To add to the turmoil of Greece and the Euro Crisis, there is now the sudden collapse of the Chinese stock market, which has been so vast that even the mighty Chinese government is incapable of controlling it. The world economy is tottering, and these latest events in China are yet another sign of the diseased economic system that is capitalism.

The world economy is tottering. In the last week it has been buffeted by two extremely turbulent financial storms – Greece and, suddenly, China, the world’s second largest economy. Globally, the system is extremely unbalanced, with massive wealth accumulating in tiny handfuls whilst the billioned masses must keep borrowing from these billionaires to make ends meet. This top heavy, blind and irrational system cannot stand on its own feet and the nation states are buckling under the weight. The sudden stock market collapse in China has been so vast that even the mighty Chinese government is incapable of controlling it.

In June 2014 the Chinese government relaxed regulations on the stock market, in particular, they greatly liberalised rules on margin trading – the risky practice of buying shares not with savings but with borrowed money. These rule changes are part of a much broader, long term strategy by the government of economic liberalisation to better accommodate the law to the reality of the capitalist relations now dominating the Chinese economy. In particular, the Chinese government is trying to chase away economic crisis, specifically a classic capitalist crisis of overproduction, by encouraging internal consumption. Allowing people to borrow and speculate more easily is the chosen method of boosting consumption, one that is of course consistent with the overall capitalist policy of the government.

This is the cause of the stock market’s fantastical boom since June 2014 – from June to June, the stock market has risen in value by around 150% – precisely as economic growth, and more importantly long term growth prospects, have slowed significantly in China. The worldwide paradox of booming stock markets and profits in a time of unprecedented, prolonged economic crisis is but a sign of how deep that crisis is – governments have no alternative but to prop the system up, but the system is so broken that the medicine will not work, and so only produces malignant growths in the form of feaverish stock market and property bubbles.

Volatility and instability

So absurd was the Chinese market’s boom on borrowed money that in June of this year the government began attempts to curtail its frankenstein’s monster – it began to make margin trading harder and on June 12 placed a new limit on this practice. On precisely that day the stock market collapsed and has been in freefall ever since – it has only recovered, partially, on the days in which the government has stepped in to prop it up. Thus, we see the market’s utter dependence on the state’s bankrolling for its very existence.

In the one month since June 12, the stock market has collapsed by around ⅓ its value – about the same amount as the UK’s entire GDP! On some days, the market has fallen by as much as 6%.

Having quite deliberately given the ‘bull-market’ its initial push by encouraging trading on borrowed money, and then caused the ‘bear-market’ by the withdrawal of precisely this regulation, the government remained true-to-form by stepping in once more to prop the market up with extremely panicked measures.

The Chinese government actually has its own margin-finance company, directly funded by the central bank, whose remit consists of lending to people who want to bet more on stocks than they have to spend! The presence of this company proves the conscious state complicity in inflating stock market bubbles; its sudden promotion in the last few days to a role of practically forcing stockbrokers to buy shares reveals the government’s desperation to keep the bubble inflated at all costs. It is reminiscent of the manner in which the government’s 2008 ‘fiscal stimulus’ essentially forced un-viable lending to take place to avoid a recession. The government wishes to control and ‘plan’ capitalism, but it can only use the short-sighted and self-defeating methods of capitalism to do so. It forces unprofitable economic activity, but with tools, such as loans, that are themselves profit-driven.

In doing so, the state has only succeeded in getting sucked into the maelstrom. Local authorities are entangled in a vast web of hidden debt, and their integrity as stable public organisations is threatened. Since June 29th, it has been legalised and encouraged for local government pensions to be invested in stocks, and since 5th July the state’s investment fund has started buying shares on a vast scale. The state’s financial viability is profoundly undermined by the all-encompassing anarchy of the market, just as in Europe.

But the sell-off has developed a momentum too powerful to be contained with these means, and so the government has used the novel practice of banning new share issues, artificially limiting supply to drive up prices. The government has decreed that anyone owning 5% or above of any company cannot sell shares for six months! This has led to a situation where a majority of listed companies had halted all trading by the middle of the week!

Bubbles bursting

The Chinese state has effectively closed the stock market to stop it falling. It is trying to ban market fluctuations! But the Chinese stock market, and the real economy as a whole, have massively outgrown state direction. The Wall Street Crash of 1929, sparked a global recession beyond the control of any government. It was able to do so not only because of the overblown stock-market bubble, but because that bubble was linked to the wider financial system on an unsound basis – margin trading. Excessive confidence caused millions to borrow money to be gambled on the exchange; when the exchange fell, all those loans to gamblers were revealed as bad loans and had to be written off, and so with the crash came a wave of bank failures.

According to Goldman Sachs, the Chinese stock market is ‘easily’ the most leveraged in history. This is all the more incredible given that margin trading has only been allowed for roughly 12 months, making this crash unlike Shanghai’s last one in 2007 when the broader credit system and average household were independent from the stock exchange. According to The Economist “leverage has soared over the course of the rally. Outstanding loans to stock investors reached a record 1.67 trillion yuan ($269 billion) as of April 13th, up some 300% from a year earlier.” By June, this had reached 2.2 trillion yuan.

On the eve of the crash ChiNext, a smaller Chinese stock-exchange like Nasdaq, had “a trailing price-earnings (PE) ratio of 90, more than double that of internet stocks at the peak of America’s dotcom bubble in 2000.” The fictitious character of the bubble was best exemplified in the Economist by the laughably fraudulent tricks being employed on this stock-market:

“Kemian Wood Industry, which used to boast of the quality of its composite floorboards, took radical steps to deal with the downturn [in the real economy]. It switched its focus to online gaming and changed its name. After its rechristening as Zeus Entertainment in early March, its share price doubled in short order. This past week, though, its transition plan hit a snag. CCTV, the state broadcaster, accused it of being one of a series of companies that are “fabricating themes and telling stories” to inflate their share prices…At least 80 listed Chinese firms changed names in the first five months of this year. A hotel group rebranded itself as a high-speed rail company, a fireworks maker as a peer-to-peer lender and a ceramics specialist as a clean-energy group. Their reinventions as high-tech companies appear to have less to do with the gradual rebalancing of China’s economy than with the mania sweeping its stockmarket.”

Government in panic

Why has the government reacted with such public, open panic to the crash? Many have pointed out that the Chinese stock-market remains small in value compared to other countries, at roughly 40% of GDP – the norm for rich countries being 100%. Furthermore, as previously mentioned, the last crash was only 8 years ago, and up to 2014 the stock exchange was consistently falling, making it one of the worst performers globally – during which time the real economy was the star of the world. It has always been a volatile market.

It also seems obvious that the government will not be able to stem the fall, and even if it can, it will succeed only in reinflating what is clearly a bubble divorced from economic reality, and yet not so divorced from it that it’s irresponsible reflation could not damage the latter.

So why not let this silly bubble deflate away and concentrate on keeping the real economy growing? The answer lies in the fact that the real economy, globally and in China, is far from healthy. If the Chinese economy were healthy, balanced and moving in the right direction, it would never have given birth to a stock-market bubble on such a scale.

China’s growth has contributed hugely to the crisis of overproduction that is the real root of the financial crisis. Too much wealth and productive capacity have accumulated in too few hands, the rest consequently lack the money and the consumptive power, to put all this productive power to use. For capitalism such a situation is neither new nor avoidable, what is new is the global scale of this crisis at which China is centred.

For instance, China produces as much steel as the rest of the world combined. The ongoing world slump limits the demand for steel, which is used in so much manufacturing. It is no surprise, then, that iron ore prices fell to their lowest point for six years. China’s slowing economy, itself a product of restricted global demand for its products, is the cause. Just this week iron-ore fell in price 10%, apparently its worst ever trading day. The steel price in China is now cheaper per tonne than cabbage.

The world crisis of capitalism is worsening in the Pacific. According to the Economist, “Taiwan’s exports were down 14% year-on-year in June (and imports down 16%). Both the South Korean and Taiwanese manufacturing PMIs were around 46, indicating sharp contraction. All told, emerging market PMIs now average below 50.” Both of these economies are heavily dependent on trade with China.

The world crisis of capitalism is worsening in the Pacific. According to the Economist, “Taiwan’s exports were down 14% year-on-year in June (and imports down 16%). Both the South Korean and Taiwanese manufacturing PMIs were around 46, indicating sharp contraction. All told, emerging market PMIs now average below 50.” Both of these economies are heavily dependent on trade with China.

On Wednesday the government announced it is to spend 250bn yuan in another, smaller fiscal stimulus, to ensure the real economy stays growing. But this, as well as the panicked measures regarding the stock-market, represent exactly the kind of policies the government wants to move away from. Because of the limited scale of global demand for Chinese manufactures, it is recognised that the economy must rebalance towards internal consumption to maintain demand for its vast industrial base.

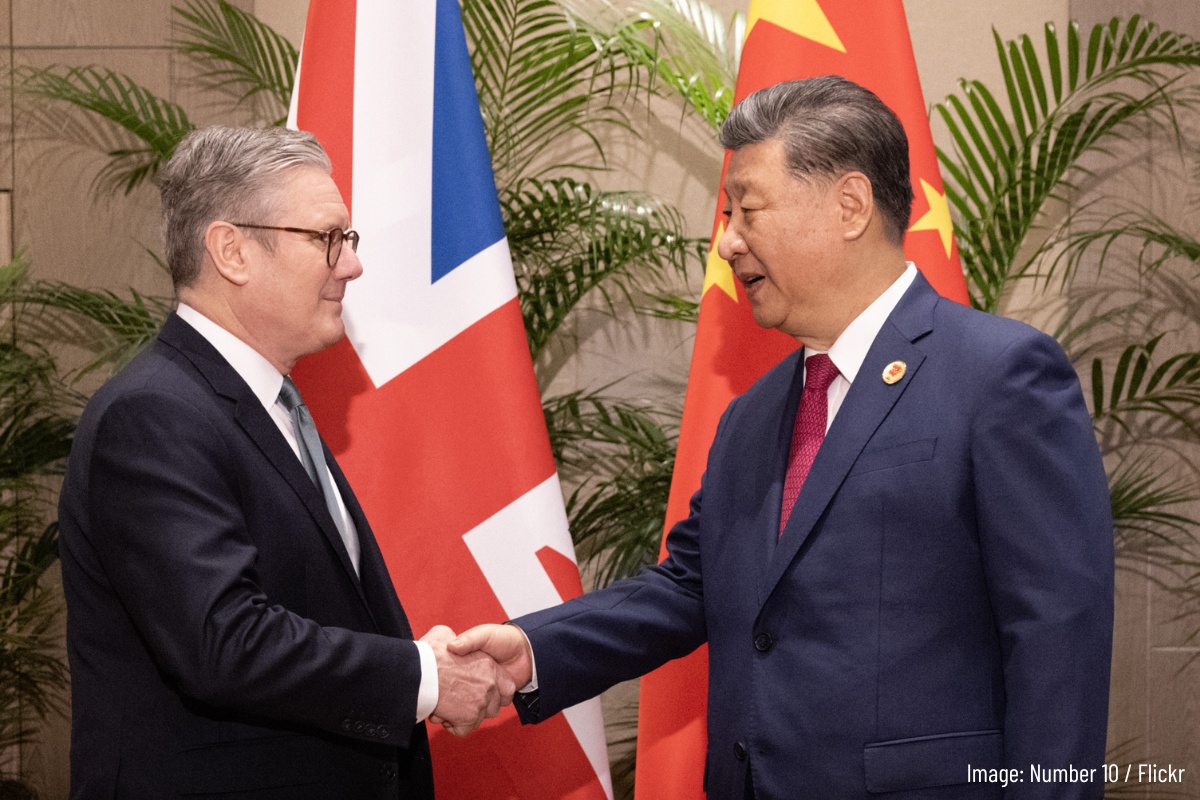

Heavily promoting the stock-market as an alternative to saving was integral to this strategy. It is for this reason that the government has staked so much credibility on the growth of the stock market, and explains the panicked attempt to reflate the bubble, which was according to the People’s Daily the ‘carrier of the Chinese Dream’ – a corny soundbite of Xi Jinping’s that sums up how far China has gone down the path of bourgeois society. The success of the stock market is seen as the the rebirth of China as the leading imperialist power on the planet, it is a kind of barometer of how far China is in its glorious mission to usurp the United States. The media unashamedly urged people to buy stocks, fostering the illusion that ‘uncle Xi’ would guarantee the market could only go up.

The nationalist mania this is part of and helped to raise to new pitches is encapsulated in the case of Sina Weibo user ‘Lover of the Spratlys’, a fervently nationalist woman who, inspired by the propaganda, invested just under $200,000 in stocks, ⅓ of the sum borrowed, and subsequently lost 40% of her money. The Spratlys are an island chain essentially part of the Philippines but which imperialist China is trying to gradually take over as part of its effort to wrest control of the South and East China seas from the US.

On June 25th, this ardent nationalist left the following post on Sina Weibo: “I put all my family’s money into CRRC. Two months of torment and every minute of it was pain. Tomorrow I will leave, carrying a lifetime of suffering with me!” Authorities followed the post, managed to track her down and save her life, but no doubt there have been and will be many more suicides amongst the 90m people who have invested in the stock market in the boom of the last twelve months.

Millions of ordinary people have naively been sucked into this speculative frenzy with no real understanding of the stock market. “Thousands of people gathered in ‘street stock market saloons’ in Shanghai from early afternoon until late in the evening to swap tips.”

An organic crisis

The whole thing – a boom in the real economy running out of steam, massive margin trading, and millions of ordinary people joining in the craze for ‘easy money’ is extremely reminiscent of Wall Street 1929.

The government knows its existence depends on the maintenance of China’s boom and rising living standards, but it also suffers an existential dread of the evil day when this boom inevitable comes to a crashing halt. It is desperately searching for a means to extend the boom, and thought it had found it in the stock market bubble. It tries to order the economy about, as if it weren’t an incredibly complicated organism of 1.3bn people determined by blind market forces. Having staked so much on the stock market, it fears its collapse may infect the real economy and bring the dreaded class struggle with it.

The whole economy is not only linked to a sickly world economy, but itself suffers from the debt disease more and more. Chinese debt has ballooned from 0% under the planned economy, to around 250% of GDP today. But under capitalism, what means are there to treat this plague? The ongoing crisis in Europe proves just how impossible it is to cure from within the system, because debt lies at the heart of the very contradictions of the system itself. In recent years, as this debt has grown and seeped into the whole economy, the government has tended to order loans to be rolled over – that is, it once again attempts to dictate to the market economyagainst the logic of the economy itself. It simply orders loans due for repayment not to be repaid, because it knows that a huge proportion of them cannot be repaid and never should have been created in the first place. But loans are made in order to be repaid, with interest. Eventually, the evil day of repayment must come. If the economy is run on a capitalist basis, the basic principles of capitalism – for instance that loans generate profits – must ultimately operate.

Just yesterday it was reported that the government has once again ordered loans to be ‘rolled over’ – this time for loans made to buy stocks. But as with the European crisis, ‘kicking the can down the road’ not only fails to resolve the problem, and puts it off, but also ends up worsening the problem by building up more and more debt. Greece’s debt has grown with all the bailouts. Similarly, China’s fiscal stimuli and stock and housing market leveraged bubbles, and the rolling over of the debt incurred, will only produce more unsound debt and bigger crises for the future.

The stock-market crash is further evidence of the diseased global capitalist system, of its organic crisis. The solution is not bureaucratic diktat, the ‘banning’ of the crisis, but its real abolishing through expropriating the vast wealth built up in the hands of the world’s capitalists, so that we can rationally, democratically use this wealth to meet the world’s needs directly. That requires a socialist revolution in China, Europe and the rest of the world. That is the real solution we are fighting for.