The weaknesses and challenges affecting the UK economy are significant: poor productivity performance; pronounced regional differences in economic performance; a high degree of centralisation; a low rate of investment; uneven skills distribution; a weak trading performance and a weakening diffusion of innovation.

“The UK’s current and past industrial policies and practices have significant shortcomings and are not sufficient to address the challenges facing the UK nor capitalise on future opportunities. Lessons must be learnt from them and the decision-making processes and understanding that underpins them altered.”

Significant shortcomings indeed.

Later on the report returns to the theme of the actual dire state of economic affairs and what must be done:

“Summer 2017 is a critical moment for the UK economy. The political uncertainty caused by the election outcome comes with a backdrop of growing economic concerns, with signs that the uncertainty caused by Brexit is having a negative material impact on the economy. Now more than ever the UK requires strategic economic management – and this is what we mean by industrial strategy. Long-term strategic management of the economy can enable the UK to respond to current challenges and make the necessary investments in our people, places and industries to achieve greater future prosperity.”

“The weaknesses and challenges affecting the UK economy are significant and are not recent but have developed over decades. In the decade since the financial crisis some have become more apparent, whilst others have worsened, and they are underlined by the new uncertainties caused by Brexit. To highlight the challenges is not a counsel of despair, but necessary to understand the starting point and context for a new industrial strategy.”

“UK productivity in 2015 was 16% lower than the G7 average. The UK has also experienced a pronounced slowdown in productivity growth in the decade since the financial crisis – the so-called productivity puzzle, in part due to the financial services sector and declining North Sea oil. This has coincided with an unprecedented slowdown in real wage-growth over the same period.”

So not a good picture then.

What is to be done?

Anyone toiling through this report will at this point be confronted with a series of graphs further outlining just what a pathetic state the UK economy is now in. So what does the report now suggest should be done?

“A new strategy must be shaped by analysis of current economic weaknesses and challenges and how to address them, an assessment of past and present policy shortcomings, and an understanding of future anticipated change.”

It goes on:

“Industrial strategy requires long-term objectives. It should seek to achieve sustainable economic development and enable the economy to deliver prosperity that is widely shared; address persistent weaknesses in the UK economy; mobilise the private sector to drive innovation and productivity growth; establish a clear rationale for public investment to support industrial development and provide a framework for science and innovation investment.”

Not much then! But hang on, there’s more.

“An industrial strategy must be informed by a positive vision of a future destination for our country and motivated by an urgent sense of national purpose. This can be achieved by reframing the challenges the country faces as strategic goals to be met.”

“Our assessment is that the strategic goals of the state are: decarbonisation of the energy economy; ensuring adequate investment in infrastructure; developing a sustainable health and social care system; unlocking long-term investment; supporting high-value industries in building export capacity, and enabling growth in all parts of the UK.”

Everyone a Keynesian now?

At this point – and there is an aptly named executive summary printed early on, so that bored readers can avoid having to read all 50 plus pages of the report – you might be wondering when the details of this new cunning plan to save British industry are ever going to appear. In truth there is a long wait. Most of the time the report seems happy to throw as many buzz words at the reader as its authors can get away with, alongside constantly reminding us that what is needed from an industrial strategy is that it is a strategy and that it deals with industry – a very cunning plan indeed.

In fact, it is very difficult to identify any actual concrete ideas here. But after a long while some pointers do emerge:

“Competition policy: A strong competition and state aid regime is an essential component of industrial strategy, to enable innovation, new entry and structural change. Competition policy, regulatory functions and consumer policy need to be joined up to bring a strategic perspective to making sure markets function well.”

State aid? Surely not. We have been constantly told that capitalism is far more dynamic and efficient than the state and that the best thing the public sector could do is disappear. Yet here we have a report suggesting that our pioneering entrepreneurs require state funding to get them out of a pickle.

It doesn’t stop here, as the report now goes on:

“Investment: A new strategy should seek to increase the UK’s investment rate and achieve a more diverse financial ecosystem. The government should increase and co-ordinate public investment and ensure financial regulation is consistent with industrial strategy objectives. It should encourage industry, institutional investors and venture capital to increase and unlock long-term investment.”

The reasoning for this wishful thinking about increasing and unlocking all this money is explained:

“The UK’s low investment rate is a factor in its sluggish productivity performance, with business investment in particular trailing behind most other G7 countries and expected to decline further in the short-term. This does not mean there is a straightforward remedy – and it is not the job of an industrial strategy to determine how and where private enterprises should invest. However, it is clear that the sustainable development of any capitalist economy depends upon plentiful capital, invested efficiently in productive and innovative activities. Industrial strategy is legitimately concerned with ensuring that private investment is aligned with the public interest, as far as possible. “

So any ideas then?

“Greater diversity within the financial ecosystem is essential for a successful industrial strategy. The UK’s investment rate is too low, and a key factor in explaining poor productivity performance. We believe the government should increase public investment, in a co-ordinated manner, and consider how to ensure that financial regulation is consistent with industrial strategy objectives where possible. There is no simple, singular solution to the dependence of venture capital on government support, or the reluctance of large firms to reinvest their profits; the adoption of a coherent, long-term industrial strategy will help, but issues such as these should be recognised as impediments to sustainable development and monitored as such.”

Or no solution at all under capitalism, in fact.

So how is this to be done? The authors of the report have an idea:

“The government has an enormous influence on the economy through its role as a purchaser of goods and services from the private sector; this amounts to about one third of all public sector spending (£242 billion in 2013/14). In addition to direct government spending, a substantial amount of national infrastructure is privately funded in highly regulated sectors, such as energy, where the government has both substantial financial exposure (though, for example, loan guarantees) and a high degree of effective control. This amounts to around 30% of the total £300 billion national infrastructure pipeline up to 2020/2021. There has been an often expressed and long-held ambition to use this purchasing power as an instrument of industrial policy. To date this has not been realised, but it could be in the context of a new industrial strategy.”

At this point you are probably wondering if the last seven plus years of austerity cuts ever really happened.

In passing, it must be galling for these people to have to announce that state-spending still plays such a critical role in keeping the capitalist system afloat. In fact, capitalism has always been happy to suck as much money from the public purse as possible, usually offering little in return, be it in the form of grants, “awards”, preferential conditions, special enterprise zones or just through huge public-sector projects such as Crossrail.

Pipe dreams

Hold on, the report sees another problem:

“To achieve this, there will need to be a change in mindset from the one that regards the goal of procurement policy to be solely to achieve short-term cost savings, to one that recognises that only through driving innovation will the long-term goals of the state be met.”

A change in mindset? After decades of being told that in these difficult times the state sector has to cut costs, become more “efficient” and generally avoid spending more than needed – to always go for the cheapest option – now the authors of the report want to use this state spending as an economic tool, to provide a helping hand – state benefits for the rich with no means testing it seems – whatever the cost.

The truth is that this report is built on a series of pipe-dreams: that adequate finance can be made available (possibly via new state banking sources or the sudden generosity of venture capitalists); that the state can now start spending like mad to provide a boost to industry; and – most seriously – that British industry will just abandon the habits of a lifetime and use this money, not to boost profits and share dividends, but instead to address the dire state of under-investment and low productivity that has dragged down the UK economy.

The reality is that whilst the capitalists function as a class (despite what they might say to the contrary), they also function as individual capitalists in competition with and against each other, with the aim of maximising wealth for themselves, first and foremost. If the so-called national interest – or even just the rotten interests of British capitalism as a whole – coincides with this then fine, but if not it is just too bad: money is money. Past dreams of a national industrial strategy have all floundered on these dangerous rocks.

Another factor that the authors of the interim report seem not to have fully grasped is that we have increasingly seen the dominance of finance capital over industrial capital. This will not have come as a surprise to Marxists, as Karl Marx predicted 150 years ago that this would happen as capitalism matured and entered into senile decay.

This process has also been reflected in the dominance of finance capital inside the political wing of the ruling class: the Tory party. The gravitation towards finance has been fuelled by a lust for cheap and easy profits. In recent times it has become a safer and more profitable route for capitalists seeking to protect and expand their wealth. It is one reason why the banker-dominated Tory-led government from 2010 onwards prioritised austerity over industrial stimulus, as the fear of sovereign debt (as demonstrated by Greece) was always going to frighten the financiers more than the industrialists.

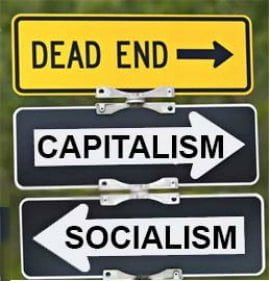

The dead end of capitalism

The report correctly notes that there has been an ongoing problem with getting funding for industrial production at all levels. As a result, the authors can look no further than the state to resolve this shortfall. What a condemnation of the so-called dynamic and innovative capitalist system, its banks and investors.

The report correctly notes that there has been an ongoing problem with getting funding for industrial production at all levels. As a result, the authors can look no further than the state to resolve this shortfall. What a condemnation of the so-called dynamic and innovative capitalist system, its banks and investors.

The fact that the interim report spends so much time saying nothing and ends up being more than a little vague about any actual proposals suggests that even its authors are aware in some way of the problems faced in establishing any sort of nationwide strategy that will have an effect. They can see the long term problems that have woven themselves into the DNA of big business and can see the need to do something about it. But the problem remains: what “solutions” under this system will work?

The authors of the interim report want us to believe that strategic economic management, agreed and accepted by all, where the state operates as an “enormously powerful actor” on the economic stage, will resolve all problems. Even if they could pull it off then still the fundamental problems and contradictions of capitalism in crisis would not be solved. In the end, the bosses would return to self-interest, short-termism and – as always – trying to get the working class to pay for the crisis.

The deep-seated problems of British (and world) industry can be solved – but not by capitalism. What is needed is a socialist plan of production, operated under a system of workers’ control and management. With the profit motive and the chaos of private ownership removed then industry could be developed, modernised, and made more productive for the benefit of all, not an elite few. Industry could be turned to the task of producing what society needs, rather than just pushing out commodities for sale in order to produce the maximum profit for the rich.

Even just nationalising the top 200 monopolies, banks and finance houses would have an immediate impact in transforming the economy, removing the stranglehold of the greedy bankers and freeing up the resources that are currently sitting dormant. That trillions of pounds and dollars are just hiding away in banks and financial institutions is something that the report has nothing to say about, other than by implication about the failures of banks and speculators to invest under current conditions.

That the best minds to be found by capitalism could come up so short in the wild search for an industrial strategy to arrest the long-term decline of UK capitalism should be a source of great encouragement to Marxists. The fight for socialism remains the only way forward.