You

couldn’t make it up! About two years ago the banks in Britain, the USA and all over the world began to

go bust. It started over here with Northern Rock and culminated in the USA with the

collapse of the giant Lehman Brothers, the biggest corporate bankruptcy in

history. The problem for governments was that the banks were threatening to

take whole chunks of the capitalist system over the precipice with them. The

banking collapse and the ‘credit crunch’ were the triggers for a general crisis

of capitalism.

So

So

governments here and everywhere else hastened to bail out the banks. This was

seen as necessary because the capitalist system is based on the circulation of

commodities by means of money, and money circulates via the banks. In other

words governments intervened in order to prop up the capitalist system.

This

rescue cost enormous sums of money – our money. In the case of Britain, the

cost of keeping RBS and Lloyds TSB in business is reckoned to have cost about

£1.5trn added to the national debt. This is almost as much as our GDP – as much

as 60 million people in the country produce in one year! As a result of this

crippling burden of debt Britain

is running a deficit of more than 10% of GDP. This is the equivalent of spending

£110 for every £100 you earn. This cannot go on. The national debt has to be

serviced and ultimately paid for through out taxes or, like repaying any other

debt, by going without other things.

There

is a second reason for the crisis in state finances apart from the failure of

the banks. The fact is that the crisis is costing the government money. In a

boom, tax revenues roll in and relatively few people are claiming benefits.

It’s a different story as recession bites. Tax receipts collapse and welfare

payments balloon. A crisis of capitalism necessarily brings in its wake a

crisis in government finance. Then we get calls for austerity from the rich.

They demand cuts. They demand that the working class bears the burden of the

crisis.

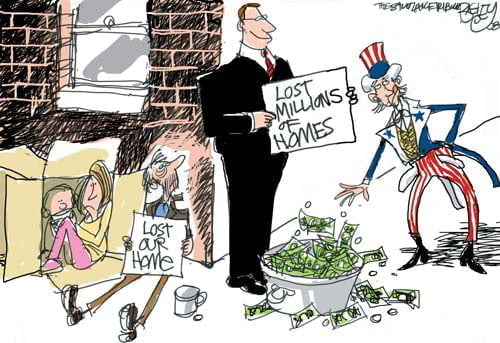

How are the bankers faring in the crisis? Having been given

the kiss of life with taxpayers’ money, are they humble and contrite? Not a bit

of it. Has the government used the opportunity to bring them to heel so they

don’t lead us on another crazy financial steeplechase? Not at all. As Adair

Turner, head of the regulatory Financial Services Authority, has pointed out,

the remaining banks are coining it. And they’re not so stupid as to lend these

windfall profits out to those who have fallen on hard times because of the banker-led

recession. On the contrary, they are ‘recapitalising’ their books as the easy

money rolls in. Those substantial profits are "a

legitimate matter of social interest, rather than a private matter [for the

banks]". This really presents a cast-iron case for the socialist

nationalisation of the banks that Socialist Appeal has been calling for.

The

The

government, and all the main opposition parties, are proposing instead that we

cut big chunks out of the welfare state to repay ‘our’ debts. The welfare state

is one of the most precious gains of the British working class. It offers an

element of security in a capitalist world riddled with uncertainties.

Is

it teachers and nurses who are responsible for the present crisis in state

finances? Is it the sick, the elderly and our children in need of education who

are to blame? Of course not. So why should the working class make all the

sacrifices to get capitalism out of a crisis of its own making?

Yet

that is what the capitalists are trying to insist upon. The cuts they demand

could mean a generation of austerity. They want us to pay twice for their

crisis, once through bailing out the banks and again through cuts in social

spending. The burden of repayment could actually serve to throttle off the

recovery, but paying back their money comes before the welfare of the poorest

and most vulnerable.

The

ruling class has means at its disposal to get its way. Governments usually

borrow money by issuing securities to rich people, to members of the capitalist

class. If the state needs a lot of money all at once, it will have to pay a

higher interest rate on these securities, and government debt will become still

more unmanageable. The financiers can refuse to play ball. The bosses can even

threaten a “strike of capital” if their privileges are seriously threatened.

It’s

a clear alternative. We can either continue to uphold the capitalist system

where profits are the only thing that counts and the working class pays for the

bosses’ crisis. Or we can fight for socialism, for a society where people come

first. To do that, we need to take over big business and not just the banks.