In the stormy period of the early 20th century, capitalism was rocked by revolutionary upheavals. Meanwhile, the ideas of Marxism were making strides forward in the European labour movement.

In response, a group of intellectuals based in Vienna – known as the Austrian school of economics – attempted to mount a theoretical assault against Marxism.

On the one hand, the founders of this school attempted to ‘disprove’ the labour theory of value, which is key to Marx’s theories, putting forward instead their own ‘marginal utility theory’ of value.

On the other hand, later members of the Austrian school, including infamous libertarian figures such as Friedrich Hayek and Ludwig von Mises, attempted to ‘prove’ that socialist economic planning is impossible in principle.

In this article from issue 36 of the In Defence of Marxism magazine (published on 15 January 2022 – buy it here), Adam Booth answers their arguments, showing how – on both counts – their attempts to overthrow Marxism represented a retreat from a scientific, materialist outlook of the economy, into a subjective idealist approach; a reactionary defence of capitalism, providing a mere apology of the status quo, not an understanding of the system and its contradictions.

Arm yourself with the revolutionary ideas of Marxism! Subscribe to ‘In Defence of Marxism’ – the quarterly theoretical journal of the International Marxist Tendency!

The Austrian school of economics: Capitalism’s free-market fanatics

At the time of writing, the global economy is in the grip of chaos and crisis – the result of a combustible cocktail of volatile swings in demand, years of chronic under-investment, and pandemic-induced bottlenecks in production and distribution.

Some experts are predicting that it will take years before backlogs are cleared, labour shortages are filled, and prices stabilise. In the meantime, ordinary families face scarcities of basic necessities like food and fuel, and real household incomes are being eroded by rampant inflation.

Insane contradictions are apparent everywhere. In Britain, for example, 100,000 pigs are set to be slaughtered and discarded as waste, due to a lack of skilled butchers. In other words, the cold logic of the profit motive is leading to the pointless death of huge numbers of animals, while supermarket shelves are left bare.

A similar example can be seen in the UK property market, with the disgusting spectacle of hundreds of thousands of empty homes being used as vehicles for speculation, alongside similar numbers of people sleeping rough on the streets, long waiting lists for council-provided accommodation, and a dire housing crisis.

On a global scale, meanwhile, humanity faces an existential crisis due to the climate catastrophe. It is clear that capitalism is killing the planet. But big business politicians have no solutions to this impending disaster.

All of these events are a fine demonstration of the so-called ‘efficiency’ and ‘dynamism’ of the free market; of the ‘rigors’ of competition. They have shone a light on the bankruptcy of capitalism – a system of production for profit, not need. And they have shown why we need a genuine socialist alternative, based on economic planning, public ownership, and workers’ control.

Presented with this anarchy and lunacy, the most frenzied free-marketeers have certainly been a little more quiet recently – online, in the media, and on the streets.

Nevertheless, the fundamental position that they defend, about the efficiency of the market, remains alive and well inside university economics departments and textbooks, where students are force-fed a diet based on the ‘efficient market hypothesis’.

According to such ‘theories’, the economy is little more than a series of graphs, equations, and mathematical models – an idealised system that would all be in perfect equilibrium and harmony, if only it weren’t for pesky trade unionists demanding higher wages; central bankers printing too much money and inflating bubbles; and politicians erecting dastardly barriers to free trade.

In reality, these ideas are as old as capitalism itself. They can be traced back to ‘Say’s Law’, attributed to Jean Baptiste Say (a French classical economist of the late 18th/early 19th century), who asserted that supply creates its own demand; that every seller brings a buyer to the market.

The conclusion of this supposed ‘law’ is that the market should be left unimpeded and unrestricted, in order to bring about balance in the economy. Never mind the social consequences and human costs – in the ‘long run’ all would be well if only the ‘invisible hand’ of the market were allowed to work its magic.

This is the basic premise of laissez-faire capitalism that libertarians have clung on to throughout the decades, come rain or shine.

The classical school

As far as they are even aware of their own heritage, the theoretical roots of modern libertarianism can be found in the ‘Austrian School’ of economists – the most infamous representatives of which were Friedrich Hayek and his mentor Ludwig von Mises.

These open reactionaries, in turn, saw themselves as the true inheritors of the liberal classical school of bourgeois economics, best known for figures such as Adam Smith and David Ricardo.

The classical school emerged as a branch of ‘political economy’ – economics as a specific field of study, which had evolved with the rise of capitalism. This school produced thinkers who tried to understand the economy in a scientific manner; who sought to examine capitalism as a system with its own laws and dynamics.

And whilst they relied upon the power of abstraction to uncover these laws, they did not descend into the idealistic mathematical ‘models’ that bear no relation to reality, so characteristic of bourgeois economists and academics today.

The classical economists were part of the 18th-century Enlightenment: an intellectual movement based on a materialist philosophical outlook, which attempted to find an explanation for phenomena in nature and society grounded in ‘reason’ and ‘rationality’.

The highpoint of the classical school came with British economists such as Smith and Ricardo, who investigated key questions concerning the workings of the capitalist system, including concepts such as value, trade, wages, rent, and the division of labour.

Their liberalism, in turn, reflected the interests of the British bourgeoisie – providing a theoretical justification for the free trade policies that their native capitalist class were pursuing in order to create and dominate the world market.

In terms of attempting to theoretically and scientifically understand capitalism, Marx consciously continued where Ricardo left off. It is in this sense that Marx and Engels referred to their ideas as ‘scientific socialism’ – they based themselves on a materialist view of history and of the economy; not on utopian blueprints for how society might look.

Unlike Ricardo, however, the purpose of Marx’s economic writings was not to represent the interests of the bourgeoisie, but to theoretically arm the working class and the labour movement.

Starting from the same assumptions as Ricardo and the best of the classical economists, Marx showed in the three volumes of Capital – alongside many other works on economics – how capitalism is riddled with contradictions and is inherently prone to crises.

By employing such a method, developing the theories of the classical economists, and drawing out the logical conclusions implicit within them, Marx aimed to “deal the bourgeoisie a theoretical blow from which it will never recover”.

Marx had demonstrated the conclusions that flowed from developing the ideas of Smith and Ricardo on a consistent materialist and scientific basis. He showed how capitalism contains the seed of its own destruction, through the operation of the very laws that the classical economists had begun to uncover.

Bourgeois economists who followed Ricardo, therefore, were forced to backtrack: abandoning the scientific method of the classical school; retreating into idealism, and mystifying capitalism.

For this reason, Marx called such ladies and gentlemen the ‘vulgar’ economists. Instead of attempting to genuinely explain and understand the capitalist system, these reactionary thinkers became mere ‘apologists’ for it.

Viennese offensive

By the end of the 19th century, the organised working class was on the march. Mass trade unions and socialist parties had been built. In 1889, the Second International was founded to coordinate the efforts of the international socialist movement.

These organisations – on paper, at least – subscribed to the ideas of Marxism, scientific socialism, and revolution.

The ruling class could sense the threat of this rising workers’ movement, and of the Marxist ideas upon which this rested, and began an all-out ideological counter-offensive. The epicentre of their attacks came from Austria – and in particular, the University of Vienna.

The primary capital of the Austro-Hungarian Empire, fin de siècle Vienna was home to a range of intellectual, cultural, and scientific movements, with philosopher Ludwig Wittgenstein, artist Gustav Klimt, and founder of psychoanalysis Sigmund Freud amongst the famous figures rubbing shoulders in the city’s coffeehouses in the early 20th century.

The University of Vienna, meanwhile, became a hotbed of reactionary ideas. Philosophically, it was a breeding ground for the subjective idealism of Ernst Mach, which even became fashionable amongst a layer of the Russian intelligentsia and socialist movement.

As a result, Lenin felt it necessary to launch a sharp counter-attack against Mach and his followers, which he did brilliantly in the form of Materialism & Empirio-Criticism – a powerful polemic that simultaneously exposed the barrenness of these subjectivist views, whilst providing a thorough defence of materialism.

Nevertheless, Mach’s ideas were influential in the later development of further pernicious philosophical trends, such as logical positivism, as advocated by the Vienna Circle. And these, in turn, left their mark on Austrian thinkers such as Karl Popper, who explicitly waged war on Marxism and historical materialism.

Labour theory of value

On the economic front, the bourgeoisie’s Austrian attack was led by figures such as Eugen von Böhm-Bawerk, Friedrich von Wieser, and their tutor Carl Menger, who were also influenced by the subjective idealism that was prevalent in the University of Vienna and its environs.

Their opening shots against Marxism were fired at the ‘labour theory of value’ (LTV): the foundation of Marxist economics, which provides an explanation for the law of value that underlies the exchange of commodities (goods and services produced for the purpose of exchange), and thus the dynamics of capitalism.

In place of the LTV, the Austrian school had their own theory: Marginal utility theory (MUT).

Basing itself on individual consumer preferences, not on objective social factors, MUT was a completely unscientific, subjectivist ‘theory’, which had simultaneously been developed by various vulgar economists across Europe, including William Stanley Jevons in Britain, Leon Walras in France/Switzerland, and Carl Menger in Austria.

MUT contrasts sharply with the LTV: a materialist theory that can be traced all the way back to Aristotle. In essence, the latter explains that it is the application of labour – and labour time – in production that makes things valuable.

This concept had been taken up and developed by classical economists such as Smith and Ricardo, forming a key pillar of their economic theories. Marx, in turn, also based himself on the LTV, whilst giving it a dialectical depth that the classical view lacked.

The problem with the ideas of Smith and Ricardo was that, despite seeking ‘rationality’ on the basis of a scientific approach, they were imbued with the individualism of the bourgeois liberalism that they and the Enlightenment represented.

They should be applauded for attempting to analyse capitalism as a system, with laws of motion that could be discovered and understood. But for them, this system was a simple, mechanical one.

They saw the economy, in other words, as little more than an addition of individuals working and exchanging directly with one another; isolated men on a desert island, comparing the labour time of various productive tasks in their own head.

In this ‘Robinson Crusoe’ model, there exists a single individual who is both the only producer and the only consumer. Where the laws of exchange are to be examined, meanwhile, it is on the basis of treating the capitalist system as merely a scaled up version of a barter economy.

For example, the stranded inhabitant of our imaginary island might spend four hours chopping trees to produce a wooden raft, and another four hours harvesting one hundred coconuts; thus, they would conclude that one raft is worth one hundred coconuts.

Clearly, however, this abstract hypothetical scenario is a million miles away from the realities of capitalism. We live in an economy composed not of isolated individuals, but of classes: of workers who must put food on the table by earning a wage; and of capitalists who employ and exploit these workers in order to make a profit.

Trade and exchange, meanwhile, does not occur directly between individual producers, in the form of barter, but through businesses and consumers; that is, through the impersonal interactions of money and the market – these days, increasingly, by logging into platforms provided by giant monopolies such as Amazon.

Marx and value

For this reason, Marx took this basic premise of the LTV – that labour is the source of all new value – and developed it further.

He explained that it is not individual labour time, but socially necessary labour time that makes commodities valuable: the average time required to produce a commodity for the market, under given technological and historical conditions.

This insight, in turn, was the basis for Marx’s theory of exploitation, which unwrapped the mystery of where profits came from – an enigma that had eluded the classical economists.

In summary, Marx outlined that the capitalists’ profits come from surplus value, which in turn is simply the unpaid labour of the working class.

What the capitalists purchase from the worker, Marx said, is not their labour, but their labour power – their ability or capacity to work for a given period of time (an hour, day, month, etc.), for which they are paid a wage in return.

In the course of the working day, however, the worker produces more value than they are paid back in the form of wages; that is, it takes only a fraction of the working day for the working class, on average, to produce the commodities needed to maintain and reproduce their own labour power.

The rest of the working day, above-and-beyond this socially necessary labour time required to reproduce the working class, constitutes surplus labour time, and thus surplus value, which the capitalist in effect receives for free.

The law of value, therefore, lies behind all the other dynamics of capitalism: the drive by the bosses to intensify work and squeeze more surplus value out of the working class; the push to raise productivity by investing in technology, in order to out-compete other producers, and thus make super-profits; and the inherent tendency towards accumulation, expansion, and growth.

And most importantly, this same law of value also explains why capitalism periodically plunges into crisis – crises of overproduction, which arise due to the origins of profit: the fact that the working class, receiving only a slice of the value that they create, can never afford to buy back all the commodities that they produce. Or put another way, the fact that, under capitalism, the productive forces continually outstrip the limits of the market.

Price versus value

The Austrian school could also see the importance of the LTV to Marxism. They therefore explicitly sought to focus their attacks at what they perceived to be scientific socialism’s soft underbelly.

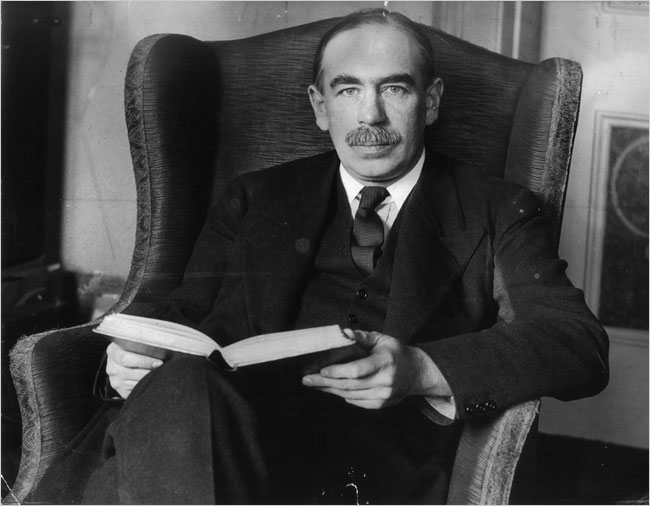

Marx explained that it is the socially necessary labour time that determines why some commodities are more valuable than others / Image: Public Domain

If they could undermine this foundation, they believed, the rest of Marxist theory would all come crumbling down – and with it, the whole socialist movement.

Carl Menger’s disciple Eugen von Böhm-Bawerk became the champion of the Austrian neoclassicists in their battle against Marxism. “He recognised the looming threat of Marxist socialism, both politically and economically,” writes Janek Wasserman, author of The Marginal Revolutionaries, a collective biography of the Austrian school, “and attempted to undercut it using marginal utility theory”.

Böhm-Bawerk made various critiques of the LTV and Marxism, most of which were based on a (potentially purposeful) misunderstanding and confusion surrounding the difference between labour and labour power; but most importantly, between value and price.

Marx himself had very clearly differentiated between these. He did not deny the role of market forces – supply and demand – in determining prices. But these, Marx explained, were like fuzzy noise around an underlying signal.

Behind the seeming randomness and chaos of prices, he elaborated, lies an order; something lawful and objective. Amidst these fluctuations and ‘accidents’, in other words, there exists a ‘necessity’: the law of value.

“In the midst of the accidental and ever-fluctuating exchange relations between the products,” Marx explains in Capital, “the labour-time socially necessary to produce them asserts itself as a regulative law of nature.

“In the same way, the law of gravity asserts itself when a person’s house collapses on top of him. The determination of the magnitude of value by labour-time is therefore a secret hidden under the apparent movements in the relative values of commodities.” (Karl Marx, Capital, volume one, Penguin Classics edition, p168)

Continuing Marx’s analogy with the law of gravity: what we see in terms of planetary motion is only the appearance of the phenomena. But underlying this are invisible, intangible – yet objective and material – laws; laws that can be discovered and understood.

Such laws do not exist separately from nature or society; they are not encoded into the night sky, or woven into the fabric of human consciousness and behaviour. Rather, they are the dialectical, generalised dynamics of motion arising from the complex interactions that take place within the system under question.

The law of value, similarly, is not something timeless and external, but is a law that only asserts itself at the historic point where commodity production and exchange becomes generalised, universal, and dominant – such that production loses any individual or particular character, and agents in the market are confronted not with each other, but with an objective price.

The exchange of commodities, then, on average, is determined by their value – that is, by the socially necessary labour time (SNLT) congealed in a commodity. This includes both the ‘dead labour’ embodied and passed over in the form of the raw materials, tools, and machinery, etc. consumed in the course of production; and the ‘living labour’ added by the worker, which alone creates new value.

Market forces act to push prices above and below this value. For example, when demand for a certain commodity exceeds the available supply, then its price will rise above its value. Vice-versa when supply exceeds demand.

This, in reality, is the case most of the time, with all manner of ‘distortions’ – such as the existence of monopolies – that prevent supply and demand from being in perfect balance. Prices, therefore, will tend to fluctuate.

But these oscillations will tend to occur around some sort of average. Certain commodities will always tend to exchange for higher proportions of others. Unless you have a really beaten-up car, or an incredibly fancy pen, a single car will tend to be worth the same price as many pens.

When supply and demand are assumed to be in ‘equilibrium’, in other words, Marx explains, it is the SNLT that determines why some commodities are more valuable than others.

Marginal utility theory, on the other hand, looks only at prices; only at the superficial appearance, and not at the underlying laws of motion. Like Oscar Wilde’s cynic, the marginalists “know the price of everything, and the value of nothing”.

Marginalism and subjectivism

In rejecting the LTV, the supporters of MUT were consciously breaking with the legacy of the classical school, which had based its analysis of capitalism in production. By contrast, MUT now looked to the consumer to determine the value of commodities.

“Marginalists flipped classical economics on its head,” Wasserman notes in The Marginal Revolutionaries. “Instead of focusing on the production side of economics, they turned to consumption. It is the satisfaction of the wants of consumers that matters for value, not the labour required for production.”

Value, in other words, was said by MUT’s proponents to be something purely subjective, based on the ‘utility’ of a commodity: the usefulness to the consumer compared to other commodities, at the ‘margins’.

“Value is…the importance that individual goods or quantities of goods attain for us because we are conscious of being dependent on command of them for the satisfaction of our needs,” stated Menger, according to a pamphlet produced by the Ludwig von Mises Institute called The Austrian School of Economics: A History of Its Ideas, Ambassadors, and Institutions.

Ironically, the Ludwig von Mises Institute has made this pamphlet available for free online – a tacit admission that such ideas have zero ‘utility’ to society.

Wasserman, similarly, provides Wieser’s succinct definition of marginal utility: “Simply put, the value of an individual unit [of a good] is determined by the least valuable of the economically permitted uses of that unit.”

Marx, however, also understood the importance of commodities having a utility; a ‘use-value’ to society. If a commodity is of no use to anyone, then it can’t be sold. As a result, such a commodity has no ‘exchange-value’; no price. It would be completely worthless.

This is the answer to the trivial criticism of the so-called ‘mud pie paradox’, whereby opponents of Marxist economics attempt to ridicule the suggestion that labour is the source of value. “Surely then,” these detractors ask, “if I spend hours making a mud pie, then this should be extremely valuable?”

But such an assertion is clearly false on two accounts, as Marx more-than-adequately explained in anticipation. Firstly, as mentioned above, all commodities must have a use-value – a usefulness – in order to be exchanged, and thus have an exchange-value.

And secondly, again, even if a mud pie was of use to anyone, it is not the personal or individual labour time invested in its production that would make it valuable, but the average or socially necessary labour time required to make such a commodity in general, within given historical and technological conditions.

In other words, what we see under capitalism is not individuals directly and subjectively comparing the products of their own personal labour with one another. Rather, both producers and consumers are presented with an objective price on the market.

As highlighted before, we do not exchange on the basis of barter, as Robinson Crusoes on a desert island, but via the medium of money and the market.

To go back to an earlier example, when you search for things to buy on Amazon or Google, you are not confronted with a scattering of small producers, with whom you can haggle. Instead, you are (mostly) given a choice of suppliers, who compete with each other to offer the cheapest price they can; a price that will tend towards a given level for any commodity that is relatively replicable.

How, then, can these vast multitude of commodities on offer be compared against each other? What is it that ultimately determines their exchange-value or price – the monetary form of expression of their value?

Clearly such a comparison cannot be made on the basis of their utility, which is something subjective and qualitative. Every type of commodity has its own physical properties and characteristics; its own qualities, specific to its potential or intended use. Moreover, the usefulness of a commodity will vary greatly between different consumers.

Importantly, to return to the example above, those looking to sell their goods online do not price these according to their ‘utility’ – neither from the point of view of the producer or the consumer.

Such suppliers rarely have any personal connection to their customers, through which they might ascertain a commodity’s subjective usefulness.

And furthermore, from the perspective of the producer, the whole point is that the commodity has no usefulness for them; they produce solely for the purpose of exchange – to make a profit, not to fulfil any personal needs.

Commodities therefore cannot be compared on the arbitrary basis of their ‘utility’. What is required, in terms of measuring value, is a common quality that is relative, quantifiable, and objective. And the primary thing that all commodities share, which allows them to be compared in exchange, Marx explains, is that they are products of labour – in particular, social labour.

Idealism vs materialism

In the end, the marginalists ended up tying themselves in knots. They claimed, for example, that value was determined by the subjective preferences of independent individuals. But what, in turn, determines these subjective preferences?

Clearly our evaluations of the worth of various goods and services are not hard-wired into our brains. Rather, they are the product of experience and social norms. We have an expectation of how much things should cost, established from the accumulation of historic knowledge about the price of comparable commodities.

The economists of the Austrian school, however, base themselves on the isolated individual, ripped out of all social context. They reduce the dynamics of capitalism to the behaviour of abstract, ahistorical individual buyers and sellers, not seeing that the whole is greater than the sum of its parts. Value, for them, is explained purely in terms of the subjective impulses of the individual.

But a genuinely scientific approach to economics must be based on discovering objective laws, not on analysing subjective whims. It must seek to uncover the dynamics of the capitalist system: the laws that emerge from the millions of interactions that take place in the course of the production and exchange of commodities – without being reducible to these interactions, and indeed imposing themselves upon them.

Like Marx, and the classical economists before him, the Austrian school also saw themselves as the discoverers of capitalism’s economic laws. But for them, such laws were seen as ‘eternal truths’ based on ‘human nature’ – not as the dialectical product of an historically-evolved mode of production; that is, of a particular stage in society’s development.

For Marxists, laws are the underlying general dynamics within a particular phenomenon or system. The laws of capitalism, in this respect, are not timeless and absolute. They do not exist in a separate, ideal realm, imposed upon society from without. Yet for idealists such as the Austrians, economic laws are perceived precisely in this way.

“An apple falls from the tree and the stars move according to one and the same law – that of gravity,” stated Emil Sax, a contemporary of Menger’s, and another graduate from the University of Vienna. “With economic activity,” he continued, “Robinson Crusoe and an empire with a population of one hundred million follow one and the same law – that of value.”

Indeed, later Austrians such as Mises even believed that economic laws were timeless, and could be worked out apriori, completely divorced from any social context or empirical evidence. Mises named his line of thought praxeology – the theory of human action, based on the study of ‘rational’ economic agents and their ‘purposeful behaviour’.

This ahistorical, abstract, and idealistic approach was not invented by the Austrian School. Rather, it was inherited from their liberal forefathers, the classical bourgeois economists, who also saw capitalism and its laws as eternal; the product of an innate ‘human nature’.

As Marx explains, discussing the limits of the classical school in his Contribution to the Critique of Political Economy, “the bourgeois form of labour is regarded by Ricardo as the eternal natural form of social labour.”

“Ricardo’s primitive fisherman and primitive hunter,” Marx continues, “are from the outset owners of commodities who exchange their fish and game in proportion to the labour-time which is materialised in these exchange-values.”

“On this occasion,” Marx wryly notes, “he slips into the anachronism of allowing the primitive fisherman and hunter to calculate the value of their implements in accordance with the annuity tables used on the London Stock Exchange in 1817.”

Like Smith and Ricardo’s ‘Robinson Crusoe’ or ‘primitive fisherman’, all of the hypothetical scenarios chosen by the marginalists were completely divorced from the realities of capitalism.

The works of Böhm-Bawerk and Menger are littered with references to such abstract examples, including: “A man seated by a spring of water which is gushing profusely”; “a traveller in the desert”; “a colonist whose log-cabin stands lonely in the primaeval forest”; “dwellers in an oasis”; “a nearsighted individual on a lonely island”; “an isolated farmer”; and “shipwrecked people”.

Equally, the marginalists consistently examined fringe goods, such as diamonds or art, to ‘prove’ the correctness of MUT.

Most of the capitalist economy, however, is not dedicated to the production of rare items such as diamond rings, pearl necklaces, or fine works of art, but to the production of an abundance of day-to-day commodities, with a price that tends towards an average amount, determined by the socially necessary labour time.

As Marx explains in Capital, whilst also demonstrating the validity of the LTV: “Diamonds are of very rare occurrence on the earth’s surface, and hence their discovery costs, on an average, a great deal of labour-time. Consequently much labour is represented in a small volume.”

“With richer mines,” Marx continues, “the same quantity of labour would be embodied in more diamonds, and their value would fall.”

“If man succeeded, without much labour, in transforming carbon into diamonds, their value might fall below that of bricks,” Marx concludes. And indeed, with modern science, that is almost exactly what we see, since it is now possible to produce artificial diamonds in large quantities and at low cost, which subsequently are sold at a significantly reduced price compared to naturally-mined precious gems.

For the Austrian school, then, the whole world revolves around the subjective viewpoint of the individual. This subjective idealism was a trait shared with the retrograde philosophical trends of the period, such as the positivism of thinkers like Mach and the ‘logical positivists’ of the Vienna Circle.

On such a basis, however, the ruling class could not genuinely challenge Marxism, with ‘theories’ that were clearly a mere apology for capitalism – not an explanation of it.

Socialist calculation debate

In spite of the Austrian school’s best efforts, the socialist movement continued to grow.

This process was cut across by the First World War. But within a few years, the mood of patriotism and nationalism had given way to one of anger and radicalisation amongst the masses, with the imperialist bloodbath provoking a wave of revolutions across Europe – most notably in Russia, with the Bolshevik-led insurrection of October 1917, and in Germany almost exactly 12 months later.

The ruling class were terrified of these revolutionary developments. At the same time, the supporters of laissez-faire capitalism were also concerned by the increasing tendency towards state planning and monopoly, and away from private ownership and competition.

On the basis of the experiences of WWI, even certain layers of the bourgeoisie were being drawn towards the idea of economic planning. Faced with the pressing task of winning the war, governments had not turned towards the market to produce armaments and other essential products, but had centralised the economy in the hands of the state.

“In Germany and Austria,” Janek Wasserman recounts in The Marginal Revolutionaries, “the regimes established war planning boards, dubbed ‘war socialism’, to allocate resources.”

“For the first time,” the biographer continues, “nationalisation and socialisation became acceptable policy positions.”

This prompted a new wave of attacks from a younger generation of the Austrian School. These were led by figures such as Mises, who from around 1920 onwards began what would later be referred to as the ‘socialist calculation debate’.

Mises aimed to show that socialism, in his words, was not ‘correct in theory, but wrong in practice’, but ‘wrong in theory and in practice’.

In summary, Mises asserted that socialist planning was impossible, due to the sheer complexity of the economy. The amount of calculation required, he argued, was too much for any centralised bureaucracy to plan.

With so many things to produce and distribute, Mises claimed, only the information provided by monetary price signals – through the forces of the market – could efficiently allocate resources and labour.

Furthermore, he stated that any state involvement or regulation would lead to prices being distorted, impeding the power of the market. The only solution, therefore, was to allow the completely free, competitive market to do its work.

“Once society abandons free pricing of production goods,” Mises asserted in his book Socialism, “rational production becomes impossible.”

“Every step that leads away from private ownership of the means of production and the use of money,” the Austrian economist concluded, “is a step away from rational economic activity.”

But the very concrete examples of the Soviet Union, on one side, and the Great Depression, on the other, were a heavy blow to this extremely abstract and idealistic argument.

As Leon Trotsky explained in his masterpiece The Revolution Betrayed, commenting on the huge economic progress made under the Soviet planned economy:

“Gigantic achievement in industry; enormously promising beginnings in agriculture; an extraordinary growth of the old industrial cities and a building of new ones; a rapid increase of the numbers of workers; a rise in cultural level and cultural demands: such are the indubitable results of the October revolution, in which the prophets of the old world tried to see the grave of human civilisation.

“With the bourgeois economists we no longer have anything to quarrel over. Socialism has demonstrated its right to victory, not on the pages of Das Kapital, but in an industrial arena comprising a sixth part of the earth’s surface – not in the language of dialectics, but in the language of steel, cement and electricity.” (Leon Trotsky, The Revolution Betrayed, Chapter 1)

The unrestrained free market, meanwhile, had led to the Wall Street Crash of 1929, and the subsequent Great Depression of the 1930s: the deepest crisis in the history of capitalism – to which the Austrians had neither a genuine explanation, nor a solution.

Indeed, the medicine proposed by the Austrian economists seemed, to many in the establishment, to be worse than the disease: a stabilisation of the gold standard; balanced budgets; and free trade – all of which risked deepening deflationary tendencies, exacerbating unemployment, and prolonging the crisis.

In short, the Austrians were proposing that governments step back, pull away any safety nets, tighten their belts, and allow the economy to ‘self-adjust’. ‘No pain, no gain,’ was their motto. Needless to say, such extreme austerity policies were not particularly palatable to politicians seeking election.

Enter Friedrich Hayek, who attempted to shift the goalposts in response to these events.

Instead of being impossible, Hayek now stated in a series of essays written between 1935-40, socialist planning was technically difficult; less economically efficient; and morally and politically undesirable.

In essence, however, Hayek’s arguments were no different from that of Mises; nor, indeed, of Adam Smith: If every individual pursued their own self-interest, then this, through the ‘invisible hand’ of the market, would bring about the best economic results for society, and thus for all.

No centralised planning authority would be able to keep track of the uncertain, ever-changing landscape of personal preferences and priorities, Hayek contended. Only the free market, through the information of prices, could process such dynamic and complex calculations.

To prove his point, however, Hayek mainly attacked not genuine socialism, but its Stalinist caricature of top-down bureaucratic planning that existed in the Soviet Union at that time.

In turn, rather than demonstrating the correctness of his own ideas, Hayek primarily dedicated his efforts to attacking those who defended socialist planning in various forms.

These primarily fell into two camps: either apologists for the Stalinist bureaucracy – figures like the English Communist and Cambridge economist Maurice Dobbs; or reformists and academics like Oskar Lange and Fred Taylor.

Whilst the former largely turned a blind-eye to the economic disasters that were unfolding in the Soviet Union, due to the suffocating effects of the bureaucracy, the latter were proponents of so-called ‘market socialism’: a utopian mixed economy, based on a confused (permanent) blend of common ownership, centralised planning, and the capitalist market.

Despite suffering no lack of intellectual shortcomings himself, Hayek had little trouble in tearing these muddleheads to pieces. Without a solid foundation in Marxist theory upon which to base their rebuttals, such people were left floundering by Hayek’s polemics.

Trotsky on planning

The only person who could offer a genuine defence of socialist planning – alongside a proper explanation for the pertinent dangers of bureaucracy – was Leon Trotsky. This he did in The Revolution Betrayed; and also in a marvellous article entitled The Soviet Economy in Danger.

In these, Trotsky brilliantly outlined both the achievements of the Soviet planned economy (as quoted earlier), and also how this potential was being suffocated by the cancerous growth of the Stalinist bureaucracy.

Importantly, however, Trotsky also discussed the nature of this bureaucracy, providing a materialist explanation for how it had come to overshadow – and derail – the conquests of the October Revolution.

In short, Trotsky wrote, the rise of the bureaucracy was not an inevitable product of socialist planning, as Hayek and the Austrians idealistically maintained, but was the result of attempting to build socialism in conditions of economic backwardness and isolation, as seen in Russia:

“The basis of bureaucratic rule is the poverty of society in objects of consumption, with the resulting struggle of each against all. When there is enough goods in a store, the purchasers can come whenever they want to. When there is little goods, the purchasers are compelled to stand in line. When the lines are very long, it is necessary to appoint a policeman to keep order. Such is the starting point of the power of the Soviet bureaucracy. It ‘knows’ who is to get something and who has to wait.” (Leon Trotsky, The Revolution Betrayed, Chapter 5)

Ironically, the only time that Hayek engaged with Trotsky’s arguments was when it was convenient for him to selectively pull quotes from these writings, ripping them completely out of context in order to lampoon his opponents.

For example, in The Soviet Economy in Danger, Trotsky makes a number of completely correct assertions, saying that, “It is impossible to create a priori a complete system of economic harmony”; and that no “universal mind exists…that could register simultaneously all the process of nature and society” in order to “a priori draw up a faultless and exhaustive economic plan”.

What Hayek fails to mention, however, is what follows these passages, where Trotsky goes on to explain what measures are required to successfully plan the economy on a socialist basis – above all, the need for workers’ democracy, control, and management.

“Only continuous regulation of the plan in the process of its fulfilment, its reconstruction in part and as a whole, can guarantee its economic effectiveness,” Trotsky elaborates.

“The art of socialist planning does not drop from heaven nor is it presented full-blown into one’s hands with the conquest of power. This art may be mastered only by struggle, step by step, not by a few but by millions, as a component part of the new economy and culture.” (Leon Trotsky, The Soviet Economy in Danger)

Furthermore, Trotsky goes on to explain that such a workers’ state would have to utilise the information provided by market price signals in the transition from socialism to communism – that is, in the transition from scarcity to superabundance – in order to ascertain where there are the greatest shortages, and therefore where investment is most urgently needed.

“The innumerable living participants in the economy, state and private, collective and individual,” Trotsky explains, “must serve notice of their needs and of their relative strength not only through the statistical determinations of plan commissions but by the direct pressure of supply and demand.”

“The plan is checked and, to a considerable degree, realised through the market. The regulation of the market itself must depend upon the tendencies that are brought out through its mechanism. The blueprints produced by the departments must demonstrate their economic efficacy through commercial calculation. The system of the transitional economy is unthinkable without the control of the ruble. This presupposes, in its turn, that the ruble is at par. Without a firm monetary unit, commercial accounting can only increase the chaos.” (ibid.)

Trotsky later reiterated these same points in The Revolution Betrayed. “A planned economy cannot rest merely on intellectual data,” he comments. “The play of supply and demand remains for a long period a necessary material basis and indispensable corrective.”

Indeed, Trotsky foresaw these problems in advance. As early as 1922, he emphasised that purely socialist planning methods “cannot be created a priori, through cogitation, or within four office walls”.

Between capitalism and a fully socialist society of superabundance, he explained, there would exist a number of transitional stages, in which the methods of the market cannot be wholly dispensed with.

Politics and economics

Trotsky agreed that top-down, bureaucratic planning could not work. And he also accepted the need for price signals – but only as a temporary guide, in the transition from socialism to communism, as money, the market, the state, and classes all withered away; or, in the words of Engels, as “the government of persons is replaced by the administration of things, and by the conduct of processes of production”.

Of course, any formal similarity between Hayek’s and Trotsky’s positions on this question were entirely superficial. In reality, the two theoreticians were coming from completely opposite class perspectives. Hayek was criticising bureaucratic Soviet planning from the right; Trotsky from the left.

In this respect, it is wholly disingenuous for libertarians (then and now) to use Trotsky – who was categorical in his defence of the Soviet Union and the gains of the October Revolution – in support of their reactionary ideas.

“Despite its heritage of backwardness, despite starvation and sluggishness, despite the bureaucratic mistakes and even abominations,” Trotsky asserted, commenting on the degenerated workers’ state in Russia, “the workers of the entire world must defend tooth and nail their future socialist fatherland which this state represents.”

At the same time, whilst Hayek and Lange et al. were engaging in abstract arguments over idealistic blueprints, we see how Trotsky approached the question of economic planning dialectically and materialistically.

A fully socialist economy, he stressed, could not be implemented from above, according to plans dreamt up in the minds of a bureaucratic clique, but would emerge out of material conditions bequeathed by capitalism, after the working class had taken power.

The precondition for utilising market forces and price signals as a compass to direct socialist planning, Trotsky therefore emphasises, is that the revolution has abolished capitalism, seized the main levers of the economy, and put them in the hands of a workers’ state.

In other words, instead of Stalinist bureaucratic planning, or so-called ‘market socialism’, there needs to be a genuinely rational socialist plan involving a system of workers’ democracy, control, and management.

Over time, as the productive forces develop, common ownership expands, and economic antagonisms diminish, information from this system of workers’ democracy would gradually replace the need for monetary price signals.

Instead of being guided by market forces, the organised working class itself would indicate what could and should be produced; where investment should be prioritised; and how labour and material resources should be distributed.

All the while, accountable and recallable elected representatives would utilise all the latest and best science, technology, technique, planning, data, logistics, and accounting methods inherited from modern capitalism.

The important point, Trotsky emphasised, is that the ‘problem’ of socialist planning is not one of ‘economic calculation’, as Hayek and Mises had asserted. Similarly, intellectuals like Lange were wrong to focus on this detail. It is not simply a question of building bigger and better computers. We cannot calculate our way to communism.

The economy is not a set of simultaneous equations to be solved, or a computer model that can be programmed from above. Nor is it a collection of abstract, isolated, atomised individuals on a hypothetical desert island.

Rather, the economy is a living, breathing system composed of flesh and blood. It is ordinary people trying to put food on the table; trying to make ends meet.

Above all, it is a struggle between opposing classes and their material interests: between the exploiters and the exploited; between the capitalists seeking to maximise their profits, and workers seeking to defend their lives and livelihoods.

The real problem, therefore, as Trotsky underlined, is not an ‘economic calculation’ one, but a political one. It is not a question of calculation, but of class; a question of power – that is, which class owns and runs the means of production? And according to what laws? On what basis – for needs or profits?

As Trotsky eloquently summarises:

“The struggle between living interests, as the fundamental factor of planning, leads us into the domain of politics, which is concentrated economics. The instruments of the social groups of Soviet society are – should be: the Soviets, the trade unions, the co-operatives, and in first place the ruling party.

“Only through the inter-reaction of these three elements – state planning, the market, and Soviet democracy – can the correct direction of the economy of the transitional epoch be attained.

“Only thus can be assured, not the complete surmounting of contradictions and disproportions within a few years (this is utopian!), but their mitigation, and through that the strengthening of the material bases of the dictatorship of the proletariat until the moment when a new and victorious revolution will widen the arena of socialist planning and will reconstruct the system.”

Capitalist planning

The fact is that we already see immense levels of planning today – not by governments or nation states, but inside the big monopolies and multinationals that dominate the global economy.

Far from the economy being a multitude of Robinson Crusoes exchanging with one another, ever since the days of Marx himself, capitalism has been chiefly characterised by the existence of large-scale industry and a world market, with production organised inside huge multinational companies and corporations.

The majority of economic activity, today, occurs not in the marketplace, but under the direction of the bosses inside these firms. They do not leave the ‘invisible hand’ to make decisions relating to production within their businesses. Instead, they plan everything: from the farms and the factories, through to the shops and the supermarkets.

As socialist authors Leigh Phillips and Michal Rozworski explain in their entertaining history of the ‘socialist calculation debate’, humorously entitled People’s Republic of Walmart:

“Walmart is perhaps the best evidence we have that while planning appears not to work in Mises’ theory, it certainly does in practice. And then some…

“If it were a country – let’s call it the People’s Republic of Walmart – its economy would be roughly the size of Sweden or Switzerland…

“Yet while the company operates within the market, internally, as in any other firm, everything is planning. There is no internal market. The different departments, stores, trucks, and suppliers do not compete against each other in a market; everything is coordinated.

“Walmart is not merely a planned economy, but a planned economy on the scale of the USSR smack in the middle of the Cold War. (In 1970, Soviet GDP clocked in at about $800 billion in today’s money, then the second-largest economy in the world; Walmart’s 2017 revenue was $485 billion.)”

Whilst parroting Hayekian nonsense about capitalism protecting ‘freedom’ and ‘liberty’, meanwhile, the bosses are in fact the biggest dictators inside the workplace, leaving their employees with no choice, no freedom, no individuality. As Marx comments in Capital:

“The same bourgeois consciousness which celebrates division of labour in the workshop, the life-long annexation of the worker to a partial operation, and his complete subjection to capital, as an organisation of labour that increases its productive power, denounces with equal vigour every conscious attempt to control and regulate the process of production socially, as an inroad upon such sacred things as the rights of property, freedom, and the self-determining ‘genius’ of the individual capitalist

“It is very characteristic that the enthusiastic apologists of the factory system have nothing more damning to urge against a general organisation of labour in society than that it would turn the whole of society into a factory.” (Marx, Capital, p477)

But whilst there is an incredible level of planning within firms, there is still anarchy between them. Due to the private ownership of the means of production, each company produces blindly for an unknown market; for individual profit, not under a common plan based on society’s needs.

The result is the chaos of capitalism that we see today, with the herd mentality of profit-seeking investors leading to wild swings between shortages and surpluses.

“The contradiction between socialised production and capitalistic appropriation,” Engels states in Anti-Dühring, “now presents itself as an antagonism between the organisation of production in the individual workshop, and the anarchy of production in society generally.” (Emphasis in the original)

With modern technology and technique, we see enormous potential for planning today. A recent front cover of the Economist, for example, highlights the emergence of the ‘real-time’ economy, with big tech firms gathering unfathomable amounts of data on an hour-by-hour, minute-by-minute basis about what we are buying, where we are travelling, and what we are searching for.

“For all their equations and theories, economists are often fumbling in the dark, with too little information to pick the policies that would maximise jobs and growth,” the liberal journal comments in its editorial on this subject.

“Yet the age of bewilderment is starting to give way to greater enlightenment. The world is on the brink of a real-time revolution in economics, as the quality and timeliness of information are transformed…

“The results are still rudimentary, but as digital devices, sensors and fast payments become ubiquitous, the ability to observe the economy accurately and speedily will improve.”

But under the ownership of private monopolies such as Google, Facebook, Amazon, and co., all of this information is used to control us, rather than giving us control. As with all the technology, innovation, and planning we see under capitalism, it is used to maximise profits, not meet our needs.

We therefore see the limits of planning under capitalism. At the end of the day, you can’t really plan what you don’t control; and you don’t control what you don’t own.

Competition and monopoly

Hayek and Mises were vehemently opposed not only to socialism, but to all forms of planning. Indeed, by legitimising the idea of state intervention in the economy, Hayek believed that Keynesian-influenced governments were paving the way for the spread of Bolshevism; taking the public down a path that would lead to authoritarianism and servitude – the so-called Road to Serfdom.

But planning, as Marx and Engels explained throughout their writings, is a fact that has arisen due to the laws of capitalism: the tendency towards the monopolisation, centralisation, and concentration of production.

For libertarians such as Hayek, however, monopolisation is not seen as an objective tendency, arising from private ownership and production for profit, but is the product of subjective decisions; an aberration due to political mistakes.

“The tendency towards monopoly and planning is not the result of any ‘objective facts’ beyond our control,” Hayek claimed in The Road to Serfdom, “but the product of opinions fostered and propagated for half a century till they have come to dominate our policy.”

Such assertions reveal, once more, the idealism of the Austrian school. Again, instead of offering a scientific explanation of the capitalist system, Hayek and his predecessors hide behind a facade of mysticism and obscurantism, in order to provide a mere apology for the status quo.

However much Hayek might deny it, the process of monopolisation is an objective fact – the dynamics of which were explained very clearly by Marx and Engels.

In their search for profits, competing firms are forced to invest in new technology, in order to produce more efficiently, reduce their costs, lower their prices below the industry average, and drive their rivals out of the market. This, in essence, is the law of value at work.

The strongest, most competitive companies will gobble up the weakest ones. And this, in turn, allows them to expand further; to bring about ‘economies of scale’; and to erect ever-larger barriers to entry. The board game Monopoly aptly demonstrates this process (as it was designed to).

The result is that we see both an incredible level of division of labour across society, alongside a centralisation of the means of production in a small handful of giant monopolies and their capitalist owners.

“Freedom of competition,” Engels explains, “changes into its very opposite – into monopoly; and the production without any definite plan of capitalistic society capitulates to the production upon a definite plan of the invading socialistic society.”

Contradictions of capitalism

Importantly, it is these same laws of capitalist competition, private ownership, and production for profit that inevitably lead the system to periodically plunge into crises.

What we see, in other words, is that it is not socialism but capitalism that neither works in theory nor in practice.

In Capital, Marx explicitly chooses to start from the same assumptions as Smith and Ricardo. He wanted to begin from where the classical economists left off, taking their own ideas and running with them, in order to show their inherent contradictions – the contradictions of capitalism.

Amongst these are the assumption that commodities are all sold at their values (i.e. that prices = values), with no monopolies or other restrictions to the flow of capital. Similarly, in volume one at least, Marx assumes that money is metallic, with no forms of credit.

Marx did this in order to examine the law of value and the dynamics of the capitalist system in their purest form, and thus to explain the general causes lying behind the various economic phenomena that we see in society under capitalism.

What these assumptions amount to, in fact, are the very same ideal capitalism that Hayek and the libertarians call for: a free market, with pure competition, no price distortions, and no bubbles.

Yet even on this basis, Marx shows that capitalism inherently leads to crises of overproduction, due to the nature of the profit system.

In summary, such crises are inherent to capitalism, because of the origins of profit: the unpaid labour of the working class.

As explained earlier, workers produce more value than they are paid back in the form of wages. The working class, as a whole, can therefore never afford to buy back all the goods that they produce. But if commodities cannot be sold, then the capitalists – who only produce for profit – will shut up shop. A vicious cycle of falling demand and falling investment ensues, bringing the economy to a standstill.

The capitalists can utilise all manner of tricks to avoid or delay this crisis. But only, as Marx and Engels state in the Communist Manifesto, “by paving the way for more extensive and more destructive crises, and by diminishing the means whereby crises are prevented.”

The overall result of this contradiction, then, is not ‘efficiency’, but enormous waste, in the form of mass unemployment; idle factories; poverty amidst plenty; and a destruction – not a development – of the productive forces.

“Society suddenly finds itself put back into a state of momentary barbarism; it appears as if a famine, a universal war of devastation, had cut off the supply of every means of subsistence; industry and commerce seem to be destroyed; and why? Because there is too much civilisation, too much means of subsistence, too much industry, too much commerce.” (Marx and Engels, The Communist Manifesto)

Debates about ‘economic calculation’ and how to most efficiently allocate scarce resources are therefore misleading.

The task facing humanity is not one of calculating how to allocate scarce resources, but of taking the enormous productive forces and superabundance at society’s disposal into common ownership and workers’ control; and of developing these forces further, so that they can be put to use rationally and democratically, in order to meet our needs, and not the capitalists’ profits.

“The fundamental evil of the capitalist system,” Trotsky emphasises in this respect, in The Revolution Betrayed, “is not the extravagance of the possessing classes, however disgusting that may be in itself, but the fact that in order to guarantee its right to extravagance the bourgeoisie maintains its private ownership of the means of production, thus condemning the economic system to anarchy and decay.”

None of this is due to poor policy decisions, as the Austrians idealistically proclaim, but is the product of the inherent contradictions of capitalism.

Even when everyone is acting ‘rationally’, pursuing their own self-interest, as Smith, Hayek, and all the other liberals and libertarians suggest they should, the result is an outcome that is deeply irrational for society as a whole.

Even when (or exactly when) capitalism is working just as it should, in other words, this is precisely when it doesn’t work at all.

Hayek vs Keynes

This is what none of the Austrian School could ever really explain: why capitalism goes into crisis.

For Hayek and Mises, for example, the Wall Street Crash and the Great Depression were all the fault of irresponsible governments and central bankers being too careless with the credit taps, allowing asset bubbles to form.

Similarly, modern day libertarians provide the same analysis in relation to the 2008 crash. Instead of fuelling the subprime mortgage scandal with artificially-low interest rates and loose monetary policy, we are told, those at the tiller should have stepped back and let the market do its magic.

But such a course of action (or inaction) would not have led to economic ‘equilibrium’ and balance. Rather, if politicians and policy-makers had not pumped credit into the system in the 1920s, and again in the 1980s, 90s, and 2000s, then the subsequent slumps would simply have been brought forward, with the crisis of overproduction taking hold and expressing itself earlier.

For all these reasons, the ruling class themselves were never convinced by Hayek.

In fact, one could say that even Hayek wasn’t entirely convinced by Hayek. Failing to land a knockout blow in the ‘socialist calculation debate’, he retreated away from his economic arguments.

Instead, he shifted towards making a political case for libertarianism, as presented in The Road to Serfdom: complaining moralistically that planning inevitably leads to totalitarianism, and saying that only the competitive market could provide true ‘freedom’, ‘choice’, and ‘individuality’.

Yet later in life, he and his hypocritical acolytes had few qualms about openly supporting the iron fist of the Pinochet dictatorship, in order to smash Allende’s socialist government in Chile and forcibly introduce the invisible hand of the market.

Instead of Hayek’s utopian libertarianism, faced with the Great Depression, the ruling class in the 1930s (in the USA, at least) turned towards the supposed ‘pragmatism’ of Keynesianism – most famously with President Roosevelt’s New Deal of government stimulus and major public works projects.

This, in itself, was a tacit admission of the need for planning. The market had failed. State intervention was needed to pull capitalism out of its quagmire. Although even then, these Keynesian policies did not work, with the crisis continuing – with ups and downs – for a decade, all the way until the Second World War.

The ruling class couldn’t bear the social consequences of what the Austrians were suggesting, with their calls for so-called ‘creative destruction’; that is, making the working class pay for the crisis immediately, through austerity, mass unemployment, and attacks on wages, conditions, and living standards.

Reassurances from Hayek and co. that such immense pain and suffering would be temporary, and that things would all be well ‘in the long run’ offered little relief or comfort. After all, as Keynes had once remarked:

“This long run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again.”

The ruling class were not interested in justifying a free market that clearly was not working. Instead, they were looking to save capitalism, using the state – to save capitalism from itself.

And this is what Keynes and Keynesianism seemed to offer: a ‘solution’ based on managing and patching-up capitalism, without the need to go on the offensive against the working class, risking social explosions and political instability.

Similarly, the most ardent defenders of the free market today have run cap-in-hand to the government during the pandemic. Few bourgeois economists, meanwhile, have objected to the unprecedented state intervention seen in response to the coronavirus crisis, with $17 trillion in direct fiscal support and stimulus, and a further $10 trillion injected into the economy by central banks – all to prop up the system and prevent a total collapse.

The same was also seen in the wake of the 2008 crash, with the capitalist class begging for bailouts for giant financial monopolies that were deemed ‘too big to fail’. Of course, when it came to footing the bill for this, these same bosses and bankers were nowhere to be seen. Instead, it is workers who have been paying through the last decade-or-more of cuts.

Thanks to the postwar boom, Keynesianism remained in vogue amongst politicians and academics alike for several decades, until these policies of government stimulus, state regulation, demand-side management, and deficit-financing came crashing down in the 1970s, paving the way for a swing towards so-called ‘neoliberalism’.

But we must be clear: despite the confusion created by reformists, who idolise the ‘good’ Keynes and chastise the ‘bad’ Hayek, Keynesianism and Hayekianism are two sides of the same liberal capitalist coin.

In fact, whilst they are famous for their intellectual sparring in the 1930s, Keynes and Hayek had far more in common than they would have liked to admit.

Both were firmly and categorically against revolution and the working class, and on the side of capitalism and the ruling class. Both saw themselves as the true inheritors of the classical economists and the Enlightenment. Both came from extremely privileged backgrounds, and nostalgically harked for a return of the Victorian era and the Gilded Age.

Both were imbued with a utopianism and idealism characteristic of the bourgeois liberalism they represented. Both had a mechanical and abstract view of the economy, rather than a dialectical and materialist perspective. And most importantly, both men – and their ideas – fundamentally accepted and defended the capitalist system.

Their differences were more over the form of this economic system, not the class content; over degrees of capitalist state intervention versus capitalist free market.

Keynes was clearly in favour of the market, but was simply concerned by the extent to which laissez-faire principles and rentier capitalism had taken hold. Hayek, meanwhile, whilst opposing planning in place of competition, was not against state intervention and government welfare programmes on principle.

Importantly, neither Keynesianism nor ‘neoliberalism’ offer a way forward for the working class. Keynesian attempts to manage capitalism do not work. Leaving our lives and our futures in the hands – the ‘invisible hand’ – of the market, meanwhile, is a road to misery and disaster.

Freedom and necessity

Today, most libertarians have largely abandoned any attempt to even justify capitalism economically. Instead, libertarianism has mostly been reduced to a series of moralistic, individualistic prejudices about ‘liberty’ and ‘freedom’, as outlined by Hayek in Road to Serfdom.

Hayek’s ideas and arguments, meanwhile, as well as being a staple of most university economics courses and textbooks, are mainly promoted by various well-financed think-tanks and free market institutes – funded, ironically, by the very big business monopolies (such as the Rockfellers) that he claimed to abhor.

“The Institute for Business Cycle Research, founded by Mises in 1927 and run by Hayek,” Janek Wasserman writes, “demonstrated the convergence of liberal ideas and capital.”

“Austrian school members received patronage from wealthy benefactors from Austria and the United States. In return, they provided their economic expertise…

“A look at its board of trustees reveals the important connections Mises and Hayek had cultivated with the conservative establishment. Besides Mises and Hayek…of the other forty-five members there were representatives of the conservative federal government, lobbying groups for industry, bankers, CEOs, and nationalist professors.”

In return for this big business philanthropy, the Austrians provided right-wing politicians (such as Thatcher and Reagan) with a convenient theoretical fig-leaf to hide behind, as they smashed the trade unions, and attacked workers’ rights and wages, in an effort to boost the capitalists’ profits.

From everything that has been said above, it is clear that the ideas and ‘theories’ of the Austrian school hold no water. But the same is true of libertarian appeals for ‘freedom’.

In reality, there can be no real freedom for any individual within a system that is out of our control; in a system that, having arisen unconsciously out of historical and economic necessity, now imposes itself upon us; in a system where the economy and its laws do not work for us, but against us; in a system where all the important decisions are taken not democratically, by ordinary people, but by a dictatorship of capital – an authoritarian and unaccountable elite of bosses, bankers, and billionaires.

For Hayek, freedom meant the absence of political ‘coercion’ and ‘force’ on individuals – refusing to acknowledge the very real economic coercion and force imposed on the working class by the laws of capitalism. Freedom for him, in other words, was freedom for the bourgeoisie from any restraints on their money-making.

But as Engels noted in his brilliant polemic with Dühring, drawing on Hegelian dialectical philosophy, real freedom is not obtained by imagining ourselves to be free of the laws within society, the economy, and nature – laws that operate blindly behind the backs of individuals, capitalists and workers alike.

Rather, true liberation comes about precisely from understanding these laws, and being able to manipulate them to our own advantage as a species. Freedom, in short, “is the insight into necessity”.

“Freedom does not consist in any dreamt-of independence from natural laws, but in the knowledge of these laws, and in the possibility this gives of systematically making them work towards definite ends.

“This holds good in relation both to the laws of external nature and to those which govern the bodily and mental existence of men themselves – two classes of laws which we can separate from each other at most only in thought but not in reality…

“Freedom therefore consists in the control over ourselves and over external nature, a control founded on knowledge of natural necessity; it is therefore necessarily a product of historical development.” (Engels, Anti-Dühring, chapter 11)

One can imagine themselves to be a bird, free to fly away, for example. But this does not mean that you will be able to escape falling to your death if you jump out of a third-floor window, and attempt to take flight.

By understanding the laws of gravity, motion, Newtonian mechanics, and aerodynamics, however, we can create machines – aeroplanes or drones – that can allow us to fly.

Similarly, whilst the motion of every molecule of gas in a cylinder is seemingly random and unpredictable, thanks to a history of scientific investigation, we now know that there are laws of thermodynamics that govern the dynamics of such a system as a whole, with very definite relationships between temperature, pressure, volume, and so on.

Furthermore, by understanding these laws, we can convert the heat contained in a mass of gas into steam, and use this to turn turbines that can generate electricity; that is, to create the force and power that lies behind the Industrial Revolution, and which has transformed society and nature.

The same is true of economics. The libertarians, however, are not interested in scientifically understanding the capitalist system. Their goal is not to explain the workings of the economy, but to throw dust in the eyes of workers, and provide a theoretical justification for the inequalities and injustices of capitalism.

Marxism, by contrast, aims to genuinely understand the world, in order to change it; to consciously recognise and understand the laws of capitalism – laws of necessity that, as Hegel says, are “blind only in so far as they are not understood” – so that we can overthrow them through revolution, and replace them with a new set of laws based on socialist planning and workers’ democracy.

This is the task that faces us: to organise workers and youth, basing ourselves on the solid foundations of Marxist theory; to arm ourselves with the weapon of Marxist ideas, in the fight for revolution. Only on this basis can humanity liberate itself from the shackles of capitalist chaos and crisis.

We leave the final word to Engels:

“With the seizing of the means of production by society production of commodities is done away with, and, simultaneously, the mastery of the product over the producer. Anarchy in social production is replaced by systematic, definite organisation. The struggle for individual existence disappears.

“Then for the first time man, in a certain sense, is finally marked off from the rest of the animal kingdom, and emerges from mere animal conditions of existence into really human ones.

“The whole sphere of the conditions of life which environ man, and which have hitherto ruled man, now comes under the dominion and control of man who for the first time becomes the real, conscious lord of nature because he has now become master of his own social organisation.

“The laws of his own social action, hitherto standing face to face with man as laws of nature foreign to, and dominating him, will then be used with full understanding, and so mastered by him. Man’s own social organisation, hitherto confronting him as a necessity imposed by nature and history, now becomes the result of his own free action. The extraneous objective forces that have hitherto governed history pass under the control of man himself.

“Only from that time will man himself, with full consciousness, make his own history – only from that time will the social causes set in movement by him have, in the main and in a constantly growing measure, the results intended by him.

“It is humanity’s leap from the kingdom of necessity to the kingdom of freedom.” (Engels, Anti-Dühring, chapter 24)