In the first quarter of 2025, Swedish fintech company Klarna’s net losses doubled to £72.9 million. Alongside this, the amount that customers have failed to pay back on their loans has risen to over £100 million – 17 percent more than in 2024.

Meanwhile, the service – which allows users to ‘buy now, pay later’ (BNPL) – is being implemented in as many places as possible, no matter how risky.

Deliveroo, eBay, ASOS, and many others now have Klarna as a standard payment option. For the music festival Coachella, a staggering 60 percent of tickets were purchased using BNPL this year. A recent survey also found that 14 percent of Americans now use BNPL to pay for groceries.

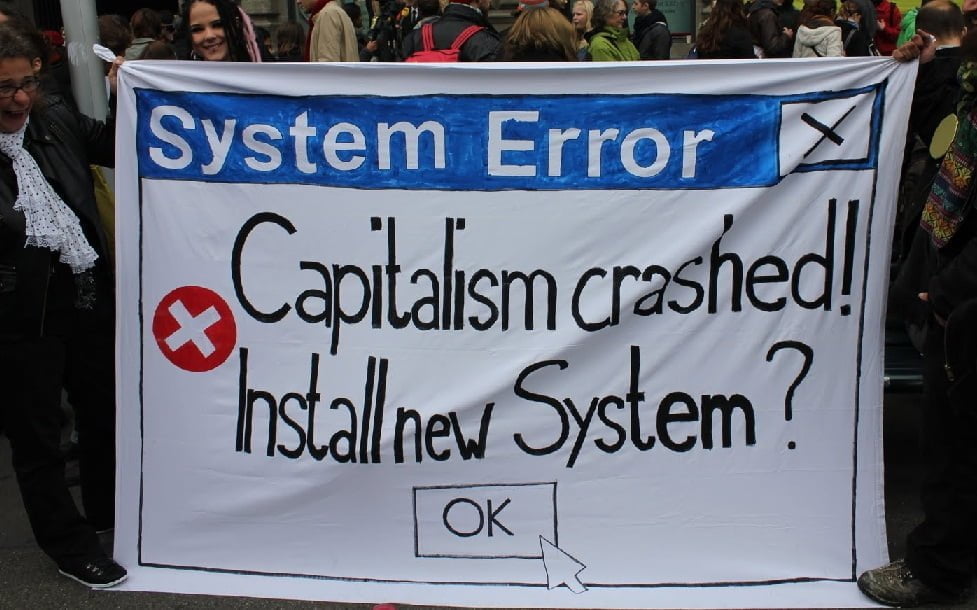

The news of Klarna’s financial troubles has sparked a number of memes online, many of which reference the film The Big Short which depicts the 2008 financial crash.

They’re called synthetic debt bundles of gym memberships and burritos… and they’re awesome https://t.co/sCIVWKxrqI pic.twitter.com/X0ifPcNw2x

— Michael Burry Stock Tracker ♟ (@burrytracker) May 20, 2025

https://t.co/e48Ax1Hh7j pic.twitter.com/X2bFaH8cx6

— pri (@macrodosi) April 26, 2025

These predatory credit practices are more prevalent than ever. BNPL companies make hundreds of millions in ‘late fees’ from people being unable to pay back their loans on time. They are nothing more than loan sharks with flashy marketing and venture-capital backing.

Consumer credit plays another useful role for the capitalists: by allowing workers to spend money that they don’t have, it greases the wheels of the capitalist market, which is glutted with commodities.

Speculation and bubbles

Despite being founded in 2005, it took 19 years for Klarna to have its first profitable year in 2024 – only to then immediately begin making losses again in 2025! For a company valued at around £10.74 billion, this beggars belief.

In reality, however, Klarna is just one among many large speculative tech companies (known as ‘unicorns’) whose market ‘value’ is derived not from its actual profitability today, but the promise of profitability at some point in the future.

The idea is simple in theory: invest billions in ‘disruptive tech’, gain market dominance through low prices, and then switch to ‘profit mode’ by laying off staff and hiking prices.

With fewer and fewer avenues for profitable investment in a world economy suffering from overproduction, these get-rich-quick schemes are very alluring to the capitalists. This explains the explosion of speculative tech companies in the past decade.

But while some of these companies, like Uber and Deliveroo, finally began turning a modest profit in recent years, hundreds of them are failing to attract new investors and are recording massive losses – earning them a new moniker: ‘zombiecorns’.

Just like the ‘tulipmania’ of the 17th century, this is a classic example of a speculative bubble. Many of these companies are beginning to run out of road, and their desperate investors can see the cliff-edge on the horizon. The turmoil in the world economy can only add to their woes.

Workers bear the brunt

As everyone who has drank alcohol will know, after the party comes the hangover. The same is true of the capitalists’ drunken orgies of speculation.

2008 is a shining example of this: a reckless rise in the availability of credit – particularly mortgage credit – triggered a global financial meltdown, resulting in massive state bailouts for the banks, and the brutal austerity implemented ever since. The stagnation and decline of living standards in turn created a new impetus towards predatory lending.

Wonga, for example, arose out of this in the aftermath of 2008, offering seemingly free loans to help workers make it to payday. But when workers failed to pay back what they had borrowed, interest rates could reach an extortionate 1,500 percent!

In 2018, Wonga went bust, as a result of expensive compensation claims for their predatory practices. It seems that its successor, Klarna, may soon end up in the red as well.

The world economy is sitting on a ticking time bomb of debt, which threatens to drag the entire system into turmoil.

From tech companies laying off staff and driving down wages, to families being made reliant on BNPL to make ends meet, it is always the working class that bears the brunt of capitalism’s crisis.

These parasites must be expropriated, and their vast amounts of capital should be used as part of a socialist planned economy. That way, everyone’s needs could be met without the need for loans, late fees, and profiteering.