At a White House dinner on 24 February, Joe Biden held up a microchip and recalled a popular saying: “Remember that old proverb: for want of a nail, the shoe was lost; for want of a shoe the horse was lost.” And – as the proverb goes – without the horse, the messenger was lost; without his message, the battle was lost; and so on until, eventually, the empire itself was lost. For the empire which is the United States, that nail – according to Biden – is the microchip.

As the pandemic drove a boom for personal computers, electronic devices, and video game consoles, demand for microchips rocketed. Now the world is in the midst of a shortage. This has had a knock-on effect on the American automotive industry where, for want of the humble microchip, 1.3 million fewer vehicles might be manufactured in the USA this year.

Suddenly the American ruling class has been thrown into panic as they realise just how much they depend on these little wafers of silicon, comprising billions of transistors. This isn’t just a question of consumer goods but one of national security. “If a potential adversary bests the United States in semiconductors over the long term or suddenly cuts off US access to cutting-edge chips entirely, it could gain the upper hand in every domain of warfare,” warned a National Security Commission on Artificial Intelligence.

But if the microchip bottleneck is an accident, it’s not alone. It is just one of a whole host of accidents that have recently highlighted a growing trend towards the unwinding of ‘globalisation’. Everywhere there is a trend in the opposite direction: towards ‘national self-sufficiency’, ‘reshoring’, and isolationism as capitalist governments try to shield themselves from the crisis at the expense of their neighbours, cornering strategic supplies, snapping up markets and shutting others out.

In the past year, COVID-19 brought all this to the fore, beginning with an international scramble for PPE and medical supplies. Supermarket shelves were left bare and supply chains were thrown into chaos. Companies with bare inventories that depended on ‘just-in-time’ production were left completely unprepared for the shock. In response to the crisis, 140 special trade restrictions were surreptitiously introduced by governments everywhere.

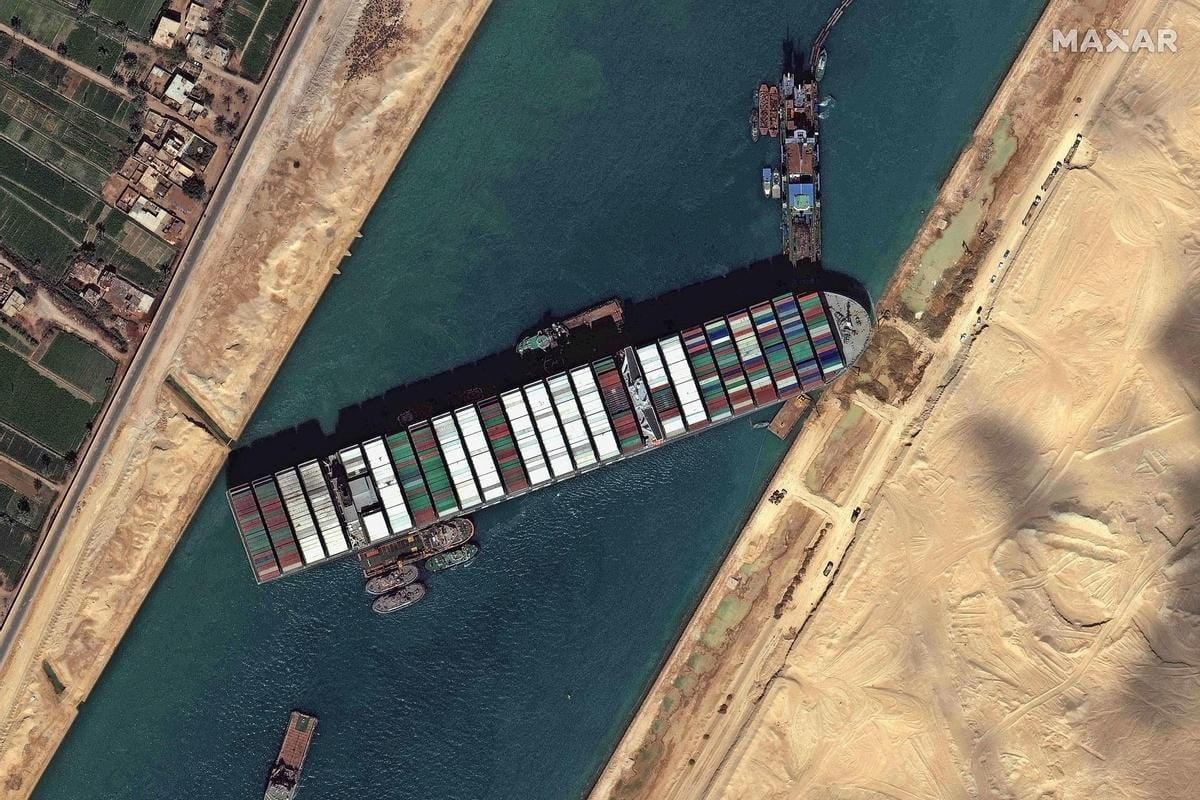

2021 has been kicked off with the disgusting spectacle of vaccine nationalism and export controls on doses and key vaccine ingredients. Meanwhile, when the Ever Given vessel managed to lodge itself in a key trade artery, the Economist aptly described the ship as a “200,000-tonne metaphor” for the vulnerability of supply chains.

Even before COVID-19, the world was already heading in this direction. For four years, Donald Trump had been pushing a policy of ‘America First’ – promising to re-shore jobs and protect American industry. The average tariff applied to imports to the US rose from 1.7% in 2016 to 13.8% by 2019. Trump’s policy was, of course, an attempt to demagogically capture much of the anger of working and middle-class Americans at a loss of decent jobs and sliding living standards. But the policies of the EU, China and others evidenced the same trend. The new crisis has given renewed impetus to the trend towards the unravelling of globalisation.

The rise of globalisation

What has caused this retreat from globalisation? From the 1950s to the early 2000s, the integration of the world economy seemed to have unstoppable momentum. Globalisation – the expansion of world trade and supply chains – was necessary for the post-war upswing and the recovery after the crash of the 1970s. Capitalism is hemmed in on all sides by the twin barriers of private property and the nation-state. Globalisation allowed capitalism to temporarily overcome the limits of the nation-state. Now it is returning with a vengeance. Today, on the contrary, barriers to trade are going up left, right and centre, while capitalism is only able to keep going thanks to the life support of state aid.

The difference between the period of ‘globalisation’ and the current period, starting with the crisis of 2008, is that during the former the world enjoyed a strong, sustained boom. As long as markets were expanding, the intensity of national competition eased off. At any rate, US imperialism had no serious rivals. Barriers to international trade were torn down at their behest.

At the same time, ‘just-in-time’ manufacturing methods – pioneered in Japan in the post-war period – were extended across longer and longer global supply chains. These methods favoured efficiency and slimmed-down inventories so that every cent of efficiency savings could be pocketed. The combined success of these methods for a time helped to further propel the boom. For example, the IMF estimates that as much as 60 per cent of the fall in the price of machinery relative to consumer goods, can be attributed to free trade.

The collapse of the Soviet Union and the opening up of China created new markets and new fields for exploitation too. The entry of China onto the world market in particular, and the mass migration of workers from the countryside to new Special Economic Zones, provided Western multinationals with an abundant source of cheap labour. Whilst the Chinese state was carefully cultivating the growth of a powerful capitalist class, at the time China remained largely a source of cheap, mass-produced, low-tech goods. It was in no position to seriously compete with the USA, Europe or Japan in high-tech goods. Capital flowed into China. But it brought with it the technology that would eventually – combined with the nurturing that domestic Chinese capital received from the still-powerful state sector – create a powerful rival to the main imperialist powers.

The decline of globalisation

The factors which drove globalisation are now dragging it down. On the one hand, the crisis of capitalism – driven by overproduction flowing from the success of these methods – has intensified competition for markets the world over. On the other hand, the decline of US imperialism and the rise of China is further feeding imperialist rivalry.

Already before 2020, in order to export the crisis, protectionist measures were increasingly gaining ground. Increasing instability has now also shone a light on the methods of just-in-time production. As the world becomes politically and economically more turbulent, the risk of shocks to supply chains has also increased.

Just-in-time production had been all about efficiency savings. There was no forward planning and no thought of building redundancy into the economy. This made the world economy exceptionally brittle. COVID gave us a spectacular demonstration of how brittle it is when – beginning with China – the entire world went into lockdown in 2020.

Everywhere the state stepped in with export controls and massive subsidies to prop up ‘their’ capitalist class. Subsidies are the inverse of protective tariffs, but they have the same effect. Rather than creating barriers for foreign capitalists, they give a boost to domestic capitalists. Of course, subsidies can only be maintained at this level for a while as it comes at the cost of tremendously increasing state debt. The nations with the deepest pockets will naturally win at the expense of the poorest nations on Earth. So whilst the capitalists of the rich countries are happily expecting a rebound, the poorest countries in the world have been exceptionally hard hit.

It’s not just economic disruption caused by the crisis, but political threats to supply chains that are increasingly causing anxiety for the various national gangs of capitalists. As national antagonisms are magnified, they are looking at the vulnerability of their stretched supply chains with alarm. The aforementioned host of recent accidents has brought this point home: the more stretched supply chains become, the easier it becomes for a hostile power to grab you by the throat.

Capitalist governments the world over are drawing the conclusion that they have to look out for number one. In place of drawn-out, global supply chains there is a shift towards ‘sovereignty’. The trend threatens to undo decades of ‘globalisation’ as the tentacles of international capital are withdrawn behind national frontiers. As each gang of national capitalists looks out for its own interests, the impact on world trade and world capitalism could be severe to say the very least.

Chips for America

The Biden administration has put the question of self-sufficiency and security in strategic industries at the top of its agenda. As one of his first Executive Orders upon entering office, Biden ordered a 100-day review of the security of all of America’s supply chains.

Before the outcome of that review, huge quantities of cash have already been earmarked. Biden’s much-discussed $2.5 trillion investment package includes $300 billion to support US manufacturers and strengthen supply chains. $50 billion will go to a new department for monitoring domestic capacity in critical goods; $52 billion will be made available as credit to domestic manufacturers; $50 billion will be spent subsidising the creation of new domestic semiconductor capacity, and $30 billion will go towards shoring up America’s so-called ‘bio-preparedness’ to avoid having to again depend on foreign medical supplies in the case of another COVID-type event.

As mentioned, the question of microchips, in particular, has been identified as a key point of strategic concern for American capitalism. The problem is, almost all microchips – at least of the most technologically advanced variety – are created in one of two places, both in South East Asia: in Taiwan (by TSMC) and in South Korea (by Samsung). The supply chain of electronics is almost completely based in South-East Asia – where China is attempting to extend its domination – with different countries playing different parts in the chain. Some have even suggested that Taiwan could become the flashpoint of wars for control over semiconductors. In the past, such levels of imperialist rivalry as we are seeing would already have led to war. But the danger of nuclear annihilation means that the US and China must avoid direct military confrontation today at all costs.

As part of the tightening up of this push for ‘self-sufficiency’ in key industries, Biden has introduced a ‘Chips for America Act’ that will funnel $37 billion just for starters into the effort to secure a domestic supply of these much-needed components. The United States isn’t alone. The EU has also promised measures to double its share of chip manufacturing to 20% by 2030, and China has included ‘integrated-circuits’ on its list of technologies that will receive a 7% increase in spending in its latest five-year ‘plan’.

Imperialist rivalry

The problem isn’t just one of manufacturing high-end chips. There is also the question of the raw materials that go into producing such chips and other high-tech products. Rare-earth minerals are key ingredients in the manufacture of products including computers, fighter jets, electric car batteries, LCD screens and fibre optics.

While the rare-earth oxides that go into microchips comprise a market of just $5 billion, industries worth trillions of dollars depend on them. This is a prime example of the kind of ‘bottlenecks’ that are now making the strategists of capital sweat.

The problem is, these minerals are not evenly distributed across the globe. Indeed, over the past few decades, China has quietly been cornering the market in rare-earth minerals. According to Foreign Policy:

“China produces or controls over 70 percent of the world’s mined REs [rare earth minerals], and it refines more than 80 percent of all REs into mixed oxides and separates more than 90 percent of all REs into individual elements. China and Chinese-controlled enterprises produce more than 99 percent of all so-called new REs metals.”

The USA sources 80%, and the EU no less than 98% of its rare-earths from China. It is dominant in terms of both access to ores and processing capacity. As demand for these minerals soars, competition over geographically limited deposits will reach new heights. The struggle for deposits will open up new flashpoints for the main imperialist power blocs, with large deposits of some rare-earths believed to be located in pristine areas including Greenland and the Arctic floor. A new conflict has opened up over this question in Greenland, where the newly elected government opposed the expansion of rare earth mining, which is clearly of interest not just to their Danish overlords, but also to US imperialism.

‘Beggar-thy-neighbour’ policies

The scramble to re-shore industries – for which microprocessors are merely the tip of the iceberg – could have severe consequences. The American corporation, Intel, has dashed to the front of the queue for state aid in a bid to become the American microchip champion. They have promised to spend $20 billion to build two semiconductor plants in Arizona, with the help of American tax dollars. As the Economist explained:

“Free money is always nice. If America’s government insists that American companies buy more American-made chips, Intel stands to benefit. But government backing can encourage over-expansion; building factories takes years, while demand for chips changes quickly, fuelling regular boom-and-bust cycles. Support can also unexpectedly be snatched away. Investors, already nervous about the sliding profitability of Intel’s core business, may fret about the impact of over-investment on margins.”

In other words, if the state steps in to help set up factories at home for these key strategic industries in the context of existing over-capacity, they run the risk of over-investment. That is to say, the rush to plug the gap could run the risk of exacerbating the global crisis of overproduction. As we saw with the massive American investment in shale oil – which was, again, partly a question of ensuring national ‘energy security’ for American capitalism – the result was a crash in oil prices and a massive glut of overproduction.

The logic of the situation would push governments to protect newly built factories from “temporary” fluctuations in the market – be it through further subsidies, tariffs or quotas. That is to say, one protectionist measure flows from the last.

Other unintended consequences could also flow from the new policy. The rise of just-in-time production in the 1990s and the off-shoring of industries to wherever labour was cheapest was intended to push down costs. This had the effect of driving deflation.

Now they are rushing to reverse this trend, with assistance from the state. But doing so – at a time when governments are resorting to the printing press to keep capitalism afloat – could drive prices up, stoking inflation. For companies that depend on the razor-thin margins that global free trade and just-in-time production secured, the cost of ‘diversifying’ could be more than they can bear.

The overall effect of this protectionist trend will be to draw capital in behind national frontiers. Downward pressure will be exerted on world trade, causing markets to contract, feeding national antagonisms. The world economy could enter into a vicious cycle of protectionist measures, new trade wars, and even military confrontations.

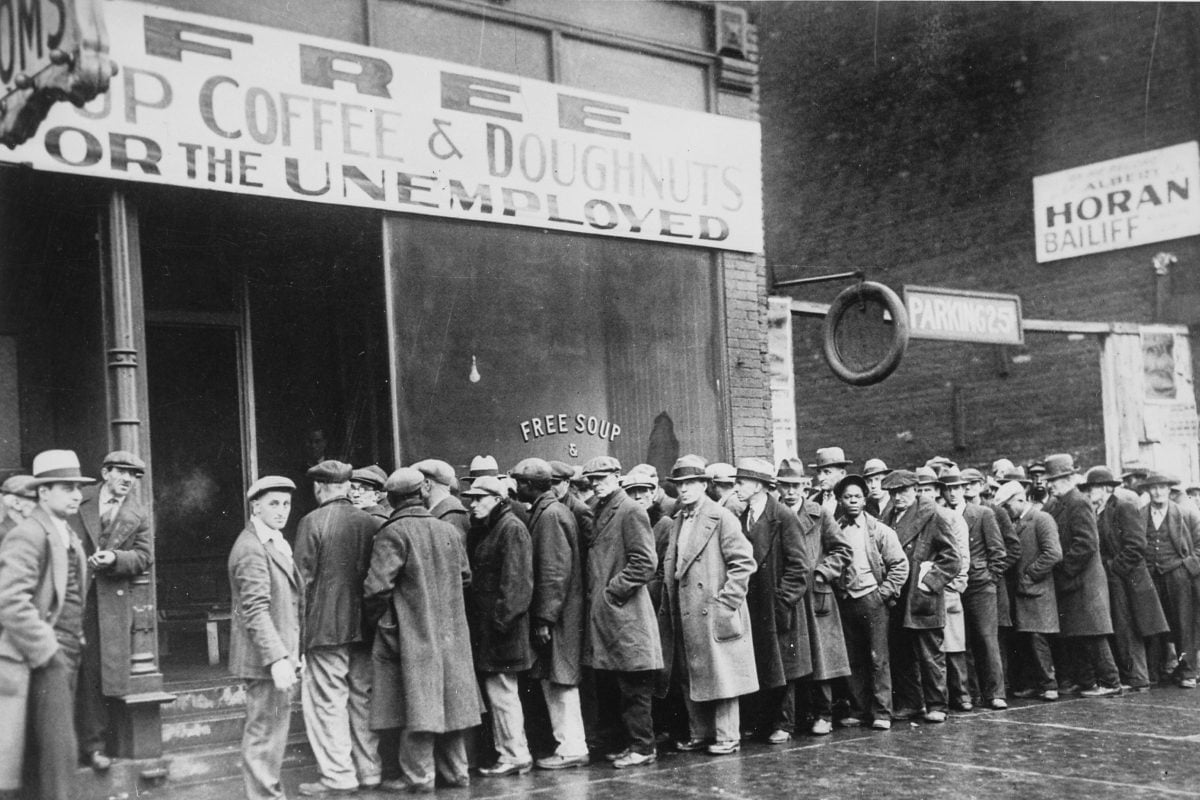

We have seen where these policies lead before. In the 1930s, the Wall Street Crash triggered an unprecedented economic crisis. But it was the attempt to export the crisis by various means – known as ‘beggar-thy-neighbour’ policies – that served to turn a recession into a deep depression. The period finally culminated in the barbarism of World War Two – an outcome ruled out today because of the existence of nuclear weapons.

Today the world is crying out with the most glaring contradictions. We have before us the most incredible productive forces and unprecedentedly complex supply chains. We have a world economy based upon a worldwide division of labour, and complete international interdependence. Yet national antagonisms and rivalry have never been so severe. The attempt to turn back the clock on globalisation will only serve to intensify the crisis.

We are presented with crises – such as the COVID-19 pandemic and the environmental catastrophe – that almost scream out for international cooperation and economic planning. Yet the profit motive and the nation-state loom as giant obstacles, not only blocking the road to human progress but threatening to throw civilisation back to a state of barbarism. Only by putting the profit motive and the nation-state in the dustbin of history can humanity move forward. Only by abolishing capitalism can we throw out these barbaric relics of humanity’s past.