Amidst all of the Brexit chaos and Tory disarray, the Office for Budget Responsibility has sent a shockwave through British political and business circles with its latest economic forecasts – and, in particular, its sobering analysis about the persistent problem of low productivity in the UK. Josh Holroyd looks at the interminable problems facing British capitalism and its Tory representatives.

Just when Theresa May and the Tories would have been hoping for some respite after a dismal conference period, the OBR (Office for Budget Responsibility) has sent a shockwave through British political and business circles. In its annual “Forecast Evaluation Report” (FER), published this month, the OBR downgraded the UK’s economic outlook, having revealed that both GDP and productivity growth had consistently fallen short of OBR predictions over the last two years.

This comes alongside the IMF’s latest “World Economic Outlook” report, which predicts that over the next five years the UK’s GDP will grow by less than that expected of Greece, in a forecast which the Financial Times described sardonically as “slightly more optimistic than the current consensus”. In such a bleak context, Treasury officials are now predicting a public services “bloodbath” when the beleaguered chancellor prepares his Budget next month

The productivity puzzle

At the heart of the OBR’s sobering analysis lies the persistent problem of low productivity in the UK. According to its report, productivity (the amount of wealth produced by each worker per hour) in the UK grew at an average of only 0.2% per year over the last five years and is still stuck below pre-crisis levels.

More worrying still, the latest figures show that productivity has fallen by 0.3% over the last year. This lost decade of UK productivity is not entirely unique; the USA and most of Europe are also experiencing their own productivity crises. What is unique is the sheer scale of the UK’s decline since 2007, which has been larger than any other member of the G7.

The culprit, as the OBR notes, is the “sustained weakness in investment” by UK businesses, i.e. the complete failure of British capitalists to invest in developing the real economy. According to the Financial Times, “UK infrastructure is rated second worst among G7 members.

Moreover, ‘the UK invests in total 1.7 per cent of GDP in private and public R&D’. This is well behind the average in the OECD, let alone the leaders, which spend over 3 per cent of GDP.” In addition to a lack of physical investment, the UK is currently facing a deep “skills crisis”, with many sectors, particularly construction but also others such as health, having to rely on skilled labour from abroad.

Yet, despite the appalling weakness of British capitalism, profits have ballooned! Indeed, the OBR notes that despite the rather gloomy picture painted in other areas, “Profits growth was stronger than in both our March 2015 and March 2016 forecasts.” Meanwhile, British workers have been repeatedly told that the British recovery is the “strongest in Europe” by a host of Tory politicians.

Making the working class pay

How can we solve this conundrum? The answer from big business is, for them anyway, all too simple: sweating every last drop of profit out of millions of overworked and underpaid workers. More people working longer shifts; more people choosing to (or being forced to) retire later; and exploited migrant labour, usually employed on low wages and poor conditions: all these have been used to plug the UK’s “productivity gap”. It is this policy which has been relentlessly pursued by British bosses, aided by the government’s homicidal austerity policies, over the last seven years.

How can we solve this conundrum? The answer from big business is, for them anyway, all too simple: sweating every last drop of profit out of millions of overworked and underpaid workers. More people working longer shifts; more people choosing to (or being forced to) retire later; and exploited migrant labour, usually employed on low wages and poor conditions: all these have been used to plug the UK’s “productivity gap”. It is this policy which has been relentlessly pursued by British bosses, aided by the government’s homicidal austerity policies, over the last seven years.

The effects of this policy can be seen in the OBR’s own statistics. Unemployment is at its lowest level since the 1970’s, at 4.3%, whilst wages have actually fallen: something many economists thought impossible.

This has given the UK the dubious honour of being the only “advanced” country in which wages have contracted whilst the economy was growing. Only Greece, which saw its GDP collapse after the 2009 Euro crisis, could match the size of the wage cut faced by British workers.

Facing a major squeeze on their incomes, UK households have had to take on huge debts and even turn to charities such as food banks, whilst British capitalists have pocketed their stolen wages. Marx’s idea, that profits ultimately come from the unpaid labour of the working class, has never been truer.

But sadly for Britain’s bosses, like all good things, this too must come to an end. With both unemployment and wages so low, there are fewer and fewer people left to force into underpaid, precarious employment. Eventually, this finite resource will run dry and, without any improvements in productivity, economic growth will come to a juddering halt.

Even consumer demand backed by borrowing, which had previously driven growth in the UK, is reaching its limit, with households’ savings at a record low and debts at an even higher level than in 2007, according to the bank of England.

Zombie capitalism

Another probable cause for the UK’s productivity crisis is the “abnormally low level of interest rates”, which according to the OBR “could also be weighing on productivity growth by allowing weak and highly indebted firms to survive for longer than they normally would, by alleviating the burden of servicing their debts”.

This touches on a fundamental contradiction, not just of British capitalism but of the world economy as a whole. It was precisely this policy, of setting ultra-low interest rates alongside enormous ‘quantitative easing’ (money printing) programmes, which was followed by central banks all over the world in order to incentivise investment and reignite the global recovery. Clearly, it has not been successful.

Instead of prompting an influx of productive investment from companies benefitting from cheap credit, the low cost of borrowing has simply allowed many so-called “zombie firms” to stagger on, neither growing or collapsing, neither alive or dead. Meanwhile, corporations and banks have taken advantage of this situation by pouring funds into the stock exchange and other speculative investments rather than the real economy.

This in turn creates another problem: an “addiction” to cheap credit which would provoke a sharp downturn if the money drip were to be pulled out too quickly. This explains the persistence of central bankers like Mark Carney in holding down interest rates, until now.

In reality, all that has been achieved in the period since the crisis is a postponement of a further crisis by means of cheap credit and a pitiless squeeze on workers. The underlying crisis of overproduction, caused by the inability of the market to absorb all that is produced, is if anything even greater now than in 2007/08. A rise in interest rates will only expose this fact all the more quickly as the increased cost of borrowing would only make a fresh debt crisis more likely.

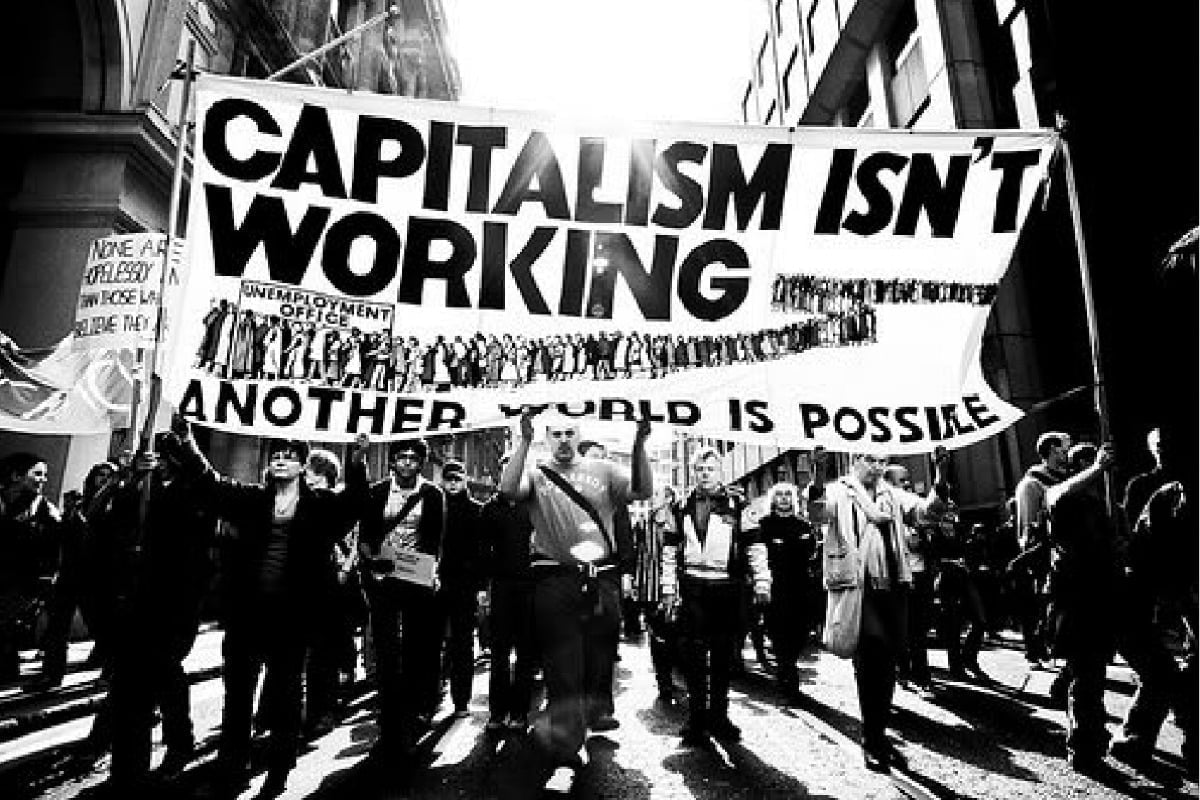

No solution under capitalism

Capitalism only offers one solution to this crisis: more attacks on the working class. Faced with the slower growth and restricted tax receipts expected in the UK’s low-wage, low-productivity economy, the government will either have to go after the bosses’ profits or make further cuts. It will choose the latter. Perhaps more importantly, it would not be allowed by capitalism to make any other choice, even if it wanted to.

Capitalism only offers one solution to this crisis: more attacks on the working class. Faced with the slower growth and restricted tax receipts expected in the UK’s low-wage, low-productivity economy, the government will either have to go after the bosses’ profits or make further cuts. It will choose the latter. Perhaps more importantly, it would not be allowed by capitalism to make any other choice, even if it wanted to.

Faced with growing political pressure, Hammond and the Tories may choose to raise public sector pay to a level above inflation (although not by much we suspect), but the money spent on this will undoubtedly then be recouped from elsewhere, such as through the ongoing inhuman assault on vulnerable benefit claimants.

Even then, the government will likely find itself under increasing pressure to restrict borrowing even further, as indicated by the decision of Moody’s to lower the UK’s credit rating due to concerns over the recent “easing of austerity”.

If it is to end the humanitarian crisis of austerity and overcome the deep contradictions in the British economy, a Corbyn-led Labour government (and one seems more and more likely) must not limit itself to a programme of taxation and borrowing. Any threat to the bosses’ profits would be resisted by any and all means, as shown by the ongoing crisis in Venezuela.

The incredible hoard of wealth which has been quite literally robbed from the workers since the crisis (and before) must not simply be taxed. It must be seized and the banks and monopolies nationalised to fund a vast campaign of investment and development throughout the economy under a socialist plan of production.Hundreds of years of British capitalism have brought us to this point; only the socialist transformation of society can take us in a new direction.