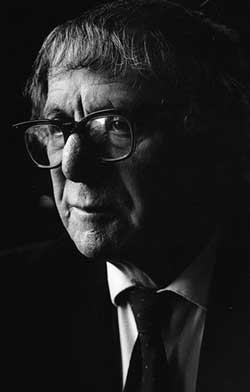

Today is the third anniversary of the death of Ted Grant who died on July 20th 2006 aged 93.

Ted Grant was born in South Africa in 1913. Travelling

to Britain in search of broader horizons, he stopped off in Paris to

talk with Leon Sedov, Trotsky’s son. With Ralph Lee he formed the

Workers’ International League (W.I.L.), which subsequently fused with

the R.S.L. to became the Revolutionary Communist Party (R.C.P.) in the

war years.After the war he defended Trotsky’s analysis of the

Soviet Union in that it was a deformed workers’ state – one in which

private property and capitalism had been abolished, yet where the

workers did not hold political power. He argued that the so-called

“communist” countries of Eastern Europe were in fact run on the same

lines as the Soviet Union, and he used the term Proletarian Bonapartism

to describe them.During the 1960s he extended the analysis to the

colonial countries that had become “communist”. He argued that the

intelligensia of these countries looked towards Stalinism as a way to

develop their economies and alleviate the desperate conditions; but

since the masses had not been roused on a socialist programme, the

bureaucratic nature of these regimes was inevitable. Ted Grant was most famously the political editor of Militant and was expelled from the Labour Party in 1983. Throughout the 1990s he continued to contribute to Socialist Appeal and In Defence of Marxism. He died in 2006, after being an active Marxist for over 75 years.In September of this year Wellred will publish the first volume of Ted Grant’s writings covering the 1930s and the first few years of the Second World War.

To mark this anniversary we are publishing an article from 1994 co-authored with Alan Woods.

The Relevance of Marxism Today (first published in 1994 as an introduction to Trotsky’s article ‘Marxism In Our Time)

On the threshold of the twenty-first century, humanity stands at the

On the threshold of the twenty-first century, humanity stands at the

crossroads. On the one hand, the achievements of science, technique and

industry point the way forward to a dazzling future of prosperity,

social well-being and unlimited cultural advance. On the other, the

very existence of the human race is threatened by the ravishing of the

planet in the name of profit; mass unemployment, which was confidently

asserted to be a thing of the past, has reappeared in all the advanced

countries of capitalism, not to speak of the nightmare of poverty,

ignorance, wars and epidemics which constantly afflict two thirds of

humanity in the so-called “Third World.”

The fall of the Berlin Wall and the collapse of the bureaucratic

Stalinist regimes of Russia and Eastern Europe provoked a wave of

euphoria in the West. The demise of Stalinism was heralded as the “end

of Socialism.” The final victory of the “free market” was trumpeted

from the pages of learned journals from Tokyo to New York. The

strategists of capital were exultant. Francis Fukuyama even went so far

as to proclaim the “end of history.” Henceforth, the class war would be

no more. Everything would be for the best in the best of all capitalist

worlds.

Ideological counter-offensive

In the last few years we have witnessed an unprecedented offensive

against the ideas of socialism on a world scale. The collapse of the

bureaucratically controlled planned economies of the East was held up

as the definitive proof of the failure of “communism,” and, of course,

the ideas of Marx.

This is not the place to deal in depth with the reasons for the

collapse of Stalinism. That will be done in a future work in this

series. The fall of Stalinism came as no surprise to the Marxists, who

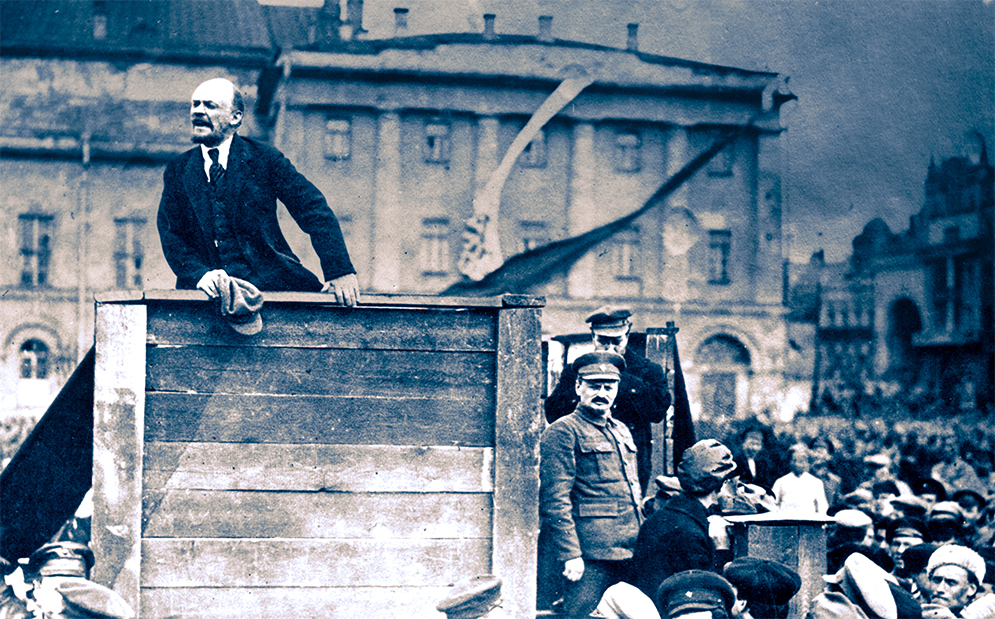

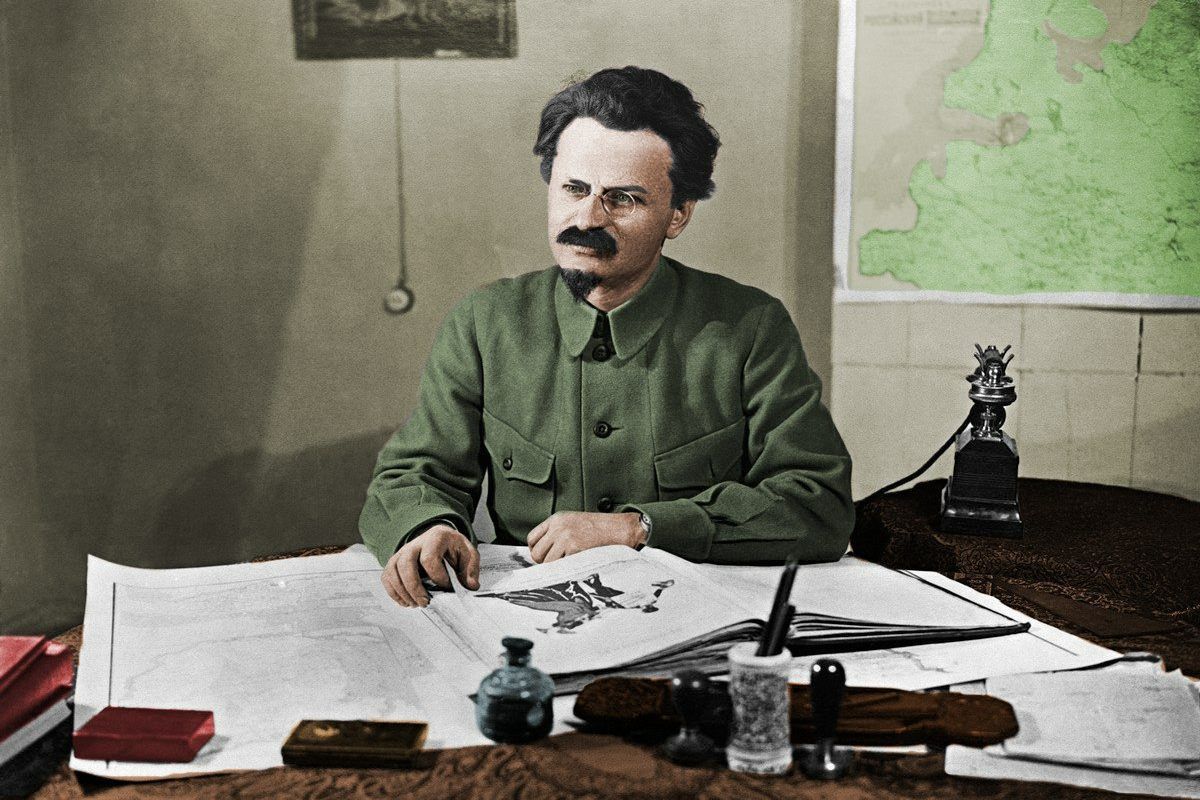

had predicted it in advance. Indeed, Leon Trotsky already analysed the

bureaucratic regime in the Soviet Union in the 1930s and, using the

Marxist method, explained the inevitability of its collapse.

In the first place, Stalinism and socialism (or communism), so far from

being identical, are mutually exclusive. The regimes in the USSR and

its Eastern European satellites in many ways were the opposite of

socialism. As Trotsky explained, a nationalised planned economy needs

democracy as the human body requires oxygen. Without the democratic

control and administration of the working class, a regime of

nationalisation and planning would inevitably seize up at a certain

point, especially in a modern, sophisticated and complex economy. This

fact is graphically reflected in the falling rate of growth of the

Soviet economy since the early 1970s, after the unprecedented successes

of the planned economy in the earlier period.

However, what the Western critics of Marxism do not want to publicise

is that the movement in the direction of a capitalist market economy in

the former Soviet Union and Eastern Europe, far from improving the

situation, has caused an unmitigated social and economic disaster.

It is true that the productive forces stagnated under Brezhnev. But

what is the position now? Every index points to a catastrophe of

unprecedented dimensions. If we take the last three years, there has

been a decline of industrial production in Russia of about 40-45%. This

is a staggering collapse—far worse than the slump of 1929-32 in the

West. Investment fell by 45% in 1992, and an additional 12% in 1993,

and continues to fall. Inflation topped 20% every month in mid-1993.

The rouble has collapsed and the rate of exchange is now 1,250 to the

dollar, and still falling.

This situation can only be compared to the effect of defeat in a

devastating war. The effects on the population, which has rapidly been

reduced to absolute misery, can best be shown in the sudden

deterioration of life expectancy.

Under the planned economy, the people of the Soviet Union enjoyed a

level of life expectancy, health care and education on a level with the

most developed capitalist countries, or in advance of them. What is the

position now?

The Financial Times of 14/2/94 carried a front page article with the

title “Russia faces population crisis as death rate soars.” The article

points out that: “In the past year alone, the death rate jumped 20 per

cent, or 360,000 deaths more than in 1992. Researches now believe that

the average age for male mortality in Russia has sunk to 59—far below

the average in the industrialised world and the lowest in Russia since

the early 1960s.”

These figures merely confirm what is self-evident: That the attempt to

impose a “market economy” on the peoples of the former Soviet Union has

been a finished recipe for destroying all the gains of the past seventy

years, driving down living standards and plunging society as a whole

into an abyss.

Of course, the apologists of capital assure us that all this will be

temporary, that “in the long run” the market will create the conditions

for prosperity. To which we can answer in the words of Keynes: “In the

long run, we’re all dead.”

A few years ago, the Western media confidently predicted that

capitalism was about to enjoy a new period of dazzling economic

success, on the basis of new markets in Russia and Eastern Europe.

These illusions have been rapidly shattered by reality. Under

capitalism a “market” is not a question of the size of population. If

that were so, then India and Africa would be huge markets. However, a

market depends upon purchasing power—something which is noticeable by

its absence in the ex-Stalinist countries. Far from providing new

markets for capitalism, these countries represent a colossally

destabilising factor, as most clearly shown by events in former

Yugoslavia and the former USSR itself.

World Capitalist Crisis

Trotsky’s Introduction to “The Living Thoughts of Karl Marx” represents

a classic restatement of the basic positions of Marxism. In all its

essentials, it has been brilliantly confirmed by the present evolution

of capitalism on a world scale. Nevertheless, for a whole period

following the Second World War, it appeared to many to have been

falsified by the march of events.

As Trotsky had predicted, the Second World War ended in a new

revolutionary upsurge. In the period 1943-7, the working class moved

time and again to transform society in Italy, France, Greece, Britain,

Denmark and Eastern Europe. The betrayal of the revolution by Stalinism

and Social Democracy provided the political basis for a recovery of the

equilibrium of capitalism. This was the prior condition for the

economic upswing which lasted from 1948 to 1974.

It must be emphasised that there is no such thing as a “final crisis of

capitalism”. Marxism understands history as a struggle of living

forces, not an abstract schema with a preordained result. If the

working class does not overthrow it, the capitalist system will always

find a way out.

The reasons for the post-war economic upswing have been explained by Marxists since the 1950s (see Ted Grant: “Will There be a Slump?”).

There were many different factors, such as post-war reconstruction, the

discovery of new industries during the war, and to some extent the

increased involvement of the state (“state capitalism”) through arms

expenditure, deficit financing and nationalisation, which, for a

temporary period partially mitigated the central contradiction of

private ownership of the means of production.

However, the main factor which acted as a motor-force driving the world

economy was the unprecedented expansion of world trade. Thus, the

Financial Times (16/12/93) pointed out that:

“Over the whole period between 1950 and 1991, the volume of total world

exports grew twelve times, while world output grew six times. More

startlingly still, the volume of world exports of manufactures rose

twenty three times, partly because this is where trade liberalisation

was concentrated, while output grew eight times.”

These figures clearly show how the rapid expansion of world trade in

the post-war period acted as a powerful motor-force which drove the

growth in output. This is the secret of the capitalist upswing from

1948-74. It means that, for a whole historical period, capitalism was

able partially to overcome its other fundamental problem—the

contradiction between the narrowness of the national market and the

tendency of the means of production to develop on a global scale.

Now, however, this tendency appears to have reached its limits. In

1992, world trade grew by 6,5%. While this is a lower rate than in the

period of the post-war upswing, it is nevertheless historically quite

high. (In the period between the Wars it was nearer 2.5%.) Despite

this, it did not stop Europe and Japan from sliding into recession. In

other words, the growth of world trade no longer has the same effect as

in the previous period.

During the period of capitalist upswing from 1948-74, we saw a

staggering increase in the productive forces, fuelled and stimulated by

an unprecedented expansion of world trade.

The capitalists, above all in Japan, the USA and Western Europe, were

prepared to invest colossal sums in expanding the productive forces in

pursuit of profit. The productivity of labour increased enormously as a

result of a constant revolutionising of the means of production. New

branches of industry were established—plastics, atomic energy,

computers, transistors, lasers, robots, etc.

From a Marxist point of view, this was an historically progressive

development, which creates the material basis for a socialist society.

The strengthening of the working class and the squeezing out of the

peasantry in Western Europe, Japan and the United States, also changed

the class balance of forces within society to the advantage of the

proletariat.

However, this period of capitalist expansion came to an end with the

recession of 1973-4. Already in that period we saw the re-emergence of

mass unemployment, not seen since the 1930s. The big movements of the

working class in Greece, Portugal, Spain, Italy and Britain showed that

the workers were beginning to draw revolutionary conclusions from their

experience.

This was temporarily cut across by the boom of 1982-90. However, this

boom was completely different to the economic upswing of 1948-74.

Originally sparked off by the Reagan rearmament programme, the boom of

the 1980s was of an unsound character. Whereas the parasitic service

sector underwent a big expansion, the capitalists continued to close

factories and lay off workers in all countries.

The boom was kept going by a massive expansion of credit, which, as

Marx explains, can temporarily take capitalism beyond its limits,

before bouncing back like an elastic band stretched almost to

breaking-point. A further element in the situation was a colossal

increase in the public deficit of the USA and other capitalist

countries which fuelled the boom for a while, but which could not be

sustained indefinitely.

Precisely these factors which served to prolong the boom of the 1980s

have now turned into their opposite. Part of the reason why the Western

world is finding it so hard to drag itself out of recession is because

they used up during the boom mechanisms which capitalism uses to get

out of a slump.

The uncontrolled expansion of credit has left the West with a painful

hangover in the form of huge consumer indebtedness. In Japan, for

example, for every 100 yen earned, 170 yen are owed. In the United

States, for every dollar earned, a dollar two cents are owed, and so on.

The bourgeois economists failed to predict this recession, which is the

longest and most severe since the Second World War. Of course, sooner

or later they will get out of it. However, it is proving to be

extremely difficult. With the exception of a very shaky recovery in

Britain and a rather more stronger one in the USA, the other economies

of Western Europe and Japan remain stubbornly depressed. The official

predictions of recovery are constantly postponed and revised downward.

The Economist (Dec.1993-Jan.1994) reports that: “The OECD now predicts

that average growth in its member countries will speed up (!) to 2.1%

in 1994 and 2.7% in 1995, after average growth of only 1.2% in each of

the past three years. Some countries will fare better than others. A

solid, if unspectacular, recovery is already underway in the United

States, Canada, Britain, Australia and New Zealand—the countries that

dipped into recession first. All five are tipped to grow by around 3%

or more in both 1994 and 1995.

“Continental Europe and Japan, however, remain obstinately in recession.”

Even a growth of 3% would be a miserable result. It would not mean a

substantial fall in unemployment. Hence, the Financial Times refers

glumly to “a joyless recovery.” But it is not even certain that they

will attain this level of growth. A year ago the OECD predicted that

Japan would grow by 2.3% in 1993, and 3.1% in 1994. Instead, Japan’s

GDP actually fell by 0.5% in 1993 and the forecast for 1994 is only

0.5%. Compare these figures to the normal Japanese growth rate of 4-5%

a year and we see the very profound nature of the crisis.

Even on the most optimistic estimates, unemployment in the OECD will

remain (officially) at 8.5% for the next two years. In Europe, the

average rate of unemployment will continue to rise to at least 11.5%.

In other words, a sluggish (“joyless”) boom will solve none of the

fundamental problems of the capitalist system. In fact, it will

exacerbate them.

Whereas in the period of upswing from 1948-74 we had long periods of

boom interrupted by shallow and short recessions, a very different

picture is now emerging: of relatively weak periods of boom,

characterised by low rates of investment, low growth and permanently

high unemployment, which are only the prelude to increasingly deep and

prolonged periods of slump. Such is the glittering prospect which

capitalism offers to humanity on the eve of the new millennium.

Mass Unemployment

One of the most malignant symptoms of the diseased state of capitalism

in its epoch of senile decay is the appearance of mass organic

unemployment.

During the period of capitalist upswing, mass unemployment was alleged

to be a thing of the past. Through Keynesian deficit financing and

“managed capitalism,” the capitalist cycle of “boom and bust” was

supposed to have been overcome. Marx had been shown to be fundamentally

wrong!

In point of fact, even in this period the capitalist cycle of boom and

slump continued to exist. However, under conditions of general upswing,

the small slumps or recessions which took place were generally short

and shallow, and were hardly noticed by the masses.

In the 1950s and 60s, the average unemployment in the advanced

capitalist economies of the OECD was about 2-3%. Most Western

governments defined this as “full employment.” Now this situation

appears as a dim and distant memory. Today, half the OECD countries

have a jobless rate of 10% or more. Since the early 1970s, unemployment

in the advanced capitalist world has more than doubled.

According to the official statistics, which deliberately falsify and

underestimate the true levels of unemployment, a record 35 million

people are out of work in the OECD. The real figure would be nearer 50

million or more, particularly if we add the “discouraged” workers who

have given up looking for a job.

Unemployment in the European Union (EU) has increased inexorably over

the past two decades from 2.4% in 1970, to 6% in 1980, to almost 12% at

present. (about 20 million people—roughly the population of Greece and

Portugal combined). In the USA, 6.5% are out of work and in Japan, too,

unemployment is rising for the first time in decades. In fact, many

economists consider that the true rate of unemployment in Japan is not

the official 2.5% but nearer 10%. Bear in mind that unemployment in

Japan has not exceeded 3% since the Second World War. Now all that is

about to change.

The main point is that this unemployment is qualitatively different to

anything we have seen since 1945. This is not “cyclical” unemployment

which rises and falls with the normal trade cycle of capitalism. It is

not even the “reserve army of unemployed” which, as Marx explains, is a

necessary feature of capitalism.

This is a permanent, organic, or as the bourgeois economists call it,

“structural” unemployment. The system is no longer able to absorb the

large numbers of workers who enter the labour market each year. On the

contrary, it cannot even keep in employment those who are already at

work.

Even in periods of booms, like the boom of 1982-90, the capitalists

behave like Luddites, destroying the means of production, closing down

factories and throwing large numbers of workers onto the streets. In

periods of slump, this situation gets worse. But even when the economy

finally picks up, it is unable to reabsorb them.

Unemployment is a cancer which gnaws at the bowels of society. The

atrocious waste represented by unemployment is shown by the fact that

we are currently losing (on official figures) the equivalent of 35

million man-years of production every year.

In addition to this, the money spent on unemployment benefit and social

security, insufficient as it is, serves to aggravate the problem of

budget deficits which plague all Western governments. Since they cannot

just let 35 million people and their dependants starve to death (not

out of any charitable feeling, but because of fear of the social and

political consequences), the capitalists are compelled to pay out huge

sums of money for people not to work.

In the words of the Communist Manifesto, the bourgeoisie is “unfit to

rule because it is incompetent to assure an existence to its slaves

within its slavery, because it cannot help letting him sink into such a

state, that it has to feed him, instead of being fed by him.”

Like some uncontrollable and terrifying epidemic, unemployment strikes

the young and old, men and women, black and white, educated and

uneducated, skilled and unskilled. Even the managerial strata,

professional people and white collar workers who never thought they

would be out of work—find themselves unceremoniously thrown on the

scrap heap in the prime of life. For many 40 year olds (and even

younger people) who lose their jobs now may never find work again.

As The Economist (7/7/93) put it: “Many who toiled long and hard to

climb a career ladder are, indeed, finding that the rungs are falling

away under their feet.”

The capitalists have no answer to the problem of unemployment. The old

Keynesian recipes have been shown to be bankrupt. The huge budget

deficits which exist in all capitalist countries (except Japan, for

special reasons) means that deficit financing and “pump priming” to

artificially boost demand through state expenditure is ruled out.

The dominant wing of the bourgeois have unceremoniously ditched the old

Keynesian nostrums (which were, let us recall, supposed to have

provided the definitive answer to Marxism).

“In the 1930s, when jobless rates soared above 20% in America and

Britain, a British economist, John Maynard Keynes, argued that the cure

for unemployment was to stimulate demand by increasing public spending

or cutting taxes. In the 1950s and 1960s Keynesian demand management

seemed to do the trick. Unemployment stayed low. But since the early

1970s, it has ratcheted up in each cycle. An increasing proportion of

unemployment is clearly structural.” (The Economist, 12/2/92).

The fact is that, even in the event of a shaky recovery which seems

likely in the next period, unemployment will not noticeably go down in

most countries. It will remain an ugly and chronic ulcer, sapping the

strength of society.

The Daily Express of February 11th 1994, in a article on the dire

position of Britain’s manufacturing sector pointed out that more than

360,000 jobs had been lost in the industry during the recession in the

three years to 1993, and that a further 47,000 were forecast to

disappear in 1994, precisely in a period of recovery of the British

economy. It goes on to predict that:

“Even though the industry is expanding, engineering companies will

continue to cut workforces as new technologies force out the

unskilled.” And this is no exception, but the rule, and not only in

Britain. In 1993, nearly half the unemployed in Europe had been out of

work for a year or more, with little or no prospect for improvement.

The situation in Japan, where until recently most workers thought that

their jobs were guaranteed for life, is no better. Although the overall

unemployment figures seem low by comparison with Europe, the underlying

trend is sharply up. The Economist (18/12/93) points out that the

number of full-time jobs in Japan increased over the year to October

1993 by a mere 0.1%. But since the workforce is growing by 0.5% a year,

unemployment continues to increase: “The number of people registered as

unemployed is up 20% on last year. Until September 1992, job vacancies

outnumbered jobs seekers: now there are 67 openings per 100 job

seekers,” and the article concludes pessimistically: “Unless the yen

falls along with Japan’s trade surplus, the present troubles may soon

seem mild.” In fact, the yen has risen, and Japan’s crisis has gone

from bad to worse.

Machinery and the Working Day

Those of us with long enough memories can remember the days when the

“experts” promised us a glorious vista of the future when, on the basis

of applied science and technology, the burden of work would be done

away with, hours reduced and the central problem of society would be

what to do with our leisure time.

How ironic these arguments sound today! While million of unemployed

languish in conditions of enforced “leisure,” other millions with the

good luck to remain at work find themselves subjected to

ever-increasing pressures to work longer hours with lower pay and worse

conditions. and to spend the maximum exertions of their nervous system

and muscle-power in the cause of greater “productivity” (read:

“profitability”).

Yet, in truth, all the earlier predictions concerning the possibility

for reducing the working day were correct. The potential for a

universal reduction in working hours—and thereby the abolition of

unemployment—is implicit in the spectacular advance of technology in

the past few decades.

Let us consider the implication of industrial robots. There are 500,000

of these machines in the world at the present time. Japan, with just

0.3% of the surface of the world, and 2.5% of its population, possesses

more than 300,000 of the total—double the number of five years ago.

In the USA, the number of robots has grown by 50% in the same period,

according to figures published by the McKinsey Global Institute. Italy,

France, Spain and other countries have likewise increased their number

of robots.

The introduction of these machines means that the number of workers in

a factory can be drastically reduced, while the productivity of those

who remain, vastly enhanced by machinery, registers a substantial

increase.

In France, for example, the two major car manufacturers have reduced

their workforce by no fewer than 200,000 over the past twelve years,

with an increased productivity of 12% in the same period. Similarly,

the Peugeot factory in Spain reduced its 12,000 workforce by half over

the last decade.

The same technology can be applied to many other fields—the

transformation of plastics, for example, or the textile industry. Even

in the food industry, such operations as the packaging of cheese is

done by robots, which can also be used to eliminate human participation

in dangerous occupations. Robots mean greater quality, more flexibility

in production, and speed.

The universal application of such technology in the context of a

rational and harmonious plan of production, with the democratic

involvement of the workers at all levels, would signify a complete

transformation of the life of society.

The working week could immediately be reduced to a four day, thirty

two-hour week without loss of pay, and at the same time production

could be rapidly increased both in quantity and quality. Thereafter,

the working day could be steadily reduced, thus providing the material

conditions for such a flourishing of democracy, art, science and

culture as the world has never seen.

This is precisely the material basis for socialism—a new and

qualitatively higher form of human society. These are not utopian

day-dreams, but conclusions which flow logically and inevitably from

the present state of knowledge and the actual demands of the productive

forces.

And yet, at every step reality knocks its head against the potential of

production and technique. Instead of a world of leisure and

self-fulfilment, we have a social nightmare of mass “structural”

unemployment on the one hand and relentless, inhuman squeezing of

labour power on the other. How to explain such a crying contradiction?

Marx’s “Capital”

In the first volume of Capital, Marx explains that the introduction of

In the first volume of Capital, Marx explains that the introduction of

machinery under capitalism necessarily means a lengthening of the

working day. The purpose of employing machinery is to cheapen the

product by economising on labour.

However, there is a contradiction implicit in this. The profits of the

capitalist are extracted from the unpaid labour of the working class.

The increase in the productivity of labour made possible by the

introduction of machinery is achieved by a heavy initial outlay on

costly machinery which, in themselves, add no new value to the end

product, but merely import to it, over a period, bit by bit, their own

value:

“Machinery, like every other component of constant capital, creates no

new value, but yields up its own value to the product that it serves to

beget.” (Vol. 1, p387)

The only way to ensure a greater return on this outlay, is to make his

machinery work non-stop, day and night, with no interruptions, while

simultaneously squeezing every atom of surplus value from the worker,

both by lengthening the working day through overtime, the abolition of

tea-breaks, etc. (“absolute surplus value”), and by enormously

increasing the intensity of labour by speed-ups, productivity deals and

all kinds of pressure (“relative surplus value”).

Thus, as Marx explains, “machinery, while augmenting the human material

that forms the principal object of capital’s exploiting power, at the

same time raises the degree of exploitation.” (Vol. 1, p395) And again:

“If machinery be the most powerful means for increasing the

productiveness of labour—i.e. for shortening the working-time required

in the production of a commodity, it becomes in the hands of capital

the most powerful means, in those countries first invaded by it, for

lengthening the working-day beyond all bounds set by human nature.”

(Vol. 1, p403)

Competition, the constant revolutionising of the productive forces and

techniques, the desire to “corner the market” and get an advantage over

others, were the factors which, in the past at least, compelled the

capitalist constantly to re-invest in expensive machinery.

However, once having introduced new machinery, it is in the

capitalist’s interest to use it to the maximum. It cannot be allowed to

stand idle for an instant, partly because it deteriorates, and partly

because it can quickly become obsolete. That is why, under capitalism,

the introduction of machinery leads to greater exploitation and an

increase in the working day.

The introduction of new technology to a given branch of production

means that in that branch, for a time, huge super-profits can be

earned. Later, however, the other capitalists catch up and the rate of

profit is levelled out.

Ultimately, the amount of surplus value obtained by the capitalist

depends upon two things: a) the rate of surplus value and b) the number

of workers employed. However, the introduction of machinery tends to

reduce the number of workers and therefore change the ratio of variable

to constant capital. Machinery (constant capital), as we have seen,

does not add any new value to the final product above and beyond what

is already present in it. “Hence, the application of machinery to the

production of surplus value,” Marx explains, “implies a contradiction

which is immanent in it.” (Vol. 1, p407)

The Tendency of the Rate of Profit to Fall

In the Grundrisse, Marx refers to the tendency of the rate of profit to

fall as “the most important law in modern political economy.”

Nevertheless, Marx never considered this as an absolute phenomenon. In

the third volume of Capital, he explains the tendencies which served to

counteract this law. For example, Marx points out that the

intensification of exploitation (“relative surplus value”) can restore

the rate of profit, and also the tendency to cheapen the price of

commodities, including machinery. We have seen precisely these factors

operating in the recent period, as the capitalist attempt to increase

their profit margins by squeezing every atom of surplus value from the

sweat and nervous strain of their workers.

In other words, what we are dealing with is only a tendency which

manifests itself over the whole history of capitalist development.

Nevertheless, there can be long periods—even decades—in which the

tendency of the rate of profit to fall is cancelled out by the

counteracting tendencies already mentioned.

In his book The Current Crisis written in 1987, Mark Glick publishes

the following figures for the long-term rate of profit in the United

States:

1899—22% 1939—7%

1914-18—18% 1945—23%

1921—12% 1948—17%

1929—17% 1965—18%

1932—2% 1983—10%

Thus, from an historical point of view, we see that, leaving aside

the inevitable cyclical fluctuations, the rate of profit now is lower

than it was a hundred years ago. However, for whole periods this

tendency has been reversed.

If we take the figures for the main capitalist countries during the

period of the post-war upswing, when colossal sums were spent on new

plant and machinery, the tendency of the rate of profit to fall is

clearly revealed:

Profit Margins in Manufacturing Industry as a Percentage of the Value of Production:

| 1951 | 1960 | 1979 | 1973 | 1975 | 1977 | ||

| Italy | 25.2 | 16.5 | 19.9 | 3.6 | 3.3 | ||

| West Germany | 34.4 | 29.3 | 20.6 | 13.6 | 11.0 | 11.8 | |

| Japan | 36.3 | 43.7 | 39.3 | 29.2 | 15.5 | 16.6 | |

| USA | 25.9 | 19.6 | 16.2 | 17.7 | 17.5 | 18.6 | |

| Britain | 30.8 | 27.4 | 16.1 | 17.7 | 4.7 | 9.6 |

The slight discrepancies between these figures and Glick’s are due

to the fact that the statistics are often evaluated differently.

However, the important thing is the trend, which is quite clear.

In the subsequent period, particularly the 1980s, this tendency was

sharply reversed, as the capitalists of all countries took steps to

restore the rate of profit. This was mainly done by drastically

increasing the rate of exploitation. Employers took advantage of the

huge “shakeout” of the early 1980s to squeeze extra surplus value from

the workers who remained in employment. This was particularly true in

Britain and the USA.

In general, the boom of 1982-90 represented the weakest investment

cycle since the Second World War. Only in Japan and Germany was there a

significant increase in capital investment. In the United States,

investment in productive industry remained weak in comparison to the

booms of the past. On the other hand, merciless pressure was exerted on

the American workers to keep wages down and boost profit margins.

By such means, the capitalists have succeeded in partially

restoring the rate of profit. But even so, the rate of profit is still

far less than it was in the “golden age” of the 1950s and early 1960s.

Nevertheless, the capitalists can accept, for a time, a reduced rate of

profit, provided the mass of profit is maintained.

Some people imagined that a new period of capitalist expansion

would be guaranteed by the opening of new fields of investment in the

“information revolution.” This illusion has been rapidly shattered. The

computer and software market has also rapidly reached saturation. In

two years, the cost of personal computers fell by half, and the price

of related products— spreadsheets, word processors, databases and the

rest, is being dragged down after it.

In point of fact, this new area of production is a classic case

which illustrates the correctness of Marx’s economic theories. The

costs of developing complex new products are huge. Microsoft’s Access

database alone cost about $60m. This can only be offset by a rapid

increase in market share and a huge volume of sales.

However, with the appearance of overproduction and falling prices,

profit margins have begun to fall. In the quarter to September 1993,

Borland’s net profit margin sank to 2.6% of sales, down 4.2% a year

earlier. The equivalent figures for Lotus were 7% and 14.6%. Even

Microsoft anticipates a fall in its net profit margin to around 15%

from falling sales of application software.

The capitalists can, for a time, tolerate the tendency of the rate

of profit to decline, on condition that the mass of profit is

maintained.

As we have pointed out, the Japanese capitalists for decades have

led the world in investment in new machinery and technology. The

long-term decline in the profitability of Japanese industry is a

well-documented fact.

Between late 1986 and early 1991, capital investment in Japan

accounted for two-thirds of GNP growth. According to investment experts

Smithers and Co, the current slump in business investment in Japan is

directly related to this phenomenon; the graph shows a continuing

decline of the rate of return on physical capital: “it takes more and

more investment to deliver a given increase in output. This fact has

its counterpart in Japan’s declining long-term growth rate.” Before the

“oil crisis” of 1974, the trend growth of real GNP was nearly 9%. Then

it declined to 4%. One of the factors in this was “that the return on

investment has declined sharply. Business investment became even less

profitable in the most recent capital-spending binge.” (The Economist,

29/5/93).

“Experience in Europe and America suggests that a

ratio of capital spending to GNP of about 12-15% is typical for a

mature economy. Japan’s ratio peaked at 22% in 1991. Since then

companies such as Toyota have announced steep reductions in investment.

But capital spending still accounted for 20.5% of GNP in 1992. Further

severe cuts seem inevitable, with consequences for both employment and

consumer confidence, Smithers and Co. expects capital spending to fall

by almost half before this adjustment is complete.” (Ibid)

All the big Japanese companies have seen their profits slashed. In

the six months to September 1992, Matsushita (the world’s biggest

electronic manufacturer) experienced a fall of 66% in pretax profits,

NEC, 71%, Mazda, 72%, Nippon Steel, 74%. The average drop in pretax

profits was 36%. Nissan saw its first ever loss since it was quoted on

the stock exchange in 1951—a total of $114 million.

The result? Factories mothballed, wages frozen, bonuses paid in

unsold goods and, for the first time in decades, Japanese workers

sacked. In other words, the much-vaunted “Japanese model” has finally

collapsed.

The aggressive exporting methods of Japanese companies are part of

an attempt to restore profitability by intensive participation on the

world market. On the other hand, together with massive investment in

the most modern machinery, the Japanese capitalists have developed new

techniques and working practices designed to squeeze the maximum

productivity from the workers. Thus, the Nissan plant in Sunderland

produces 80 cars per worker per year (the same as in Japan) compared to

an average of about 45 cars in the European car industry. However, both

the stepping up of pressure on the workers and the attempt to find a

way out of the crisis through exports come up against insuperable

barriers.

One of the ultimate causes of capitalist crisis is over-production.

The working class can never purchase the total product of its labour.

The capitalists cannot increase wages to the point where its surplus

value is eliminated, since the pursuit of surplus value is the

motor-force of the entire system. Other things being equal, if the real

wages of the working class increase, the capitalists’ profits will

fall, producing a collapse of investments, the life-blood of the system.

In the recent period we have seen a ferocious struggle to push down

real wages, while simultaneously forcing up the productivity of labour.

In the United States, for example, real wages have not risen in twenty

years. In British manufacturing industry, the workforce has been

reduced from six million to four million over the past decade, yet the

level of production remains the same. And this has been achieved

without the massive introduction of new machinery, which would have

been a progressive development.

However, the relentless squeezing of the workers to achieve higher

rates of profit is reaching its limits. There is a point beyond which

the workers’ physical ability to produce cannot go. The drive to go

beyond these limits will inevitably produce an explosion.

Even leaving this out of account, from a strictly economic point of

view, the continuing “shake-out” of workers from the factories creates

new contradictions. On the one hand, the rise in unemployment reduces

demand and thereby deepens the crisis. On the other hand, since surplus

value can only be produced by human labour, at a certain point the

expulsion of workers from the factories must lead eventually to a fall,

not only in the rate of profit, but in the mass of profit.

The attempt to find a solution by increased participation in world

markets also has a limit, insofar as the capitalists of all countries

are attempting to do the same thing.

Compared to these points, the trusts of Marx’s day were mere

child’s play. The The only solution is to attack the workers’ living

standards. We see this tendency in all countries at the present time.

However, this merely gives rise to new contradictions. To the extent

that they succeed in cutting wages, on the basis of the “need to be

competitive” in one country, the competitive advantage will be

cancelled out, all the capitalist countries will be back to square one,

but the masses of all nations will be worse off.

The attempt to solve the problem by increased participation on

world markets has led to an ever fiercer struggle between the USA,

Europe and Japan. Such is the sharpness of the conflict that, in any

other historical period, it would have already led to war. In the

modern epoch, for reasons explained by the Marxists in the past, a

world war between the main imperialist nations is virtually ruled out

(although “small” wars such as the Gulf War and the Yugoslav conflict

are inevitable). Instead, we have the threat of trade wars, and the

increasing division of the world into rival blocs, dominated by the

USA, Japan and Western Europe.

The ferocious struggle for competitive advantage, the desperate

attempt to boost profit margins, means that each national capitalist

class will seek to put extra pressure on its workers. Wages, hours,

conditions, social reforms, trade union rights—all the gains of the

past—are under attack. This is a recipe for class struggle.

Concentration of Capital

It is ironic that, precisely in this epoch, when the entire world

economy is dominated by huge multinationals, the apologists of capital

try to show that the future lies with small enterprises, or, to use

their favourite catch-phrase, “small is beautiful.”

This wishful thinking is like the day-dreams of a decrepit old

libertine who tries to forget his present ailments by recalling the

vigour of youth. However, the youthful phase of capitalism is gone

beyond recall.

Marx explains how free competition inevitably begets monopoly. In

the struggle between big and small capital, the result is always the

same: “It always ends in the ruin of many small capitalists, whose

capitals partly pass into the hands of their conquerors, partly

vanish.” (K. Marx, Capital, Vol. 1, p. 626)

Today, the vast power of the monopolies and multinationals

exercises a total stranglehold on the world. With the access to

staggering sums of money, their economies of scale, their ability to

manipulate commodity prices and even their power to determine the

policy of governments, they are the true masters of the planet.

The brilliance of Marx’s method is shown precisely from the fact

that he was able to predict the inevitable tendency towards

monopolisation when “free competition” was still the norm.

Nowadays, despite the demagogic twaddle of journals like The

Economist about “small is beautiful,” there can be no question of this

general historical tendency being reversed. Quite the contrary. The

last few decades have witnessed an unprecedented tendency towards the

concentration of capital.

The broad historical tendency towards the concentration of capital

is absolutely incontrovertible. If we take the percentage of total

assets held by companies in the United States, for example, we get the

following result:

| 100 biggest | 200 biggest | ||

| 1925 | 34.5 | —- | |

| 1939 | 41.4 | 58.7 | |

| 1954 | 41.9 | 50.4 | |

| 1968 | 48.4 | 60.4 |

At the present moment in time, no less than nine-tenths of the US

economy is in the hands of the top 500 companies, and 80% of that is in

the hands of the 100 biggest. A US Senate report of 1980 further

revealed that the controlling interests of the stocks of these

companies was in the hands of just two dozen big financial

institutions. In turn, these companies are controlled by each other.

For example, over a third of the shares of Citibank were held by just

twenty-four of its leading “competitors.”

The figures for Britain are no less illuminating. Let us take the

percentage share of the largest 100 firms in manufacturing:

| 1909 | 16% | |

| 1935 | 24% | |

| 1949 | 21% | |

| 1958 | 32% | |

| 1963 | 37% | |

| 1970 | 46% |

The situation as regards Germany is no different. In 1982, firms

with over 200 employees accounted for only 11.9%. By 1991 it was 45.1%.

Small may or may not be “beautiful,” but the plain fact is that

firms with over 500 employees overwhelmingly predominate in all major

capitalist economies as against small enterprises, accounting for 49%

of manufacturing in France, 66% in Britain, 60% in West Germany and a

staggering 71% in the USA.

The only exception is Japan, with 33%, but this is more apparent

than real, since the large number of small firms are heavily dependent

on the monopolies, and really represent auxiliaries of the industrial

giants. At the present time, Japanese small firms are going bust at the

rate of more that 1,000 each month. A similar position exists in Europe.

An editorial in The Economist (18/7/92) points out that “there were

3.6% million more small and middle-sized enterprises in the European

Union in 1989 at the start of the decade.

“Now the gap is back, and widening. Many small firms have collapsed

as economies stagnated and the share prices of the survivors have done

less well than those of the big companies. Banks have cut their

lending.” And this is the voice of the journal which used to wax

lyrical about the small and medium firms which were allegedly going to

represent the future of the “free market economy”!

Yet these figures do not tell the whole story. In the recent

period, especially during the boom of the 1980s, the tendency towards

the concentration of capital has been enormously accelerated, as the

big monopolies made huge fortunes out of take-over bids, often

accompanied by all kinds of fraud and corrupt practices—leverage bids,

junk bonds, asset stripping, insider dealing, and so on. This kind of

speculative fever, the urge to “make a fast buck” out of non-productive

activity, and not at all the creation of real wealth through

investment, is what characterises the present period of capitalism.

In Britain, where the capitalist class has operated in an entirely

parasitical way for years, the “merger-mania” revealed itself in a

particularly crude way throughout the “Thatcher decade,” coinciding

with the wholesale dismantling of manufacturing industry. Thus, in 1979

there were 534 takeovers, with a total value of £71.6 billion. By 1987,

that figure had risen to a staggering 1,125, with a total value of

£715.5 billion—ten times as many.

The same phenomenon can be seen on a global scale. In the first

nine months of 1990, the number of world-wide mergers and acquisitions

stood at 6,883. The following year, despite the recession, the

corresponding figure was still 6,151. The process of the concentration

of capital proceeds apace, despite all the propaganda about “free

enterprise.”

In Britain, fifty big companies control 90% of international trade.

On a different level, one third of world trade is in the hands of giant

multinationals with truly staggering sums of capital at their disposal.

The speculative movement of this capital around the world can make or

break governments. The power of the big monopolies was revealed by the

crisis of the European Monetary System (EMS), when the manipulation of

billions in the international money markets compelled the devaluation

of the pound, the lira, the peseta, and other currencies.

In the period of capitalist ascent, the bourgeois played a

progressive role in developing the productive forces, investing in

industry, science and technology. In the epoch of capitalist decline,

we see a very different picture emerging. Speculative activity and

investment in the parasitic service sector is displacing investment in

productive activity as a source of profit. When huge fortunes can be

made by a single telephone call by a currency speculator, why bother to

risk capital in costly machinery which may never make a profit?

Gambling on the stock exchange has reached epidemic proportions.

Nearly $200 billion a year goes to finance speculative takeovers in the

United States alone. While factories were being continuously closed, in

the period 1989-91 more than half of world-wide investment was

dedicated to services. While part of this was of a productive character

(transport and other parts of the productive infrastructure which is

incorrectly included under the heading of “services” by the bourgeois

analysts), the majority, from junk-food shops to banking and insurance,

was parasitic and non-productive.

Every day about $1,000 billion exchanges hands on the foreign

exchange markets. Yet only 5-7% of this represents real production and

exchange deals. The rest is made up of massive speculation in

international currencies, where fortunes are made in a matter of hours

without the need for any productive activity, whatsoever.

To understand the explosive growth is speculative activity, between

1980 and 1990, the volume of world-wide cross-border transactions in

equities increased at a compound rate of 28% a year, from $120 billion

to $1.4 trillion a year. Currency trading has grown by more than a

third since April 1989, when a central bank survey estimated net daily

turnover at $650 billion—and that was double the previous survey’s

estimate for 1986.

The vast sums of money handled by the big banks, and used mainly

for speculative purposes, is shown by the following figures. In 1980,

the level of international lending (including domestic deals in foreign

currency) was $324 billion. By 1991, despite the sharp cut-back in

lending to Third World countries, as a result of the debt crisis, that

figure had increased to a staggering $7.5 trillion.

To give an idea of the meaning of these figures, it is necessary to

remind ourselves that in 1980, the combined gross domestic product of

the 24 OECD countries (the entire developed capitalist world) was $7.6

trillion. In 1991 it was $17.1 trillion. So in one decade, the stock of

international bank lending rose from 4% of total OECD GDP to 44%.

These figures give a true picture of the power of the big banks and

monopolies on a world scale. At the last count, in 1990, there were

approximately 35,000 “transnational corporations” with 147,000 foreign

affiliates. However, in reality, a handful of giant monopolies

predominate. The parasitic and speculative character of these

monopolies explains why the boom of 1982-90 had an entirely different

character to the post-war upswing.

Benjamin Friedman of Harvard University points out that between 1980 and 1989:

“Corporations were borrowing not to invest but to

finance transactions— including mergers, acquisitions, stock

repurchases and leveraged buy-outs— that merely paid down their own or

other corporation’s equity. As a result, the corporate sector’s

aggregate net worth declined by more than one-fourth compared to the

size of the economy.”

Marx explains that the bourgeois in the end are dealing in “phantom

figures”—interest and speculative activities which would swallow up the

whole production of the world. The statistics show that the fever of

speculation vastly exceeds the actual level of production on a world

scale. Marx also warned that this process cannot be prolonged

indefinitely, but as we now see in Japan, inevitably leads to a

collapse of production, once the speculative bubble is burst.

The destiny of million of human beings is in the hands of these

monstrous monopolies, guided purely and simply by the predatory

instinct to make “easy money” by non-productive means. The collapse of

the EMS and the permanent instability of world finance markets are a

graphic illustration of this power, which is an additional factor for

instability, threatening at any time to engulf the world in a new

financial crisis, which, given the precarious and unsound state of

world capitalism, could end in a deep slump.

“To put it at its mildest, governments have no grounds

for complacency about the risk of another depression. Today’s financial

markets are more than capable of assembling the preconditions, and

economic policy may not be able to cope if the do…

“Global capital flows are one of the biggest reasons

to fear that a financial upset might cause a deep, worldwide

recession.” (The Economist, 19/9/92).

Overproduction and Slumps

The sickness of the system is shown by the phenomenon of excess

capacity which affects all the main capitalist economies. In Marx’s

day, the crisis of capitalism manifested itself in periodic crises of

over-production. Under modern conditions, the big monopolies have the

necessary technology to calculate in advance the available market for

their products. Therefore, they have tended to reduce production before

getting to the point of actual over-production.

The fact that the capitalists are not capable of fully utilising

the productive capacity even in a boom is a graphic illustration of the

Marxist assertion that the productive forces have grown beyond the

narrow limits of private ownership and the nation state.

However, the situation at the present time is even worse. Instead

of excess capacity we see the re-appearance of actual over-production

in a number of areas, not only agriculture, where the “food mountains”

appear as an obscene insult to the starving millions in the Third

World, but cars, computers and many other commodities.

In the Communist Manifesto, written in 1847, Marx and Engels accurately described the kind of crisis which we now see:

“In these crises a great part not only of the

existing products, but also of the previously created productive

forces, are periodically destroyed. In these crises there breaks out an

epidemic that, in all earlier epochs, would have seemed an

absurdity—the epidemic of over-production. Society suddenly finds

itself put back into a state of momentary barbarism: it appears as if a

famine, a universal war of devastation had cut off the supply of every

means of subsistence: industry and commerce seem to be destroyed and

why? Because there is too much civilisation, too much means of

subsistence, too much industry, too much commerce. The productive

forces at the disposal of society no longer tend to further the

development of the conditions of bourgeois property; on the contrary,

they have become too powerful for these conditions, by which they are

fettered, and so soon as they overcome these fetters, they bring

disorder into the whole of bourgeois society, endanger the existence of

bourgeois property. The conditions of bourgeois society are too narrow

to comprise the wealth created by them. And how does the bourgeoisie

get over these crises? On the one hand by enforced destruction of a

mass of productive forces; on the other, by the conquest of new

markets, and by the more thorough exploitation of the old ones. That is

to say, by paving the way for more extensive and more destructive

crises, and by diminishing the means whereby crises are prevented.”

(Marx and Engels, Selected Works, Vol.1, pp.113-4).

These lines are as fresh and relevant today as when they were written, over 140 years ago.

Just take the state of the car industry, where hundreds of

thousands of workers have been thrown on the scrap heap because the

market is saturated. The Japanese car makers had obtained a big

advantage over their foreign rivals partly on the basis of investing in

modern technology, partly by a more ruthless and “scientific” squeezing

of relative surplus value from their workers.

The Japanese monopolies, with their strong emphasis on modern

machinery, were prepared to put up with a relatively low rate of return

on investment, made up by a greater volume of sales through exports.

However, most families in Japan, the USA and Western Europe now

possess at least one television, a car, a video, hi-fi equipment, etc.

The tendency to expand the market artificially through credit has

reached its limits, leading to a general crisis of debt.

In this situation, there has been a fall, not of the rate, but of

the mass of profit. In the past, every Japanese car made 83,000 yen in

profit. The figure is now about 15,000 yen. Moreover, Japanese car

manufacturers had developed a productive capacity based upon the

assumption of a 10-15% market growth every year. In fact, market growth

has been at most 2-3% in the recent past.

Western Europe’s car market declined by 16% in volume terms in

1993, giving rise to a vicious price war between car companies trying

to dump their surplus products. Only the biggest and most powerful

companies can survive in such a situation, and not all of them.

The Economist (5/2/94) explained the seriousness of the position:

“The underlying proof of the European car industry’s

problems is surplus manufacturing capacity of about 2 million cars a

year. If all Europe’s plants were manned and equipped to run at full

stretch, the overcapacity could be 3.5 million cars a year.”

Living Standards

For a period of almost four decades after the Second World War the

capitalist system experienced a new lease of life for reasons outlined

above. This was reflected in increasing living standards for a large

part of the population in the advanced capitalist countries.

In the Introduction to the Living Thoughts of Karl Marx, Trotsky

deals with the so-called “theory of increasing misery,” which the

bourgeois critics of Marx have utilised to try to discredit Marxism,

pointing triumphantly to the increased living standards of the workers

of the West in comparison to the past.

However, Marx never denied that, under certain conditions, wages

could rise. Such an assertion would be utterly childish. On the

contrary, he went to some lengths to explain how wages inevitably rise

in certain periods of capitalist development, and fall in others. But

even in the most prosperous periods of capitalism, the relative

improvement of living standards can never abolish surplus value, and

can never change the social position of the worker:

“But just as little as better clothing, food and

treatment, and a larger peculium (a slave’s allowance—EG and AW), do

away with the exploitation of the slave, so little do they set aside

that of the wage-worker. A rise in the price of labour, as a

consequence of accumulation of capital, only means, in fact, that the

length and weight of the golden chain the wage-worker has already

forged for himself, allow of a relaxation of the tension of it.” (K.

Marx, Capital, Vol. 1, p. 618)

When the capitalists are making super-profits from the labour of

the working class, when demand is rising and order-books are full, and

when the workers feel strong enough to com