This British perspectives draft document (2008), agreed on February 3rd,

has been issued by the Socialist Appeal editorial board as part of a

wide-ranging discussion about the likely development of events in

British society. Such a document is not a blue-print, but an attempt to

understand the underlying processes at work in Britain today, and how

these will be reflected in the class struggle. The document will be

discussed at the Socialist Appeal conference at the end of April.

World economy

1. For the past five years the world economy has been in a boom. The boom has

1. For the past five years the world economy has been in a boom. The boom has

actually been quite vigorous, with annual growth rates of 5%. This obviously

raises the question as to whether capitalism is entering a new golden age like

that of the post-War boom. Our

answer to that is in the negative. If we look at the growth figures for the

advanced capitalist countries they show an average growth of 2.8%. These are

fairly ordinary figures for boom years, characteristic of the slower period the

world economy entered into after 1974.

2. What

is different is that the ‘emerging economies’ are growing strongly at 7.8% a

year. China has been growing at 11% and India at 9% since the end of the last

recession. We have to be careful here. It is not the case that the less

developed countries’ economies have all caught fire. We are mainly talking

about India, China and other Asian economies. The pattern elsewhere is much

more nuanced.

3. If

we strip out these ‘emerging countries’ (which are of course very important to

the world economy in view of India and China’s huge populations) it is business

as usual. Commentators are unanimous that the rapid growth of these economies

is not the motor of world economic growth.

The USA

4. The engine of world economic growth over

the past five years has been the American consumer. 4-5% of the world’s

population have been apparently responsible for 19% of the increase of demand

in the world economy.

5. Now

at first sight this is strange, since most American consumers are workers, and

working class incomes in the USA have been stagnant for the past thirty years.

The American consumer is spending more not because their income has increased,

but because their wealth has risen. For most Americans the only real wealth

they have is their home. This house is not just a roof over one’s head, but

also an appreciating asset that can be borrowed against.

6. We

have pointed out for years that rising house prices are a classic bubble. Now

the bubble has burst for all to see. US house price are in free fall. New house

building is at a standstill. All commentators agree that the stimulus to world

output given by the American consumers spending money they haven’t got was

bound to come to an end in 2008 in any case. The USA is forecast to grow at less

than 2% in that year.

Sub-prime mortgage crisis

7. And

that was before the sub-prime mortgage crisis burst in the summer of 2007. It

emerged that the banks were lending for mortgages to people with no income, no

jobs and no assets. We have no idea quite how widespread this recklessness

went.

8. Now

commentators as different as Greenspan and the IMF are saying it is fifty-fifty

as to whether the US economy goes into recession this year. At present we have

no way of knowing whether the sub-prime mortgage scandal will trigger a

recession and how deep-going its effects will spread. One thing is certain. If

the US goes into recession, so does the world.

Credit crunch

9. The

9. The

next stage in the current financial crisis is the credit crunch. This means

that the banks become suspicious of one another, and either refuse to lend or

demand much higher interest rates than usual. Normally inter-bank lending is a

routine part of the financial system. Economists discuss how central banks

routinely adjust Official Bank Rate, the rate at which the central bank lends

to the high street banks. This bank rate is assumed to be the tip of a pyramid

of lending. The next level down in the pyramid, the rate at which banks lend to

one another is supposed to automatically adjust to the change from the top.

That is not happening. That means that the central banks are no longer in

complete control of the situation.

10. Why

has it all seized up? The sub-prime mortgages have been bundled up into

‘structured investment vehicles’ and sold on to other financial institutions.

They usually end up in the banks as a reserve asset. It is normal financial

practice under capitalism that what is a liability for one person (e.g. a

mortgage) can be an asset for another. After all it provides a steady income

stream. The problem is that millions of people are in the process of defaulting

on their mortgages. The banks have no way of knowing which SIVs will continue

to yield a revenue and which are duds. It is this uncertainty that has brought

about the credit crunch.

11. The

central banks of the world have decided to throw money at the national banking

systems to try to overcome the freeze in inter-bank lending. It is possible

that this could avert the immediate financial crisis. It is not certain that

this will lead to a ‘soft landing.’ How far have the financial authorities lost

control? Will it work? The situation is fraught with difficulties for world

capitalism. It should be emphasised that the current crisis is the result of bubbles

deflating. Re-blowing these bubbles is not a solution. It will not make the

problem go away. At best it will make things worse later on.

Northern Rock

12. It

was the credit crunch in turn that brought down Northern Rock. It is an irony

of capitalism that a bank that does not have a single sub-prime mortgage on its

books should be laid low by dodgy dealings in Florida or Pennsylvania. But that

is evidence that a world division of labour, and a worldwide spread of risk and

calamity, is governed by the global financial system. We are all dependent on

one another in the world market, but we don’t realise it till something goes

wrong. And things are almost bound to go wrong from time to time if the world

economy is interdependent but unplanned.

13. At

the time of writing we do not know what will happen to Northern Rock. But we do

know that a central domino from the financial system has been knocked down. We

don’t know how many other dominos it will take with it.

14. Northern Rock’s strategy was to borrow short

on the money markets to lend long to mortgage holders. This aggressive business

plan had won the management many plaudits in the past. Northern Rock grew fast.

Then the money markets dried up and the bank was left stranded. Huge sums of

taxpayers’ money have been lobbed at the wreckage.

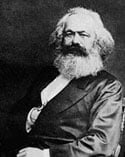

15. Marx

noted in a footnote to Capital that, "The monetary crisis defined in the text

as a particular phase of every general industrial and commercial crisis, must

be clearly distinguished from the special sort of crisis, also called a

monetary crisis, which may appear independently of the rest and only affects

industry and commerce by its backwash. The pivot of these crises is to be found

in money capital and their immediate sphere of impact is therefore banking, the

stock exchange and finance."

16. There

is no doubt that the present crisis originated in money capital. It is the

second type of crisis discussed in the quote, rather than one triggered by a

crisis in ‘the real economy’. The question to be answered, and answered by

events, is what backwash effects it will have on a world economy which appears

to be on the verge of a recession.

17. We

17. We

believe that the misselling of sub-prime mortgages is not a practice confined

to the USA. The level of repossessions in the UK has risen sharply since the

crisis broke out. And it’s early days yet. More unpleasant surprises lie in

store for finance capital in Britain. Commentators like Will Hutton have

emphasised that this is the most serious financial crisis in Britain for thirty

years. Let us not forget that the 1970s was a period of the most severe

economic crises since the Second World War, and one where these economic

problems posed revolutionary possibilities in this country for the first time

for decades.

18. It

is worth looking briefly at previous financial crises, like the Wall Street

crash of 1929. Contrary to the general impression, the stock exchange collapse

did not come out of a clear blue sky. The USA was clearly entering recession

from the spring of 1929, contrary to the situation with the present financial

crisis, which has not yet infected the ‘real economy.’ Car sales, a decisive

sector of the economy at that time, were already collapsing in the spring of

that year. But the subsequent years after 1929 were not ones of a spiralling

downward economic decline. For long periods the situation would appear to have

stabilised. Then people would wake up to find, for instance, that the Kredit

Anstallt bank had collapsed and the crisis had entered a new phase. So it is

likely to be in the coming months and years. The present crisis will travel

through different stages of difficulty and disaster.

19. The

UK in the ‘neoliberal’ era is a country with instability built into its

foundations. Yes, most people’s living standards have improved. But this has

been at the cost of both partners going out to

full time work, with child care as a constant problem, particularly for

the woman, with increased intensity of work, with overtime often unpaid, and

with a mountain of debt hanging over workers just to get a roof over one’s

head. Workers have survived so far. But it is like riding a bike. The real

problem is how to avoid falling off when the thing stops. The

UK is one of the most heavily indebted countries in the world. Whereas

Americans owe $1.42 for every dollar they earn, in Britain we owe £1.62 for

every pound earned. These debts that have kept capitalism afloat now lurk like

so many land mines below the surface as we enter a period of capitalist crisis.

Recession – when?

20. Economic

commentators have been predicting the next recession for 2008 or 209 in any

case. One of the problems in economic prediction is this interaction between

developments in the real economy and apparently accidental occurrences in the

world of high finance. Recession could be brought forward or made worse by the

present financial crisis, as some argue the ‘new economy’ bust in 2000 acted as

a trigger for the last recession in the following year.

21. So

economic developments are uncertain.

But the alarms are clearly ringing for the world economy, and for

Britain. What would recession mean for politics in Britain? It is elementary

that it would not produce an immediate outburst of revolutionary zeal. That did

not happen in the recessions of 1929 or in 1974. But a few years later there

were revolutionary repercussions from the Wall Street crash. The question of

power was posed in Germany, France and Spain as a result of complex processes,

of which the economic crash was at least in part responsible. Likewise the 1974

recesssion did lead to revolution in Portugal and a revolutionary situation in

Spain, though it cannot be regarded as the exclusive cause.

22. What

would a downturn in the next year or so mean for consciousness? It would pose a

big question mark over the ability of the British economy to sustain increased

living standards for the majority year after year. As we have indicated,

workers in Britain live a highly geared life, just managing to balance the

stress of life at work with the

compulsion to get head over heels in debt in order to pay for a house and to

keep a family. For many, the repossession of their home or getting stuck in

negative equity or losing their job would be the last straw. For all, it would

be a warning. The mood would be one of profound insecurity. Insecurity can turn

into fear, or it can turn into struggle. A recession will change the terms of

the debate. It could actually cause millions of people to call into question

the basic principles of the ‘neoliberal’ phase of capitalism that has dominated

their lives since 1974.

British economy

Relative decline halted?

23. In

the past we talked about the special crisis of British capitalism. This

analysis was based on Trotsky, particularly in his book Where is Britain going? It applied the notion of combined and

uneven development to the first capitalist nation. From the 1920s Britain was

perceived as falling behind its rivals. By the 1960s Britain was regarded as

‘the sick man of Europe.’

Has

this special crisis disappeared? Yes and no. The crisis and relative decline

was essentially a problem of the manufacturing sector. But this sector has severely

contracted, at least in view of its former glory. So the problem of the

relative decline of British manufacturing industry has been ‘solved’ by its

virtual extinction! Formerly the ‘workshop of the world,’ Britain began

deindustrialising earlier and more drastically than the other major capitalist

powers. Indeed the Tories raised the slogan in the 1980s that ‘manufacturing

doesn’t matter.’ They did so partly to cover the wanton destruction to industry

caused by the mass unemployment of the 1980s, unemployment that their policies

(and huge policy mistakes) had made worse.

24. Traditionally

the relative decline of British capitalism expressed itself as a balance of

payments crisis, of an excess of imports coming into the country, over and

above our exports being bought by foreigners. Under a fixed exchange rate

regime, this would lead to a run on the pound to pay for the excess of imports

over exports, and the government would be forced either into a humiliating

devaluation or deflation of the whole economy. As we shall see, this problem of

uncompetitiveness has not gone away.

City and industry

25. On

25. On

the other side of the coin from manufacturing the City of London has emerged

apparently victorious in its contest with New York to become the world’s

leading financial centre. The UK commands 20% of international lending compared

with America’s 9% share. This is a blessing and a curse to British capitalism.

On one hand hundreds of thousands are employed in the City and Canary Wharf on

financial transactions. Though we all know about the £8bn in City bonuses paid

out in Christmas 2006, most financial service workers have no share in this

glitz and lead mundane working class

lives. The majority work in high street banking, not the City.

26. ‘Invisibles’

are a massive earner of foreign currencies, partly filling the black hole in

the balance of payments left by the collapse of manufacturing. These are

services. For the most part they are financial services. ‘We’ make $1trn a day

from derivatives trading. On the other hand, the success of the City has

partially covered up the catastrophe occurring in the regions dependent on

traditional manufacturing industries to make a living.

27. Exchange

rate policy has been a traditional area where finance and industrial capitalism

have clashed. Exporters of manufactured goods tend to favour a depreciation of

sterling which makes their goods cheaper abroad. The City supports a strong

stable pound so that foreigners can have confidence in leaving their money

here. Brown has taken the City’s side.

28. He

has followed a policy of malign neglect in relation to the exchange rate, a

policy instrument that remains available to finance ministers even in a ‘neoliberal’

age. The rate of exchange can be manipulated by using interest rates. In this

he continues his short-sighted and stupid policy of keeping silent when the

Tories pegged the pound into the Exchange Rate Mechanism in 1990 at what was

clearly an over-valued rate. Sterling has clearly been over-valued for most of

the past ten years. It has actually been higher for nearly all the 1997-2007

period than it was when it was lodged in the ERM from 1990-92. So a million

manufacturing jobs have gone under this Labour government. The overvalued

exchange rate has made it very difficult for British manufactures to compete on

the world market.

29. The

result has been a balance of payments problem that would have been regarded as

catastrophic, and would have brought down governments in the 1960s and 1970s.

The deficit on goods with the rest of the world in 2006 was £60bn, amounting to

more than 5% of GDP. A surplus on invisibles (services) brought the deficit

down a bit to 4%. The only thing that prevents a vast gulf opening up beween

what the world gives us and what we give to the world is earnings on

investments overseas. British capitalism has become a rentier economy once

again, as it was in the nineteenth century.

30. More

evidence that the prolonged upswing is unsustainable comes from the statistics

on consumer debt. Since Labour was elected, consumer credit has gone up by 65%

and mortgages by 94%. Over the same period real earnings increased by an

average 22.4%. Economic growth was fuelled by people spending money they didn’t

have. When the recession comes and many of these people find themselves out of

a job, there will be major repercussions throughout the economy.

Manufacturing still matters

31. It

31. It

is clearly impossible for a nation of sixty million people to all make a living

in the world by playing about with coloured pieces of paper in the City. New

Labour’s notion that the economy can move into a new era where all jobs are

based on knowledge and design skills is clearly also a fantasy. One reason, of

course, is that their skills training programme is a joke. Another is that it

is very difficult to maintain and hone design skills if you’re not actually

making anything. Our surplus from other countries in design industries halved

from £1.4bn in 2001-2 to £700m in 2004-5 for that reason.

32. We

discuss later the predominance of new employment in what is called the service

sector. What most of these activities have in common – child minding, nursing,

driving people around Salford in buses – is that they cannot be exported. They

are not internationally tradeable. Generally,

manufactures can be sold abroad for goods we want. It is therefore disastrous

to let industry go to the wall. Such is the government’s commitment to

neoliberalism, that it has made no attempt to protect or even encourage British

industry. If manufacturing is dying, that must be the will of the market, and

the will of the market is the will of God!

Growth and the government

33. The

economy has been growing continuously for more than ten years. Two and a half

million extra jobs have been created. The government has admitted that 1.3

million of these went to immigrant workers. The economic problems of the past

seem to many workers to be a distant memory. This situation has led Brown to

boast about an ‘end to boom and bust’. Britain slowed down but did not actually

go into the recession of 2001-3 that hit the rest of the world. This long

period of upswing is bound to have an effect on consciousness. In fact, from a

historic core rate of growth of about 2 ¼%, over recent years expansion has

been moving a little faster at about 2 ¾%. The principal reason for this

acceleration seems to be the huge wave of migration from eastern European

countries that have gained accession to the EU. We shall discuss the political

implications of this change to the British workforce later in the document.

34. What

has government policy done to create this benign economic environment? The

answer is – nothing. Capitalist governments have two policy levers at their

disposal – fiscal and monetary policy. Fiscal policy relates to government

taxing and spending. For the first years after 1997, Gordon Brown stuck to very

tight Tory public spending limits. His predecessor Kenneth Clarke, who left him

this straitjacket as a little parting gift, admitted he thought the targets

were impossible. Later Brown loosened the reins and spent serious money on the

health service in particular. In fact 89% more was being splurged on the public

sector than in 1996-7, the last financial year the Tories were in charge. This

should have transformed the quality of public services. But the perception is

very different. Certainly the big queues for treatment under the Tories have

mainly disappeared. But anyone who has visited a hospital recently can see that

resources are still being withheld. The problem here was that a large amount of

this cash was drained away by the fraud of PFI.

35. The

fat years are now definitively at an end. The government has called a halt to

expanding public spending. It is time to rein it in. This is in advance of a

crisis in the real economy. Of course cutting state spending will make the

crisis worse, when it comes. Brown is also trying to cut the living standards

of public sector workers, using the threat of inflation as an excuse. It will

come as a surprise to many workers that the rising price of bread, of milk and

of petrol are caused by above inflation settlements to nurses and teachers,

particularly as they have already been putting up with very moderate wage

settlements.

36. What

did Brown do about monetary policy? In the first week of power in 1997, he

handed control over to the Monetary Policy Committee of the Bank of England. A

major lever of government policy under capitalism was delivered over to a bunch

of pointy heads and wonks. So,

if the economy has behaved well over the past ten years, the government can

take no credit for that.

37. That

is not the way it will be perceived by the mass of the population. As long as

the economy delivers improved living standards to the majority of the people,

active political involvement is likely to remain low. As we have argued above,

recession is coming to the world and so to Britain sooner or later.

Industrial perspectives: background

issues

Proletarianisation

38. The

most significant trend in the world today is proletarianisation. Global head

counts are hard to come by and figures come with a time lag. The last estimate

of numbers seems to have been by Filmer

for the World Bank in 1995. He worked out there were 880m workers in the world.

Since we know the ‘South’ has been industrialising fast, there are almost

certainly now one billion humans who make their living exclusively by working

for a wage. Together with their families, they are an increasing majority of

the world’s workforce.

39. Filmer

estimated the peasant population at one billion in 1995. There continues to be

a steady flight to the towns, so this number must have gone down since. It is

probable that there are now more workers than peasants in the world’s workforce

for the first time ever.

40. At the same time there were 480m described as self-employed. Most of these

live in the towns. Their jobs are often casual and precarious. It would be

wrong to characterise them as lumpenproletarians (to use Marx’s expression in

the Communist Manifesto), though the

ever-growing shanty towns and slums on the outskirts of all the cities of the ‘third

world’ pose the prospect of growing a hardened lumpen layer over time. But the

vast majority of these people aspire to regular full-time work, to the status

of proletarians.

Deindustrialisation?

41. When

we discuss deindustrialisation, we need to take the long view of the processes.

In 1900, according to Feinstein, 47% of the labour force in the OECD (rich)

countries was engaged in agriculture. Britain was an exception in this regard,

as it was already fully industrialised. A hundred years later the numbers

involved in farming had fallen below 5%. Most of these workers moved into

manufacturing in the first instance. The numbers involved in farming fell, of

course, because productivity rose there and many fewer workers were needed to

feed the population. The process of rising productivity in both agriculture and

industry meant that, over the course of the century, workers flowed first from

agriculture into manufacturing; while later others were migrating out of

manufacturing into the service sector. Feinstein reckons that about 30% were

involved in industry at the beginning of the century and the same proportion at

the end. So the other net result – that the service sector went from 25% to 67%

over the course of the twentieth century – is actually the result of several

conflicting economic trends.

42. Feinstein

points out that a 3% annual growth in GDP, which is about average for most

countries in the OECD for the twentieth century, will over 100 years produce a

seventeen-fold increase in income. How is this extra income spent? Since the

industrial sector has been at the cutting edge of rising productivity, the

relative price of manufactures has fallen, and people will spend a smaller

proportion of their income on them, while enjoying vastly more material

prosperity in terms of manufactured goods than people a hundred years ago.

43. There

has been much discussion of deindustrialisation in the advanced countries even as the global south industrialises apace. We need to

be clear what this means and what it does not mean. Feinstein shows that, for

the OECD (mainly rich) countries, manufacturing output increased faster than

national income over the period 1950-1995, with the sole exception of the USA.

Manufacturing has become relatively more important in their economies. The

advanced capitalist countries have been producing more manufactures, despite increased competition

from the less developed countries in this regard.

44. But,

because of the dramatic increase in manufacturing productivity, it takes fewer

and fewer workers to produce these goods. If a smaller number of workers are

producing the same amount of manufactured goods, then each manufacturing worker

has potentially more power to paralyse profits. This is not only true of

industrial workers. The sharpened division of labour and the development of

stock control programmes such as the just-in-time system means that relatively

small groups of workers (as in rail and road transport) have the power to

paralyse capitalism and cause an enormous loss of profits in a short period of

time. And, when workers with this clout have showed themselves prepared to use

it, they have made gains and the unions have gained members. The message is

loud and clear – militancy pays.

45. But

there are other sectors where productivity has not risen at all, sometimes over

centuries. Pulling pints in a pub or looking after children may be two

examples. The service sector is labour intensive. In consequence a relatively

larger proportion of the population is likely to be employed in these sectors,

as less are employed in manufacturing. The shifts in the pattern of employment

caused by this slewed productivity growth are bound to produce significant

changes in trade union membership and organisation, and in the consciousness of

the different layers of the working class.

Manufacturing and services

46. These

expanding areas of employment are generally referred to as the service sector

in the official statistics. Production is divided into primary (agriculture and

extraction, such as mining), secondary (industry) and tertiary (services). The

service sector is not a Marxist term. In reality it is a ragbag of

contradictory elements. Transport workers such as bus and train drivers, are

counted as part of the service sector.

In reality they know they are working class and most people would instantly and

unhesitatingly identify them as such.

47. The

47. The

term service sector is a hodge podge. Nurses, teachers and other useful members

of society have little in common with bond dealers or corporation lawyers, who

in any case are not workers at all. Yet both groups are described as working in

the service sector. Some differences

between service and manufacturing workers seem to be the product of statistical artefact. Workers at Gate

Gourmet make convenience foods in the form of aircraft meals. They are

manufacturing workers. Workers in McDonalds, who fulfill a very similar

function, count as service workers.

48. The

service sector is traditionally harder to unionise and it is easy for

management to hire and fire, in general because of the low skill base and the fact that they have no legal rights

for the first year of employment (two years under the Tories). The other side

of this is that workers in such jobs have no loyalty to the firm, no commitment

to the industry and drift from job to job. Sectors like the NHS and local

authority workers are exceptions with a long tradition of unionisation. The

fact that most health workers have taken the time to acquire a scarce skill,

and in doing so have shown a commitment to the health service as a long term

career, means they are more inclined to organise to defend their wages and

conditions. Even if they have not gone through a formal education process,

public sector workers have usually received in-house training, so they cannot

be regarded as casual and unskilled. That enhances their bargaining power with

their employers.

49. We

now have not many more than 3 million workers in manufacturing compared with a

labour force of 29 million. It should be noted that millions of workers in

energy generation, construction, dockers, forklift drivers and other

‘distribution’ workers in transport, all hospital workers and virtually

everyone in the public sector are excluded from the manufacturing sector. But

most of these are seen as traditional working class occupations. There are

1.75m transport and communication workers, 6.7m in shop and distribution,

hotels and catering (are female shop assistants in Woolworths middle class?),

and 7m in health and education (hospital ancillaries heavily outnumber doctors

in health).

50. Transport

workers are even productive workers in Marx’s sense; that is, they produce

surplus value for their employers. Note that Marx does not narrow the

definition of productive labour to those who make things, as Adam Smith did.

Call centre workers are working for a boss’s profits, so they are productive workers

in that sense. There are nearly a million such workers. Workers who write

computer programmes are also producing surplus value.

The changing working class

51. In

fact the distinction between productive and unproductive labour is not

important to the question of who is

working class. The essential definition is – how do you make your living? Have

you any alternative to working for someone else? What you actually do all

day is irrelevant.

52. Of

course there are contradictory and transitional phenomena. The ruling class

have always needed to work through stooges to do their dirty work for them,

like all previous ruling classes. After all they have better things to do than

supervise the working class! In a sense a stooge’s relationship to the means of

production is irrelevant. If they have decided to become stooges and support

the other side, the fact that they make their living through working for a wage

is neither here nor there. We can use the contradiction between their

ideological commitment and the way they make their living to neutralise some in the course of the struggle.

Blue and white collar

53. One

important distinction between class and caste is that individuals can move

between classes. That does not in fact obliterate class differences; it

strengthens them. So we also have to look at the aspirations of workers, and

whether they can fulfill these aspirations. Edwardian ladies of leisure may

have taken up typing for a few years before entering into a well-appointed

marriage. They never regarded themselves as members of the working class while

they were slumming it. It goes without saying that their consciousness was a

million miles removed from that of twenty-first century clerical workers in the

private or public sector. For the vast majority of us there is no way out from

wage slavery except socialist revolution.

54. The

difference between blue and white collar workers was important at the beginning

of the last century, with the beginnings of scientific management and the

emergence of a managerial bureaucracy. These black-coated workers, as they were

called, had markedly superior social status to those on the shop floor. In

addition these layers were recruited from the old middle class. By and large

they lived in different areas from industrial workers and had no social contact

with them outside the world of work. Such people would often have investments

to fall back on and kept servants. They could also be expected to share the

outlook of the ruling class. Otherwise they would be unable to carry out their

supervisory tasks satisfactorily.

55. How

different now! The remorseless grinding down of the pretensions of the

so-called middle class has been a feature of capital accumulation over the past

century. Teachers may have regarded themselves as ‘different’ a hundred years

ago. No more. They live in the same kind of housing stock in the same streets

on the same sort of wage level as other workers. They have responded to their

perceived change in status in a positive way by making their occupation one

with a relatively high level of trade unionisation – in other words they have

acquired working class consciousness.

56. Millions

of white collar workers now work in conditions not fundamentally different from

those manufacturing workers put up with. They are often in giant clerical

factories, and their pace of work is measured relentlessly, often by the very

computer that is their basic work tool. This has been the most significant

change of the last century, that the so-called middle class has found its place

in the labour movement. Regarding oneself as middle class today is actually a

question of false consciousness based on the lack of effective trade unions at

work and the illusions created by home

ownership. Though consciousness lags, the old nineteenth century type middle

class has ceased to exist..

57. The

petty-bourgeoisie, who both work for a living, and own their own dwarfish means

of production, is little more than a distant memory. The peasantry had been

destroyed in this country long before

Marx wrote Capital. In the countryside a tripartite class structure held sway,

consisting of landlords, capitalist farmers and agricultural proletarians. Farm

workers in Britain have always been extraordinarily difficult to organise. In

the towns craft workers have long ago been displaced by mass factory

production, except for isolated professions making luxuries. Their last hiding

place, as small shopkeepers, is now being dive bombed by the supermarket

express and metro convenience stores.

Working class consciousness

58. The

definition of class is not a question of lifestyle, though it is true that

workers who are conscious of their identity may share a certain lifestyle as

they live together in a working class community. Certainly a worker of the Chartist

era would not recognise wearing a cloth cap and keeping a whippet (long

regarded as the parody of working class identity) as a badge of being working

class at all. In any case the problem is that the development of capitalism

tends to destroy settled working class communities, and their lifestyles with

them. And capitalism is changing much faster now than it was in the time of

Queen Victoria. In the nineteenth century, and for much of the twentieth

century, the working class lived in separate homogeneous communities. The

reason they no longer appear to do so is that they are now the overwhelming

majority of the nation. They are between 80% and 90% by any criterion, with all

the qualifications about intermediate layers and people in transition between classes.

59. Consciousness,

of course, is not a direct reflection of social being. In general the ruling

ideas of any era are the ideas of the ruling class. Workers come to class

consciousness through struggle. The working class is many-layered, not a homogeneous

lump. Occupational change produced by changes in capitalism is part, but only

part, of the way consciousness changes. For long periods consciousness lags

behind conditions. Then, in the course of struggle, it can take gigantic leaps.

Over the last twenty years of government policies consciously designed to

promote the idea that individuals can get ahead as individuals rather than

advancing together in collective organisation, working class consciousness has

become blurred.

60. But

it is important that a growing 68% of us regard ourselves as ‘working class,

and proud of it.’ Interestingly, a Guardian poll found that 56% of 25-34 year old regarded themselves as

working class compared with 48% of 55-64 year olds. So much for working class

consciousness dying out.

A history of struggle

61. The

61. The

general pattern of the industrial class struggle in Britain has been of a

repeated cycle of a buildup of grievances and discontents without an outlet, then

an eruption of anger and struggle, and a relapse as the movement sinks back,

exhausted for the time being.

62. Occupational change is a permanent

feature of capitalism. In the past there was a deep division between craft

workers (often with a five year apprenticeship) and mass production workers.

The unskilled were regarded by the existing craft unions as unorganisable.

Sometimes developments appear to stagnate, perhaps for decades, and then there

is a leap of consciousness with the opening up of class struggle. 1889 was the

year when labour ceased what Engels called its ‘forty year sleep’. In that year

accumulated changes led to the successful organisation of unskilled workers

such as dockers and gas workers. That was also the beginning of the modern

giant general unions. In fact trade union membership, the level of struggle

and, apparently, class consciousness then fell back after 1889, though not to

the 1888 level, till the next labour upsurge in 1909-14.

63. That

has been the repeated pattern: sections of the working class regarded as

‘backward’ and unorganisable moving into struggle, followed by a partial

relapse. There was another upsurge after the First World War, possibly the

biggest of the lot, then, after the defeat of Black Friday, a period of the

classes measuring one another up before the General Strike of 1926.

64. It

is also the case that a lack of strike action is not necessarily evidence of a

defeated working class. The General Strike of 1926 was the most serious defeat

the working class has ever experienced industrially. The formation of the National

Government in 1931 and the mass unemployment that peaked in 1932 were all part

of a period of defeats. But the years before the Second World War were ones of

revival in some parts of the movement, for instance among armaments workers and

bus drivers (driving was then a scarce skill). Certainly the labour movement

was continuing to advance throughout the 1940s and 1950s. Strike statistics

were low. This is because disputes were often short, since management settled

at once to keep the wheels turning and the profits rolling in. Strikes were

almost always unofficial, as the monolithic right wing bureaucracy acted

throughout as a fire hose. And often they involved small groups of workers.

Leapfrogging differentials was a common pattern of class struggle in those

years. This means that assembly line workers would put in for parity with craft

workers, who would then begin negotiations to maintain their differential. This

sounds sectional. It is not the ideal way to bargain for the interests of the

workforce as a whole. But it was often treated as a kind of game by the

workers, aimed at getting higher wages all round. It seems there was not one

national official stoppage from 1926 through to the bus workers’ strike in

1958.

65. The 1960s and 1970s were one of the stormiest periods in

the history of British capitalism. The setting was the relative decline of

British capitalism becoming more acute as the world moved towards recession.

What was significant was not the fact of recession, but the way it illuminated that

an era of prosperity and relative class peace was coming to an end. Workers

were forced to come to an understanding that they had to fight to maintain the

wages and conditions they had gained over the previous period of post-War boom.

The ‘soft’ side of the ruling class was shown to be a mask as the boss class in

Britain and elsewhere began to prepare private armies and strengthen the forces

of the state for use against the working class.

66.

Revolutionary and counter-revolutionary possibilities began to open up. The

1970s were a decade of struggle. The miners’ strike of 1984-85 was almost the

last act in a period that was one of unprecedented turmoil and change. It is

not altogether surprising that we have seen a prolonged lull since after such

titanic struggles.

See also: