The global economy is now in its fifth year of crisis. Living standards for the vast majority have been steadily getting worse, with falling real wages and a complete dearth of jobs. Despite this, profits for the biggest companies continue to rise. Adam Booth examines the gaping and growing inequality in the society.

The global economy is now in its fifth year of crisis. Living standards for the vast majority have been steadily getting worse, with falling real wages and a complete dearth of jobs. Despite this, profits for the biggest companies continue to rise.

This gaping and growing inequality has, of course, not gone unnoticed by the capitalists and their mouthpieces in the media. A recent online article by The Economist entitled “The Mismatch”, highlighting the continued rise in profits for big business, begins by saying:

“What went up has not come down. Although the economy has been weak, American corporate profits are high relative to GDP [Gross Domestic Product – i.e. national wealth/output]. Indeed the collapse in 2008 and 2009 was a brief blip in what looks like a long-term upward trend.”

Put simply, an increasing share of the wealth produced within the USA – the biggest and richest economy in the world – is falling into the hands of the capitalists in the shape of profits.

In another recent article, The Economist (10th August 2013) outlines a similar picture for the UK, stating:

“By some measures, the economy is moving from ‘rescue to recovery’…Yet the wallets of many, particularly those on lower and middle incomes, bear little evidence of it. Inflation is relatively modest, but wages lag far behind. A recent government funded study found that 52% of Britons are struggling to keep up with the bills…

“…Their predicament dates to the early 2000s, when GDP and earnings peeled apart. Living costs have since left median wages far behind…real earnings will have shrunk by £6,660 ($10,250) over the 2010-15 parliament.”

The originally cited article goes on to say:

“The popular explanation is that the economic background has shifted firmly in favour of capital and away from labour. In the pre-1980 economy, strong trade unions would claim back the profit share for their members. The arrival of billions of workers in China and Eastern Europe into the labour market has kept downward pressure on wages (except for financiers, of course) and allowed capital to increase its share.” (our emphasis)

In other words, the growing inequality that we have seen in society in the past few years is not the result of the current crisis, but is part of a long term process of decades, in which the capitalist class has increased their profits at the expense of workers – both in the advanced capitalist countries and in emerging economies – who have faced increasing levels of exploitation.

This article from The Economist also conveniently fails to mention that these “strong trade unions” in the pre-1980 economy were forcibly attacked and broken up by the capitalist state – e.g. by politicians such as Thatcher – who took on the trade unions and introduced laws limiting their ability to organise and take action to defend conditions.

An inherent contradiction

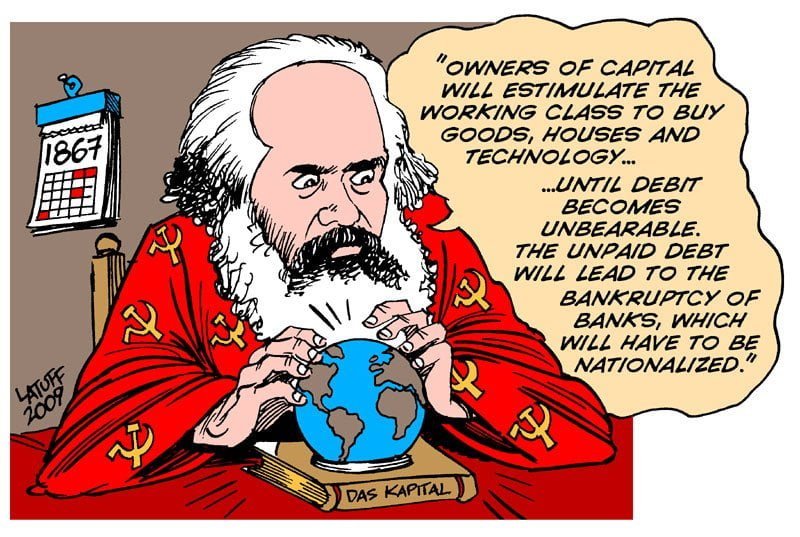

But the same article goes further still, referencing Marx and pointing out that it is not the crisis that has caused this rising inequality between capital and labour, but the rising inequality that has caused the crisis:

“Karl Marx thought this would eventually cause capitalism’s collapse – industry would become concentrated in a few hands with monopoly power and workers would be unable to afford to buy the goods they made.” (our emphasis)

And here we come to the crux of the issue with the capitalist system – an issue that the reformists consistently miss. The inequality we see today – with declining living standards for workers and youth alongside increasing corporate profits – is not simply the product of the crisis, but is the logic of capitalism itself. The gap between capital and labour is not a mere symptom of the crisis, but is also its cause – and the disease is the capitalist system itself.

Capitalism is a system with an unquenchable thirst for profits. Each capitalist must continually accumulate, invest, and expand or face losing their share of the market. Yet in this chase for ever increasing profits, competition forces each capitalist to invest in labour saving machinery, attack workers, and cut wage costs. And by all doing so at the same time, the capitalist class as a whole are cutting away at the wages of the working class as a whole – that is to say, cutting away at the very demand for the goods that capitalism produces; cutting away at the branch that they, the capitalists, are sitting on.

This process, as Marx explained, is not a crisis of underconsumption – i.e. a crisis due to workers not consuming enough that can be easily resolved by taxing the rich and paying workers more, or by stimulating the economy through government investment, as the reformists and Keynesians idealistically imagine – but a crisis of overproduction: the result of an inherent contradiction arising from a system in which the means of production are privately owned and where production is only for profit. It is not that workers are merely paid too little; in a system where production is for profit, the working class – as a whole – will never be able to afford to buy back the commodities that they produce.

It is not simply that there is inequality – i.e. a gap between capital and labour – that crises occur; this inequality is a necessary part of the capitalist system: the exploitation of the many is the prerequisite for the wealth of the few; the mere simultaneous existence of these opposites – of the capitalist and the worker – necessarily implies an inequality. And it is the logic of this system that each side will try to increase their share of the wealth – the capitalist to increase profits and widen this inequality; the worker to increase wages and reduce inequality – and this is precisely the meaning of class struggle: the struggle between the capitalist and the worker for the surplus produced in society. Thus, as the reformists continually fail to comprehend, to eliminate inequality is to eliminate the capitalist system itself.

Cash hoards and excess capacity

The same article in The Economist then asks an important question:

“But one doesn’t need to be a Marxist to perceive that the share of capital might be cyclical; surely high returns should be competed away? A high return on capital [i.e. high profits] should attract more entrepreneurs or should encourage existing business to invest more, bringing the return on capital back down. So why isn’t that happening?”

The article then goes on to present statistics demonstrating that corporate profits in the USA (as a share of GDP) are at an over 30 year high (of over 12%), whilst business investment (also as a share of GDP) is at a record low over the same period (at around 10%). Figures elsewhere demonstrate the same phenomena – that big businesses are not investing. For example, Gillian Tett in the Financial Times (17th January 2013) comments that:

“In recent years, commentators and politicians have often bewailed the fact that American companies are sitting on oodles of spare cash. Some studies calculate this to be about $2tn. Others put it even higher…Either way, what is crystal clear is that this cash hoard has been rising…

“…Logic might suggest this is not an ideal development. After all, if companies are hanging on to cash, rather than investing it in machinery or hiring workers, that will not create growth.”

Meanwhile, Tony Jackson, also writing in the Financial Times (11th March 2012), provides similar figures for European and British companies, who have cash hoards of €2tn and £750bn respectively. Jackson bluntly states that, “It is a notorious truth that western companies are hoarding cash. They are not hiring or investing as they should”. Statistics for Canadian firms talk of a cash hoard of over $500bn, up by 43% since 2009. Apple – the giant multinational consumer electronics firm – alone are sitting on a cash pile of $100bn.

To put these figures into context: the UK GDP is approximately £1,570bn and its total accumulated government debt currently stands at around £1,200bn. Big businesses in the UK, therefore, are sitting on cash piles (of £750bn) – idle money that could be spent straight away – equivalent to about half of everything the British economy produces each year; also equivalent to over 60% of the national government (public) debt. This £750bn of idle cash in the banks of big business is greater than the annual UK public spending, which stands at around £700bn per year.

Meanwhile, the $2tn ($2,000bn) worth of money that US corporations are sitting on is double the value of the US Federal budget deficit (i.e. the shortfall between government spending and government income from taxes), which currently stands at around $1tn. This $2tn in the pockets of US big business is also equivalent to about 12% of US Federal debt (around $17tn), whilst the €2tn in the hands of European corporations is equivalent to around 18% of total eurozone debt (which stands at around €11.1.

Just imagine what a tremendous boost to the economy it would mean to invest all this idle money! The UK economy could be given a one-off annual boost of almost 50%, with annual public spending – on education, healthcare, transport, etc. – more than doubling.

So why aren’t businesses across the world investing? Why sit on piles of cash when profit rates are high and there is money to be made? The Economist tries to answer their own question:

“But China must play an important part in the puzzle. As we know it has been investing like crazy, with almost 50% of GDP devoted to capital spending at some points. To go back to Apple, this was a great boost to its profits; since the cost of producing the hardware fell, while the company’s design skills enabled it to continue to charge premium prices.

“Michael Howell of CrossBorder Capital suggests that the world economy has faced a problem of too many producers.

‘In short, it is a capacity glut, not a savings glut. Excess capacity financed by abundant Chinese credit pushed down the marginal rate of profits on new capex [capital expenditure] and this drove down real bond yields.’”

In other words, the lack of investment on a world scale is due to the enormous existing excess capacity – i.e. overproduction – in the system. Why would any capitalist invest more – in new production; in jobs, machinery, factories, infrastructure, etc. – when businesses cannot sell what they already produce?

The role of China

As The Economist suggests, the Chinese economy is playing an important role in this situation of global excess capacity. As the above article points out, and as we have noted in our own previous analysis, the Chinese government has – over the past few years – re-orientated their economy away from export-led growth and towards investment. The reasons for this are straightforward: with a collapse in demand in the USA and Europe – China’s main export markets – as a result of the crisis, the Chinese economy needed to find a new source of growth or face a crisis and collapse of its own.

In order to maintain their blistering pace of economic growth, China effectively enacted one of the world’s largest ever Keynesian experiments, with credit expanded massively to fund an enormous surge in investment; lending in China rose from 122% of GDP in 2008 to 171% in 2010 – a larger increase of credit than that seen in the USA in the run up to the financial crisis of 2007 – and, as a result, the total debt-to-GDP ratio (including household, corporate, and government debt) now stands at around 200%.

As we noted previously, and as the more far-sighted bourgeoisie are now also noting, this investment binge, which began in 2008-09, has created enormous contradictions, both within China and on a world scale. The expansion of credit has led to a huge build up of local government debt in China and the central government are under pressure to try to deflate this credit bubble without bursting it in the process. Meanwhile, the massive amount of investment in China – accounting for up to 50% of Chinese GDP, as mentioned previously by The Economist – has further increased the productive forces in China, and thus globally also, which in turn only exacerbates the existing excess capacity and crisis of overproduction. As The Economist explains in another recent article, in reference to the views of Paul Krugman – Nobel prize-winning economist – on the Chinese economy:

“Investment should expand an economy’s capacity to meet the needs of its consumers or its export markets. But in China, Mr Krugman argues, much investment spending is Sisyphean: it is simply adding to the economy’s capacity to expand its capacity…[our emphasis]

“…It is clear that China should lower its investment rate. But Mr Krugman and others say that a lower investment rate could precipitate a crash. Their concern echoes a 70-year-old model of growth devised by Roy Harrod and Evsey Domar, in which the economy is balanced on a knife-edge between boom and bust. [our emphasis]

“The model recognises that investment plays a dual role in an economy. It is, as Martin Wolf of the Financial Times puts it, both “a source of extra capacity” and a “source of demand”. Sometimes these two roles work at cross purposes. If growth slows, then the economy will not need to add as much capacity. That implies less investment. But because investment spending is a source of demand, less of it also implies less demand, lowering growth still further. In avoiding excess capacity, the economy ends up creating more of it…

“Critics of China’s high investment worry not just about the redundant capacity it creates, but also about the debts it leaves behind. China as a whole is thrifty: its saving rate is even higher than its investment rate. But savers and investors are not usually the same. Standing between them is China’s financial system, which transfers vast resources from the first to the second. The debts of China’s firms amounted to 142% of GDP last year, according to Goldman Sachs, and investment vehicles sponsored by local governments had debts worth another 22.5%. Though impossible to calculate accurately, bad debts might amount to the equivalent of a quarter of the country’s GDP” (The Economist, 17th August 2013)

Rather than resolving the crisis, therefore, the enormous amount of investment in China has merely sown the seeds for an even larger crisis in the future – both in China and on a world scale.

As The Economist states:

“Since a cash crunch in June, when its central bank withheld liquidity from the banking system to punish reckless lenders, China has become a big source of worry for the world economy…

“…The IMF this week argued that China’s growth has become ‘too reliant on investment and an unsustainable surge in credit’. Investment again contributed the majority of China’s growth in the first half of the year.” (The Economist, 20th July 2013)

And comments further elsewhere:

“China is in the midst of a precarious shift from investment-led growth to a more balanced, consumption-based model. Its investment surge has prompted plenty of bad debt…

“…The bad news is that the days of record-breaking speed are over. China’s turbocharged investment and export model has run out of puff.” (The Economist, 27th July 2013)

The slowdown in China, in turn, threatens the economies in Brazil, Australia, Africa, etc., who have become reliant on exporting raw materials to fuel China’s economic growth.

Global imbalances and tensions

The Western capitalists hope for a “rebalancing of the economy” in China, away from investment and exports, and towards more internal consumption and imports. In other words, the capitalists in the USA, Europe, etc. would like for capitalists operating in China to pay Chinese workers more, so that they can buy goods from businesses in the USA and Europe. This, in turn, would allow US and European companies to spend their vast cash piles, investing in production to create new jobs, and thus exporting the crisis away from the West and into China.

The other possibility, and the worry for the capitalists in the USA and Europe, is that the huge excess capacity in China – with its accompanying excess of commodities – will finds its way onto Western shores, acting to drive down the (record high) profits of US and European businesses mentioned above.

As the originally quoted article from The Economist concludes:

“All this may suggest one way in which profits may return to “normal” levels. With the Chinese economy not growing as fast as it once was, surplus Chinese capacity may flood world markets, driving down profit margins…The more benign possibility [for the US and European capitalists!] is that the Chinese switch their economy from production to consumption and that US companies boost their capex [capital expenditure – i.e. investment] to try to exploit this new market.”

In either case, the outlook is for increased tensions between nations – each seeking to protect the profits of the capitalists in their own countries – as the crisis of capitalism continues, grows, and spreads across an interconnected world economy. Once again we see the tremendous barriers that capitalism erects to the development of the productive forces: the private ownership of the means of production; and the nation state.

Capitalism is an inherently anarchic, chaotic, and unstable system; as long as such a system exists, inequalities and imbalances will exist also. These barriers to the development of the productive forces – the result of this irrational and anarchic system – must be smashed and replaced with a rational and democratic plan of production; an international socialist system of production in the interests of the vast majority. Only in this way can we live in a truly equal society, with harmony both between different people and between people and the environment upon which we rely.