According to the latest figures, whilst homelessness has increased and people who can’t afford their mortgages are being evicted from their homes, there are 11 million empty houses across Europe. This is yet another damning indictment against the irrational capitalist system.

Whilst homelessness has increased and people who can’t afford their mortgages are evicted from their homes, there are 11 million empty houses across Europe, according to figures collated by the Guardian.

Spain is very badly affected with more than 3.4m homes lying vacant. There are over 2m empty in France, and the same in Italy; 1.8m in Germany and more than 700,000 in the UK.

Many of these homes are owned by banks. The banks gave massive loans to get these homes built – but now they are not worth what was paid out. Why don’t the banks sell or rent these houses at market prices? Could it be because, if they sell or rent those homes for what they are really worth now, they would have to reflect those lower amounts in their balance sheets? The banks are in enough difficulty already without potentially devaluing their assets.

Ireland is another country with a big problem of empty houses, relative to the size of its population: 400,000 homes are empty and the Irish government has begun demolishing 40 whole estates of empty housing that were built during the boom. There are another 1,300 unfinished developments which the government is yet to decide what to do with. Experts have said it will take forty-three years to fill all those empties considering Ireland’s current low population growth rate. Ireland’s population had grown strongly during the boom. Before that boom many had left Ireland to find work – the boom had been attracting them back, but the crisis has put that process into reverse.

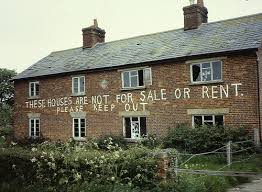

In the UK there are 700,000 empty homes despite historic low levels of house building, a factor contributing to rising house prices and rents. Some of those empty homes need major repair work, as Gavin Smart of the Chartered Institute of Housing explains. Others are in places where people do not want to live. But there are many that have been bought by big investors and deliberately kept empty so that they can be sold when prices rise.

The Guardian gives the example of “Billionaires Row” – the most expensive housing in London – where one-third of the homes are empty. Some have been kept empty so long that they are falling into ruin.

And what about those places where people do not want to live – why are they unpopular? Often they are in areas with high levels of unemployment – people have moved away to find work elsewhere.

Britain has seen average house prices rise – but this is mostly in and around London. Meanwhile prices have been falling in some other areas, or only growing slowly. These problems come about from the unplanned nature of capitalism – factories and offices close when they are unprofitable, devastating whole communities, provoking population flights and depressing prices.

How can the empty homes problem be solved? One Spanish council has called for those properties, kept empty by banks, to be taken over by local councils and rented out. This would be an excellent start to solving the problem.

But as long as capitalism exists there will be booms and slumps, with housing being built (or just started) when profits are there to be made. As night follows day, slump ensues, leading to a fall in “effective demand” (i.e. workers’ ability to buy). This again leads to homes standing empty, whilst there remains a real demand – a real need – for housing for the homeless and the badly housed.

Only a socialist planned economy can guarantee the provision of jobs and good quality accommodation for all, based on social need not private profit.