The prolonged upswing of British and world capitalism since the second world war, in the areas where the capitalist system has been maintained, calls for an examination of the basic ideas of Marxism on the question of economic development. If there is a fundamental change in the working of the system then it is necessary for Marxists to make a suitable reappraisal. Marxism represents the concentrated analysis of the laws governing the development of society. In the field of economics, the laws underlying the development of capitalist society have been worked out and explained by Marx. Despite extension and deepening in the works of Lenin and Trotsky, these basic laws have remained fundamentally the same for more than a century.

Undoubtedly the economy, since the second world war, has developed on somewhat different lines to those following the first world war. But every decade of capitalist development has tended to be different to every other decade. The basic laws underlying the development of capitalist economy have, however, remained intact.

The immediate perspective in the economy is of a rise in production, this year, of probably 6 per cent. This in its turn will mean a strengthening of the demand of the working class for a bigger share of production. Hence the concessions of capitalism in the field of wages and hours in the last few months. The victory of the railway workers has been predicated by this fact.

The world economy is beginning to move towards slump (or recession – a small slump that does not deepen into long-lasting depression – according to the definition of the capitalist economists). Until recently, there has been quite a high rate of development of the economy in all the major capitalist countries, in fact largely throughout the capitalist world. This development in Western Europe and in many of the ‘undeveloped’ areas of the world is beginning to slow down. There are already signs in the fall of prices of shares on Wall Street – always a sensitive, if not always correct, barometer – that the economy of the United States may have its downswing in a deeper ‘recession’ or ‘slump’ soon.

The huge investments in industry, the turn to mechanisation and automation, increase, at the same time, the amount of constant capital in proportion to variable capital, ie the capital invested in machinery, buildings, plant etc, rises in proportion to the amount invested in wages. This must lead to a fall in the rate of profit. The present decline of investment is a reflection of the capitalists’ realisation of this tendency, even though they do not understand the reason for it.

However, these swings, up and down, are normal to the development of the trade cycle, at every phase of the development of capitalism. What has to be established is not the episodic differences, but whether there is a new element, such as the intervention of the state, which changes fundamentally the movement of the trade cycle from anything experienced by capitalism in the past.

The basic Marxist postulates, on this question, are that the exploitation of the working class by the capitalists means that the surplus value, created by the workers, is accumulated by the capitalists and then reinvested in industry. The explanation of the development of the economy under these conditions is the division of the economy into ‘department 1’ (production of the means of production) and ‘department 2’ (production of the means of consumption). The surplus produced by the working class, over and above its own subsistence is, apart from a small part consumed by the capitalists, ploughed back into production. The whole historic role of capitalism has been the development of the productive powers of society by the use of the surplus in capital construction. Hence the growth of production.

Competition between different capitals produced the need for ever greater productive equipment. This, in its turn, meant the gradual accumulation and concentration of capital in fewer and fewer hands. The continuous expansion of expenditure on constant capital (C) or means of production, in relation to the amount spent on variable capital or wages (V), in its turn produced the tendency of the rate of profit to fall. This is confirmed in different language by all serious economists including Keynes. Even the university professors, on studying the data, are compelled to admit the truth of this proposition for the modern epoch, even more than in the past.

The fundamental cause of crisis in capitalist society, a phenomenon peculiar to capitalist society alone, lies in the inevitable over-production of both consumer and capital goods for the purposes of capitalist production. There can be all sorts of secondary causes of crisis, particularly in a period of capitalist development – partial over-production in only some industries; financial juggling on the stock exchange; inflationary swindles; disproportions in production; and a whole host of others – but the fundamental cause of crisis lies in over-production. This in turn, is caused by the market economy, and the division of society into mutually conflicting classes.

None of this has been changed by the developments of the period since the second world war. This can be demonstrated by a comparison of the inter-war period, pre-1914, and the post-second world war period.

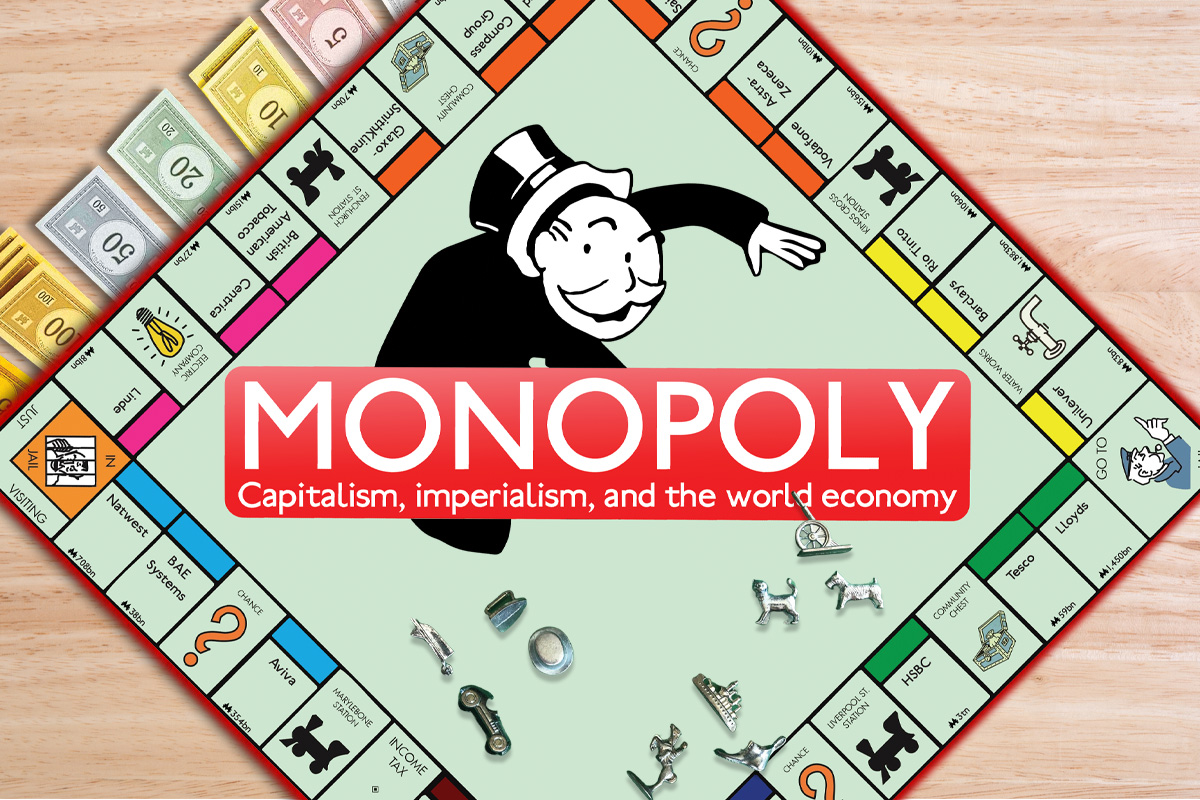

Since the second world war, because of the pressure of competition from America, the rise of Soviet and Eastern European and Chinese production as a formidable threat to capitalism projecting into the future, the economy of formerly relatively backward economies such as those of Japan, Britain, France and Italy has had to be rationalised. The development of world production has meant that competition between national captitalisms has forced further modernisation and further division of labour and specialisation even between the major capitalist nations. (This is one of the reasons why the Common Market, on however shaky a basis, has been formed, provoking in its turn the Outer 7(1) countries grouped round Britain as a reply). The ‘national’ economics thus work more and more together with the state and using the state as a lever. Monopoly capitalism and the state intertwine and fuse.

In his book Trends and Cycles in Economic Activity William Fellner demonstrates that the trade cycle in the post-war period has not been fundamentally different to the trade cycle of the past:

“While averaging for decades smooths out much of the cyclical instability, the decade-averages remain noticeably influenced by the somewhat depressed character of the decade of the 1890s as a whole, and by the war and post-war prosperity of the entire decade of the 1940s…a basic tendency towards a proportionate rate of increase of between 30 per cent and 40 per cent per decade…when two decades are ‘abnormal’, in opposite directions as the 1930s and the 1940s, the tendency asserts itself for a 20-year period.”

Dealing with the United States, JA Schumpeter in Business Cycles declares: ‘The number of minor interruptions between the major downturns seem to have been greater in the United States than in most European countries, even though the secular trend has been particularly steep in the United States.’ Dealing with the difference in the trade cycle between Britain and America, to explain the present tendency Fellner points out:

“It may be that the British cycle is still somewhat lengthier than that in the USA. Earnest students record that in the 19th century the length of the British cycle was between seven and ten years; American investigators found a cycle of somewhat shorter duration…The difference may be due to the structure of the economy, or even to a difference in national temperament. One might say that the Americans are quicker off the mark, in reacting to a change in circumstances, or one might say that they are more volatile.

“For a number of years the British cycle, and that in continental Europe also, has been out of phase with the American cycle…The primary cause of this divergence was the larger scale of the American defence effort, even in proportion to the size of her economy, after the Korean episode.” (2)

It is true that the rate of growth in the period 1870-1914 was at a higher tempo than in the period between the wars, but that reflected the fact that the relatively progressive nature of capitalism had changed. The world war of 1914-18 marked a definite stage in the development of capitalism. This was reflected in the impasse in which the private ownership of the means of production and the national state had landed society.

The economic upswing, following the second world war, is due to a whole series of factors. There is nothing ‘unique’ in such an upswing. The possibility of such an economic upturn of capitalist society was foreseen by Trotsky in his criticism of the blind mechanical conceptions of the Stalinists:

“Will the bourgeoisie be able to secure for itself a new epoch of capitalist growth and power? Merely to deny such a possibility, counting on the ‘hopeless position’ in which capitalism finds itself would be mere revolutionary verbiage. There are no absolutely hopeless situations (Lenin). The present unstable class equilibrium in the European countries cannot continue indefinitely precisely because of its instability…

“There will be no new boom of world capitalism (of course, with the prospect of a new epoch of great upheavals) only in the event that the proletariat will be able to find a way out of the present unstable equilibrium on the revolutionary road.” (The Third International After Lenin, pages 64-5) [source]

And again:

“From Marx on, we have been constantly repeating that capitalism cannot cope with the spirit of new technology to which it has given rise and which tears asunder not only the integument of bourgeois private property rights but, as the war of 1914 has shown, also the national hoops of the bourgeois state, (ibid page 52) [source]

“Politics, considered as a mass historical force, always lags behind economics…the international capitalist system has already spent itself and is no longer capable of progress as a whole…

“Theoretically, to be sure, even a new chapter of a general capitalist progress in the most powerful, ruling, and leading countries is not excluded.” (ibid page 81) [source]

Dealing with the trade cycle, The American National Bureau of Economic Research has prepared a table, dating back about a century. This table shows the peaks and troughs of economic activity in the United States in this period. (See Table 1)

To these could be added the peak of 1953, the trough of 1954, the peak of 1957, the trough of 1958, the peak of 1959-60 and the subsequent decline.

What then are the basic reasons for the developments of the post-second world war economy?

- The political failure of the Stalinists and the social democrats, in Britain and Western Europe, created the political climate for a recovery of capitalism.

- The effects of the war, in the destruction of consumer and capital goods, created a big market (war has effects similar to, but deeper than, a slump in the destruction of capital). These effects, according to United Nations’ statisticians, only disappeared in 1958.

- The Marshall Plan and other economic aid assisted the recovery of Western Europe.

- The enormously increased investment in industry.

- The growth of new industry – plastics, aluminium, rockets, electronics, atomic energy and by-products.

- The increasing output of the newer industries – chemicals, artificial fibres, synthetic rubber, plastics, rapid rise in light metals, aluminium, magnesium, electric household equipment, natural gas, electric energy, building activity.

- The enormous amounts of fictitious capital, created by the armaments expenditure, which amount to 10 per cent of the national income in Britain and America.

- The new market for capital and engineering products, created by the weakening of imperialism in the undeveloped countries, which has given the local bourgeoisie the increased opportunity to develop industry on a greater scale than ever before.

- All these factors interact on one another. The increased demand for raw materials, through the development of industry in the metropolitan countries in its turn, reacts on the undeveloped countries and vice-versa.

- The increasing trade, especially in capital goods and engineering products, between the capitalist countries, consequent on the increased economic investment, in its turn acts as a spur.

- The role of state intervention in stimulating economic activity.

All these factors explain the increase in production since the war. But the decisive factor has been the increased scope for capital investment, which is the main engine of capitalist development.

The relatively progressive role of capitalism between 1870 and 1914 consisted in the development of the productive forces, at a fairly rapid rate. It is true that sufficient productive forces had been developed for the working class to take power, ie the material conditions for workers’ power had been created by the previous expansion of the productive forces under private ownership. Under workers’ power the productive forces would then have developed faster. But nevertheless, so long as capitalism can develop the productive forces at a fast pace, it serves the need of progress and can maintain itself so long as it serves this purpose.

Since the second world war, capitalism, in an uneven, contradictory fashion, has suffered such a period of ‘rebirth’. It is true that it is a temporary uplift of a rotten and diseased economy, reflecting the old age of capitalism rather than its resilient youth, that it shows all the feebleness of a decayed system. But even within the general decline of capitalism such periods are inevitable so long as the working class, through faulty leadership, fails to end the system. There is no such thing as a ‘last crisis’, a ‘last economic slump’ of capitalism, a ‘ceiling on production’ or any of the other primitive ideas put forward by the Stalinists during the great depression of 1929-1933. Nevertheless the enfeeblement of capitalism is reflected in the revolutionary events following the second world war.

From the viewpoint of Marxism, this economic revival of capitalism is not a negative phenomenon only. It enormously strengthens the numbers and cohesion of the working class, and of the position of the working class within the nation. The next break in the economic conjuncture will pose even greater problems in front of capitalism than in the past.

It is this economic revival, and not the role of government spending, or the increased role of the state, which is the main factor explaining the recessions or little slumps which have followed the second world war. Of course the increased role of the state with the end of laissez faire had already been pointed out by Marx and Engels. The tendency of the productive forces to outgrow the envelope of private ownership, forces the state to intervene more and more in the ‘regulation’ of the economy.

Lenin, Bukharin and Trotsky had shown the enormously increased role of the state, during and after the first world war. In his last writings Trotsky had reinforced the arguments on the increased economic role of the state. The greatly increased role of the state was explained by the growth of productive forces, the concentration of capital, the growth of trusts and the development of monopoly capital. All these developments had been summarised in Lenin’s Imperialism. There was a fusion of monopoly capital with the state which acted as the direct agent of big business. This did not mean ‘regulation’ or a ‘plan’ of production in the sense of the economy of a workers’ state. Neither did it mean an abolition of the domination of the market. Within the limits, especially of arms production, it increased the contradictions within capitalism. The ‘regulation’ was principally at the expense of middle-sized and small business, as in the recent credit squeeze and the increase in the rates of interest, which affect big business very little but are burdensome to the minor capitalists.

The subsidies to big business, the denationalisation of profitable sectors of nationalised industry are an indication of the real role of the state as the tool of the banks and trusts. The state has taken over those sections of industry rendered unprofitable by the development of new industries and techniques, and by the need for huge capital expenditure and modernisation, which were not economic or profitable for capitalism.

In the case of Britain there was the need to transform the basic industries: coal, gas, electricity, transport and steel, for purpose of rendering engineering, shipbuilding, chemicals and other industries, competitive on world markets. Thus the measures of state capitalism, which constitute an important argument for statification, do not in themselves alter the basic laws of capitalism.

But the factors which have assisted in maintaining full or relatively full employment in the main capitalist countries, that is expenditure on armaments, have led in their turn to the persistent and steady inflation. In West Germany, which did not have such a burden, taking advantage of the difficulties of her rivals in this connection, and with a large reserve of labour from the former German territories, Czechoslovakia, and East Germany, the price level up to the recent period was relatively stable. In addition, the amount ploughed back in capital investment was correspondingly higher. Now, with full employment, they are beginning to face the same problems as their rivals:

“In West Germany the non-recurrent elements in the process of expansion were particularly striking; large scale unemployment early in the 1950s and the high rate of immigration of labour from East Germany; gaps left in the stock of physical resources by the destruction of the war, by the post-war dismantling of plant, and by the partitioning of the country. These factors in combination yielded high rates of profit in a process of expansion distinguished by a rapid growth of employment and by a high rate of investment, in extending the capital structure.” (The Economic Bulletin for Europe, volume 3, 1959)

The economic experts of the United Nations, regarding with dismay the last few slumps, have come to understand that the bourgeoisie has by no means been enabled to solve the economic problems facing their system. The Annual World Survey of the United Nations published in 1959 contained the following wry estimate:

“No special factors of major significance can help to explain the downturn in United States economic activity in 1957-8 or the virtual standstill in total West European production in the course of 1958…Regardless of the extent to which the recession may have been inherent in the build-up of excess capacity or might have been accelerated by government restriction, it is evident that the world has not yet learned how to avoid the costs of recurrent industrial slumps.”

And again commenting on the sharp character of the fall in 1958…’Nor would it be wise to assume, on the basis of the post-war experience, that in the future all recessions are bound to be short and mild.’

Incidentally, the United Nations’ economists estimate that the last ‘recession’ cost the United States billions of dollars in both real income and capacity to import. Reflecting the illusions of the ‘under-consumptionists’ who believe that all will be well if the capacity to consume is maintained, the United Nations’ economists speak of ‘an array of automatic stabilisers, including progressive tax systems, social security, and farm support programmes…’ But even they make the point:

“It is important to bear in mind, however, that stabilisers can only slow down a rate of decline; they cannot in themselves initiate an upturn…While depressions of the order of magnitude of the nineteen thirties have become unthinkable both on social and on political grounds, recessions of greater duration and depth that those heretofore experienced in the post-war years cannot he prevented by exclusive reliance on any automatic stabilisers.” (World Survey, page 4)

The development of the economies in Western Europe, Japan, the United States and Britain – with this or that national difference – all demonstrate the same phenomenon: the increase in capital investment, as the key to the economic upswing in the decade and a half following the second world war.

Apart from the subsidies to private industry, which amounted to 385 million in Britain in 1958, and the enormous expenditure on armaments, which constitutes unproductive expenditure, in many of the countries of Western Europe – but particularly in Britain – the ruined basic industries were nationalised, in order to modernise them so as to serve as useful instruments in increasing profits of private enterprise, especially in the more modern industries.

Those sections which showed profitable possibilities, such as steel and road transport, were denationalised by the Tories and now the suggestion has been made of hotels and catering, and non-railway properties and activities of the railways. Thus the nationalised sector which constitutes 20 per cent of the economy in Britain serves as the handmaiden of private industry.

Even if these industries had remained in the hands of private enterprise it would have meant large expenditure, as in America, in order to modernise them. But the investment in these fields is still only half that of the industries which have not been nationalised. As the total of capital investment in 1957 was 14.7 per cent, the highest level of investment in Britain since the war, it can be seen that the nationalised industries would have invested roughly five per cent as against 10 per cent invested by private industry. At the same time the output of the industries under private enterprise is six or seven times the output of the industries under the control of the state. This means that it is the private sector of the economy which dominates over industry in the economy as a whole, and not vice-versa. This can easily be demonstrated by the statistics given by the Census of Production published in 1958 (See Table 2)

What do these statistics show? On two fundamental problems they provide an unanswerable reply to the theories of the revisionists. The argument of Strachey, Crosland, Gaitskell and others is that the relative share of the working class in the increased production has increased. These figures demonstrate irrefutably that the share of the working class, relative to the total production, has fallen. Statistics from America, Italy, Japan and West Germany would undoubtedly demonstrate the same thing.

It is true that the absolute standard of living has increased (overtime, women working, increased productivity of labour, bonus schemes, full employment etc would be the explanation) but the relative share of the working class has dropped. So the ‘under consumptionist’ idea that the capitalist crisis has been overcome by the increased share of the consumers is demonstrated to be palpably false. The share of the ‘consumers’, including the capitalists, has dropped from approximately 67 per cent in 1938 to a little over 54 per cent in 1957 of the total ‘cake’ of national production.

The increase in productive capacity in Britain has been 3 per cent a year since the war – twice as high a rate of increase as that achieved in the inter-war period and probably faster than for many years before 1914. After the war until 1951 one fifth of output was offset by increases in the price of imports. Output rose between 1946 and 1951 by 14.5 per cent…Real national income by 11.5 per cent. Between 1951 and 1955 real national income rose by 15.5 per cent as against a rise in gross domestic product of 12.5 per cent. Between 1955 and 1958 gross national product rose by 5 per cent as against a rise in production of only 3 per cent. Between 1951 and 1958 gross national investment, savings and depreciation increased from 15 per cent to nearly 20 per cent. Net national income rose from under 7 per cent to over 11.5 per cent.

From the point of view of Marxism, in any case, a continuing rise in the share of national production by the working class, in itself at a certain stage would cause crisis and slump by cutting into the share of the national income going to the capitalists, thus over a period causing a fall in the rate of profit. This is so because it is only out of the surplus created by the workers, that the capitalists find the wherewithal to invest. Meanwhile the continuing technological progress means that the capitalists are compelled to invest (in real terms leaving aside the fall in the value of money) more and more in production for the purpose of competing on the national and international markets. Thus the explanation of the post-war period of ascent cannot be explained by the increase in the standard of living – a la Crosland and Jay.

On the other hand the statistics of national production, which, allowing for marginal errors, are an accurate description of the national economy from a capitalist point of view, demonstrate the shallowness of the theories of Maurice Dobb and of various Stalinists that it is the increased role of the state which has prevented another 1929. It is true that the role of the state has increased. But the statistics demonstrate the limits of this phenomenon. From 1938 to 1957, including the expenditure of the national and local authorities on building, social services and armaments, the total proportion of the increased national income spent by the state amounted to 14.7 per cent of the national income in 1957. If one includes also the figures of expenditure of the nationalised industries it would amount to about 20 per cent of the national income, or one fifth, in itself a gigantic figure but not sufficient to determine the basic movement of the economy. It is not state industry which dictates the movement of private industry, fundamentally, but private industry which dictates the movement of state industry.

In an epoch such as this it is necessary for Marxists to have an answer to any tendencies, bourgeois, social-democratic and revisionist (this is particularly necessary in the political climate created by the temporary upswing of capitalism).

A restatement of the fundamental Marxist doctrine on this question puts the whole problem in its proper perspective. There can never be a slump in an economy which is state-owned, as far as ‘the commanding heights of the economy’ are concerned, because it is then possible to plan production on the same lines as an individual factory. If mistakes are made, as in the plan of the Soviet bureaucracy, it is easy to overcome this by simple administrative decree.

The only limits to production, apart from the mistakes of the bureaucrats, their swindling, inefficiency, red tape, etc, is the level of production and the productive forces themselves. They can plan to produce consumer goods, capital goods, rockets or cannon, or what-have-you, but so long as the level of the productive forces is taken into consideration, and due limits of proportion observed, with this or that error, nevertheless the entire capacity of production (leaving out discrepancies in raw materials etc) can be used to its utmost limits! That is the fundamental distinction between an economy based on state ownership and an economy of partial ownership by the state, an economy of state capitalism.

Why cannot expenditure by the capitalist state solve the problems of the economy in a capitalist society? In an economy where private ownership is the dominant form of production, production remains for the market. All taxes must come from the economy itself, either they must come from the profits of the capitalists, or they must cut into the income of the working class. In either case it cannot over a period prevent crisis. To cut into the income of the capitalist would cut into the rate of profit; money spent by the state, taken from the pockets of the capitalists, cannot be spent by the capitalists. Similarly, money extracted from the workers in taxes for the benefit of the capitalists and their state, cuts into the market for consumer goods. Thus, either way, the state eats into the vitals of the economy. The state in the modern period has become a monstrous incubus and parasitic burden on production. What the state gains on the swings, the capitalists lose on the roundabouts. The worst thing from a capitalist point of view is for the state to cut into the profits of the capitalists. For that aggravates the crisis while 80 per cent of the economy remains in the hands of private ‘enterprise’. That is why as speedily as possible the capitalists get their state to lessen the taxes on profits and especially the allowances for new investments. The Tory government (and the Labour government after them) systematically lessened the taxes in this way.

On the other hand the various Keynesian ‘solutions’ of this problem are basically unsound. If the state, by ‘deficit financing’, as advocated by Gaitskell, spends in effect money it does not possess, it means that there will be an inflation of the currency, and over a period it would amount to the above propositions on the distribution of the national income. The only difference being that crisis would be aggravated by the ruin of the currency. The reason for this would be the inevitable rise of prices, other things being equal, to the same proportion as the increase of the money in circulation not backed by goods or money.

As stupid is the suggestion by Gaitskell, and echoed by others, of an increase in the expenditure of the nationalised industries. The nationalised industries cater as basic industries for the capitalist economy as a whole. The money for these industries, in so far as it is not provided on’normal’ lines to be financed by the market, must be gained by deficit financing or taxes, and thus cuts into the amount that can be spent by industry as a whole. The economic unreality of the suggestion that increased expenditure by nationalised industry could solve a crisis of production is indicated by the present crisis in the coal industry. The railways, electricity, gas and other nationalised industries are dependent (apart from individual consumption) on the orders of private enterprise, of the engineering, chemical, food and other industries. A fall in production in these industries means inevitably a fall in production in the nationalised industries. The crisis in the coal industry demonstrates the truth of this proposition even during the current boom. It is only because of the boom that the government can afford an accumulation of tens of millions of tons of coal at the pit-heads.

Expenditure on armaments is expenditure on ficticious (unproductive) capital. Expenditure on public works, roads, hospitals, schools is necessary if marginal expenditure (not directly linked to production, but necessary to it) but can only be an amelioration of the problem, for the reasons sketched above. Incidentally the Radcliffe Commission demonstrated conclusively the fallacy that the economy was controlled by monetary measures. In fact, as Marxists have always argued, the reverse is the case. The development of the economy in the direction of inflation or deflation compels the raising or lowering of the bank rate. The general conclusion of the Committee was that:

“Monetary measures cannot alone be relied on to keep in nice balance an economy subject to major strains from both within and without. Monetary measures can help, but that is all…We suspect that extravagant hopes would not have been placed in monetary policy in recent years had it not been for the desire above all to avoid increases in taxation and reduction in government expenditure. The gradual diminution of the burden of taxation should make it easier for more realistic views to prevail in the future.“

In other words, far from regarding the expenditure of the state as a saving grace and a blessing, the bourgeoisie is constantly groaning at the burden of the state (a necessary Old Man of the Sea it bears on its back). An increase in state expenditure on police and army to defend the loot of the bourgeoisie, and social services necessary to keep the social demands of the masses in check, education etc, etc, means less in the pockets of the capitalists themselves. In fact, since the war, in proportion to total income and the increase in wealth, while armaments’ expenditure has enormously increased, there has been a neglect of the services, in real terms, which indirectly cater to the needs of the economy. The Times Review of Industry in December 1959 comments: ‘The cumulative effect of under-investment in “non-industrial” public assets – is likely to give rise to economic and social problems of a major order.’

In the United Nations’ World Survey there is an explanation of the slump of 1957-8 which fits in with the theoretical conceptions of Marxism: ‘There is now virtually unanimous agreement that a substantial building up of excess capacity (in Britain and America) throughout the economy in 1955-7 was a major factor in bringing on the recession in 1957-8.’ Meanwhile, the first flush of capitalist expansion since the war is coming to an end:

“Contrary to widespread illusion about the magnitude of the 1955-7 boom – fed in part by the self-same fear of inflation – the true dimensions of the expansion were modest indeed. In the US, even in the peak quarter of 1957, the volume of industrial production did not exceed the pre-recession peak level of 1953 by more than six per cent and at the low point of the 1957-8 recession the volume was only three or four per cent above that of the corresponding period of 1951 – fully seven years earlier…Although the rate of growth has been higher on the average in other industrial countries, most notably France, Italy, the Federal Republic of Germany and Japan, it has been quite modest, especially in the United Kingdom.” (ibid, page 6)

The ‘excess capacity’ in industry in Britain is a symptom of over-production of capital and the limits of the market. There have been a series of partial crises, affecting different sections of the economy in the past period, ‘excess-capacity’ of capital, industry, consumer over-production, over-production of raw materials, food, etc, etc at various stages and at different times. It was only the simultaneous concatenation of all factors of crisis which led to the devastating depression of 1929-33. Gradually the proportion that pertained in the 1920s in a whole series of economic sectors are assuming similar proportions at the present economic tide. At each successive stage the assumptions of the economic experts of the United Nations and of the bourgeoisie as a whole have been falsified. The industrial upswing in the Western countries produced in its turn a demand for raw materials and foodstuffs (primary products). This led to an increase in production in the ‘undeveloped areas’. The boom in production of minerals etc, led to an increase in the price of these products (the market still dominates nationally and internationally) and an improvement in the terms of trade. But this in its turn, according to the strict logic of capitalism, led to ‘over-production’ and a fall in prices. The fall in the prices of primary products in the recession of 1957-8 alone amounted to between seven and eight per cent – equivalent to six years’ lending to the undeveloped areas by the International Bank for Reconstruction and Development at 1956-7 rates.

According to the United Nations’ survey ‘the terms of trade in the late 1950s appear to be about the same as in the late 1920s’. The idea has been sedulously disseminated that a solution to the problems of capitalism can be found in the development of the undeveloped areas. It is true that a big increase in capital expenditure will ameliorate the problem for a short period of time but it can only render it worse at a later stage. However, on a capitalist basis, the limits of this development must be seen. The United Nations admits:

“It cannot be said that the present level of international aid is a negligible contribution to the development of the poorer countries; in the aggregate it fully offsets the decline in the share of private foreign capital in relation to the exports of primary producers since the nineteen twenties [only offsets! – EG]. Yet it needs only to be realised that on a per capita basis the total assistance amounts to only $5 per annum for the contributing countries and to no more than $2 per annum for the receiving areas, to see how grossly inadequate is the sum to permit a significant breakthrough in economic development.”

The ferment throughout the colonial world is based on these figures. It is a case of capitalism threatening to crack at its weakest links. This explains the change in the political policy of imperialism. This will have immense political and economic consequence at a later stage.

There is a widening gap between the growth of the economy and the rate of expansion of the undeveloped areas and the advanced metropolitan centres. Due to the growth in population of the colonial and ex-colonial areas the disparity has been increased. Between 1938 and 1955-7 there was a substantial rise in the output of food and raw materials, but this amounted to only two fifths of that of manufactured products.

This in its turn has led to the problem of the increasing gap between the undeveloped areas of the world, and the metropolitan centres. Due to the increase in production in the industrial countries, despite increases in industrial production too, the undeveloped countries are further behind in industrial growth than before the war. At the same time the development of population in these areas means that the absolute level of the standard of living, which is increasing at the present time in the industrial countries, is falling in the so-called under-developed areas, as at best the increase in the means of subsistence and industrial production is hardly keeping pace.

The bourgeoisie had believed that the problem of the relation of primary producing countries to the industrial countries had been solved by the rise in the prices of raw materials and foodstuffs in the first post-war shortages. Indeed they were worried that the terms of trade for such countries as Britain would change permanently to the disadvantage of the industrial countries. The United Nations’ economists wrote learnedly on this problem.

The one thing that never occurred to them was the inevitable over-production which would follow on the shortages. Following on the demand, a huge investment in copper, lead, tin, wool, cotton and other raw materials took place, leading to a surplus being produced and hence over-production.

In the capitalist world, in spite of the increase of trade, in comparison with 1929, there has been a fall in the proportion of world trade. This means that on the world market over a period the crisis of capitalism will be aggravated. The different capitalist powers will not be able to find a means of escape in the national contradictions except in the world market at each other’s expense. The total trade of the primary producing countries has only increased by one third in proportion to that of manufactures. If oil is deducted from the total it would fall to one seventh and petrol involves mainly the countries in the Middle East.

A similar phenomenon to that of the post-world war one period is the relative decline in the position which America had established immediately after world war two. The increase of production up to 1957 has been 14 per cent in the United States and 32 per cent in Western Europe. In Western Europe, over five years, from the early months of 1953 until the end of 1957, the rise in industrial production was 40 per cent. In America, from mid-1954 to mid-1957, the increase in industrial production was only half that, 20 per cent. In Britain, between the peaks of 1953 and 1957, the increase was only six per cent. ‘The primary (reasons for the fall in production): one among them was a decline in fixed investment activity, and especially in business investment.’ (UN World Economic Survey , page 181)

Dealing with the situation in Britain the United Nations’ World Economic Survey continues: ‘The UK economy was stagnant from the end of 1955 onwards, with minor ups and downs. Industrial production in that country fell during 1956 below the level attained in the latter months of 1955 and did not subsequently exceed that level even at the end of 1958.’ Explaining the fall in the economy also in Western Europe and Japan:

“The preponderant factors in recent economic developments in Western Europe and Japan have been the weaknesses in fixed investment and in export demand. On the whole, changes in government expenditure had not contributed to the previous upswing and they did not influence developments in 1958 either.” (ibid , page 192)

Dealing with the capitalist and especially the American economy since world war two, Fellner points out correctly:

“Indeed, the period over which the economy has shown considerable resistance to downward impacts is long enough to suggest that, of the ‘artificial’ stimuli (here listed), only the high military expenditures could have much relevance to the period as a whole…Also the mildness of the 1948-9 recession in particular could scarcely be attributed to military and foreign aid expenditures because the recession and the beginning of the recovery fall in the span which followed the gradual reduction of war-time spending and which preceded the resumed military expenditures of the Korean hostilities.

“During the span 1947-50 in which the recession and the early recovery fall, government spending was considerably higher relative to national income than in the 1920s (arms expenditure was many times as great) but mostly lower than in the depressed 1930s and the tax structure had become very much stiffer.“

A similar process can be seen in the recession of 1957-8. It was not government expenditure but the development of the economy itself which pulled the economy in Western Europe, Britain, the United States and other countries out of the recession, ie the ‘automatic’ workings of the economy itself. In fact the bourgeoisie, the economists of the United Nations, and serious economists in Britain and America, were pleasantly surprised by the brief character of the recession in 1958-9. Succeeding it there was a typical capitalist boom, in which production leaped ahead in Britain, Western Europe, Japan and the United States.

Commenting on present claims to have solved the problem of consistent growth Oscar Hobson writes in the February issue of the Banker: ‘Shades of 1929, when the problem of perpetual boom-cum-stable price level was almost everywhere proclaimed to have been solved.’

The economists of the bourgeoisie understand very well that investment is the key to the rise of the economy. On page 179 of the World Economic Survey (1959) the expert of the United Nations writes:

“The economic upswing had been based primarily on large scale investment in fixed assets and a rapid growth of private expenditure on automobiles and other durable goods. Unlike the Korean boom, no part was played in the process by rising government expenditure. On the contrary it was the levelling-off of or decline in government expenditure as the Korean conflict ended that released resources for use in the private sector. In some countries, however, exports rather than domestic expenditure provided much of the impetus to higher activity.”

Writing in the Financial Times , the ‘orthodox’ former Financial Secretary to the Treasury, Enoch Powell MP, says:

“This (increase of production in 1959 in Britain) domestic increase was part and parcel of a general trade recovery, just as the lull which had preceded it belonged to a widespread trade recession: both were participated in by countries whose governments were purporting to behave quite differently…the government have taken out of the economy by taxation and borrowing from the public as much extra as they have put into it by increased expenditure.

“This, in turn makes it unlikely that the government has in fact, as opposed to intention, done anything to ‘stimulate the economy’. the recovery, like the recession, has taken place in response to other forces of a wider and different character; or, if you like, in the immortal words of the steward to the sea-sick lady: Madam, you don’t have to do anything, it does itself.

“This is perhaps on theoretical grounds – though hardly on any others – to be regretted. Once again we have been denied the privilege of observing at first hand a British government coping with a recession on orthodox Keynesian lines. We still do not know approximately what would be the result if, in the face of a persistent fall in propensity to spend, a British government equally persistently increased its expenditure and financed it by the creation of money through floating debt. At any rate that was not the history of the 1958-60 recovery.” (Financial Times, 7 January 1960).

Here Powell is arguing on the lines of a market economy, that the attempt of the state at pump-priming will no more solve the problem than the Rooseveltian pump-priming of before the war. Powell understands some of the limitations of a capitalist economy; that what the government ‘puts in’ is determined by what it can take out in the form of taxes etc, so long as it is a market economy based on private enterprise.

In the Financial Times, an American economist, writing on the prospects for the American economy, is, of course, filled with optimism. But even he is cautious. Dealing with the factors leading to the rise in the American economy, he comments:

“In all probability the next decade will not be marred by a serious depression…There will be changes of pace, and we should count on a brief dip or two; but worse than this we do not expect. Since the depression decades of the 1930s, Americans have learned a good deal about the functioning of their economy…The resurgence of faith in what a market economy can do has been important in maintaining consumer spending in recessions; unemployment compensation and improved asset positions and credit facilities have also contributed…”

The last factors mentioned can only be a sop to a declining economy and cannot maintain the economy on a stable foundation for any length of time. These factors have been in existence in Britain since after the first world war, without affecting the economy fundamentally. However, there are certain factors which have kept the economy on an even keel. The amount spent on research and development of new techniques and products in the United States last year amounted to $12,500 million and out of this $9,000 million was contributed by private industry in the United States. The real explanation of the protracted boom in the United States the above economist gave in the following terms:

“The dependence of firms on new products, materials, methods for survival and growth in a competitive economy forces their introduction as quickly as feasible, lest the temporary differential profits which pay for research are lost. Since technology does not pause for economic recovery, new investment now can operate to shorten recessions and lessen their severity.”

But such a process cannot continue indefinitely. No firm is going to invest in new techniques and products if the sale of these will be lower than the previous sales of the product. If their returns will not cover their margins, plus at least the same profit as formerly, there would not be any point in continuing to plough in good money, in order to recover what has already been invested. Moreover, the rate of profit must decline over a period with continually new investments, to such an extent as not to be compensated by the increased surplus value, even though there was an increased rate of exploitation with an increased productivity of labour.

The Financial Times of 26 January 1960 reports the activities of the Eisenhower administration: ‘It seems clear that a major revolution in thinking has taken place in high circles in the US. It adds up to no less than the rejection of the Keynesian doctrine – at least where periodic deficit financing is involved.’ ‘The Budget’, again to quote The Economist’s Washington correspondent, reporting the Administration’s viewpoint ‘should not merely be balanced over the business cycle…it should also show a substantial surplus.’ Already in face of the recession of 1958 the Republican government had insisted on the need to balance the Budget. ‘They did this because of the fear of inflation, which threatened to get out of hand’.

The new recession bids to be far more serious and long-lasting than the last. The New York Stock Exchange is a harbinger of the coming collapse. The Financial Times of 30 January, 1960 in its editorial was already sounding the alarm:

“The disturbing feature in Wall Street’s behaviour is the talk of a new business recession…It is little more than a year since the USA was suffering from the effects of the last recession and another downturn in 1960 would be intolerable…On this side of the Atlantic the odds still appear against an early business downturn.”

The same tale of woe is told by The Times Review of Industry:

“It is entirely possible that the prospective 1960 boom will be strong enough to carry through most or all of 1961 as well. Even if it does, however, its unnatural birth as the aftermath of the steel strike may make the eventual recession something more than the mild readjustment to which the USA has become accustomed since the war.” (February, 1960)

Thus the ink had hardly dried on the prophesies of a new upswing before the first tremors of a new collapse were being reflected in the press. The capitalists themselves have too much at stake to share the optimism of the Croslands and the Jays as to the stability of capitalism. Whatever the exact date, it is absolutely certain that the unprecedented post-war boom must be followed by a period of catastrophic downswing, which cannot but have a profound effect on the political thinking of the enormously strengthened ranks of the labour movement.

Table 1: Economic activity in the United States 1857-1949

| Peak | June 1857 | Oct 60 | Apr 65 | June 69 | ||||

| Trough | Dec 58 | June 61 | Dec 67 | Dec 70 | ||||

| Peak | Oct 73 | Mar 82 | Mar 87 | July 90 | ||||

| Trough | Mon? 79 | May 85 | Apr 88 | May 91 | ||||

| Peak | Jan 93 | Dec 95 | June 99 | Sept 02 | ||||

| Trough | June 94 | June 97 | Dec 1900 | Aug 04 | ||||

| Peak | May 07 | Jan 10 | Jan 13 | Aug 18 | ||||

| Trough | June 08 | Jan 12 | Dec 14 | Apr 19 | ||||

| Peak | Jan 20 | May 23 | Oct 26 | Jun 29 | ||||

| Trough | July 21 | July 24 | Nov 27 | Mar 33 | ||||

| Peak | May 37 | Feb 45 | Nov 48 | |||||

| Trough | June 38 | Oct 45 | Oct 49 |

Table 2: Distribution of Final Demand For Britain

| 1938 | 1948 | 1949-51 | 1952-54 | 1955-57 | 1957 | |

| Consumers | 67.2% | 61.2% | 57.7% | 55.6% | 54.7% | 54.2% |

| Public Authorities | 12.8 | 12.7 | 13.2 | 15 | 13.9 | 13.7 |

| Capital Formation | 10 | 11.8 | 11.6 | 12.1 | 14.1 | 14.7 |

| Exports | 11 | 14.4 | 17.5 | 17.3 | 17.3 | 17.3 |

Notes

(1) The European Economic Community (EEC or Common Market) was formed in 1957. The “Outer 7′ was the European Free Trade Association (EFTA) founded in response to the EEC in 1960. The UK was a member of EFTA until it joined the EEC.

(2) At the end of the Second World War Korea was divided. A Stalinist regime was established in the North and a capitalist regime under US domination in the South. The Korean War between the two regimes lasted between 1950-53. Sixteen capitalist powers, under UN auspices, sent forces under US general MacArthur to the South, while China backed the North. During the war about 5 million died.