Location, location, location! Grand design! Home in the

sun. Yes, those house and home TV

programmes are still going, but maybe not for much longer.

Last week, the Bank of England hiked its interest rates, yet

again, to 5.75%.This was the fifth rise

since August 2005. And the head of the

bank, Mervyn King, said that "further action" on interest rates could be

necessary. Most observers reckon the

interest rate that most borrowing and mortgages are based on – the bank rate –

will go to 6% or more by the end of this year.

Already, the recent hikes have meant that the cost of

typical £125,000 mortgage is now costing £130 a month more than this time last

year. As much as 44% of the income of

the average household is now being swallowed up by mortgage costs. Many households have fixed-rate mortgages

that are unaffected by the bank rate moves. But 2.8m families will see a sudden jump in costs when their fixed rate

schemes come to an end over the next year.

The bean counters (accountants) Price Waterhouse Coopers

calculate that the burden of debt for the average UK household has now reached

19% of disposable income, a record level, passing the peak reached in the high

interest year of 1990. Indeed, average

household income rose 5.2% from 2004 to 2006. But after paying for higher interest-rate costs, the rise in income was

just 3%. After taking off the rise in

prices over that period, it means that most British households have not

improved their standard of living since 2004 because of the rise in housing

costs.

We know that British families have accumulated £1trn in debt

at the last count. Of course, they have

the value of their homes to put against that. But as the cost of servicing their mortgages rockets, the burden of

financing this huge debt will rise even further.

The Citizens Advice Bureau, a body that must deal with the

problems when people get into too much debt, announced that 2007 could go down

as the worst ever for Britain’s debt crisis. Personal insolvencies will reach a record surpassing last year’s record

of 107,288 bankruptcies. The Bank of England is hiking interest rates because it is

worried that the property market is getting out of hand again. In the leafy streets of Chelsea and

Kensington where the super-rich Russian and Arab émigrés buy their property

with wads of cash, prices have rocketed 30-50% in a year. But in the rest of the normal world, prices

are not really moving up that much. They are already at levels that make it impossible for most young people

to get on the ‘housing ladder’. And now

with the cost of mortgages rocketing, all hopes are gone.

The real problem is not just the very rich driving up house

prices with their tax-avoiding bonuses and illegal funds (that Gordon Brown’s

treasury did nothing about). It is not

just excessive demand for property but the lack of supply. Back in the 1950s and 1960s, people on a

working wage could expect to get a decent home through the council. It may not be much but at least it was

adequate and at an affordable rent.

But now in 2007, that is cloud cuckoo land. It is a sorry state to say that in the 21st

century in Britain, young people are forced to stay with their parents or

in-laws up to their mid-30s before they can get a flat at some extortionate

price or rent.

The reason is yet another part of the destruction of the

public sector and the welfare state that successive governments, both Tory and

New Labour achieved in the 1970s and 1980s.

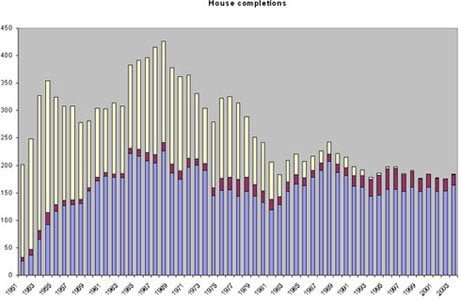

House building peaked in 1968 under the Wilson government

when 426,000 homes were built, of which local councils built 46%. Council house building declined under the

Callaghan Labour government, but of course it was really killed off under

Thatcher. Building stopped and the

existing stock was sold off at knockdown prices.

Council building is now virtually zero. It was supposed to be replaced by ‘social

housing’ with building by housing associations. But housing associations build only 20,000 a year, the same rate

back in the 1960s – and indeed half the rate of the 1990s.

New home building is now totally dependent on private sector

building for profit. And this they have

failed to do.Last year, they built

about 180,000 new homes (mostly flats not houses), still 20% below what they

managed 40 years ago! And of course,

these are for phenomenal prices, out of the reach of 35% of people not on the

housing ladder.

The destruction of the public sector housing programme by

the Tories and New Labour together helped create the housing crisis for

majority. The population is bigger now

than 40 years ago and yet house building now is just 40% of that achieved in

1968. Moreover, back then nearly half

was for low rent accommodation that the poorest could afford. Now over 90% of new homes are at

astronomical market rates and low-rent new homes are almost non-existent.

New Labour under John Prescott talked Blairily (lyingly) of

building more homes. But these were to

be mainly in the south-east where everybody is already suffering from

overcrowding, noise and traffic. The

regeneration of more lowly populated areas was ruled out because there are no

jobs there. Why were there no jobs? It’s because British capitalism is now so

lopsided towards finance over industry that incomes, jobs housing and the

environment are bent towards the south-east.

Our new New Labour prime minister, Gordon Brown, has claimed

that he is a builder. Yet it was as

chancellor that he presided over the worst slowdown in home building the country

has ever seen. The Treasury so

ruthlessly throttled the flow of funds to councils and housing associations

that we now need 23,000 new homes year just to keep up with the demand for

low-rent accommodation and we aren’t getting them. In 2001, Labour presided over the lowest building rate for new

homes since 1945. The 2012 London

Olympics is supposed to revive a corner of East London with 40,000 new

homes. That target has now been cut to

9,000.

Higher interest rates means suffering for many families in

debt payments. But there could even be

worse, if it causes house prices to fall as in the US. Then there is a double whammy, higher

mortgage costs and falling house prices.

In the US, house prices have been falling for the first time

since the Great Depression. As a

result, many borrowers who either engaged in speculating on buy-to-let house

purchases or were just lower-paid first-time buyers have been increasingly

unable to pay and are selling up at prices below what they paid for. As a result, they are defaulting on their

mortgages.

US banks have been lending to these people without even

checking on whether they can pay their loans back because they expected rising

house prices to cover any problems. People borrowed by just ‘certifying’ themselves on their level of income

and this was not checked.

Loans or mortgages in this ‘sub-prime’ market were huge

during 2005 and 2006 in the US (25% of all mortgages). Now the default rate on these loans has

reached 14% and set tot rise to 20% – one in five of these borrowers are going

bust.

And even more serious crisis beginning to come out of the

bushes. The US financial sector has

been doing big business laying off these loans to others in batches of debt

called collateralised debt obligations (CDOs). CDOs were good business because they incorporate huge fees and they were

supposedly backed up by the rising value of property. But now all is turning sour and banks, hedge funds and other

mortgage lenders who bought CDOs are getting into trouble. The big investment bank Bear Sterns had to

announce the closure of its CDO hedge fund with billions lost. The stock market took a shudder on the news.

There is a real risk of a credit and financial crunch. That is the danger that is flashing amber

right now. The UK will not be immune

from a similar credit crisis. Sub-prime

home loans are 8% of the UK mortgage market, worth around £30bn. According to the Financial Services

Authority, most of the eleven big banks lending money in this market paid no

attention to whether the borrowers could pay them back. Over half the borrowers self-certified their

incomes!

The credit-led boom in world stock markets and property

prices is now in jeopardy as central banks raise interest rates

everywhere. Only this month, the

European Central Bank, the Bank of England raised their rate. Central banks in Switzerland, Canada,

Australia, New Zealand, India and China have also.

The pain is being felt in homes across the UK, the US, and

much of the world.

***HOUSING UPDATE***

Mr Brown told BBC Radio 4’s Today programme he would

look at ideas to make home ownership easier, such as

20-year fixed-rate mortgages and more shared-equity schemes.

He added: "We’ve got to make houses more affordable."

Mr Brown said there was a need to "make the system of

house-buying more flexible" for first-time buyers and

people moving home.

More properties had to be built, particularly on

"brownfield land", he said, adding: "This is a new and

urgent challenge that we’ve got to meet by the public

and private sectors working better together."

Mr Brown’s spokesman denied claims that much of the

countryside would be lost after Communities Minister

Hazel Blears said house building took "priority" over

environmental concerns.

She told the local government select committee she

could not give "categoric assurances" about redrawing

the green belt.

The Conservatives said this had "raised the prospect

of the government systematically concreting over"

protected land.

They also suggested she had given "the green light to

green belt destruction on a massive scale".

Shadow planning minister Jacqui Lait said: "We need to

build more homes. But the government should work with

local communities – and must respect the wishes of

local people who want to protect their green belt for

current and future generations."

But Mr Brown’s spokesman said the government could

"give assurances" that all land currently classed as

green belt would remain so under new plans to increase

housing.

He said the prime minister was "not proposing any

changes to the robust terms" of the current green belt

land provision.