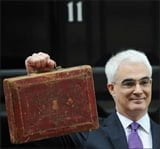

The budget figures show starkly how desperate is the position of the British economy, faced with what Darling called the ‘worst global economic turmoil’ in living memory. The amount the economy will shrink has been revised to a record 3.5% fall this year, the biggest drop since the Second World War.

All we hear from Darling in reply are futile measures and fudge. He promises a £2,000 bonanza for those who trade in 10 year-old cars for a new model. He seems unaware that 86% of the cars we buy are imported and that we in turn export 70% of those we produce. So how will that help the British car industry?

He promises to create jobs in deprived areas, but details coming from him are thin on the ground. In any case the schemes on offer, when contrasted to the jobs tsunami we confront, will be equivalent to bailing out the oceans with a tea spoon.

New Labour is in such a pickle that they’ve had to hit the rich they’ve been pampering for the past twelve years with a 50% top rate on tax. But to show they are still on side with capitalism the Chancellor declares he will be looking for £15bn in ‘efficiency savings’ in the public sector – code for cuts.

Above all Alistair Darling’s April budget reveals what a dire situation the state funds are in. He has admitted that public borrowing will soar to £175bn. That means we as a nation will be spending more than £112 for every £100 we earn. That is why the Chancellor has so little room for manoeuvre.

This should come as no surprise. A crisis of capitalism means less money coming in to the coffers as tax and more being paid out as benefits as the economy slows and unemployment mounts. A crisis of capitalism expresses itself therefore as a crisis in the government’s finances. What is startling is the suddenness of their deterioration. How long ago it seems since ‘prudence’ was Chancellor Gordon Brown’s catchword!

More borrowing means a bigger public debt. The forecasts just get worse and worse. Last November Darling predicted in his pre-budget report that the national debt would hit 57% of GDP. (Brown’s ‘sustainable ceiling’ – the maximum debt that could be safely handled was 40%.) Early this year the Institute of Fiscal Studies reckoned that debt would hit 80% of GDP by 2015-16. Now Capital Economics calculates debt could eventually soar to £1.5trn, more than 100% of all the goods and services we produce in a year.

Just to take the IFS prediction. That’s a £39bn hole in public finances – the difference between spending out and receipts in. One way to plug it would be to levy £1,250 extra tax on every family in Britain. The alternative is equally chilling. It would mean a total freeze on all public spending for five years. Given that medicine for the NHS is bound to go up in price and that the average population is ageing and more likely to become ill, that would mean savage real cuts just to stand still.

It’s not just central state finance that’s under the hammer. Local councils get most of their funding from the government. Trish Haines, president of the Society of Local Authority Chief Executives (Solace) warns, “People are talking about possible reductions in public spending of 10 to 15 per cent, even of up to 30 per cent.” (Financial Times 19.03.09) But local councils have statutory obligations to house the homeless and look after the elderly etc. What happens to a statutory obligation when the council doesn’t have the money to carry it out? Solace is talking about the future of local government as ‘doomsday’.

Where did all the money go? We didn’t get a sniff, that’s for sure. Brown and Darling gave it all away to the bankers. And we pay for New Labour’s generosity. The financial crisis has been a staggering drain on the public purse. And there’s no end in sight. £25bn went to Northern Rock in 2007, £42bn to Bradford and Bingley last September, £37bn to RBS, Lloyds and HBOS in October, more than £25bn to RBS in February, and £10bn to Lloyds in March.

We have wasted one fifth of a year’s production in bailing out the banks. And the resulting financial burden is shredding our living standards and social services.

What of the green shoots of recovery that only government ministers can detect? Well, for a start unemployment will definitely keep on rising for at least a year and probably longer. It will hit three million this time next year. And for most of us mass unemployment is the crisis

It is true that capitalism will eventually pull itself out of the ditch eventually, unless it is overthrown in favour of socialism. But what sort of recovery will we see when we’re being robbed blind by the government to keep up our payment to the bankers who have crashed the economy in the first place? Darling is promising more cuts in government spending and increases in tax after 2011. No jam tomorrow!

The government is in a dilemma. They have a gaping hole in their finances. Big business and the bankers are warning they may lose confidence because of the sheer mass of debt. Recent bond auctions (the way the government borrows money is by issuing bonds) have shown the demand by the rich for acquiring pieces of government paper is limited. So the only way the government can plug the gap is by taxing us, stopping us spending our own money and thus choking off the recovery in the process.

Marx once said that under capitalism the only part of the national wealth common people really own is the national debt. He was right. That was not the only thing he was right about. Brown and Darling are administering a system that is producing nothing but hardship for working class people as far ahead as the eye can see. It’s time for capitalism to go.