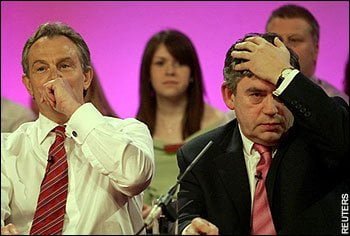

“The war against Iraq can have a big effect in opening up the divisions, even at the top of the Labour Party. Every poll conducted delivers a majority opposed to war with Iraq, but Blair is intent on maintaining his role as Bush’s number one poodle. This can easily lead to divisions and splits in the Parliamentary Labour Party and even in the Cabinet. Blair has been ruling through his little coterie of spin doctors up until now. He will not find the ground so stable beneath his feet when he faces splits in the cabinet, confrontation with the unions and an economic crisis.” The New Situation in Britain, January 2003

In the nine months since the publication of The New Situation in Britain, events internationally and here in Britain have continued to accelerate. Both at home and abroad the war in Iraq has dominated all questions. Despite the quick victory of US/UK military forces over Saddam Hussein’s regime, the war has solved nothing for imperialism. On the contrary, as we predicted, they have instead created a far more unstable situation throughout the Middle East, in Iraq itself, where a guerrilla struggle is now underway that could drag on for years, and at home in the US where Bush may yet lose the next election. The consequences of the imperialist adventure in Iraq have had an even greater impact in Britain than in the US. Here the furore over the death of weapons inspector Dr. David Kelly and the Hutton inquiry represent the most important crisis faced by Blair to date.

The purpose of this article is to supplement the current Perspectives document and consequently should be read in conjunction with it. As such it will not go into all questions in detail.

Nevertheless, we could not begin without registering the astonishing developments of the last nine months. How could one fail to mention the biggest single demonstration in British history? On February 15, 2003, two million men, women and children marched through the streets of London. At first glance, they may appear to have achieved nothing. Indeed no demonstration of this kind, even one as massive as two million, could dissuade imperialism from its course of action. Britain alongside the US proceeded to bomb the living daylights out of Iraq and then invade. Yet at the same time that demonstration marked the beginning of the end of Blair. As we explained at the time, as vitally important as the question of war is – and as real as the revulsion felt by millions at being dragged into this conflict was – this historic demonstration illustrated something still more profound. It acted as a focal point for years of frustration with the failures of the Blair government. As such it represented a fundamental turning point in the situation in Britain. Seen alongside the growth in militancy and the beginnings of a shift to the left in unions which we described in detail previously, the sound of two million pairs of feet marching through the streets of London announced the opening of a new chapter in British politics. In the context of international developments, the millions and millions who marched worldwide and the development of class struggles in Europe and internationally, it is clear too that the new situation in Britain is part and parcel of a new, profoundly unstable and tumultuous period in world history.

World Situation

The international situation is dominated by profound instability in every sphere, diplomacy, international relations, politics and economy. At the core of this instability is the inability of capitalism to develop the productive forces in the way they did previously. This does not mean ‘reducing everything to economics’. This would be a terrible distortion of Marxism. Instead it means recognising that the crises in every field trace their roots back to the inability of the social and economic system to take society forward.

The war in Iraq has solved nothing from the point of view of imperialism. The so-called “road map” to peace in the Middle East has been torn up; in reality the US has stirred up a hornets’ nest from which they will find it very difficult to extricate themselves.

Meanwhile the unfolding drama of revolution and counter revolution in Venezuela has taken another step forward with the complete failure of the so-called ‘opposition’ to mobilise a demonstration as part of their campaign for a recall referendum, whilst the pro Chavez forces mobilised two million in support of the government which at present is pursuing only limited reforms. Yet even these are too much for the capitalists of Venezuela and their masters in the US. As a result Chavez may yet be forced to go much further than he might intend. Certainly, for the moment, every attempt on the part of reaction is decisively repulsed by the independent actions of the masses.

US imperialism has indeed become the most powerful force in history. Yet while it struts arrogantly across the world it continues to pack yet more dynamite into its own foundations.

The fate of the United Nations is an important indicator of the profound nature of the change which has taken place in international relations. Those institutions which reflected the world situation, the balance of class forces internationally, following the second world war, the UN, NATO etc. all face crisis. The UN in particular is desperately trying to recover from the deadly blow it received at the hands of US imperialism.

In the new world situation these institutions no longer suit the needs of US imperialism. Therefore they are shunted into a siding from where they impotently plead for some role in the world. They quickly moved to ratify the occupation of Iraq as legal, in spite of all their earlier bluster. The US now wants to use the UN as a bank and a source of civil servants to assist their troubled occupation of Iraq. All this is a long way from the UN’s former image as a worldwide guardian, and policeman of international relations. Where it stands in the way of the interests of US imperialism the UN is simply pushed to one side.

US economy

Despite the quick victory of formal hostilities, the US may now find that it has bitten off more than it can chew in the occupation of Iraq. Two US soldiers are now dying in guerrilla fighting each day. This can have a big effect on the morale of the troops and on public opinion in the US if it continues for any time. That is most likely given the devastation of Iraq’s economy and infrastructure. Naturally the Iraqi people, no matter how pleased they may be to see the back of Saddam, have not welcomed the forces of occupation with open arms. This was the delusion of Bush and Blair before the war. However the US and UK troops are not seen as liberators but as an unwelcome army of occupation. The French revolutionary Robespierre once explained that people do not usually welcome missionaries who carry bayonets. What the imperialists had hoped would be seen as some kind of repetition of the Normandy landings of 1944 is rapidly turning into the turmoil which followed the Gulf of Tonkin incident in Vietnam in 1964.

The widespread opposition of the Iraqi people towards their invaders is compounded both by the arrogance and stupidity of the invading forces, and by their continued failure and inability to restore vital public services and infrastructure. Many towns remain without electricity and water.

Continued guerrilla conflict means that the forces of occupation will need to be strengthened. Blair has already committed more troops. Bush whilst trying to force some assistance out of the UN will need to do likewise, and the cost of the occupation continues to mount.

Even the blind optimists of Wall Street were shaking at the prospect of war in Iraq. However once ‘victory’ was declared a new spending spree saw the US market rise by 25 percent.

What was the cause of this renewed ‘confidence’? Was it the prospect of a real recovery in the economy? In truth it was more of a confidence trick on the part of the US central bank – the Fed – and the US government. Alan Greenspan, the chairman of the Fed, announced yet more interest rate cuts and pumped billions of dollars into the banking system. Consumers were told to buy now and pay later, furthermore, you can borrow as much as you like at historically low levels of interest.

Meanwhile Bush – like his predecessor in the role of cowboy President, Reagan – dished out tax cuts by direct payment of cheques to households, as well as launching new military spending and issuing massive new contracts.

As a result of these measures the stock market recovered and consumer spending was maintained. Economists now believe this is a real recovery and predict growth of around 3 or 4 percent in the second half of this year compared with just 1.5 percent in the first half. Is such a prediction justified? In the second quarter the economy grew by 2.4 percent, double the rate in the first quarter. However, these ever hopeful economic gurus are overlooking the increase in defence expenditure which grew by 44 percent during this period, entirely accounting for the difference in the rate of growth.

Military spending may have had a short term effect on the economy, but this cannot last long, indeed it is preparing not a new recovery but a new crisis. The enormous budget deficit being run up in the US alongside the burgeoning trade deficit, does not bode well for the continuation of the consumer spending which props up the economy at present or industrial investment without which there can be no real recovery.

The capitalists will not invest in replacing equipment or employing workers unless profits improve. At the height of the nineties boom the margin of profit on each unit sold by US companies was an average of 13.5 percent. By September 2001 that had fallen to 7.5 percent. Goods and services could not be sold, and prices could not be raised therefore, the only way out was to cut costs. From the time Bush became President to the present some 3 million Americans have lost their jobs. The capitalists also stopped investing. Through these cost cutting measures they managed to increase profitability, but only by a feeble one percent. The world market does not allow for an increase in production or in prices, indeed there is deflation with falling prices in Japan but also in Europe and in the US itself.

Only services and banking have been able to raise prices. Yet despite all the economic gurus delusions manufacturing remains both decisive and decimated.

One major factor in this equation is the role of China which continues to flood the world market with cheap textiles, toys and electronic equipment driving down prices everywhere. The US now has a bigger trade deficit with China than with any other country, importing in excess of $100 million worth of goods more than it exports. Astonishingly the shelves of Wal-Mart are so bulging with Chinese goods that they account for ten percent of this burgeoning deficit on their own.

Economists nonetheless have been pointing to a recent increase in profitability in the US economy. The top 500 companies reported average 10 percent profit growth over last year. But averages are dangerous things, as are all bald statistics. In reality the only sectors that boosted their profits significantly, and thereby bumped up the average, were oil and banking.

Oil prices have remained high following the war, as production in Iraq has not yet been restored. As a result US oil companies have been making large profits. However, it is the banking sector who have really profited as a result of the massive credit expansion in the economy. The government borrows to pay for war and consumers borrow to pay for houses and holidays, but still businesses do not borrow to invest. The position of General Motors sums up the US economy. This huge US firm made little or nothing from making cars but millions from lending people the money to buy their cars. Of a total profit of $901 million, $834 million was contributed by its finance division.

Once again Greenspan and the gurus of the US economy are trumpeting the argument that manufacturing does not really matter. Yet in reality without the productive sector of the economy making things, services cannot survive. Surplus value, the source of the capitalists’ profits, is created in industry. Capitalism is above all the production of commodities. Services meanwhile are parasitic by nature. They consume surplus value. There has to be manufacturing to create the wealth to spend on services.

Goering’s policy of ‘guns not butter’ will not save them either. On the contrary, explosive US military expenditure will be the source of crisis not cure. Bush and co have embarked upon a very expensive foreign policy. The current estimate of $600 billion to rebuild Iraq is just the beginning. The US government is on course to spend $500 billion more per year than it raises in taxes for the next decade. Where will this money come from? Without meteoric growth in the economy, they will have to borrow it by issuing more and more government bonds. As a result the interest they have to pay on these loans will increase and in turn mortgage rates will rise. This is a disaster. Growth in the US economy over the last few years has been dependent on consumer spending and that will rapidly dry up as household loan repayments become more expensive.

Clinton was partly right when he said “it’s the economy stupid”. A new slide into recession would quickly cut the ground from under Bush. However, it is not just the economy. Each new US casualty in Iraq, and the death toll is mounting daily, serves to undermine Bush’s support.

In these circumstances there is already the beginning of a change in mood in the US and Bush could face defeat on this question alone.

It is not true to say that it is of no importance who sits in the White House or in Number Ten. Marxism has never denied the role of the individual in history. At certain moments this can be decisive. In general, the particular personalities involved have an impact if not on the general course of events, at least on their coloration and tempo.

Nevertheless US imperialism would face the same international situation, the same need to dominate the world market, to seek out raw materials and to carve out spheres of influence, no matter who is President. Therefore the aggressive stance of US imperialism on the world stage must continue. The removal of Bush might change this or that feature but it cannot solve anything. The Powell wing of the American ruling class, for example, may not share all the rhetoric of the Project for the American Century, nevertheless the policy of US capitalism at home and abroad requires an aggressive policy, towards the American working class and the masses internationally. By their actions they are creating their own gravediggers, preparing a new more unstable situation around the world, and within the belly of the beast itself.

Britain

More and more British troops are now dying in Iraq too. The myth of the better behaved, civilised British troops has been exposed in Basra, as we have explained elsewhere. The British military, like their American counterparts were expecting to be welcomed as liberators. Instead they are blamed for the deaths of innocent civilians, and for the failure to get the lights back on and water flowing in the taps.

The impact of the war in Iraq has been far greater here than in the US to date. Often unexpected events like the death of Dr. Kelly can play a key role in politics. Despite all their best efforts at spin, Blair has been seriously damaged by the widespread belief that Britain was led to war on the basis of lies and deceit and that a cover up extends to the very top of the government. New Labour was meant to be all about image and presentation. Blair was the holier than thou figure of the pious vicar. Now he and his entourage have been exposed as liars. As a consequence, public confidence, expressed in poll after poll, has plummeted.

According to an ICM/Sunday Telegraph poll 67 percent of people believed the government lied to them about Iraq’s weapons of mass destruction. A YouGov/Daily Telegraph poll found only 22 percent viewed the government as ‘honest and trustworthy’ down from 56 percent in 2001. A Time/CNN poll found that only 6 percent believed the government is a more reliable and honest source of information than the BBC.

The view of the mass media – The Mirror has nicknamed the prime minister B.Liar – tells us just as much.

While we suggested a year ago that Blair could lose the next election – though that was not the most likely scenario – no-one else shared that view. Now it is a commonplace. Were the Tories not in such a dire state themselves they would now be making a more significant recovery. Instead the threat to Labour’s third term comes from the widespread disillusionment which would inevitably see the turnout at the next election fall once again. At least that would be the case if Blair were still Labour leader at that time. That is not guaranteed. This fact alone demonstrates the extent to which events in Britain have accelerated. Yet this is only the beginning.

All this as a result of imperialist war, i.e. foreign policy, which is only an extension of the capitalist policy being pursued at home. Just as Blair and co are desperate to prove themselves worthy of the bosses in the city of London by carrying out their wishes to the letter, so in the international arena they are keen to prostrate themselves before US imperialism. In other words, as a result of politics and international relations, Blair is in deep trouble. Marxists must study these questions, and not just economic or industrial developments, if we are to understand the processes unfolding in society. In advance of an economic crisis which still looms and – firefighters aside – in advance of a major conflict with the unions – which likewise cannot be avoided – in reality Blair is already doomed.

British economy

The International Monetary Fund has raised serious doubts about Gordon Brown’s forecasts for the economy in its latest report. It has cut its assessment of UK growth both this year and next and expressed serious concerns about Britain’s inflation-prone housing market. These geniuses believe that the Bank of England should raise interest rates in order to rein in house price inflation! The consequence of such a policy would be to devastate consumer spending which is single-handedly keeping the economy afloat, because that spending is entirely reliant on credit.

The IMF is projecting that Britain is on course to undershoot the Treasury’s 2%-2.5% prediction for growth in 2003 arguing that the strong growth in house prices in some industrial nations, especially Britain, is a risk to global recovery.

Hefty consumer spending on the back of rising house prices has been the mainstay of UK growth in recent months. Like Blair and Brown the IMF thinks the British economy will grow, but unlike them they predict that growth will be just 1.8% this year, down from 2% in the spring.

In 2004, it anticipates that Brown will miss his growth target by an even bigger margin. The chancellor said in the Budget earlier this year that the UK would grow by 3%-3.5% next year, but the IMF has now cut its spring forecast of 2.5% to 2.3%.

Brown blames the sluggishness of the global economy and the weakness of the eurozone in particular, for the performance of the UK. So much for the Euro being a panacea for what ails British industry. Once again the utter reliance of the British economy on the world market is exposed for all to see.

With growth falling well short of government projections as we explained earlier in the year, to maintain even their meagre spending plans would require a rise in taxation or borrowing. Otherwise those spending plans will need to be severely cut. In all likelihood we will see the worst of all worlds for the working class with cuts in spending and increases in borrowing and taxes, all of which we will have to pay for.

Despite the swift end to the war in Iraq and low interest rates across the world, the IMF is anticipating a slightly less robust recovery in the global economy than they were five months ago and remain worried about the threats to the global economy from the burgeoning US trade deficit, which it believes could trigger a “disorderly” adjustment of exchange rates.

Their world economic outlook cuts predictions of growth in the 2003 global forecast to 3.1% from 3.2% and its forecast for 2004 from 4.1% to 4%.

They predict US growth of 2.2% this year and 3.6% next, while Japan is upgraded from 0.8% to a still puny 1.1% this year followed by even less growth in 2004. Their predictions for eurozone growth are still less optimistic, they have cut their forecast to 0.7% in 2003 from 1.1%.

Germany is expected to see no growth at all this year, down from a forecast of 0.5% in April, with France and Italy both cut to 0.8%.

Recession in Europe and the enormous deficit in the US with no significant recovery in the long running saga of Japan means there is no saviour for British capital on the world market.

Industrial investment hits record low

A record slump in manufacturing investment has exposed the CBI’s claims of seeing the now mythical “green shoots of recovery”. Like Bill Murray in the film Groundhog Day, no matter how hard they try to see the shadow of the groundhog proclaiming the arrival of spring, they will wake tomorrow to find the same frosty conditions as today.

Brown’s spending plans, announced in the last budget, are dependent on his unrealistic economic forecasts – which in turn were based on an upturn in the world economy which has stubbornly failed to materialise. Like the IMF, the CBI has cut its growth projections and official figures showed that manufacturing firms cut investment by 10.1% in the second quarter of the year – the sharpest reduction since records began in 1994.

“These figures are another nail in the coffin of the chancellor’s growth forecasts,” said Steve Radley, chief economist at the Engineering Employers’ Federation.

Official figures show that export orders and output were still deteriorating in August. Firms producing goods for the consumer market – such as food and drink and pharmaceuticals – were more successful than those making capital goods, which have suffered from the continued decline in investment.

As a result, while the Treasury had pencilled in GDP growth of 2-2.5% for this year, the CBI has cut its projection to 1.8% from 2.1%.

Even without a rise in interest rates most economists expect consumers to rein in their spending later this year as falls in real income growth bite. The Treasury claims that industry will then take over as the engine of economic growth. This is wishful thinking. The sharp decline in business investment proves this. Total business investment fell by 1.1% in the second quarter and by 3.5% on the same period last year, according to the Office for National Statistics.

The CBI said rising business costs, uncertainty about the economic outlook and the need to top up pension contributions had all contributed to businesses’ decisions to leave investment plans on hold in the first six months of the year. The failure of Britain’s capitalists to invest in new machinery, updating, research and skills mean that while there is no sign of the international recovery they all claim to be waiting for, when it does come – and there will inevitably be some recovery in the world market eventually – British industry will be in no position to take advantage of it. In other words, the long term decline of British manufacturing would not be magically turned around by any new recovery in the international market, the rate of that decline might be slowed, but relative to her rivals, British industry would continue its historic descent. In the words of the CBI’s chief economic adviser, “I do think that does pose a serious risk of leaving us at a disadvantage in terms of benefiting from a pick-up in global activity when it comes,”

There is no evidence of the much trumpeted rebalancing away from consumption and into production. Retail sales fell far, far less in July than they rose in June. More disturbing still, according to economists, people are compensating for slower real income growth by borrowing more. Despite the newspaper headlines about a recovery in manufacturing the figures prove otherwise. Output, according to the CBI, is still falling, and companies are cutting prices in order to stay in business. All that is happening is that order books are declining less rapidly than in the previous month.

Decisively, investment in manufacturing fell by 10% in the second quarter, exploding the idea that firms had merely been mothballing expansion plans during the build-up to war in the Gulf. That was always hope triumphing over experience: years of battling with an overvalued currency, the impact of cut-throat global competition on profit margins, the black hole in pension funds have all taken their toll on industry. Above all it has been British capitalism’s failure to invest in the productive sectors of the economy, their concentration on speculation, asset stripping and services over years which has resulted in the terminal decline of British industry.

Not to be outdone by the CBI, the Engineers’ Employers’ Federation predicted a new upturn in their most recent report too. Or, at least, that is what it said in the headlines. However, further on we read that it is too early to speak of a full-scale recovery and, unlike in previous recessions, manufacturing investment was still being scaled back after a 40% cut in the past five years.

It also indicated that the engineering sector, which has been shedding jobs at the rate of 10,000 a month, would continue to lay off staff. It expects 68,500 job cuts this year, compared with 104,000 in 2002. This is hardly a convincing description of a recovery.

Steve Radley, EEF chief economist, said: “We face the best growth in engineering and manufacturing for four years but we cannot be that confident about recovery in the world economy yet.” His forecasts suggest engineering will grow by 0.5% this year, 1.7% in 2004 and 2.7% in 2005.

After a 0.1% shrinkage this year, manufacturing as a whole is expected to expand by 1.5% next year and 1.8% in 2005. This follows the slump which began in 2001 and reached its trough last year when engineering shrank by 9%. In other words even growth along the over optimistic lines they predict will not begin to repair the damage done in the previous period.

So far, it is export demand that has propped up order books, with domestic orders still declining, but the bulk of the stimulus is coming from outside the eurozone where Germany, France, Italy and Holland remain in recession.

“The most critical factor affecting confidence over the coming months will be the state of the European economy,” Mr Radley said. “It’s absolutely critical that we see a resumption of growth.”

In 1983 and 1993, Radley pointed out, the shifts out of recession had swiftly prompted a recovery in investment but, while fewer companies are planning cuts for the first time in two and a half years, less than a fifth are anticipating increases and 30% are still cutting back.

“One of the biggest constraints on investment is uncertainty and concerns about the strength of the global recovery,” Radley added.

Manufacturing in general and engineering in particular has been hammered so much over the last couple of years that what is being touted as an improvement is simply a decline in the rate of destruction. The best that can be said about investment spending is that fewer companies are planning cutbacks.

A recovery would require investment. The capitalists will not invest however, unless they can see a market where they could sell their goods. There is no evidence of an improvement in the home market for those goods, and exports depend upon a recovery in the world market. The chorus of manufacturers calling for interest rates to be cut further, despite their current historically low levels, will no doubt grow in volume again in the coming months. However, they are unlikely to be heeded given the unprecedented levels of indebtedness and the continued gravity defying housing market. Indeed, claims that there is a recovery in industry would only encourage those that argue for an increase in interest rates. Such a policy would undermine any investment – if there was any to undermine – while pulling the rug from under house prices and credit, in other words consumer spending.

House prices are still rising across Britain, although there has been a certain slowdown in London and the south east. Average prices rose by 1.3% in August according to the Halifax. The Nationwide and Halifax both reported that annual house price growth was 19.1% in August with the average house in Britain now worth £133,908.

Martin Ellis, the mortgage bank’s chief economist, said the housing market had bounced back strongly after what he called a “lull” between February and May, when the run-up to war in Iraq dented confidence.

That confidence actually translates as historically low interest rates. The Bank of England reported that 111,000 new mortgages were approved in July, the highest level since last November. Cheap borrowing costs have helped stave off a sharp slowdown in the housing market despite weak growth in real incomes and surging household debt. However, even the exuberantly confident Halifax still expects price growth to ease later this year and early next year as first-time buyers are priced out of the market.

The housing bubble has not burst yet, but burst it will. In January 2003 we wrote, “But there is still one bubble left in UK capitalism – the property market. While UK industry stagnates and the financial sector cuts its throat, house prices go on rising at a 30% rate. This cannot last. And while it does, in the words of the deputy governor of the Bank of England, Mervyn King, it is causing ‘major imbalances’ in the economy.

Sir Eddie George, the governor of the Bank of England, has confirmed that the fear of stoking the boom was one reason why they had held back from lowering borrowing costs.

“The risk of cutting interest rates now is if it would exacerbate larger risks further down the road… of a larger shock later on,” he said.

Since then the Bank of England has indeed cut interest rates again. This has had the temporary effect of forestalling a fall in house prices, and the number of new mortgages, but it only postpones the inevitable, as they themselves explained. They are like heroin addicts who despite knowing the dangers of the next fix nevertheless cannot help themselves.

Nationally, the average home is now worth 4.75 times the average income – close to the peak of 5 times in the housing bubble of the late-1980s. In London the figure is much higher.

“Looking at the fundamentals, it is hard to feel relaxed about the ongoing boom in property prices and the ever-increasing house price-to-income ratio,” said Alan Castle, of Lehman Brothers. “The longer the boom continues, the more chance there is of an unpleasant correction.”

The Bank of England has again declared that the pace of consumer borrowing is unsustainable after households took advantage of the lowest interest rates since 1955 to run up a record £10bn more debt in June, and £9.9 billion in July, up 14% in twelve months. Households are now sitting on total debts of £888 billion which is 124% of annual disposable income.

KPMG said a quarter of the consumers it surveyed admitted to borrowing more simply to “make ends meet” by paying basic living costs such as household bills. “Net pay is falling in relative terms, partly due to the increase in national insurance contributions, and people are opting for credit and loans to top up their incomes,” said KPMG’s Carolyn Steppler.

Since Blair came to power the British economy has coughed and spluttered along with a growth rate of around two percent per year. However, in the same period household spending has grown by four percent per year. While industry remains in the doldrums and manufacturing investment continues to fall, the economy is being kept afloat by credit cards and unsustainable house price inflation.

Despite Brown’s constant claims of prudence – in reality the unwillingness of a Labour government wedded to the market to invest in public services – he has in reality presided over record breaking high street borrowing and personal indebtedness. British household liabilities exceed incomes by one third. That is a record. The KPMG survey claims that many people have no idea what interest rates they are paying on their loans or credit cards. More than a third – 36% – had only a rough idea how much interest they were paying. While interest rates remain low and repayments likewise it doesn’t matter. However interest rates only have to rise a fraction to plunge many into misery. Average credit card debt now stands at £1100 per head, double the figure just five years ago. Total consumer debt excluding mortgages now stands at £3400 for every adult in Britain, £1150 more than in 1998.

Government debt is also burgeoning with the public sector owing 50 percent more than it is worth. The Treasury’s own forecast predicts net government borrowing of £100 billion between 2003 and 2006.

For all the wishful thinking of those at the EEF who imagine they can see the green shoots of recovery, ignoring the figures they quote themselves, investment will not recover until profitability does. Given the weakness of the world market, Japan, Europe and the US it is hard to see that happening for some time yet.

The house price/credit card economy cannot continue indefinitely. There is always a morning after the night before and this time will be no different. As David Walker argues in The Guardian, “People think they can easily work off their debts – by doing overtime, winning promotion or getting a new job. But that’s to make a heroic assumption about economic conditions. Orgies do not go on forever. The economic cycle has not been abolished; unemployment will start growing again – history is littered with gurus who proclaimed its end.” (The Guardian, 29/8/03)

September 2003.

See Britain in 2003 – Part Two

See The New Situation in Britain

(London, 28/02/03)