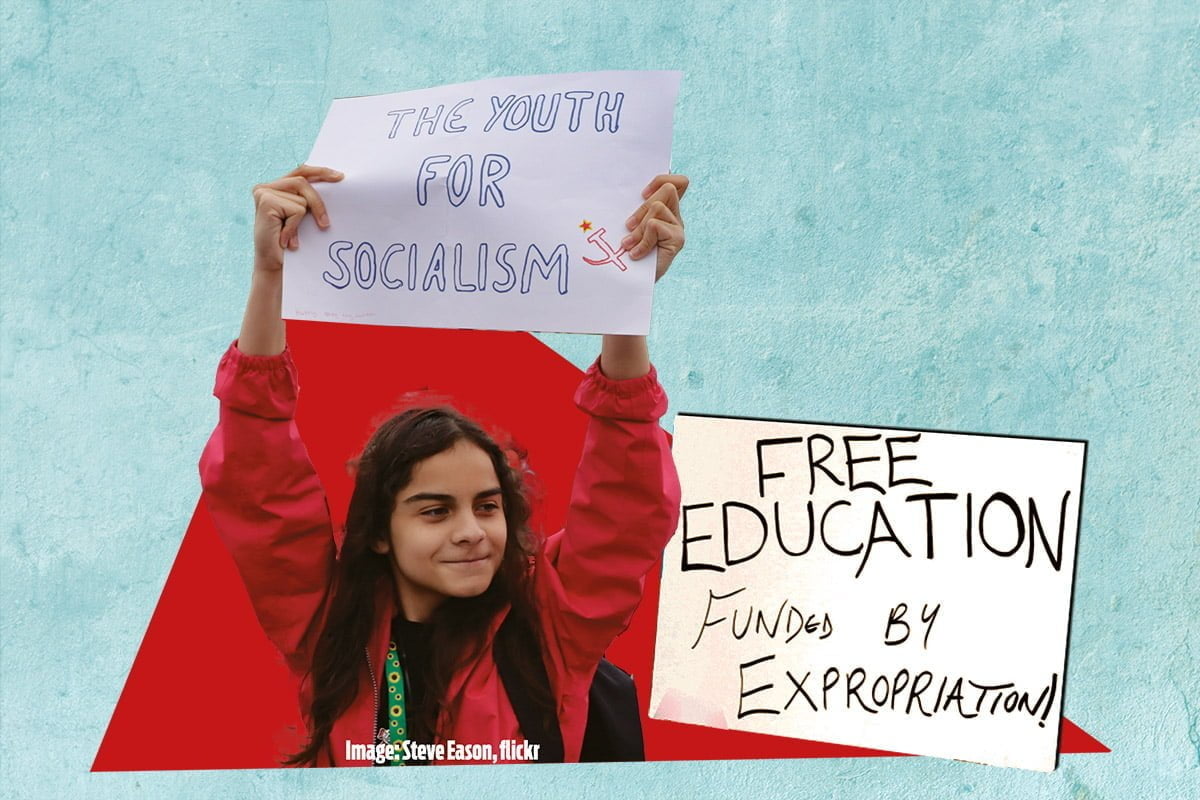

Due to austerity and marketisation, tuition fees have soared, leaving graduates with a mountain of debt. And with inflation now surging, the interest on these loans is skyrocketing. We must demand free education, funded by expropriation.

As inflation soars, interest rates on student loans are set to rise to 12% in England this year.

This comes on top of an increase in National Insurance, council tax, and energy bills, and without any equivalent increase in wages or benefits.

Yet again, we see how workers and youth are being made to shoulder the burden for the crisis of capitalism.

Footing the bill

According to a report by the Institute for Fiscal Studies, interest rates for graduates earning above £49,130 will almost triple, from 4.5% to 12%. This is the highest level of student loan interest since 2012, when tuition fees were increased.

Lower-income graduates will be hit even harder, with interest on their student debts skyrocketing from 1.5% to 9%.

This huge surge in interest will only affect graduates who took out loans since 2012, when the Tory-Liberal coalition pushed up university fees from £3,000 to £9,000 per year.

This generation is once again being taken for a ride. Having already been made to pay for the 2008 crash, they are now expected to foot the bill for capitalism’s latest crisis as well.

Interest and inflation

This interest increase will mean that a recent graduate with a typical student debt of around £50,000 will accrue £3,000 in interest over the next six months. This is three times more than someone would usually repay in a similar timeframe.

For students from the 2012 cohort onwards, student loan interest is linked to the Retail Prices Index (RPI), a measure of inflation. This has risen to 9% today, up from 1.5% last year – explaining the six times increase in interest rates.

At the same time, this highlights the enormous squeeze in living standards that students and graduates are already grappling with.

These sky-high interest rates on student loans, meanwhile, are vastly higher than average mortgage rates or unsecured credit. Students, in other words, are being charged even more by the government than they would be by private lenders.

Saddled with debt

For students entering university next year, interest rates will be capped at a lower level. But this does not mean that they will be any better off.

Instead of ludicrous levels of interest, the repayment threshold for these students will be reduced from £27,000 to £25,000. At the same time, the repayment period will be increased from 30 to 40 years.

Analysis from The Times has demonstrated that these changes will mean that an average university graduate will have to pay back £101,000 in total over their lifetime: more than double what they would under the current system.

These future graduates, in other words, will be paying back student debts well into their 60s – that is, essentially for their entire working lives.

Martin Lewis, founder of MoneySavingExpert.com, has stated that these changes “effectively complete the transformation of student ‘loans’ for most, into a working-life-long graduate tax”.

Eye-watering interest rates and new changes to repayment terms, meanwhile, are likely to put off young people from the poorest households from going to university, for fear of being saddled with debts for the rest of their lives; debts that the government has demonstrated they can inflate at will.

Where’s our money?

The deteriorating state of graduate finances over the past decade is reflected in the debts that students bear upon leaving university, which have risen from an average of £17,000 in 2012, to £45,000 in 2021. And this is before graduates even incur lofty interest rates.

The backdrop to this has been a barrage of cuts and privatisation in higher education. Government funding for universities has fallen from £16 billion in 2010 to £4.9 billion in 2021. Students and graduates are expected to make up this huge shortfall.

At the same time, university staff continue to see their pensions, pay, and conditions eroded by education bosses, leading to waves of industrial action on campuses around the country in recent months and years.

Russell Group universities, meanwhile, have racked up a £2.2 billion cash surplus in the last academic year alone.

So students may reasonably ask: Where is their money going? And why do rates continue to increase, if university budgets are in surplus?

Fight for free education

Right-wingers moan about university students being a privileged minority. But this is blatantly untrue.

In the UK, 40% of those aged 15-64 have a university degree. And this proportion is even higher amongst younger generations, for whom higher education has become a prerequisite of employment.

What these latest changes amount to, in reality, is a further tax on the working class, in order to bail out the capitalists and their system.

Due to the marketisation of education over the last decade, students have been treated as cash cows by university bosses, government ministers, and parasitic landlords. And this latest interest rate hike shows that, under capitalism, there will be no change to this trajectory.

The fight for free education – funded by expropriation – has therefore never been more important: a fight that must be linked up with that of organised workers, against marketisation and austerity, and for the socialist transformation of society.