We publish here the first part of a draft document which will be discussed at the World Congress of the International Marxist Tendency this summer. The aim of this document, originally drafted in October 2015, is to outline the main economic, social and political trends in the world today and to develop a perspective for the class struggle in the period ahead.

We publish here the first part of a draft document which will be discussed at the World Congress of the International Marxist Tendency this summer. The aim of this document, originally drafted in October 2015, is to outline the main economic, social and political trends in the world today and to develop a perspective for the class struggle in the period ahead.

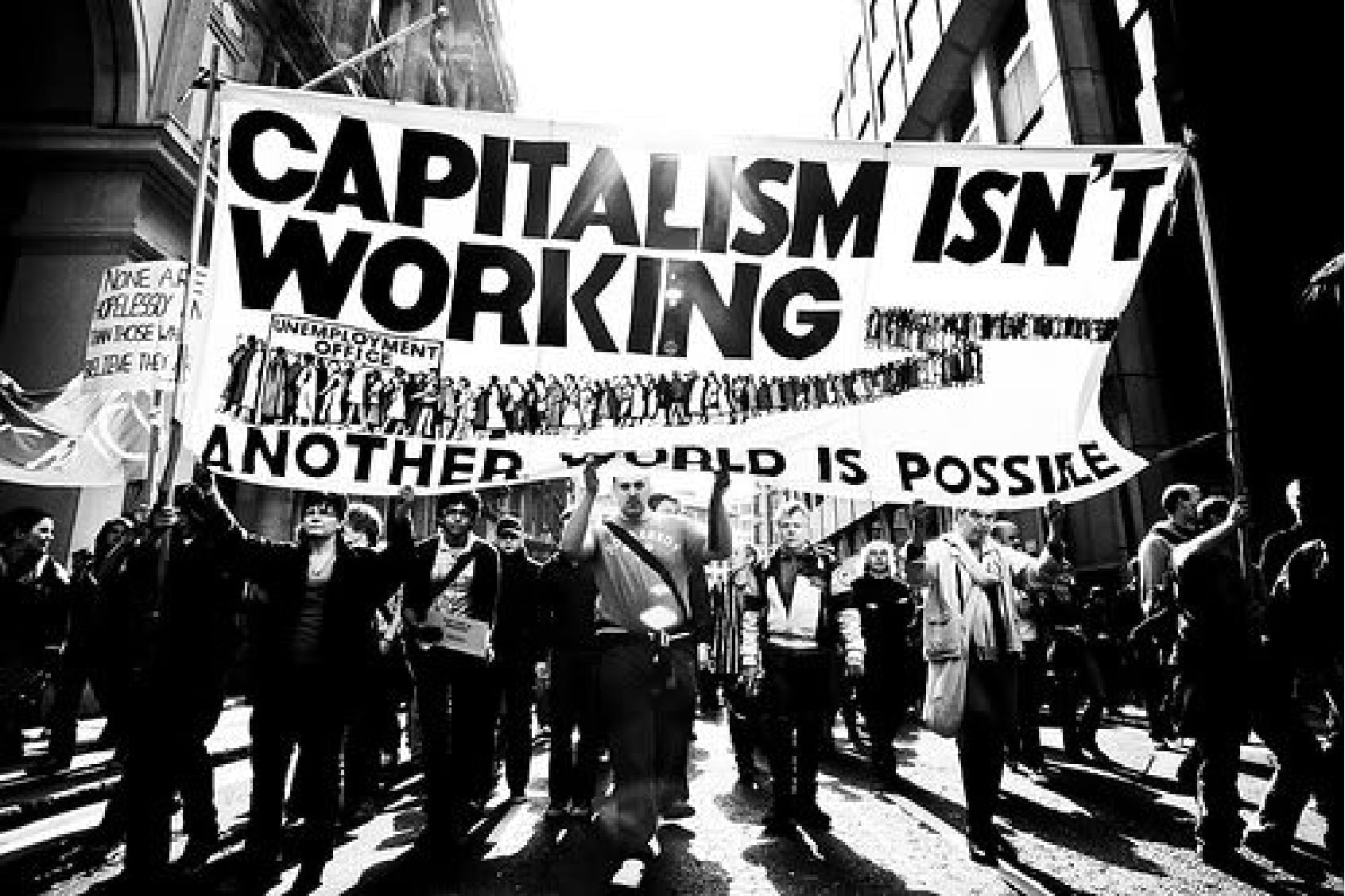

The year 2016 was ushered in by sharp falls on the stock exchange in China that swept across the globe, reflecting a mood of panic among investors. This nervousness expresses the fears of the bourgeoisie that the world is heading in the direction of a new slump. The history of capitalism is a history of booms and slumps. This cycle will continue until capitalism is ended, just as a person breathes in and out until he or she dies. However, in addition to these events, one can discern longer periods, curves of development and decline. Every period has different features that have a decisive effect on the class struggle.

Some, like Kondratiev and his modern imitators, have tried to explain this in a mechanical way. Kondratiev’s ideas are becoming fashionable these days, because they presuppose that every downswing will inevitably be followed by a long period of upswing. This thought provides a much-needed crumb of comfort to the bourgeois economists who are cudgelling their brains attempting to understand the nature of the crisis and find a way out.

The present world situation is characterised by crisis at all levels: economic, financial, social, political, diplomatic and military. The main cause of the crisis is the inability of capitalism to develop the productive forces on a world scale. The OECD believes that there will be no significant growth for at least fifty years. Booms and slumps will still continue, but the overall tendency will be downward. This means that the masses are facing decades of stagnant or falling living standards and the situation will be even worse in the so-called developing countries. That is a finished recipe for class struggle everywhere.

A new slump looms

The more serious capitalist strategists tend to draw the same conclusions as the Marxists, though with a certain delay, and from their own class point of view. The pessimism of the bourgeois economists is shown by their predictions of a period of “secular stagnation”. The International Monetary Fund points out that the global financial crisis was worse than previous episodes of turmoil and warns that most of the world’s leading economies should prepare for a prolonged period of lower growth rates.

The IMF reports are full of gloom. They have downgraded their forecasts repeatedly. In relation to 2012 forecasts, the IMF has revised its estimates for the level of US GDP for 2020 downwards by 6%; Europe by 3%; China by 14%; emerging markets by 10% and 6% for the world as a whole. Growth in the industrialised countries has not surpassed 2% for the past four years.

The IMF estimates the long-term growth rate in rich countries will average just 1.6% annually from 2015 to 2020, compared with 2.2% from 2001 to 2007. Of course, this assumes that there will not be a slump, but that is precisely what cannot be assumed. Everything points to a new and deep slump on a world scale.

In the words of Christine Lagarde, head of the IMF, “In addition, medium-term growth prospects have become weaker. The ‘new mediocre’ of which I warned exactly a year ago – the risk of low growth for a long time – looms closer.[…] High debt, low investment, and weak banks continue to burden some advanced economies, especially in Europe; and many emerging economies continue to face adjustments after their post-crisis credit and investment boom.”

Lagarde warned that the slowdown in China would have knock-on effects on countries that rely heavily on Chinese demand for their raw materials. She said there was a possibility of a prolonged period of low commodity prices, particularly in the large commodity exporters. She complained about low productivity holding back growth. But this is an explanation that explains nothing.

“The risks are rising”, warns Lagarde. “We need a new recipe.” Unfortunately, she does not enlighten us as to what this new recipe might be. But the Fund has its cookbook open at the page where a very old recipe is written: calling on politicians in “emerging markets” to “implement structural reforms”, that is, to open up their markets to be plundered by foreign capitalists, privatize state property and make labour markets more “flexible”: that is, to take measures that will lead to further attacks on jobs, wages and conditions.

At the heart of the crisis is the fact that productive investment – the key to any boom – is falling. Investment spending is forecast to remain below pre-crisis levels even if the present sluggish economic recovery persists. What this means is that the capitalist system has reached its limits on a world scale and in fact has gone far beyond them. This fact finds its expression in the mountain of accumulated debt that has been inherited from the last period. For several years, multi-national companies invested heavily in the “emerging economies”, but this has now slowed down, given the overproduction (“excess capacity”) affecting their economies.

The capitalists have lost faith in the system. They sit on piles of trillions of dollars. What point is there in investing to boost production when they cannot use the productive capacity that they already have? Lower investment also means stagnant productivity of labour. Productivity in the US is growing at a miserable 0.6% per year. The capitalists only invest for profit, but that presupposes that there are markets in which to sell their products. The fundamental reason they are not investing sufficiently to develop productivity is that there is a crisis of overproduction on a world scale.

Instead of investing in new factories, machinery and technology, they are trying to boost productivity by lowering real wages in a race to the bottom everywhere. But this only serves to further exacerbate the contradiction by reducing demand, which in turn leads to further falls in investment.

Growth in potential output in the developed capitalist countries is estimated to be 1.6% a year between 2015 and 2020, according to the IMF forecasts. This is marginally higher than the rate of expansion in the past seven years, but significantly lower than growth rates before the slump, when potential output expanded at 2.25% a year. Even that figure was miserable when compared to the colossal potential of modern industry, science and technology. Now, however, the economy is crawling along, and even that perspective is uncertain.

Falling prices and low interest rates, which in normal times would be good news, now become a mortal danger. They are the mirror image of economic stagnation and falling demand. Interest rates have been falling for the past decade. They have reached rock bottom, even turning negative. According to Andy Haldane, the Bank of England’s chief economist, these are the lowest rates for 5,000 years.

Low growth, low inflation and zero interest rates add up to what the bourgeois economists refer to as secular stagnation. The economic engine of the industrialised economies is barely running above stall speed. That cannot be maintained for long. According to the strategists of Capital, the dangers facing the global economy are more severe than at any time since the bankruptcy of Lehman Brothers in 2008.

The fears of the bourgeois were well expressed in a speech on September 2015 delivered by Andy Haldane. He warned: “Recent events form the latest leg of what might be called a three-part crisis trilogy. Part One of that trilogy was the ‘Anglo-Saxon’ crisis of 2008/09. Part Two was the ‘Euro-Area’ crisis of 2011/12. And we may now be entering the early stages of Part Three of the trilogy, the ‘Emerging Market’ crisis of 2015 onwards.”

The problem for the bourgeois is that they have already used up the mechanisms they need to get out of a slump or lessen its impact. When the next slump occurs (and it is a question of when, not if) they lack the tools to respond. Interest rates remain very low and the continuing high levels of debt rule out further huge injections of state money. “The instruments to deal with such a condition are not readily available,” as Martin Wolf coyly puts it.

Global Debt and the BRICs

Since the crisis began global debt has actually risen. The hoped-for financial healing has happened only in a few scattered parts of the global economy. The level of debt is of an unprecedented scale. Government debt has in wartime reached present levels, but never in peacetime, and household and corporate debt has never before reached such heights. Before the crisis, debt was rising everywhere. In the US it reached 160% of GDP in 2007 and nearly 200% in Britain. In Portugal, such debt reached 226.7% of GDP by 2009. In 2013, it was still at 220.4%. In the US, total debt is presently 269% of GDP. Only once before in history has it reached such a level. That was around 1933 when it reached 258%, after which it rapidly fell to 180%.

The whole point of the austerity regime was to lower the volume of debt, particularly state debt. But figures show that this is far from being the case. In the February 2015 report from McKinsey Global Institute, we find that global debt has increased by $57tn since 2007, or from 269% of world GDP to 286%. This is happening in every sector of the world economy, but in particular with government debt, which is rising by 9.3% per year. This rise in levels of debt (“leveraging”) is also happening in practically every single country. Only a few countries, dependent on China or oil prices, were reducing their debt levels, but this has been brought to an abrupt end in the last two years. This vast mountain of debt acts as a heavy burden on the world economy, smothering demand and dragging down production.

All the so-called BRIC economies are in crisis: Brazil, India and Russia are in difficulties. In fact, Brazil and Russia are in a slump. The slowdown in the so-called emerging markets is set to be even sharper than in the advanced capitalist countries. The IMF predicts that their potential output, which continued to expand in the run-up to the crisis, is set to decline from 6.5% a year between 2008 and 2014 to 5.2% in the next five years.

The growth of these economies was one of the main factors that prevented the 2008 crisis from developing into a deep slump of the world economy. Over the past five years the so-called emerging markets accounted for 80% of global growth. These markets, especially China, acted as the locomotive of the world economy before and after the slump. They were an important field of investment previously, when profitable outlets were scarce in the west.

But now that has turned into its opposite. From being a factor that propped up world capitalism it has become the main danger that threatens to drag down the whole world economy. It is not just in the traditionally developed economies that debt has risen dramatically. The debts of so-called emerging markets have swollen to unprecedented dimensions. The study by McKinsey shows that total “emerging market” debt rose to $49tn at the end of 2013, accounting for 47% of the growth in global debt since 2007. That is more than twice its share of debt growth between 2000 and 2007.

According to the IMF total foreign currency reserves held by “emerging markets” in 2014 (a key indicator of capital flows) suffered their first annual decline since records began in 1995. These capital inflows resemble a flow of blood to a person in need of a transfusion. Without a steady flow of capital the so-called emerging economies will not have the money to pay their debts and finance their deficits while investing in infrastructure and the expansion of production.

The BBC also quotes figures from the International Center for Monetary and Banking Studies (ICMBS):

“Since then [2008], it is the developing world, especially China that has driven the rise in debt. In the case of China, the report describes the rise in debt as ‘stellar’. Excluding financial companies it has increased by 72 percentage points to a level far higher than any other emerging economy. The report says there have been marked increases in Turkey, Argentina and Thailand as well.

“Emerging economies are particularly worrying for the authors of the report: ‘They could be at the epicentre of the next crisis. Although the level of leverage is higher in developed markets, the speed of the recent leverage process in emerging economies, and especially in Asia, is indeed an increasing concern.’”

Some of the most significant capital outflows are originating from countries that piled debts up the quickest. South Korea, for instance, saw its debt to GDP ratio to debt rise by 45 percentage points between 2007 and 2013, while China, Malaysia, Thailand and Taiwan experienced debt surges of 83, 49, 43, and 16 percentage points respectively.

These economies are also slowing down or are in recession, preparing a deep global slump in the coming period.

Trouble in China

Most serious of all, the Chinese economy is experiencing a sharp slowdown. The slowdown in the “emerging economies” is due, on the one hand, to the prolonged slump in demand in the advanced capitalist economies and on the other, to the decline of China. This scenario must translate into significantly weaker world trade. Dialectically, everything is interconnected, so that weak demand and markets lead to weak production and investment. Weak investment leads to weak recovery, which in turn leads to weak demand.

Most serious of all, the Chinese economy is experiencing a sharp slowdown. The slowdown in the “emerging economies” is due, on the one hand, to the prolonged slump in demand in the advanced capitalist economies and on the other, to the decline of China. This scenario must translate into significantly weaker world trade. Dialectically, everything is interconnected, so that weak demand and markets lead to weak production and investment. Weak investment leads to weak recovery, which in turn leads to weak demand.

The explosive growth of industry in China can be seen from the statistic that between 2010 and 2013, China poured more concrete than the USA did in the entire 20th century. But the huge productive capacity of Chinese industry is not compensated by a corresponding growth in world demand. The inevitable result is a crisis of overproduction.

In the period up to 2007, global demand was driven by credit and house building, especially in the US and Spain. This collapsed and demand was taken up by China, as it poured in billions into infrastructure and bank loans. Over 40% of GDP was invested, which built up the productive forces and demand for raw materials. It also built up huge excess capacity.

The bursting of the bubble in the West starting in 2008 led to the Chinese state pumping enormous amounts of money into the economy. This in turn led to an enormous speculative bubble and a massive accumulation of debt at all levels of the Chinese economy. This bubble is in the process of bursting, with far-reaching consequences. China is going the same road as Japan, the road of prolonged stagnation. The slowdown in China, in turn, has meant a collapse in commodity prices, which has hit hard the “emerging economies”. More importantly, China represents 16% of world output and 30% of world growth. When China slows, the world slows.

Overproduction in China is affecting steel and other manufactured goods. There has been a massive accumulation of debt and there are fears of a collapse of the overheating property market. More than 1,000 iron ore mines are on the verge of financial collapse. The Financial Times predicts: “China, in particular, could see a sharp contraction in the growth of potential output, as it tries to rebalance its economy away from investment and towards consumption.”

The Chinese premier Li Keqiang told the US ambassador that he relied on three things to judge economic growth: electricity consumption, rail freight volumes and bank lending. On this basis, economists at Fathom have compiled a “China Momentum Indicator” from the three sets of figures. The indicator shows that the actual pace of growth could be as low as 2.4%. Rail freight volumes are sharply down and electricity consumption is virtually flat. As a result of falling growth, China has cut its interest rates six times in the last twelve months. It has also devalued its currency to revive its exports, which intensifies the conflict with the Americans and creates massive instability everywhere.

The decline in growth in China has hit the so-called emerging economies, especially those who heavily depend on China. The fears of a Chinese slowdown were felt within China itself, especially on the falls in the stock market. The authorities intervened with $200bn to stabilise the market, but had to give up in the end. Panic has gripped investors. “If we don’t reform, the Chinese economy may even slow to collapse”, says Tao Ran, professor of economics at the university of Beijing. “All we have achieved in the past 20 or 30 years will be lost.”

The research division of Japan’s second biggest brokerage house, Daiwa, did what nobody else has done before and released a report in which it made a global financial “meltdown”, one resulting from nothing short of a Chinese economic cataclysm, its best case scenario. It added that the impact of this global meltdown would “be the worst the world has ever seen.”

World trade

The most serious threat to the world economy is the re-emergence of protectionist tendencies. The growth of world trade in previous decades and the intensification of the international division of labour (“globalization”) acted as the main motor force of the world economy. By these means the bourgeois succeeded partially and for a temporary period in overcoming the limits of the nation state. But now all this has turned into its opposite.

A striking example of this is the European Union, which the European bourgeois (led initially by France and Germany, now by Germany alone) attempted to unite in a single market with a single currency, the Euro. The Marxists predicted that this would fail and that the first serious economic crisis would lead to the re-emergence of all the old national divisions and rivalries, which were disguised but not abolished by the single market.

The crisis of the Euro, which has plummeted against the dollar, reflects the seriousness of the economic crisis. The Greek crisis is only the most obvious expression of a crisis that can lead to the collapse of the Euro and even the breakup of the EU itself. Such a development would have the most serious consequences for the entire world economy. That is why Obama is urging the Europeans to solve the Greek crisis at all costs. He understands that the collapse of the EU would lead to a crisis in the USA itself.

2015 marked the fifth consecutive year that average growth in the “emerging economies” has declined, dragging down world growth in the process. Before 2008, the volume of world trade grew by 6% annually, according to the WTO. In the past 3 years, it has slowed to 2.4%. In the first 6 months of 2015, it suffered its worst performance since 2009.

In the past, trade was a major factor driving production, but not anymore. Since 2013, every 1% of global growth has produced a trade rise of only 0.7%. In the USA, manufacturing imports have not risen at all as a share of GDP since 2000. In the decade before that they had nearly doubled.

The conclusion is inescapable: Globalisation is slowing. The engine of economic growth, world trade, is stalling. The volume of world trade fell in May (2015) by 1.2%. It fell for 4 out of the first 5 months of 2015. The Doha Round of talks has been going on for 14 years and has effectively been abandoned. The US is instead attempting to develop regional free trade blocks, in its own imperialist interests. They have recently negotiated the Trans-Pacific Partnership (TPP), which could cover 40% of the world economy, but it is full of contradictions. It needs to be ratified by a host of countries, including the US, which by no means is certain. Obama faces a hostile Congress and might be unable to ratify it before the end of his term.

Inequality

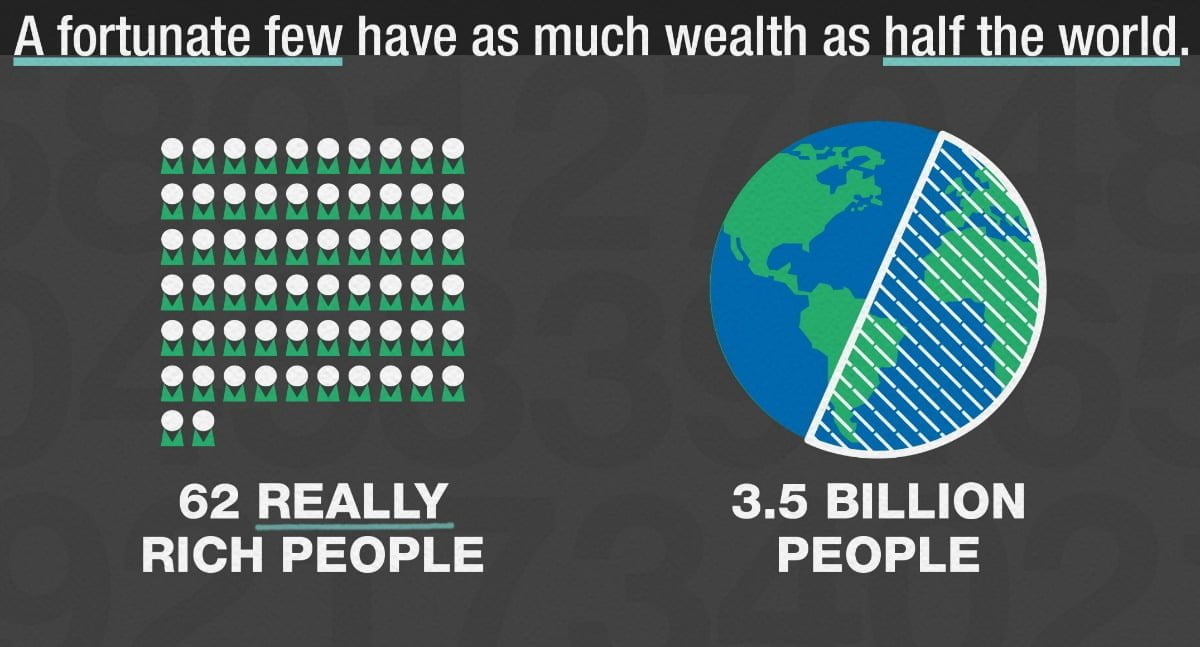

The concentration of capital predicted by Marx has reached unheard-of levels. It has created levels of inequality that are unprecedented. Enormous power is concentrated in the hands of a tiny minority of super-rich men and women who really control the lives and destinies of the peoples of the world.

The concentration of capital predicted by Marx has reached unheard-of levels. It has created levels of inequality that are unprecedented. Enormous power is concentrated in the hands of a tiny minority of super-rich men and women who really control the lives and destinies of the peoples of the world.

Young people, women and ethnic minorities also suffer disproportionately from the crisis. They are the first to be sacked and those who take the largest falls in wages. The crisis aggravates the effects of inequality and gender discrimination as well as feeding moods of racism, xenophobia and intolerance towards minority groups among backward layers of the population.

Young people are suffering the worst economic prospects for several generations. That is acknowledged by all the bourgeois economists. Younger people have seen the greatest drop in income and employment. They suffer from the constant attacks on all levels of education, which is being ruthlessly slashed and privatised in the interest of finance capital. Universities are increasingly becoming the preserve of a privileged minority.

The majority of young people are denied opportunities that in the past were taken for granted. This is a major cause of instability and threatens to cause social explosions. It was a major factor in the so-called Arab Spring and similar uprisings are being prepared everywhere.

Everywhere the poor are poorer and the rich are richer. The anti-poverty charity Oxfam published a report that shows that the share of the world’s wealth owned by the richest 1% increased from 44% in 2009 to 48% in 2014, while the poorest 80% currently own just 5.5%. By the end of 2015 the world’s richest 1% already owned more wealth (50.4%) than the remaining 99% combined.

The more perspicacious bourgeois understand the danger this polarisation between rich and poor represents for their system. The OECD says its findings raise social and political questions in addition to economic ones. Winnie Byanyima, executive director of Oxfam International, said the increased concentration of wealth seen since the deep recession of 2008-09 was “dangerous and needed to be reversed”.

Well-meaning reformers have urged world leaders to address the problems of inequality, discrimination and social exclusion as well as climate change and other pressing matters facing humanity. But how these miracles are to be achieved under capitalism is never explained. Summits and conferences come and go. Speeches are delivered. Resolutions are passed. And nothing changes.

Permanent austerity

The perspective is one of a very prolonged period in which economic recessions are interrupted by periods of sluggish economic growth with ever-increasing economic hardship: in other words, permanent austerity. This is a new scenario, entirely different to the one that existed in the advanced capitalist countries for a period of more than fifty years after the Second World War. The political consequences will therefore also be very different.

We have explained many times that every attempt of the bourgeoisie to restore the economic equilibrium will destroy the social and political equilibrium. And that is precisely what is happening on a world scale. A prolonged economic recession creates economic hardship and disturbs the old equilibriums. The old certainties vanish and there is a universal questioning of the status quo, its values and ideologies.

Since the start of the global financial crisis in 2008 more than 61m jobs have been lost. According to the estimates of the International Labour Organisation (ILO), the number of people that are unemployed will continue to rise over the next five years, reaching more than 212m by 2019. It declares that the “global economy has entered a new period combining slower growth, widening inequalities and turbulence.” If we include the huge number of people engaged in marginal employment in the so-called informal sector, the real figure of world unemployment will not be less than 850 million. This figure alone is sufficient to prove that capitalism has become an intolerable barrier to progress.

In the advanced capitalist countries governments are attempting to reduce the levels of debt accumulated during the crisis by cutting wages and pensions. But the policies of austerity have sharply reduced living standards without having any serious effect on the mountain of debt. All the painful sacrifices inflicted on the masses in the last seven years have failed to solve the crisis; on the contrary, they have made it worse.

Neither the Keynesians nor the orthodox Monetarists have any solution to offer. The already intolerable levels of debt continue to grow inexorably, acting as a dead weight on growth. Governments and companies are trying to pass the burden onto the shoulders of the working class and middle class to bring down their debt levels. This is having profound effects on social relations and the consciousness of all the classes.