If you’re a fan of the writer

If you’re a fan of the writer

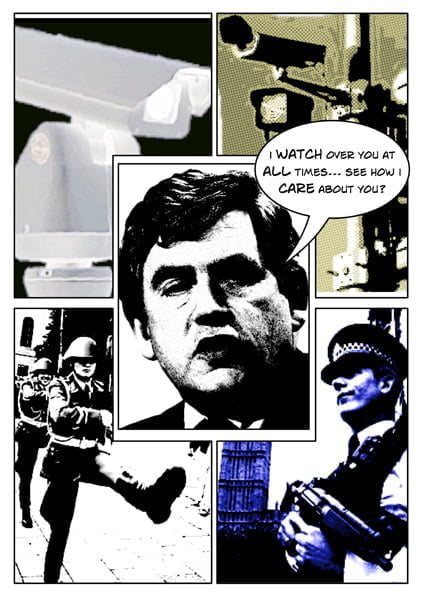

George Orwell then you may find Gordon Brown’s recent proposals to install lie

detectors into phone lines at benefit offices frighteningly reminiscent of the

novel ‘1984’, which was about a draconian totalitarian state that constantly

monitored its citizens, and brain washed them into submission. Well, it seems

that Orwell was only 24 years out.

The government is proposing

that so-called "voice-risk analysis software" be used by council staff to help identify suspect claims. It can detect minute changes in a caller’s voice, which give clues as to when they may be lying.

Now, given that the cost of

living has risen faster in Britain than in any other major economy in the world; that families are now having to pay an extra £1,300 a year in household bills;

that the recent government bailout package is set to cost UK taxpayers £2000 each; yet unemployment benefit only offers £2,900 per year, some may consider benefit fraud a

justified way of reclaiming some of their losses.

But that aside, if it’s fraud the

government wants to tackle, then it’s picking on the wrong people. According to government figures, benefit fraud cost the British economy about £0.7bn in 2005/06. That’s not a small sum. It’s enough money to pay 26,000 NHS nurses for a year. But when it comes to swindling, “dole cheats” aren’t the biggest drain on the UK economy. Not by a long shot.

Corporate Fraud

Corporate fraud is costing Britain a whopping £72bn a year according to a report by the Association of Certified Fraud Examiners. Despite the warning of recent corporate scandals involving Enron, WorldCom, Parmalat and Refco, UK companies are still estimated to be losing at least 6% of their annual revenue to fraud and corruption.

In 1990, the former Chairman of Guinness, Ernest Saunders, and two other

men were jailed for their part in the share-support scandal during Guinness’s

£2.6bn takeover bid. Last year, Michael Bright, former chief executive of Independent

Insurance, along with two of his deputies, was convicted of conspiracy to

defraud after bringing one of Britain’s largest insurance companies to its

knees with debt. Earlier this year three British

businessmen, known as the NatWest Three, were sentenced to 37 months of

imprisonment for seven counts of fraud against their former employer National

Westminster Bank.

And in the last few months, employees, stockholders

and pension plans around the world have seen $billions in stock value evaporate

after business scandals and corporate malfeasance rocked Wall Street. The most

notable scandal so far is that of Bernard Madoff, one of Wall Street’s most respected

financiers, who saw his huge pyramid scheme collapse with losses of at least

$50bn! Madoff was taking investors’ money and using it to pay other investors,

claiming fraudulently that it was the return on their investments. When several

big clients asked for their money back they found that the cupboard was empty.

"It’s all just one big lie,” Madoff later confessed as he gave details of

one of the worlds biggest ever frauds.

So how does a crisis of private business affect the

public? Well, obviously it often results in severe job and pension losses as

businesses collapse. The Independent Insurance fraud led to 1000 job losses, costing the

Financial Services Authority £357 million in compensation. Also, private

businesses are often loaded with public money. Madoff’s $50bn swindle will

affect various British banks for a start, including Royal Bank of Scotland,

which is now 58% owned by the British taxpayers. And it doesn’t end there.

Corporate Dole

The biggest “welfare

leeches” by far are not the unemployed, but corporations. British businesses

receive £billions of public money from the Department for Trade and Industry.

The DTI is basically a corporate dole office. One of its many grants – Regional

Selective Assistance – pays companies millions to “safeguard jobs”. Nearly 1 in

8 companies receiving this grant are paid more than once, which according to

the National Audit Office contradicts the aim of “helping firms become

self-sustaining”. It sounds like welfare dependency. The US spends $175bn per

year on corporate welfare.

Corporate dole is also

used to bail out business failures. In Britain £46bn worth of public money was

used to clean up after the unsuccessful British nuclear industry. In the US,

$15bn was given to airline companies, and, the Savings and Loans scandal in

1990s cost the US taxpayers $125bn.

Tax Dogers

The biggest aspect of

corporate fraud is tax avoidance. The average level of corporation tax in the world’s 30

richest countries has plunged from 37.5% to 30.8% in the last decade, according

to a survey by accountants KPMG.

Rupert Murdoch’s main British holding firm, Newscorp

Investments, paid no net corporation tax in the UK throughout the Nineties, and

it is highly likely that it still does not. Microsoft paid no tax at all in 1999, but reported

$12bn in profits. Similar stories with General Electric, and WorldCom.

A leading UK accountancy expert, Professor Prem Sikka,

stated that ‘the precise figure is impossible to work out. Some say it could be

as much as £80bn. We don’t know because the Treasury refuses to undertake

detailed research to get accurate estimates. It is dodging the issue.’ Why?

Possibly the most serious tax avoidance technique is

transfer pricing, a murky area where purchases and sales take place within the

same company. Items are sold from high-tax environments to low ones, so the tax

burden is dramatically reduced. A recent study estimated that the US Treasury

lost $175bn of tax revenues in this way between 1998 and 2001. It is unknown

how much the UK Treasury has lost.

Labour MP Austin Mitchell said: ‘Around 60% of world

trade takes place within multinationals, giving them enormous scope for fixing

the prices of intra-company transfers. Armies of accountants are available to

legitimise any phantasmagorical figure they can think of. Indeed, the big

accountancy firms devise the schemes, audit them, then say the accounts are

true and fair.’

So, what is the government doing about it? Well not

much. In fact, the man responsible for introducing lie detectors for the poor,

Gordon Brown, used to be nicknamed the ‘tax dodger’s chancellor’. Of the 70

offshore tax havens in the world, 30 are British. This is a crime against the

poor and all those who pay their taxes.

Paradox of Leniency

Where the criminal law is used it is often the most marginal who

get the harshest treatment. Large-scale tax offences get little police

attention but the police are likely to arrest social security offenders over

very small sums.

Figures published by the House of Commons Committee of

Public Accounts show that the UK’s Department for Work and Pensions (DWP) are

prosecuting 60 benefit fraud cases per thousand, while Her Majesty’s Revenue

and Customs (HMRC) prosecute a tiny two cases per thousand tax fraud cases. There are over 3,000 benefit fraud investigators in the DWP, which carry out over 2,000 investigations every week, compared with only 520 officers

working on corporate fraud.

Bankrupt small builders or lump labourers are the favourite

targets for tax convictions. The multi millionaire Lord Vestey avoided paying

millions in taxation and yet two building labourers were sent to prison for

swindling the taxman out of £3,000[i].

Earlier this year, a lady from New Addington falsely

claimed £21,401 in benefits by failing to disclose she was employed. She was

jailed for eight months. Also, a man from Wandsworth made a bogus claim for £11,416

to cover rent payments. He was jailed for 10 months. Yet, Time Warner just

settled its civil fraud charges, stemming from its accounting of online

advertising revenues, by agreeing to pay securities regulators $300m in fines.

The differential in policy against poor claimants compared to rich

tax offenders is clearly shown in this Report of the Committee on Abuse of

Social Security Benefits, which states that in the case of social benefit fraud: ‘The Departments… accept that in principle criminal

prosecutions should take place in cases of abuse by wrongful claims whenever

the evidence is reasonably adequate to secure a conviction, and that

extenuating circumstances are a matter for the court rather than the

prosecutor.’ By contrast, on the subject of corporate fraud

‘Inland revenue policy …should be that

the criminal law is invoked as a last resort for heinous cases’.

Another paper called

‘Sentencing Frauds–A Review’ commissioned in 2006 by the UK Government, documents ‘the paradox of leniency and

severity’ in the sentencing of white-collar crimes. ‘Judges may sometimes see

white-collar defendants as being more affected by social degradation’, or what

they call a ‘fall from grace’ of the offender, than of poor defendants. ‘High

level fraud cases with ‘respectables’ in the dock usually end with a

‘conditional’ prison term (or on parole) and a community service order’. ‘80 to 90% of the

sentences end in fines when it comes to the regular white-collar offences’. ‘Lower class fraudsters go to prison’.

Dr. Michael Levi,

Professor of Criminology at Cardiff University, is also stated in the document:

‘If the loss of employment is regarded as

punishment enough for high status fraudsters, what we are effectively arguing

is that because the unemployed are already unfortunate (or ‘workshy’), it is

all right to send them to prison, but not to imprison those whose incomes and

social positions should have enabled them to resist the temptation to steal in

the first place’.

And, when corporate fraudsters are sent to prison,

And, when corporate fraudsters are sent to prison,

they often return home to lavish lifestyles. In the case of Independent Insurance,

Michael Bright safely handed his properties to his wife, and he now lives off a

£3m pension, whilst many of the ex-employees have yet to be paid. And, the former Chairman of Guinness, Mr Saunders, was released from open

prison after serving only 10 months of his 5-year sentence, and has since

carved out a lucrative consultancy career while at the same time negotiating

his £75,000 annual pension from Guinness!

One of the arguments the government puts forward for

not prosecuting more corporate fraud is the cost involved.

Dr. Michael Levi continues that ‘Given

that people are still given immediate custodial sentences for stealing small

amounts from shops, it is patently inequitable that serious corporate

fraudsters should be immune from imprisonment simply because placing them on

trial is much more expensive.’

The accountancy firm KPMG warned that UK corporate

fraud might hit a record high this year as their so-called Forensic Fraud

Barometer revealed the highest value since 1995. Yet, last year, the UK Serious Fraud

Office only managed to investigate £2bn of the estimated £72bn lost to

corporate fraud. Most corporate fraud remains undetected. So why

is the government not going to greater effort in catching corporate fraudsters

given the enormous cost to the British public?

Conclusions

The conclusions one might draw from this article are bleak. The £72bn thought to be lost

each year to corporate fraud in the UK alone is enough to end world homelessness, world starvation

and world illiteracy, yet, the government seems to be putting more effort

into persecuting the poor. Why?

John Christensen, a former economic

adviser to Jersey recently commented on the subject of fighting corporate

fraud: ‘Look at those funding political parties and the [business] advisers

packing into Whitehall and Washington. They are setting the agenda. No wonder

there is little conviction in fighting this.’ A hundred years of

so-called reforms have achieved precious little. We continue to live in a world

ridden with poverty, inequality, war, and exploitation. Government policy

continues to service the interests of big business, not the general public.

It’s no surprise then that public opinion is changing.

“The public no longer believes that the legal system in England & Wales is

capable of bringing the perpetrators of serious frauds expeditiously and

effectively to book. The overwhelming weight of the evidence laid before us

suggests that the public is right”. These are the opening words of the Roskill Fraud Trials Committee

Report, London. 50% of the British public (compared with 35% in 1969)

believes that the courts favour the rich and influential.

The British government takes 40% of our

GDP through tax, yet it fails to deliver decent services. They promise

prosperity, yet they tax and de-regulate our economy into crises. Some estimate

the current crises will lead to the loss of 20 million jobs worldwide, and cost taxpayers $1trillions. Governments talk about social justice, yet they

consign millions to welfare dependency. The plan to install lie detectors into

benefit offices is yet another violation of human rights in the name of profit,

which exposes the true class nature of the state. If this is the best

capitalism can offer us in the 21st century, then shouldn’t we

change it for something better?

Footnotes

(1) – BBC

NEWS | UK | Benefit staff to use lie detector

(2) – Families hit

with £1,300 rise in cost of living – Telegraph

(3) – Revealed/ desperate final hours of the world’s biggest ever

financial fraud | Business | The Guardian

The Department for Work and Pensions (DWP)

Securities & Investment Institute (SII)

(Audrey Farrell, Class

and Corruption, UK 1993)

9 www.thisiscroydontoday.co.uk

10 www.yourlocalguardian.co.uk

Back-to-work rules target parents and

sick

By Nicholas Timmins, Public Policy Editor (FT) Published: December 4

2008 03:05 | Last updated: December 4 2008 03:05

By Nicholas Timmins and Alex Barker (FT)Published: December 2 2008 22:38

| Last updated: December 2 2008 22:38

4 Wheeler, S., Mann, K. and Sarat,

A. (1988) Sitting in Judgment. New Haven:

Yale University Press.

Guardian, 17

May 1974; Sunday Times, 16 January 1983