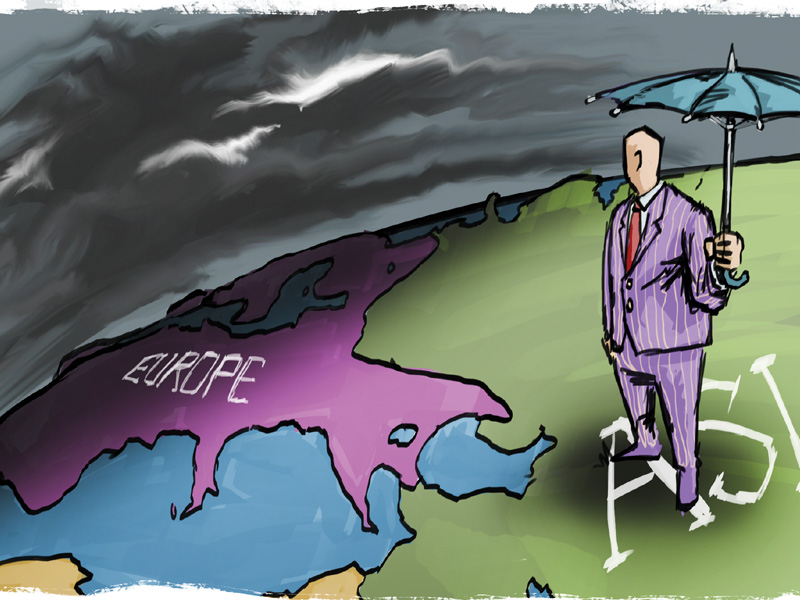

The ongoing trade conflict between the USA and China will not subside any time soon. The current protectionist battle is merely a harbinger of greater tensions and instability in world relations.

When the financial crisis exploded in 2008, apologists for capitalism said we would not see another depression because world leaders and central bankers had learnt the lessons of 1931. The errors of protectionism would not be repeated. They would weather the financial storms, keep world trade free from tariffs and other barriers, and in a year or two everything would be back to normal.

But capitalist crises have a way of destroying international consensus. Falling living standards, rising inequality, austerity and deindustrialisation have destroyed support for the so-called ‘neoliberal’ Washington consensus. Bit by bit, protectionist politics has seeped in through the cracks.

It is widely understood that Trump came to power on the back of anger at deindustrialisation and worsening living standards. Both of the key planks of his programme – a wall to keep out immigrants, and a trade war against China to end America’s trade deficit – cleary express this.

The trade war with China, an election promise on which Trump is already delivering, reflects the deep malaise of US capitalism, and marks a fundamental shift away from globalisation. It represents the deadlock in world relations and capitalism’s gloomy future.

US capitalism’s decline

The US has lost two-thirds of its industrial jobs since its postwar heyday. Half of these losses came between 2001 and 2009.

The US has lost two-thirds of its industrial jobs since its postwar heyday. Half of these losses came between 2001 and 2009.

As in Britain, these jobs have been replaced with insecure, low-skilled service sector ones. Hence the astonishing statistic that real wages for working class people have barely risen – and in many industries have declined – since the 1970s, despite profits increasing. Between 1973 to 2017, the productivity of American workers rose 77%, while pay increased only 12.4%. The difference was pocketed by the capitalists of course.

“The median American family is making less money than it was 15 years ago…2014 median family income is 6.5% lower than it was in 2007. It’s 7.2% below 1999 levels…Since the mid-’70s, wages as a percentage of GDP have fallen 7%, while corporate profits have risen 7%.” (wealthdaily.com, 23 Sept 2015)

The US working class has been living through a ‘Great Depression’ – not just since 2008, but since 1973. No wonder that life expectancy is actually declining now, thanks mainly to a massive increase in drug overdoses and suicides amongst those aged between 25 and 44.

“Drug overdose deaths hit a new record high – 70,237 last year, according to another new CDC report. The rate of overdose deaths increased by 9.6% between 2016 and 2017.

“The death rate from fentanyl and similar synthetic opioids soared by 45% in a single year… Deaths by suicide have also spiked. The suicide rate has increased by a third since 1999, according to the CDC stats, to 14 for every 100,000 people last year.” (The Guardian, 29 Nov 2018).

In this social context, Trump’s claim that America’s problems stem from its loss of greatness to China is understandably compelling for many.

And it is not without truth. In 1985, the US trade deficit with China was $6m. In 1986, it was $1.6bn, in 1987, $2.8bn. It rose every single year apart from 2001, 2009 and 2016, to reach almost $400bn in 2018, the highest ever.

Therefore Trump’s promise to reverse this through an uncompromising trade war seems like a real solution to many. He has promised to cut the deficit by a massive $200bn a year. In 2018 he put tariffs on over $200bn of Chinese exports to the US.

What will be the real consequences of this drastic action – for the US, for China, and the world economy? Is it true, as Trump tweeted, that “when you’re already $500 Billion DOWN, you can’t lose!”?

What does Trump demand?

Trump wants China to end its protection and support of Chinese companies and to start importing more US products. He wants the Chinese to end its Made in China 2025 policy, which promotes the development of Chinese technology and encourages the making of Chinese goods entirely from domestically produced components (a policy which appears to already be working – Chinese imports are growing much more slowly than the economy is). He wants China to stop forcing American firms investing in China to participate in ‘joint ventures’, whereby they are obliged to share their secret technology with their Chinese partners. And he wants an end to Chinese industrial espionage and intellectual property theft.

Trump wants China to end its protection and support of Chinese companies and to start importing more US products. He wants the Chinese to end its Made in China 2025 policy, which promotes the development of Chinese technology and encourages the making of Chinese goods entirely from domestically produced components (a policy which appears to already be working – Chinese imports are growing much more slowly than the economy is). He wants China to stop forcing American firms investing in China to participate in ‘joint ventures’, whereby they are obliged to share their secret technology with their Chinese partners. And he wants an end to Chinese industrial espionage and intellectual property theft.

In this respect, Trump actually has the backing of the US ruling class in general. There is a fear of China; a feeling that something must be done otherwise American capitalism will go the way of the British, leaving Chinese imperialism to rule the globe. This mood is widespread amongst America’s capitalists, who are certainly feeling the heat of Chinese competition.

Congress has been passing legislation along these lines for years, as we can see with various laws prohibiting the use of telecoms equipment from Huawei, which precede Trump. In August, Trump signed a new bill that prohibits any carrier with any substantial amount of installed Chinese telecom equipment from federal government contracts.

Whilst it is true that we are in the middle of a 90 day truce agreed between China and the US on December 1, the widespread support for the trade war amongst the US ruling class means that it will not disappear. The war signifies that world capitalism is at an impasse, that the major capitalist powers can no longer grow except at the expense of one another.

Trump’s tariffs are backed up by other protectionist policies intended to constrain China. Even before Trump, Obama was trying to rope US allies into a trade bloc (the Trans Pacific Partnership) that would force them to trade with one another at the expense of China. Now Washington is pressuring allies not to use Huawei, which Australia, New Zealand and Britain have complied with by banning it from supplying wireless infrastructure.

These policies serve to ‘decouple’ the world economy – that is, to discourage trade and the standardisation of technology, which will in turn drag at world economic growth. Indeed China’s own China 2025 policy, which is ongoing, is also an example of this phenomenon, since it encourages Chinese companies to source everything from within China, and involves a plan to raise Chinese production in industries in which China has to import at the moment. Both sides are resorting to protectionist policies at the expense of the other – and of the world economy as a whole.

What is the impact on China?

At first glance it would seem that Trump’s assault has hit its target, because China’s export and import figures were much worse than expected in December.

At first glance it would seem that Trump’s assault has hit its target, because China’s export and import figures were much worse than expected in December.

“In December, total exports fell to $221.25 billion, down 1.4% from November and 4.4 per cent from the same month in 2017… Total imports fell to $164.19 billion in December, a drop of 10% from last month and down 7.6% a year earlier. Analysts had expected a 4.5% rise, according to the Bloomberg survey… Nomura’s analysts said… that a significant slowdown in export growth could mean weaker growth in Chinese intellectual property filings and a rapidly rising unemployment rate.” (South China Morning Post, 14 Jan 2019).

So it would appear that the tariffs are already bearing fruit. But an early sign of their inevitable rebound on the US came when Apple (on 2 January) issued its first profit warning since the original iPhone was launched, blaming falling sales in China’s slowing economy.

China’s economy has built up enormous contradictions in the past few years. Total Chinese debt has reached at least 317% of Chinese GDP according to Goldman Sachs, growing more rapidly since 2008 than the British or American debt pile did in the run up to 2008. According to analysis from Standard Chartered, China’s share of global debt has tripled since 2009.

Should the tariffs threaten the health of the Chinese economy – which as we can see is fragile – it could engulf the world in a financial crisis far worse than that of 2008 – which was prevented from turning into an all-out depression only by China’s fiscal stimulus. Trump is playing with fire.

It should be noted, however, that it is most likely that the tariffs are only a part of the cause for China’s December slump. The global demand for consumer electronics, a huge factor in Chinese imports and exports, has peaked or even declined in the past year. In general, world demand and the world economy are not picking up.

Instead there are renewed fears of recession in the advanced capitalist countries. So demand for Chinese products is down anyway. However, this caveat is hardly cause for celebration, and only underlines the delicate nature of the world economy into which this trade war comes bursting forth.

How likely is it to succeed?

The USA’s trade deficit with China is not an accident, nor a temporary, secondary phenomenon. As we have seen, it has increased massively and without interruption for over 30 years. For three decades capitalism has sustained itself on Chinese growth and US consumption. This has brought us to a point of massive imbalances and contradictions.

But contradictions are inherent in capitalism and cannot be wished away. Capitalism is an anarchic, irrational and blind system, and when the contradictions become as large and systematic as they are today, the system goes into crisis. There is simply no way that within capitalism Chinese and American trade can be rebalanced with both countries continuing to grow in a happy equilibrium.

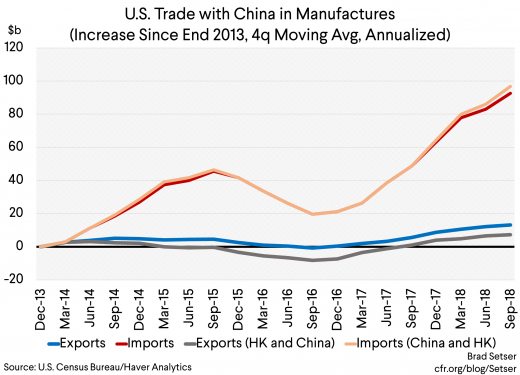

This is shown by the fact that in 2018, the year in which the trade war designed to drastically cut the deficit began, the US deficit with China rose 17% to its highest ever total!

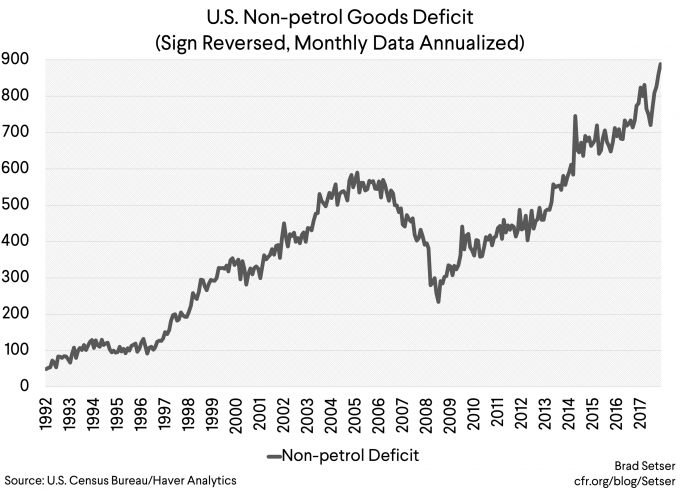

“Since 2014, the [US’s] non-oil goods deficit has basically doubled in dollar terms—initially because of a fall in exports after the dollar’s rise, increasingly because the stimulus has raised U.S. import demand.” (cfr.org, Dec 20 2018).

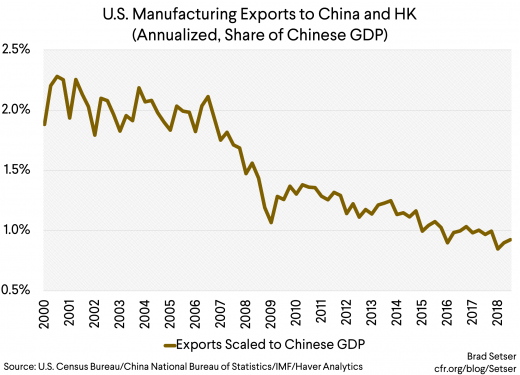

The deficit has been rising because US manufacturing has been dwindling with each passing year, as the below graphs show. But it has risen as the tariffs are applied because of Trump’s economic stimulus.

The deficit has been rising because US manufacturing has been dwindling with each passing year, as the below graphs show. But it has risen as the tariffs are applied because of Trump’s economic stimulus.

This tells us that Trump cannot stomach anything that would actually reduce the deficit, since that would require a massive recession. There is no other way to get Chinese imports down so much, so dependent is the US on Chinese manufactures. Indeed, since 1985, the only years in which the deficit hasn’t increased were all recession years.

Chinese manufacturing and technology will only improve and gain competitiveness over the US as time goes on. For example, amongst the biggest US manufacturing exports to China are Boeing planes. But China has an advanced strategy to develop an indigenous plane manufacturing industry, heavily subsidised and enjoying the advantages of China’s world beating supply chain, so this US export will probably rapidly diminish.

Chinese manufacturing and technology will only improve and gain competitiveness over the US as time goes on. For example, amongst the biggest US manufacturing exports to China are Boeing planes. But China has an advanced strategy to develop an indigenous plane manufacturing industry, heavily subsidised and enjoying the advantages of China’s world beating supply chain, so this US export will probably rapidly diminish.

China has agreed, after US pressure, to change the law so that US companies operating in China are not forced into joint ventures with local companies that take its technology. But it is happy to do so because it no longer needs to copy US technology, as in many cases its own is already superior. For example:

China has agreed, after US pressure, to change the law so that US companies operating in China are not forced into joint ventures with local companies that take its technology. But it is happy to do so because it no longer needs to copy US technology, as in many cases its own is already superior. For example:

“In 2017, Chinese AI startups attracted more venture capital than did their U.S. rivals. PricewaterhouseCoopers estimates that, by 2030, China will add $7 trillion to its gross domestic product as a result of AI deployment, nearly double the bonanza expected in all of North America.” (Washingtonpost.com, 30 Sep 2018)

Moreover, this change in legislation will only encourage more US firms to shift manufacturing to China, further diminishing US exports to China.

Impasse and instability

As the very existence of the trade war reveals, the world is faced not with a smooth passing of the imperialist batton from America to China. The US is ‘too big to fall’. As its power declines, it clings on, and threatens to take the whole world down with it in a protectionist binge.

As the very existence of the trade war reveals, the world is faced not with a smooth passing of the imperialist batton from America to China. The US is ‘too big to fall’. As its power declines, it clings on, and threatens to take the whole world down with it in a protectionist binge.

On the other hand, China’s economy, just as it begins to achieve parity with the US (and outstrip it in many areas), reaches a point of unavoidable crisis. It is not impossible that the trade war itself will help to push China into recession and unleash its debt crisis.

What this state of affairs indicates, then, is deadlock and chronic instability. Capitalism is at an impasse, economically and in terms of world relations.

The only way out of this impasse is by breaking with the straightjackets of private property and the nation state – that is, by establishing an international socialist planned economy in which the benefits of today’s advanced technology are not sources of jealousy and isolationism but international cooperation to meet the needs of humanity.