The capitalist media have presented the recent policies of Miliband and Balls on the banking system and tax as revealing a ‘growing contempt for capitalism’ amongst Labour leaders. The reality, however, is of confused and contradictory policies that simply create the illusion of defending the poor whilst ultimately defending the capitalist system.

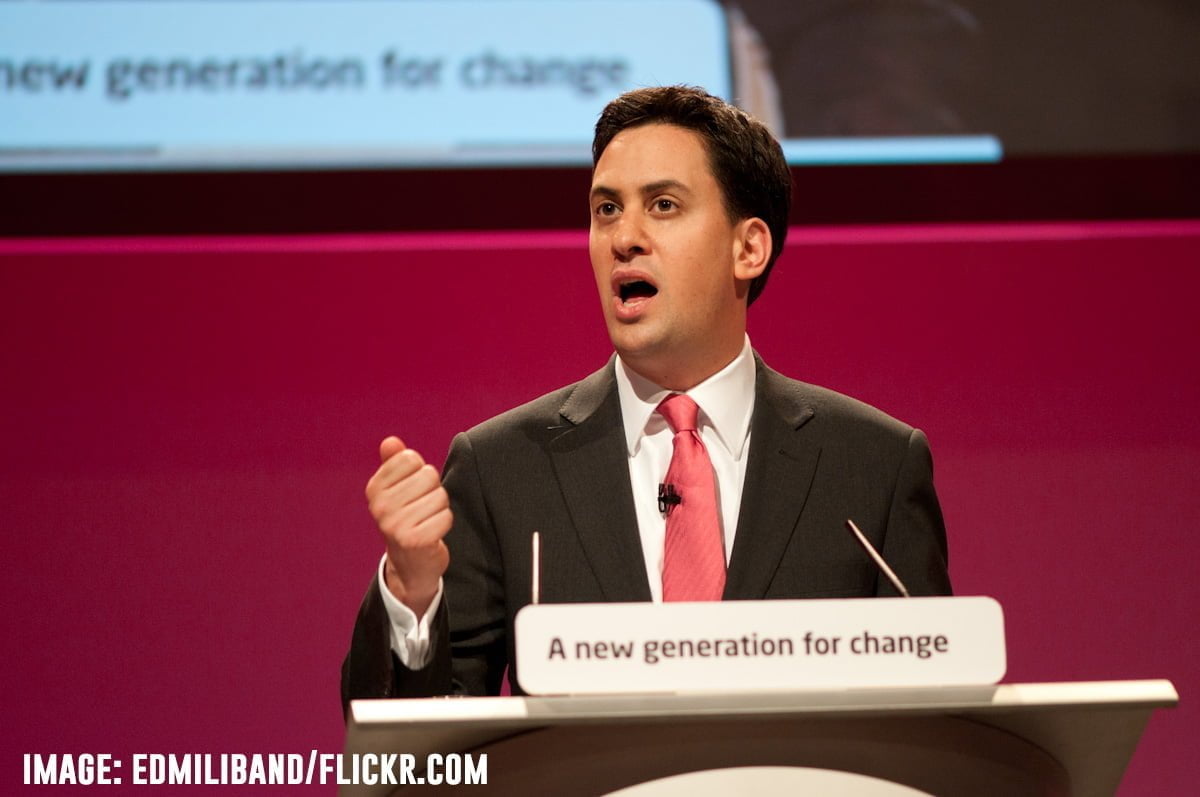

The bourgeois media have predictably taken the bait by presenting the recent policies of Miliband and Balls on the banking system and tax as revealing a ‘growing contempt for capitalism’ amongst Labour leaders. In doing so, they have made these policies seem far clearer and bolder than they really are, and as a result probably more popular. An image is being cultivated of a Labour leadership swinging wildly to the left and finally speaking up for the ‘little guy’. The reality, however, is of confused and contradictory policies (poorly) designed to appease the needs of big business, remould British capitalism to compete with Germany, and create the illusion of defending the poor.

From the point of view of the big bourgeoisie, as represented in journals like The Economist and The Financial Times, socialism is nothing more than idealistic and mistaken populism which merely hinders the market. Therefore for them, all these new policies represent the same ‘anti-business’ socialism, from Balls’ announcements in favour of a 50p top rate of income tax and lower tax for the poorest (both of which are genuinely, if very mildly, progressive), to the plans to break up banking monopolies to foster financial competition (in which there is nothing progressive at all). From the point of view of big business, these are all evidence of a rabid and dangerous ‘anti-capitalism’.

However, the duty of socialists is to analyse politics from the point of view of the class interests of the working class. All that is progressive is what benefits workers in the fight against capitalism, which is not necessarily whatever happens to be a nuisance to monopoly capital.

On this basis, we must critically support the plans Balls has announced to raise the top rate of income tax (i.e. everything ‘earnt’ over £150,000 per year) to 50p in the pound. This, of course, is an extremely limited reform and goes no where to resolving the pressing needs of workers in crisis ridden capitalism. But the money from this will apparently pay for a lowering of tax for those earning little, and as such is clearly in the interests of workers. This move represents the class pressures building up in an increasingly polarised society, which Balls feels he must to some small extent tap in to.

However, the real point of view of Balls – that of managing capitalism for the bosses – is revealed in the same policy statement, where he emphasises a binding commitment to running a budget surplus by the end of the next parliament. This means that, whatever small change he makes to benefit workers in one area, he must make ten or a hundred times as many cuts against their living standards elsewhere. Such a policy will guarantee a crisis Labour government.

The reforms to Britain’s monopolistic banking system outlined by Miliband are not at all progressive and are even more confused. The basic plan is to force banks that reach 25% market share – how this is to be defined is unstated and would be highly contested – to have their branches ‘surplus’ to 25% of the market’s total sold off to new competitors. The idea is to thereby foster competition and, as always, to become ‘more like Germany’, where according to Miliband the banks have “maintained higher levels of small business lending in recent years with commercial banks which are focused on supporting the real economy, not maximising their own profits.”

Capitalists everywhere, including in Germany, operate only to ‘maximise their own profits’. Here we see the sheer utopian blindness of Miliband’s dream of ‘responsible capitalism’. If German banks lend to small businesses, it is not because they are not greedy for profits and have the interests of the nation at heart, but because the historical development of German capitalism and the position it occupies in the world economy make such lending profitable in a way it cannot be in Britain. If Miliband wants to use the power of the state to force banks to not be interested in their own profits, we suggest he call for their nationalisation under workers control.

Such manipulations of the market never work, and often aid the rise of speculative, unproductive ‘investment’. When a similar law in the US was in force, namely before 2007, it was according to the Financial Times “counterproductive, spurring banks to fund growth by relying on alternatives to deposits – the measure used for market share. The reliance on this kind of “wholesale” interbank and short-term debt market funding was one of the key things that contributed to the crisis”, the reason being that avoiding deposits limited the capitalisation of banks – what is known as high ‘leverage’.

Lawyers and policy makers have apparently threatened that the proposal is so complicated and runs so counter to the laws of capitalism, that it would require masses of legislation that would take years, maybe two parliaments, to pass. It would therefore contribute to enormous financial and economic instability for capitalism without giving workers any tangible gains in the process – the worst kind of reformism!

This would therefore prove unpopular with workers who would quite rightly see it merely as evidence of the weak, vacillating character of reformism. For example, it has been pointed out by one leading banker that “forcing people to change bank by selling their local branch is not what customers want.”

Miliband and Balls have clearly and rightly understood that the working class, their social base of support, is increasingly moving to the left and is hostile to capitalism, a mood they need to tap in to for support but cannot do so effectively whilst clinging onto this rotten economic system. Where they can find room for it, they propose mildly progressive reforms of no real impact – such as the bank bonus tax, which will be implemented alongside these anti-monopoly rules. This tax will apparently raise £2bn a year to pay for jobs for young people – something that Britain’s monopoly capitalist system cannot itself deliver.

The Labour movement as a whole needs to let go of the capitalist system, which always drives towards monopoly, inequality and crisis, and fight openly and boldly for the interests of the working class, with no inhibitions or fatal compromises. The true content of the working class’ contempt for bankers isn’t a desire for an artificially competitive banking system, but for one that is publically owned and controlled by the masses to meet society’s needs. That is a socialist policy and it is what the Labour movement needs to fight for.