This week, the Tory government announced that the UK is set to embrace the cryptocurrency craze, in a bid to entice investors from across the world. Instead of welcoming these spivs and speculators, we must expropriate the billionaire class.

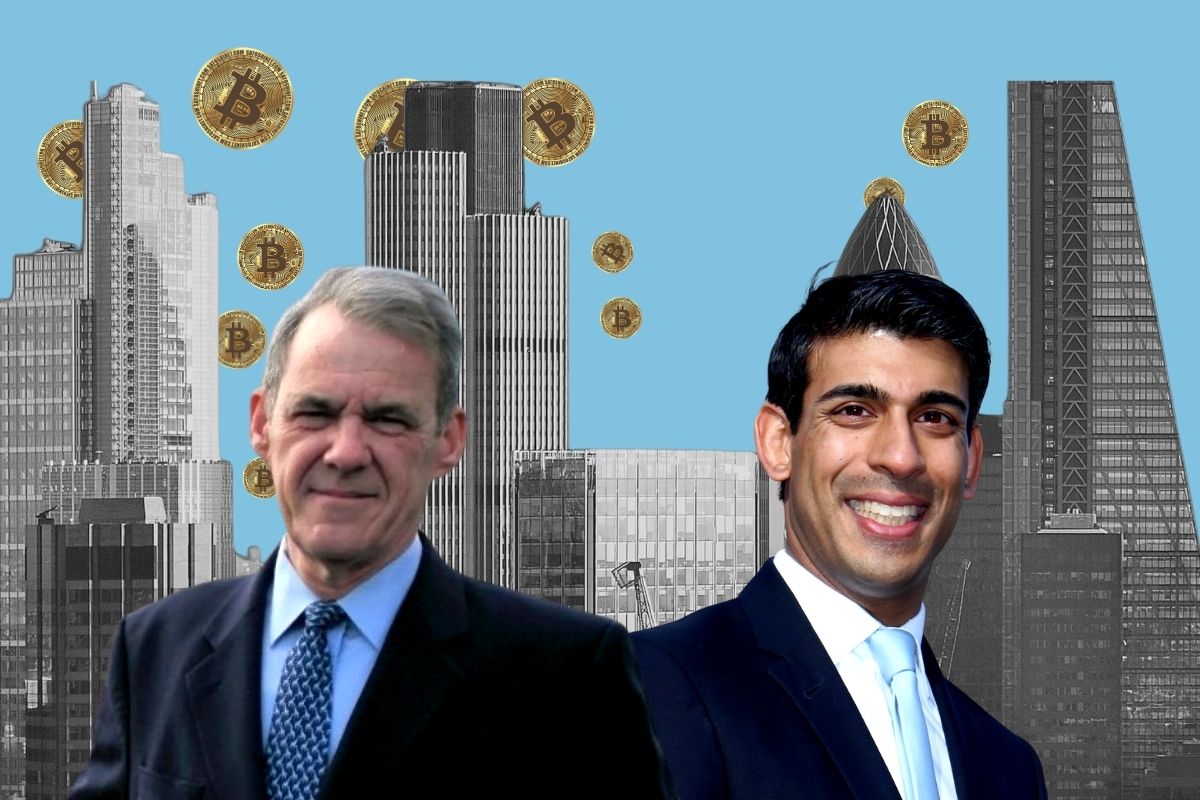

Chancellor Rishi Sunak recently declared that Britain is pushing to become a “global hub” for cryptocurrency. The Tory government is seeking to attract a wave of speculative investment in a desperate attempt to cash in on the ever-growing mania surrounding blockchain technologies and digital assets.

In a speech on Monday, City Minister John Glen stated that the government was determined to show that “the UK is open for business and open for crypto businesses”.

The government has even gone so far as to ask the Royal Mint to create an NFT (non-fungible token) – without even bothering to specify what asset the NFT would be connected to!

Speculative orgy

The world of cryptocurrency investment is notoriously volatile and unpredictable. Furthermore, it is infamous for being a vehicle for money-laundering and criminal activity.

Nevertheless, since the beginning of the pandemic, there has been a speculative orgy in areas such as cryptocurrencies.

This has largely been enabled by the trillions of dollars pumped into the global economy by the ruling class, in order to prevent a complete collapse of the capitalist system, without any profitable avenues for real investment.

As a result, the money poured into cryptocurrencies (such as Bitcoin) has reached obscene levels. As of November last year, the total ‘value’ of these digital currencies was over $3 trillion.

NFTs and SPACs (special purpose acquisition companies) have also taken off, as capitalists and ordinary punters alike desperately search for the next get-rich-quick scheme, without the grubby business and hassle of producing anything real or tangible.

Everyone from former chief of the Bank of England Mark Carney to ex-footballer John Terry are getting in on the act.

None of these so-called ‘assets’ have any inherent value, however. Sooner or later, they are destined to end up like all speculative bubbles do: in an almighty crash. And it is those at the bottom of the pile who will be left to pick up the pieces.

Chancellor @RishiSunak has asked @RoyalMintUK to create an NFT to be issued by the summer.

This decision shows the the forward-looking approach we are determined to take towards cryptoassets in the UK. pic.twitter.com/cd0tiailBK

— HM Treasury (@hmtreasury) April 4, 2022

Decline and decay

The Tories’ turn towards the cryptocurrency craze is the latest reflection of the long-term decline and decay of British capitalism.

For decades, the UK has been a rentier economy, relying not on industry and production for growth, but on financial services and an ever-inflating property market.

Between 1971 and 2011, for example, British manufacturing declined by over two-thirds – the largest drop of any major economy.

In the 1980s, Margaret Thatcher and the Tories were instrumental in cementing a permanent shift away from industry and towards a deregulated financial sector, alongside other parasitic activities.

The result is that today, Britain (and London in particular) is a gangster’s paradise for the capitalists – with the Tory government eagerly welcoming gamblers, crooks, and anyone else who turns up on the UK’s shores hoping to stash away their dirty money.

According to Oliver Bullough, author of ‘Butler to the World’, British capitalism has become a haven for “oligarchs, gangsters and kleptocrats” looking to hide their ill-gotten gains and live a life of luxury and opulence.

The National Crime Agency, for example, estimates that the UK has a £100-billion-a-year problem when it comes to money laundering.

Tory hypocrisy

In an effort to whip up jingoism over the war in Ukraine, the Tory government has clamped down on Russian billionaires like Roman Abramovich, who have made use of the British economy for decades.

This ‘patriotic’ focus on wealthy Russians, however, is entirely hypocritical. After all, the British ruling class is more than happy to host the wealth of despots and unscrupulous capitalists from across the globe.

UAE president Sheikh Khalifa, for example, responsible for the torture of foreign citizens, holds a property empire in London estimated to be worth £5 billion.

It is also no secret that former US president Donald Trump holds sizable investments in Britain, including a loss-making Scottish golf course that claimed £3.3 million in state support from the UK government during the pandemic.

Them and us

Tory plans to embrace the sordid world of cryptocurrencies are only the latest cynical and morally-bankrupt move by a ruling class that prioritises short-term profits above everything else.

At a time when workers in Britain are facing a devastating cost-of-living crisis and rampant inflation, mere days after a brutal jump in energy prices (with more to come later this year), all that Sunak and co. can think of is to open the doors to more speculation and swindling.

Such myoptic thinking reflects the long-term decline of British capitalism, which was once a major global power, regarded as the ‘workshop of the world’.

Now, however, the UK has been reduced to a second-rate player, both economically and politically; a veritable pygmy on the world stage, unable to compete with its rivals industrially and militarily. And it is the working class who are forced to pay the price for this demise.

Expropriate the billionaires

Along with his recent Spring Budget, Rishi Sunak’s cryptocurrency pipe dream provides absolutely nothing for ordinary working-class people, who, after two years of a global pandemic, only have more austerity, cuts, and crisis to look forward to.

This is yet another symptom of the impasse of capitalism, which offers no future for workers and youth. It is time that this entire rotten system was overthrown.

Instead of welcoming spivs and speculators, we must expropriate the billionaires and nationalise the banks and entire financial sector, without compensation, as part of a socialist plan of production.

On this basis, all of the money currently being pumped into speculative bubbles such as cryptocurrencies could instead be used to invest in fully-funded public services and real production, instead of lining the pockets of the capitalists.

Only then will we finally see an end to poverty, inflation, crisis, and all of the other miseries of capitalism.