In the last week, Trump announced his intention to raise tariffs on steel and aluminium imports, threatening to start a dangerous trade war with the rest of the world. This could plunge the world economy into another deep slump.

“When a country (USA) is losing many billions of dollars on trade with virtually every country it does business with, trade wars are good, and easy to win. Example, when we are down $100 billion with a certain country and they get cute, don’t trade anymore – we win big. It’s easy!” (Donald Trump, 2 March 2018)

This is nothing more than a declaration of war – trade war – by the most powerful capitalist country in the world.

This is no idle tweet. It is extremely serious and also extremely dangerous for the world economy. This row could very easily escalate and plunge the capitalist world into a deep Depression, as in the 1930s. Investors and governments are rattled, to say the least.

After all, it was not the Wall Street Crash that caused the Great Depression but the introduction of beggar-thy-neighbour policies and tariffs that led to trade wars. This, in turn, caused an unprecedented collapse in world trade, which was only rectified by the Second World War.

We have repeatedly explained that we have entered a convulsive period of sharp and sudden changes. This is another example of this.

Playing with fire

Trump is playing with fire but this is nothing new. The intended increase in tariffs of 25% on steel imports and 10% on aluminium will invite retaliation from other countries, including China and the European Union. Canada, Brazil, South Korea and Mexico will take the biggest hit.

Trudeau said the move was “absolutely unacceptable” and vowed retaliation. Wang Hejun, an official at China’s commerce ministry said imposing tariffs on such grounds was reckless.

“The spectrum of national security is very broad and without a clear definition it could easily be abused,” Hejun said. “If the final decision from the US hurts China’s interests, we will certainly take necessary measures to protect our legitimate rights.”

Trump responded by saying he would slap on even bigger tariffs.

China, which possesses half the world’s steel production, is also affected by the overproduction and glut of world steel and is attempting to dump this on world markets at rock-bottom prices. This is hitting the USA. Some in the US, not surprisingly, consider this “dumping”. Europe has already imposed two dozen anti-dumping measures against Chinese steel exports.

But the implications are far more wide-ranging than this. Trump is threatening to bring down the whole system of world trade constructed since the war.

No wonder the announcement sent stock markets around the world plunging! Wall Street has, at the time of writing, experienced the fourth daily drop in a row.

Beggar thy neighbour

Trump’s announcement goes much further than the tariffs imposed on washing machines and solar panels in January. He has invoked national security as the grounds for new trade barriers. He seems to mean business.

Trump’s announcement goes much further than the tariffs imposed on washing machines and solar panels in January. He has invoked national security as the grounds for new trade barriers. He seems to mean business.

“We must protect our country and our workers. Our steel industry is in bad shape. IF YOU DON’T HAVE STEEL, YOU DON’T HAVE A COUNTRY!” he tweeted. This was a vow to fulfil his campaign promises to defend US workers and industry from unfair foreign competition.

The reaction was predictable. Cecilia Malmström, EU trade commissioner, said the bloc would have little choice but to challenge the tariffs and to impose its own tariffs and other retaliatory measures.

“We risk seeing a dangerous domino effect from this,” she said.

“I don’t like using the words ‘trade war’, but I can’t see how [the US move] isn’t part of warlike behaviour,” Jean-Claude Juncker, the European Commission president, said. He suggested they could target American products such as Harley-Davidson motorcycles, bourbon whiskey and blue jeans.

EU officials will draw up a €2.8bn list of more than 100 US goods targeted for retaliation, which will include US steel and agricultural products like rice, maize, orange juice and cranberries. These would take effect within 90 days of the implementation of any US tariffs.

Roberto Azevêdo, the WTO’s director-general, warned that the world was at risk of descending into a trade war. “The potential for escalation is real,” he said. “A trade war is in no one’s interests.”

“But let’s be clear — no one would win a trade war,” explained Ben Inker of GMO.

Damage, inflation, and uncertainty

The IMF rushed out a statement urging calm. “The import restrictions announced by the US President are likely to cause damage not only outside the US, but also to the US economy itself, including to its manufacturing and construction sectors, which are major users of aluminium and steel,” said Gerry Rice, the Fund’s spokesman.

“This really could be a big deal,” said Brad McMillan, chief investment officer for the Commonwealth Financial Network. “The net effect of the tariffs…will be economic damage, higher inflation and greater geopolitical uncertainty.”

Electrolux, Europe’s largest appliances maker, said it was putting on hold a $250m investment in a cooking factory in Tennessee it had announced in January. “We’re concerned about the impact that the tariffs could have on the competitiveness of our US operations,” the Swedish company said.

Ivan Scalfarotto, a senior Italian trade official, said “This is totally unjustified…and it is harming the global economy,” he said, pointing to the €4.8bn of steel Italy exported to the US in 2017, as well as €1bn of aluminium. “Our producers are not happy and they are right not to be happy. But this is not just about protecting our national interest, it is about protecting our rules.”

The American Iron and Steel Institute said it was “pleased” with the tariff announcement. The Aluminium Association said “we appreciate” the president’s commitment to help the industry.

America First

But Trump is not concerned about the effects elsewhere. He is only concerned about American interests, as he sees it. His motto is “America First” and to hell with the rest of the world. As he said: “Trade wars are good”.

But Trump is not concerned about the effects elsewhere. He is only concerned about American interests, as he sees it. His motto is “America First” and to hell with the rest of the world. As he said: “Trade wars are good”.

In his first days in office he vetoed the Trans-Pacific Partnership, the biggest trade deal in a generation. He intends to review NAFTA, the “worst deal in history”.

In June 1930, President Hoover enacted the Smoot-Hawley Act that imposed swingeing tariffs on imported goods. Canada and Europe retaliated with the introduction of protectionist tariffs, which served to deepen the Depression, as world trade collapsed.

Clearly, given the intensification of world trade since then, the consequences of a trade war today are far worse than in the 1930s. Every country is inextricably linked together in the chain of world capitalism. Every country is subordinated to the world market.

Trump got elected by promising to “blow up the system”, and he could be well on his way to doing it. If challenged in a suit at the WTO, Trump could feel he could ignore it. This, in turn, would help undermine the entire basis for international trade.

The US administration said that 2018 would be the year it brought trade troops to the ramparts. This is dangerous stuff.

World slump ahead

“Today is a great day for America”, stated Peter Navarro, the author of Death by China, who serves as a trade adviser to the President. “That’s the genius of Trump,” he said.

The announcement is also linked to the civil war on trade inside the White House, where the isolationists are gaining the upper hand. This is unprecedented.

We are therefore likely to see the further escalation of global tensions. We have entered a territory where the red lights are flashing. Blinded by his own “genius”, Trump is being propelled into a trade war, the likes we have not seen since the 1930s.

These actions can become the catalyst for a world slump. It is now ten years since the beginning of the 2008 world slump, which was the deepest since the 1930s, and is still affecting us today.

On the basis of a ten-year trade cycle, we are set for another slump shortly. The exact timing is hard to predict, if not impossible, as there are so many factors involved. On top of this, the capitalist system has reached its limits and has clearly exhausted itself. The present “recovery” is the weakest in history. This is a symptom of its terminal decline.

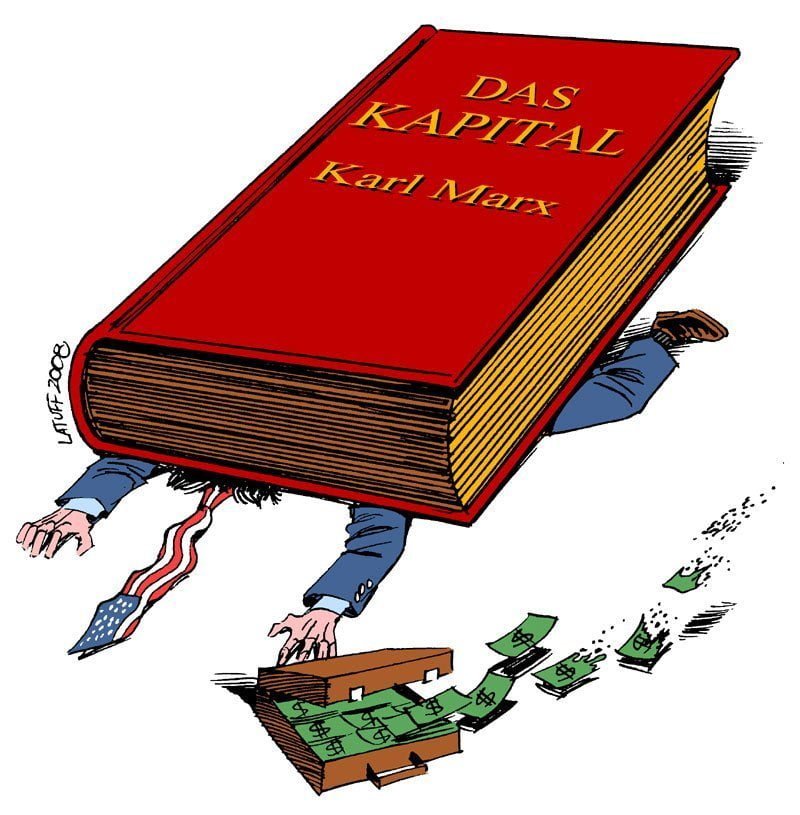

Overproduction

The capitalist system has been subject to periodic crises of overproduction, where the limited purchasing power of the masses comes into collision with ever-increasing expansion of the productive forces.

The capitalist system has been subject to periodic crises of overproduction, where the limited purchasing power of the masses comes into collision with ever-increasing expansion of the productive forces.

The capitalists overcome this contradiction by investing the profits from the unpaid labour of the working class. This serves to expand the market. However, the increased investment simply results in greater productive capacity and the increased churning out of commodities for sale. As capitalism is motivated by the maximisation of profits, falling sales will result in falling profits, leading to a slump.

As Marx explained in Capital (volume 3),

“The last cause of all real crises always remains the poverty and restrictive consumption of the masses as compared to the tendency of capitalist production to develop the productive forces in such a way that only the absolute power of consumption of society would be their limit.”

Therefore, in the final analysis, the cause of capitalist crisis is overproduction and the limited purchasing power of the masses.

Of course, there are many other contradictions inherent in the capitalist system, but the tendency to overproduction is the main one.

Cash piles

One of the main consequences of the slump of 2008 was the rescuing of the capitalism by the state. This also meant the introduction of austerity everywhere. However, the cuts in living standards experienced by the working class also meant a cut in the market for the capitalists.

One of the main consequences of the slump of 2008 was the rescuing of the capitalism by the state. This also meant the introduction of austerity everywhere. However, the cuts in living standards experienced by the working class also meant a cut in the market for the capitalists.

This “lack of demand” had a knock on effect of slashing investment. Why invest when you cannot use the capacity you already have?

Therefore, despite historically-low interest rates and plenty of cheap money, it has not meant increased investment by big business. In Britain, they are sitting on a cash pile of £700 billion. Where they do spend money, it is for unproductive gain. Corporations have been very buying their own shares in order to push up their prices. The shareholders get richer, but they have done nothing socially useful.

The capitalists have become a parasitic class of rentiers. They want to make money not through productive means but purely through speculation. Profitable investments in production have dried up as “over-capacity” becomes more widespread. Why bother to produce, when you can make more money in dealing with risky financial assets?

Asset managers operate as the vultures of capitalism, taking over companies, asset-stripping them, and throwing the workers onto the dole. The centralisation and concentration of capital continues in apace as takeovers become endemic.

A tiny elite moves its capital around the world at the caprice of the billionaire class, which give the process an even more convulsive and unpredictable character. Monopoly capitalism, where a handful of giant corporations dominate the world economy, has brought society into a blind alley.

Drowning in debt

Governments and banks were supposed to be reducing debt levels, which had become dangerously high. But with cheap money debt levels have continued to soar.

The total stock of OECD countries’ sovereign debt has increased from $25tn in 2008 to more than $45tn this year. Debt to GDP ratios across the OECD averaged 73% last year, and its members are set to borrow £10.5tn from the markets this year. Because much of the debt raised in the aftermath of the financial crisis is set to mature in the coming years, developed nations will have to refinance 40% of their total debt stock in the next three years, the OECD said. This will lead to increase turbulence.

William White, chairman of the economic and development review committee at the OECD wrote that:

“Global monetary policy has been ‘ultra-easy’ for many years. Yet it is becoming clear it is now caught in a debt trap of its own making.”

“Simply crossing your fingers and praying that ‘it might never happen’ would seem imprudent, to say the least.

“Continuing on the current monetary path is ineffective and increasingly dangerous. But any reversal also involves great risks. It follows that the odds of another crisis blowing up continue to rise.”

Even some of the strategists of capital are aware that another crisis is coming. But they have no way out. Whatever they do will be wrong. Raising interest rates, as some are doing, will make the debt burden intolerable. Those businesses reliant on cheap credit will go under. This itself could precipitate a new slump.

“This need for preparatory action is amplified, given our scope for reacting with counter-cyclical macroeconomic policies is now limited,” continues White. “These policies might spark the disorder we wish to avoid. Far better then to prepare for the worst, even as we hope for the best.” (Financial Times, 18/2/18)

Fictitious capital

“Hope springs eternal in the human breast,” stated Shakespeare. The capitalists are clinging to false hopes as there is no way of avoiding the contradictions of the capitalist system. However, it is more like the ever-present ghost of Blanco in Macbeth that haunts them.

“Hope springs eternal in the human breast,” stated Shakespeare. The capitalists are clinging to false hopes as there is no way of avoiding the contradictions of the capitalist system. However, it is more like the ever-present ghost of Blanco in Macbeth that haunts them.

Everything points to a massive slump. Just as before the 1929 crash or the slump of 2008, the stock markets are experiencing a “bull market”. Today’s markets have gone through the roof and do not correspond with economic reality.

In terms of Robert Shiller’s cyclically adjusted price/earnings ratio, valuations of the US stock market are as high as in 1929. “This should be a worry, not a boast,” wrote Martin Wolf in the Financial Times. (30/1/18)

The stock market is based largely on fictitious capital, which are values not backed up by real wealth. It is driven purely by speculation, as in the past. The CDOs and other “financial weapons of mass destruction” that have been invented have re-emerged, this time packed with even more explosives.

Debts are rising, while real wages are stagnant or falling. Corporate profits are healthy, but wages are squeezed and production is flat. They have done everything to extract the last drop of profit from the unpaid labour of the working class. Investment in industry is stagnant. At the end of the day, the “recovery” has lasted nine years and has not much further to run.

On a knife edge

Anything can trigger a slump. And when it comes it will be contagious. It will be a world event. Globalisation will simply mean globalised crisis. All the fictitious values built up in the last decade will be destroyed as stock markets worldwide collapse. This will have a knock-on effect in the real economy as production comes to a halt and credit dries up.

When the USA introduced the Smoot-Hawley Tariff Act in 1930, mainly to protect American agriculture, the slump was already underway. However, the restrictions imposed on agriculture had devastating results in Central Europe. These economies had borrowed heavily from French and British banks. When they defaulted it provoked a banking crisis which caused bankruptcies in the US.

With tariffs being imposed by other countries the whole thing spiralled out of control. Governments engaged in competitive devaluation to maintain a share of the dwindling market. The slump had produced rivalries everywhere. It was this that turned a slump into a collapse in world trade and the Great Depression.

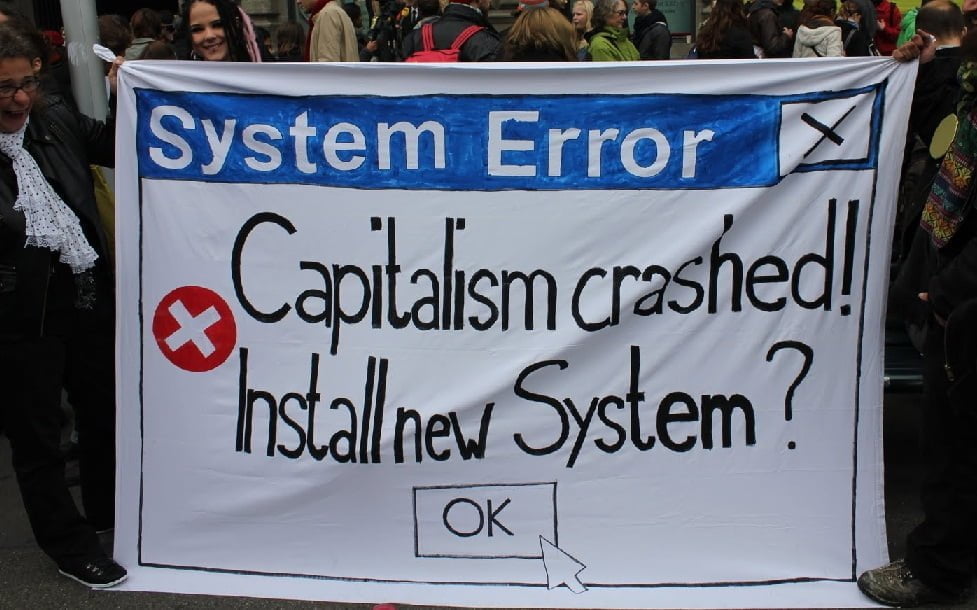

The system is broken

What this reflects is the impasse of the capitalist system. The private ownership of the means of production, together with the nation state, have become massive barriers to economic development.

What this reflects is the impasse of the capitalist system. The private ownership of the means of production, together with the nation state, have become massive barriers to economic development.

The last slump of 2008 represented a fundamental turning point. It ushered in an epoch of crisis, turbulence and upheaval. It introduced austerity and massive attacks against the working class. This is the meaning of capitalist crisis. The system can no longer afford the reforms of the past. Counter-reforms are on the order of the day.

This has resulted in a backlash against capitalism. There is growing anger and bitterness in society aimed at the rich and members of the establishment. This explains the massive class polarisation within society. The old order is crumbling and the capitalist parties are in crisis.

This explains the support for the Labour Party and Corbyn, which appears to offer an alternative. Marx explained that the Old Mole of Revolution would burrow away underground and eventually burst to the surface.

A new slump of capitalism, and a possible new Depression, will have devastating effects, much more savage than in the previous period. Millions will become politicised as they look for a way out of the crisis.

All attempts to patch up the capitalist system will be doomed. There is no way out for the working class on the basis of capitalism.

Only a socialist planned economy, under the democratic control of the working class, can offer a way forward. Only if we abolish the profit motive and the tyranny of the “market economy” can we use the talent and resources of society for the wellbeing of all.

Trump’s threats epitomise the crisis of the system. If he carries through on his threats to impose big tariffs, then all bets are off. As in the 1930s, the capitalist system will descend into a catastrophic downward spiral. Only the socialist transformation of society can save humanity from such a disaster.