Advocates of Modern Monetary Theory (MMT) must feel vindicated. As per their advice, governments across the world are pumping money into the global economy, in a desperate bid to prop up the system.

An estimated $8 trillion in state support has already been spent or pledged by the advanced capitalist countries. $4.2 trillion of this has come from public borrowing. $3.7 trillion, however, has come from expanding the balance sheets of central banks – that is, from the creation of new money.

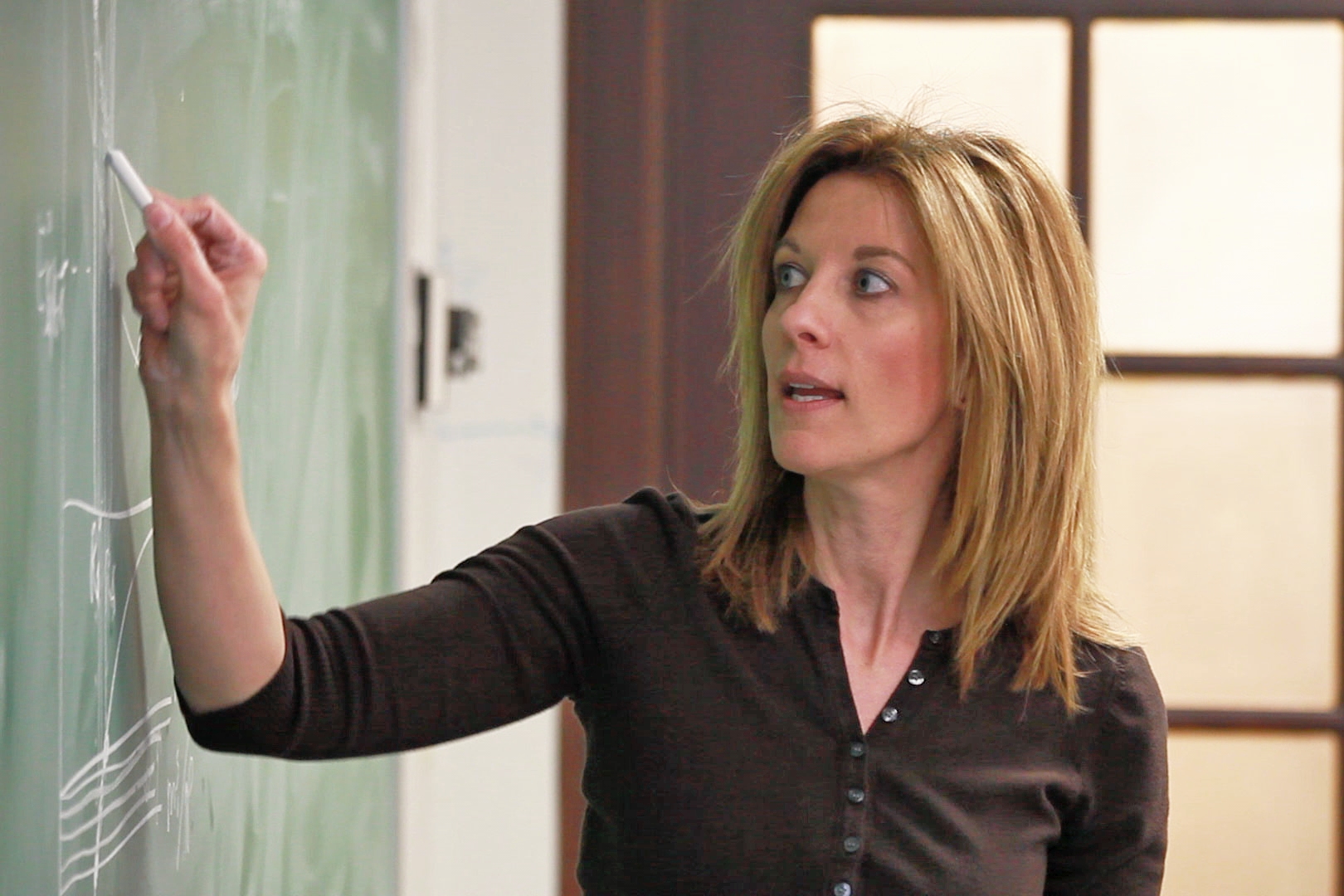

This is exactly what supporters of MMT espouse: for governments, in the face of a slump, to print and spend. And one of the most prominent proponents of this ‘new perspective’ is Stephanie Kelton, a professor of economics and a former advisor to Bernie Sanders in the USA.

‘Copernican shift’

In her new book, The Deficit Myth, Kelton outlines the fundamental tenets of MMT, attempting to provide suggestions on “how to build a better economy” in the process.

In her new book, The Deficit Myth, Kelton outlines the fundamental tenets of MMT, attempting to provide suggestions on “how to build a better economy” in the process.

MMT, the author informs readers, “is a nonpartisan lens that describes how our monetary system actually works”. With this new “lens”, Kelton says, we can undergo a “Copernican shift” in how we view the economy. And, in turn, a previously unimaginable world of possibilities opens up before us. Or so we are promised.

In truth, however, as we have explained in-depth elsewhere, there is nothing new or radical about MMT, nor about the ideas in Kelton’s book.

MMT is neither particularly modern, nor much of a theory. Rather, it is, at best, a rehashing of the reformist and liberal ideas of John Maynard Keynes – of government stimulus and ‘demand-side management’. At worst, it is a dangerous delusion – one that the labour movement and the left should reject.

Capitalism and crisis

It should be stated from the outset that Kelton (like Keynes) is not a socialist, but a liberal. There is not one mention of socialism throughout the entirety of The Deficit Myth. Similarly, at no point does the author suggest that capitalism should be replaced or overthrown.

It should be stated from the outset that Kelton (like Keynes) is not a socialist, but a liberal. There is not one mention of socialism throughout the entirety of The Deficit Myth. Similarly, at no point does the author suggest that capitalism should be replaced or overthrown.

The main propositions of MMT – and its disciples such as Kelton – can be summarised as follows:

- That countries which have ‘sovereignty’ over their currencies (i.e. the ability to create new money) need never worry about going broke, as they can always print more to pay off their debts.

- That inflation is not a risk, as long as there are unused productive resources (i.e. ‘excess capacity’ and unemployment) in the economy.

- That ‘sovereign’ governments do not need to tax and then spend, but should print, spend, and then use taxes to manage effective demand.

With this supposedly groundbreaking understanding, Kelton and other MMTers say, we can “see through the myths and remember once again that we’ve had the power all along.”

“We have nothing to lose but our self-imposed constraints,” the author states, in a nod to Karl Marx’s call to arms in the Communist Manifesto. But unlike Marx and the Manifesto, Kelton and the The Deficit Myth have nothing to say about how capitalism works – and how it doesn’t.

Take the question of inflation. Adherents of MMT state that this isn’t a problem whilst there are productive forces lying idle: unemployed workers who could be put to use; or mothballed factories and machines that could be powered up.

This may be true. Indeed, evidence from recent times shows this to be the case. Enormous amounts of new money has been created by central banks in the USA, UK, Europe, and Japan in the form of quantitative easing and ‘monetary financing’. Yet, because of the downward pressure on prices caused by the slump, inflation has remained subdued.

But at no point does Kelton or any other MMT admirer ask the simple question: why all this ‘excess capacity’ and mass unemployment in the first place? Why all this wasted productive potential? Why so much poverty amidst plenty? In other words, why does capitalism continually enter into crisis?

Imagination

In fact, revealing the bankruptcy of MMT’s reformism, Kelton scandalously accepts these devastating economic crises as simply a natural and unavoidable part of life.

In fact, revealing the bankruptcy of MMT’s reformism, Kelton scandalously accepts these devastating economic crises as simply a natural and unavoidable part of life.

“The rough patches are inevitable,” the author asserts. “There isn’t a capitalist economy on earth that has found a way to eradicate the business cycle. Economies grow and create jobs and then, eventually something happens to throw them into recession.”

“We can and should use discretionary policy to try to tame the business cycle,” Kelton continues (our emphasis). “Smoother rides are preferable to bumpy ones. But no country has figured out how to steer clear of every possible hazard.”

There you have it. We must endure the anarchy of the market. At best, we can attempt to “tame” the invisible hand, as it wreaks havoc on society. And how? Through the use of a “jobs guarantee”, Kelton argues: a programme of state-sponsored employment in socially useful work.

“We have let our imaginations become far too limited, and it is holding us back,” Kelton proclaims. “We have been too restrictive in public policy out of unwarranted fears about numbers recorded in government agency spreadsheets.”

But, in fact, with the example of the ‘jobs guarantee’, we see how little imagination MMT’s leading lights themselves have. After all, the role of this policy, as suggested by Kelton and co., is simply to mop up the unemployed and manage demand in the economy (again, no different from FDR’s Keynesian-inspired New Deal in the 1930s).

Why not go further, though? Why not end unemployment altogether – everywhere and permanently? On the basis of a rational and democratic socialist plan, involving the nationalisation of the key levers of the economy, this is entirely possible. But such a thought doesn’t even enter Kelton’s head.

Debates vs profits

As with Keynesianism, then, we see that the goal of MMT is not to abolish capitalism, but to patch it up; not to overthrow this decrepit system, but to save it.

As with Keynesianism, then, we see that the goal of MMT is not to abolish capitalism, but to patch it up; not to overthrow this decrepit system, but to save it.

Indeed, the title of Kelton’s book gives the game away. Her aim is to argue against austerity, not to fight for socialism. Her target audience is not a radical one, but a liberal one. Like Keynes, she is looking to convince the elites, policymakers, and intellectuals, not workers and youth.

“Spending or not spending is a political decision,” the author states, echoing the reformist mantra about ‘ideological cuts’. “Ultimately, the debate should stay centred on our priorities, our values, and our real productive capacity to care for our people,” Kelton implores. “MMT gives us the lens we need to have an intelligent debate.”

“MMT doesn’t pretend that the government’s currency-issue power gives it the ability to do whatever it wants,” the author clarifies. “Instead, we focus attention on the real limits we face, so we can find the best possible solutions. That’s the way the debate should work – by making real-world decisions based on real-world resources.” (Our emphasis)

But capitalism does not operate according to “political decisions” and “intelligent debates”. It is a system based on production for profit. And it is the interests of the capitalist class, and their insatiable drive for profits and new markets, that ultimately dictates the actions of big business politicians across the world.

This is the reason for the criminal waste of society’s economic resources. The capitalists produce to make profits. If they cannot do this, then workers, factories, and machinery will lie idle.

Governments can print as much money as they like. But if there are no profitable markets to be found, due to capitalism’s crises of overproduction, then this money will just pile up in the hands of the super-rich, or go into fuelling speculative bubbles.

This is exactly what is happening now. And it is why the trillions in QE money and central bank injections have not been able to pull the global economy out of the doldrums.

Illusions and myths

Distracted by her obsessive rant about deficits, government spending, and the intricacies of the monetary system, Kelton never stops to look at the world around her. This should come as no surprise, given her day-to-day environment in the ivory tower of academia and of Washington politics.

Distracted by her obsessive rant about deficits, government spending, and the intricacies of the monetary system, Kelton never stops to look at the world around her. This should come as no surprise, given her day-to-day environment in the ivory tower of academia and of Washington politics.

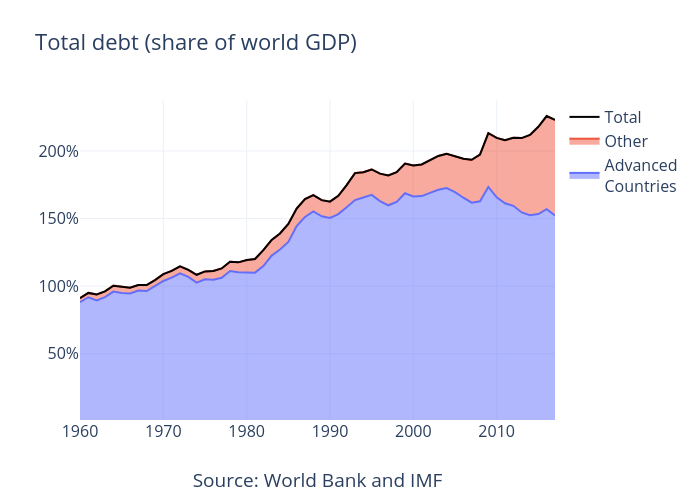

Take another question, for example: that of debt. Kelton and the rest of her MMT ilk say that debts – like deficits – are a myth. Governments with currency ‘sovereignty’ need never default, we are told, since they can always pay off national debts by ordering the central bank to create more money.

Indeed, the book’s author goes one step further and suggests that such states could eliminate their entire public debt overnight, if they so wished, by letting “the central bank buy up government bonds in exchange for bank reserves” – that is, by printing new money to pay off old debts.

“If we really want to make the national debt disappear, there are more painless ways to go about it [than via austerity],” Kelton assures. “It can be carried out using nothing more than a keyboard at the Federal Reserve.”

But this begs the simple question: if it were really so simple, why do monetarily ‘independent’ governments accumulate debt in the first place? Why not just print away the national debt, and not have to worry about it any longer? Why do politicians carry out brutal cuts – and tear apart the very fabric of society – if there is such an easy way out?

Of course, the answer Kelton lands on is the usual refrain of ‘it’s a political choice’; that austerity is ‘ideological’. This line is frequently repeated by prominent left-wingers in the British labour movement also.

Former Labour MP Chris Williamson, for example, is an MMT convert. In his own review of Kelton’s book in the Morning Star, he refers to the ‘deficit myth’ as a “deluded dogma” and “misconceived monetarist mania” pushed by “MPs on both sides of the chamber”.

And although Kelton doesn’t explicitly answer this obvious question about debt in her book, she has been forced to elaborate elsewhere; for example, when pushed by interviewers at the Financial Times.

“So today,” Kelton explains, “governments sell bonds to protect something more valuable than gold: a well-guarded secret about the true nature of their fiscal capacities, which, if widely understood, might lead to calls for ‘overt monetary financing’ to pay for public goods.”

“By selling bonds,” she continues, “they maintain the illusion of being financially constrained.” (our emphasis)

Ah, now we understand! The current broken status quo is all an “illusion”! All we need to do is swallow Kelton’s red pill, follow her down the rabbit hole, and suddenly everything will become clear!

Marxism vs MMT

Like Lewis Carroll’s stories about Alice’s Adventures in Wonderland, such gibberish is only good for reading to children at bedtime. After all, what use is this novel economic ‘lens’ for understanding the world around us, if the conclusion we reach is that ‘the problem is all in our mind’?

Like Lewis Carroll’s stories about Alice’s Adventures in Wonderland, such gibberish is only good for reading to children at bedtime. After all, what use is this novel economic ‘lens’ for understanding the world around us, if the conclusion we reach is that ‘the problem is all in our mind’?

The crisis of capitalism is not imagined, but a painfully real fact for millions and billions worldwide. It is not the product of ‘ideological’ or ‘ignorant’ politicians, but the logical result of the laws of the capitalism system, based on private ownership and production for profit.

Debt is not an “illusion”, but the monetary expression of an objective socio-economic relationship: between capitalist creditors, financial monopolies, and imperialists, on one side; and exploited workers, impoverished households, and dominated nations, on the other. This relationship cannot be wished – or printed – away. It must be overthrown.

The solution to capitalism’s crises does not lie in the reformist reverie offered by MMT, but in organising, building a mass movement, and fighting to fundamentally change our material conditions: to replace the dog-eat-dog laws of capitalism with a system based on common ownership, workers’ control, and socialist planning.

This is why such idealistic nonsense is worse than wrong – it is positively harmful. Yes, Kelton and her MMT crowd might be correct in some of their criticisms of bourgeois economists and politicians who push an austerity agenda. But two wrongs don’t make a right.

Workers and youth must not be taken in by Kelton and the rest of these MMT snake-oil salesmen. Instead, we need to base ourselves on the revolutionary ideas of Marxism – the only ideas that can offer a way forward for humanity.

‘The Deficit Myth’ by Stephanie Kelton is available in hardback and ebook from John Murray Press.