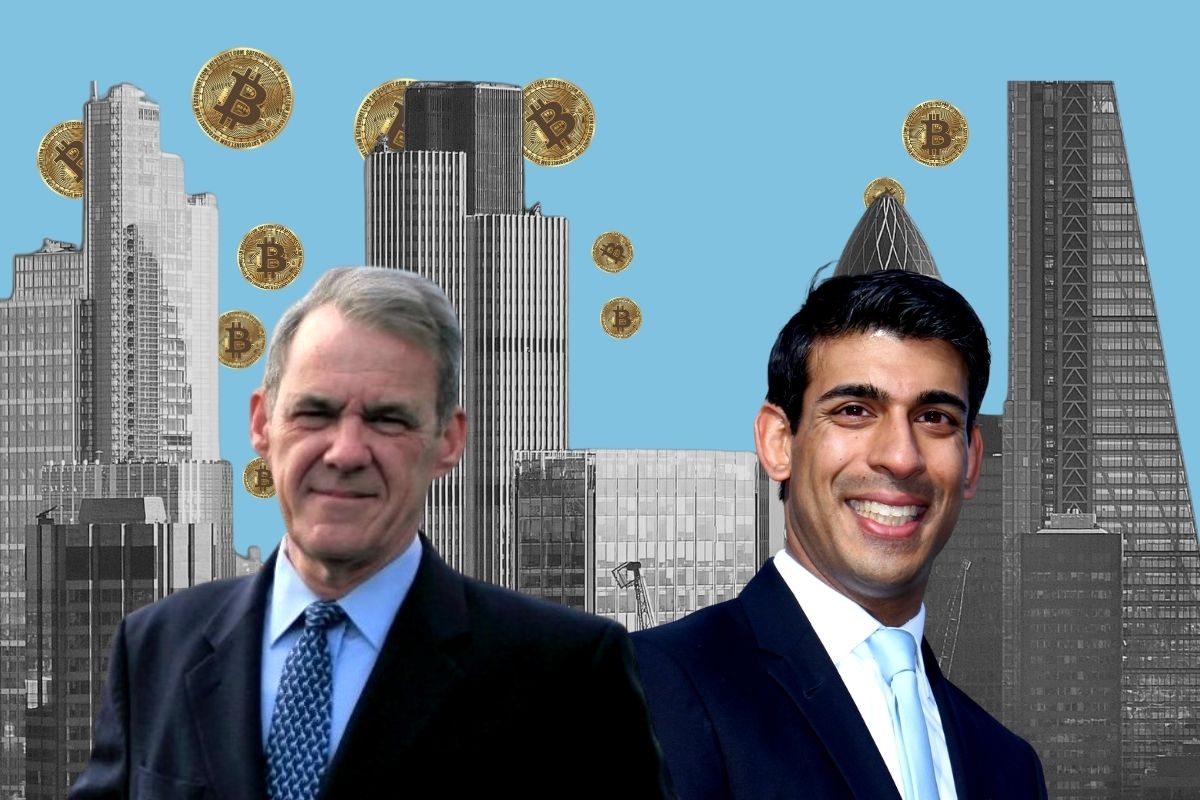

A recently released publication by author Oliver Bullough examines the central role played by the City of London in a global network of tax-dodging and money laundering. This is no accident or anomaly, however. Capitalism is corruption.

Oliver Bullough’s new book Butler To The World reveals how the British establishment descended from possessing a global empire, into being the servants of the world’s oligarchs, kleptocrats and gangsters.

Following on from his previous publication, Moneyland, Bullough’s rolling theme throughout his latest work centres around the comparison between Britain – and the City of London in particular – and a loyal butler, Jeeves, who obsequiously cleans up his master’s misdeeds and follies.

The City has a well-earned reputation for cleaning up ‘dirty’ money from around the globe. And like the butler Jeeves, City bankers and lawyers go to great lengths to protect their extremely wealthy clients from trouble. As long as they are paid well, of course.

Decline

Bullough traces the decline of the British Empire from the Suez crisis, where Britain was defeated militarily in Egypt. This humiliating defeat for Britain became emblematic of its crumbling empire.

Bullough traces the decline of the British Empire from the Suez crisis, where Britain was defeated militarily in Egypt. This humiliating defeat for Britain became emblematic of its crumbling empire.

The British ruling class, in Bullough’s view, was forced to find a new role in this world. No longer commanding the workshop of the world, the British establishment sought to find a new way to make money.

Bullough details examples that have been a feature of Britain’s decline, including: financial deregulation in the postwar period; the rise of offshore tax havens (via British Overseas Territories); the rise of the gambling industry and money laundering; and a deliberate lack of proper oversight by politicians and regulators into the dodgy dealings inside financial institutions.

According to Bullough, one of Britain’s first forays into the ‘butlering’ world was after the Second World War, where the City of London circumnavigated the capital controls of central banks, in what became known as the Eurodollar market.

The Midland Bank started to use the Soviet owned Narodny Bank’s foreign reserves – which were in US dollars – to obtain a cheap source of credit which moved more freely and profitably throughout the financial system. This loosening of the monetary system helped the early dominance of the financiers in the City.

The City grandees in the Bank of England deliberately failed to do anything about this, despite the concerns that other bankers raised. Bullough looks at this in consternation.

But this process was in reality a recognition by the ruling class of the relative decline of the competitiveness of British capitalism. Hence, their outlook became more and more short-term, and geared towards speculation.

Deregulation

Bullough neatly explains the deregulation of the gambling industry. He points out how, when the ‘New Labour’ government accelerated the relaxation of laws around betting, even the industry bosses were shocked at how far they opened the door for them!

Bullough neatly explains the deregulation of the gambling industry. He points out how, when the ‘New Labour’ government accelerated the relaxation of laws around betting, even the industry bosses were shocked at how far they opened the door for them!

Consequently, the UK industry has created around 460,000 ‘problem gamblers’, resulting in two suicides every day.

The book’s author notes that money laundering has also become a large feature of Britain’s decline. He points to a scandal where ‘Scottish Limited Partnerships’ were used heavily by gangs to hide their criminal wealth.

When campaigners highlighted this, the response of government officials was that taking away this ownership structure would hurt the ‘competitiveness’ of the City.

The government then actually extended this loophole, by introducing a British-wide ‘Limited Partnership’ company structure. This allowed for the expansion of money laundering, and allowed the City greater flexibility regarding the ownership status of companies and the profits made within them.

Smokescreen

Finally, Bullough paints a frenetic and blurry picture to explain the British financial regulatory system.

Finally, Bullough paints a frenetic and blurry picture to explain the British financial regulatory system.

Dozens of bodies are responsible for tackling fraud, rule breaking, and illegality, etc. But many of these bodies are severely underfunded and have areas of jurisdiction that overlap, creating confusion over who is responsible for what.

Added to this, there is also the deliberate over-reporting by banks and law firms of ‘suspicious activity’ to regulators. Bullough suggests that having a system of financial regulation that looks very busy and active – but in reality is completely incapable of fighting crime – is perfect for hiding Britain’s role as ‘butler to the world’.

According to Bullough, British authorities are far behind those in the US, who apparently have a much better system for tackling financial crime and swindling.

But Bullough misses the fact that when you are the world’s biggest imperial power, fraud and money laundering are seen as a threat to the ‘legitimate’ profit-making by the dominant wing of the ruling class. Hence the desire for a ‘level playing field’ by those at the top, to prevent others from undercutting their position through ‘dodgy dealings’.

The British ruling class lost their dominant position to the US and others long ago. British industry is uncompetitive on the world market, due to the long-term failure of the capitalist class to invest in modernising industry. The conscious or unconscious turn to make money as a ‘butler’ was simply an acknowledgement of this fact.

Rotten system

In contrast to Bullough, as Marxists we understand that corruption and financial swindling is endemic under capitalism, and always has been.

There is no such thing as ‘good capitalists’ and ‘bad capitalists’. Their entire system is based on the exploitation of the working class – legally or otherwise. It is just that with the system in crisis, the pressure to make profits through non-legal means only increases.

Ultimately, to eliminate corruption or tax avoidance, the answer isn’t simply to tighten regulations, properly fund regulators; or even to replace certain people in power who prioritise a different set of values, as Bullough hints at.

What is necessary is to totally sweep away this rotten system, and for its replacement by socialism. Only then can we rid the world of these parasites, that the British ‘butlering’ business is only too happy to cater for.

‘Butler To The World’ by Oliver Bullough is available to buy from Profile Books.