Even with the Tories’ election victory, British capitalism remains in a deep crisis – one that has been years in the making. Further austerity and attacks are on the cards. We must overthrow this decrepit system!

The turbulent political climate in Britain is an expression of the underlying instability of the economy, which, since the financial crisis in 2008, has been marked by an enduring period of stagnant growth. A trend that looks set to continue as we enter the new decade.

The threat of a no-deal Brexit has exacerbated this phenomenon, as the threat of a Corbyn government did also before the election result, providing uncertainty for the bosses, discouraging investment. However, these political developments were themselves a projection of the anger and desperation felt in working-class communities towards the deep cuts and the whip of austerity demanded by the crisis of capitalism.

The crisis in Britain reflects the broader trends of the world economy, which has been characterised by stagnation and the slowest recovery in history. But it is also plagued by particular conditions unique to Britain.

Britain’s economic decline

Once the workshop of the world, Britain has been in a state of decline for decades, with British imperialism losing its grasp over the empire, and its industries outcompeted by rival powers.

Once the workshop of the world, Britain has been in a state of decline for decades, with British imperialism losing its grasp over the empire, and its industries outcompeted by rival powers.

The British ruling class, famously far-sighted in the past, developed into an increasingly parasitic class. British capitalism became characterised by short-termism, pouring investment into the financial sector, into speculation and fictitious capital for rapid returns, whilst neglecting investment into the real economy.

British industry, as a result, has been in a process of decline over the last few decades, with industrial heartlands in the North and Midlands gutted and deprived of investment, abandoned and left to rot by the political establishment.

These trends have continued, and indeed accelerated, in the last decade as British industry continues to decline. Productivity in the UK has increased by just 0.3% since 2008, a historically low level of growth. In comparison, in the decade preceding the financial crisis, productivity was increasing at a rate of 2% every year. British manufacturing continues to decline: last December the IHS Markit/CIPS manufacturing Purchasing Managers’ Index fell to 47.5. This means that more companies reported contraction than growth.

As a result, the ruling class have looked to make profit not by improving productivity, but by squeezing as much value as possible from the working class for the lowest cost.

The crackdown on trade union rights, along with outsourcing and subcontracting jobs, and the introduction of temporary ‘zero hour’ contracts have worked to drive down wages and increase profits. As a result, Britain has seen the worst decade of real wage growth since the Napoleonic wars. Meanwhile, the wealth of the richest in society has skyrocketed.

However, it is the working class who are the main consumers of the products of capitalism. Driving down wages increases profits, but undermines the capacity of workers to consume.

This has resulted in a crisis on the high streets, with a number of major retailers (such as Toys R Us, Thomas Cook and Debenhams) going bust or being forced to cut back in the recent period. Last year marked the worst 12 months on record for UK retailers, with annual sales dipping for the first time since 1995.

Running out of ammunition

British – and world – capitalism is teetering on the edge of a major crisis, potentially greater than that of 2008. However, unlike in 2008, all the methods the ruling class has to deal with such a crisis have been used up.

Mark Carney, governor of the Bank of England, warns that central banks are running out of ammunition to fight a recession. Interest rates are at a historic low. In the event of another crisis, there is little room for these to be lowered further. Indeed, there are plans to further reduce interest rates in the coming months, before a recession has even begun, as the pound is falling.

In 2008, a deeper crisis was averted as the government was able to step in and bail out the banks, taking on colossal amounts of public debt in the process. Despite a decade of austerity, the Tories have failed to significantly reduce the national debt. In the case of another recession, therefore, further cuts would be required. This would make the horrors of the last ten years look like a cakewalk.

Mark Carney has suggested that fiscal policy is required to combat the crisis, either through tax cuts or increased public spending. Tax cuts may encourage more investment, but this is likely to be very limited. Britain already has the lowest corporation taxes of any developed country, so lowering them further is unlikely to be a significant draw. Furthermore, this would require further cuts to public spending to balance the budget.

Although Johnson’s government will have no issue going back on their election pledges, further cuts will hit the pockets of the working class and undermine their ability to consume, ratcheting up the pressure on already struggling retailers.

On the other hand, increases to public spending will require tax increases or borrowing – and the capitalists are unlikely to accept either. One way or another, therefore, it is the working class that will be presented with the bill.

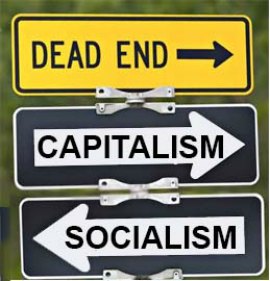

Dead-end

British capitalism, therefore, finds itself at a dead-end. Even with the Tory election victory the capitalists were begging for, the prospects for the ruling class are incredibly bleak. They are far from free from the disaster of Brexit, which could still see the UK crash out of the EU with no deal, if a trade deal is not reached by the end of the year. Meanwhile, they have exhausted all the tools available to fight the next recession.

British capitalism, therefore, finds itself at a dead-end. Even with the Tory election victory the capitalists were begging for, the prospects for the ruling class are incredibly bleak. They are far from free from the disaster of Brexit, which could still see the UK crash out of the EU with no deal, if a trade deal is not reached by the end of the year. Meanwhile, they have exhausted all the tools available to fight the next recession.

What we are witnessing is the death agony of the capitalist system. The only way forward is to overthrow this decrepit system and fight for the socialist transformation of society.