“One has a feeling of going it blindly because we’re in a tremendous stream, and none of us knows where we’re going to land.” Eleanor Roosevelt, later the US First Lady, in 1929.

“Last year’s global crash was, in real terms, almost exactly as damaging as the Great Crash of 1929 at its worst point.” John Authers, Financial Times economist, 11/2/09

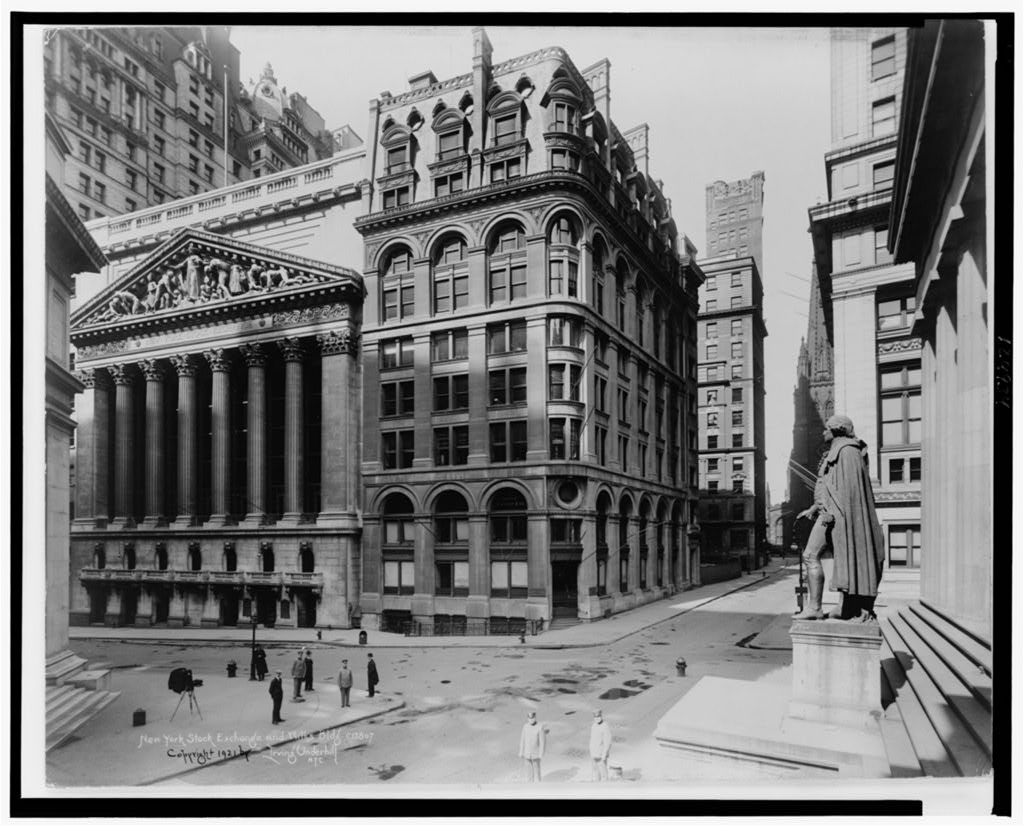

The Wall Street Crash of 1929 and the Great Depression that followed were always regarded as a turning point in history. The stock market crash began on 24 October 1929 and lasted, with certain fluctuations, up to the Second World War.

However, the destruction of productive forces during that terrible conflict resulted in a long post-war upswing that would last until the slump of 1974. Capitalism has suffered from booms and slumps since then, but the crash of 2008-9 was the deepest since the 1930s. Today we are facing an even deeper slump.

Ninety years on, it is therefore worth studying the 1929 crisis as there are definite parallels with today.

“Roaring Twenties”

The decade prior to 1929 was a boom period in the United States, commonly referred to as the “Roaring Twenties”. It was a time of rampant speculation and wild excess, especially in the stock market and in land sales. Unemployment was very low, while production, investment, wages and profits rose steadily. Prices, in turn, remained stable.

Between 1925 and 1929, the number of US manufacturing companies rose from 183,900 to 206,700, while the value of their output increased from $60 billion to $68 billion. Profits as well as the stock market were booming. Industrial profits rose 156 per cent in the five years before 1929. Industrial shares however trebled over the same period, as investors bought shares “on the margin”, namely credit. A raging “bull market” from 1925 to 1929 saw Wall Street climb to a record high. On 3 September 1929, the Dow Jones Industrial Share Index reached a peak of 381.17.

In one case, a small piece of swampland in Florida was selling for an absolute fortune, a clear sign of the speculative bubble that was building up. But the Stock Market was the real centre of the frenzy.

With share prices rising, everyone was making money. As a result, people went into debt to buy shares. While share prices rose day after day, nobody was bothered about debt. People were buying shares as prices were going up; and share prices were rising because people were buying them. It was a classic bubble, but the scale was unprecedented. The real economy no longer seemed to matter.

It was like the speculation later seen prior to 2008, where the value of derivatives and financial instruments went through the roof. It was like a house of cards waiting to collapse.

In 1929, as in 2008, the bankers and politicians all said the “fundamentals” of the economy were sound. Companies, instead of going through the trouble of investing in production, more and more started lending their surplus funds on Wall Street.

“In March 1928, the industrial average rose nearly 25 points”, states Galbraith. “News of the boiling market was frequently on the front page. Individual issues sometimes made gains of 10, 15, and 20 points in a single day’s trading.” (Galbraith, p.40) In November, over six million shares were traded.

But in March 1929, there was a panic where over eight million shares changed hands and prices collapsed. The ticker-tape was unable to cope with the volume. However, the market soon recovered and share prices resumed their meteoric rise.

The authorities also continued to exude confidence. “The high tide of prosperity will continue,” stated Treasury Secretary Andrew Mellon. The same was later the case with Alan Greenspan, chairman of the Federal Reserve, who, in 2006, described the situation as one of “irrational exuberance”, but then added that “the fundamentals were sound”.

Crash

But the expansion of the “Roaring Twenties” came to an abrupt end with the Crash of 1929. Things turned into their opposites and endless profits became endless losses. An orgy of speculation had gripped the United States over the decade of the 1920s but that was not the fundamental cause of the crisis that hit Wall Street like a bolt of lightning. The capitalist system had reached its limits and internal barriers stood in the path of further expansion.

But the expansion of the “Roaring Twenties” came to an abrupt end with the Crash of 1929. Things turned into their opposites and endless profits became endless losses. An orgy of speculation had gripped the United States over the decade of the 1920s but that was not the fundamental cause of the crisis that hit Wall Street like a bolt of lightning. The capitalist system had reached its limits and internal barriers stood in the path of further expansion.

The 24th of October was the first day of the 1929 Stock Market Crash. Some 12,894,650 shares hurriedly changed hands as prices slumped. Stocks were practically selling for nothing. The sales turned into a flood on 29 October – Black Tuesday. In just the first half-hour, 33 million shares were sold and shares fell by 13 per cent. Millionaires were becoming paupers within hours. Men who had owned everything in the morning were jumping off tall buildings by that night.

By early November, the Dow Jones was nearly 50 per cent below its September high. People thought this upset was temporary. Rallies seemed to confirm this. The leading orthodox economist of the time, Irving Fisher, described the crash “a great accident” caused by a “psychology of panic”. Andrew Mellon, US Treasury Secretary, stressed the theme that “the US economy is fundamentally sound”. Eugene Stevens, the President of Continental Illinois Bank announced that “there is nothing in the business situation to justify nervousness”.

Overproduction

But the “fundamentals” were not sound. An economic crisis was emerging, the scale of which was not apparent to anyone.

But the “fundamentals” were not sound. An economic crisis was emerging, the scale of which was not apparent to anyone.

There were short recoveries and then further falls. Consumer spending began to fall as the crisis hit the real economy.

“For a while it was possible to postpone the day of reckoning,” explained Leo Huberman. “We disposed of surplus savings and at the same time made it possible for countries abroad to purchase our exports by lending them money. Our export trade expanded as they bought goods from the United States for which they paid with money borrowed from the United States. In the domestic market the gap between production and consumption was bridged for a time by the system of large-scale instalment selling. This was especially true of those industries which were still expanding, such as the automobile, radio, and electrical products industries. The demand for durable consumption goods and housing continued to increase on the basis of this increased borrowing.” (Huberman, We the People, pp.276-7)

The system had in practice already reached its limits. As Marx had explained, the barrier of capitalism is capital itself. All the contractions came together to produce an almighty crash, starting in the Stock Market, and resulting in a massive crisis of overproduction of capital and goods. By 1932, the output of capital goods, the worst affected, was only about a quarter of what it was in 1929. It went from bad to worse, despite all the predictions about things stabilising.

World Crisis

The crisis in Wall Street was soon to become a world crisis with a wave of competitive devaluations as each national capitalist class attempted to unload the burden on to their rivals. This led to a trade war.

The crisis in Wall Street was soon to become a world crisis with a wave of competitive devaluations as each national capitalist class attempted to unload the burden on to their rivals. This led to a trade war.

People started defaulting on their debts, so everyone who was owed money began calling it in before the debtors went bankrupt. This led to further defaults and the situation spiralled down.

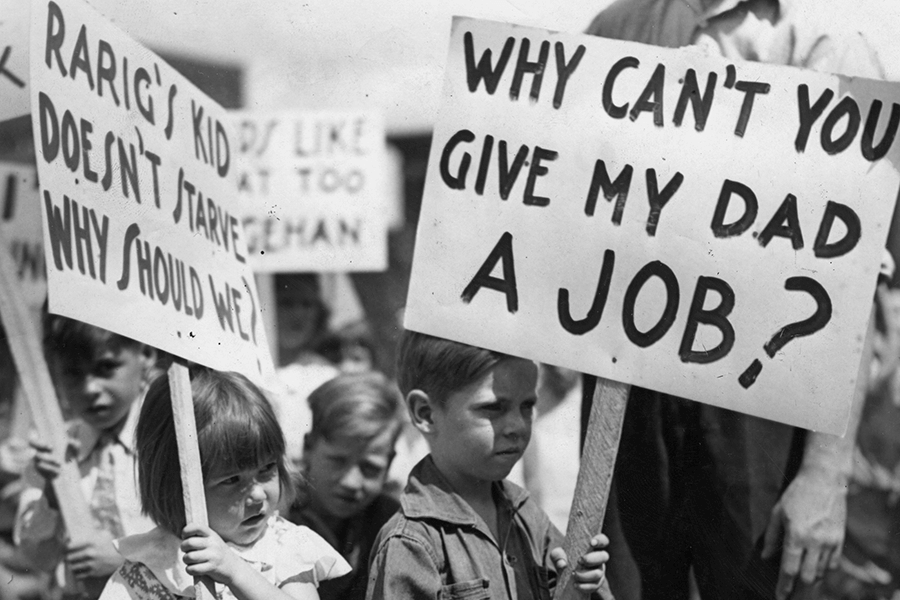

Countries demanded payment in gold. Protectionism resulted in the erection of tariff barriers in one country after another, which strangled world trade and intensified the crisis. Following the Great Crash was the Great Depression and mass unemployment. In the United States, unemployment rose from about 1.5 million in 1929 to more than 12 million by 1932. The following year, nearly thirteen million were out of work, about one in every four. The situation did not change substantially until the outbreak of world war.

The crisis of overproduction affected the capitalist world as factories and industries closed their doors. In 1920, capacity utilisation in the United States was at 94%, according to Donald Streever in his study, Capacity Utilisation and Business Investment. By 1930, it had fallen to 66%, and by 1932 had reached 42%. The average for the 1920s was 84.5%, while in the 1930s the average was 63.4%. Even by 1939, capacity utilisation was still at only 72%, where nearly a fifth of the country’s labour force and over a quarter of its productive capacity was idle. (Quoted in Baran and Sweezy, Monopoly Capitalism, pp.232, 236-7)

Of course confidence had collapsed, but this was not the cause of the crisis but a reflection of it. Clearly, there are many secondary reasons for the US crisis, ranging from massive speculation, falls in confidence, and problems in the monetary system, to the extreme concentration of wealth. But these were not the primary cause for the collapse. They all played a certain role, especially in intensifying the slump, there can be no denying, but they were by-products of the crisis rather than the real cause of the slump.

Capitalist limits

The whole of Marx’s analysis of capitalist production demonstrates that the system of profit, investment, production and consumption does not run smoothly. The real reason for the crisis was that the expansion of capitalism created its own barriers and limits in the form of overproduction. The crisis was one of the productive forces which were struggling to overcome the constraints of private property, and were gripped between the twin contradictions of limited consumption and profitable production. This expansion could not go on indefinitely, and contained within itself the seeds of its own contraction. The greater the expansion, the greater will be the subsequent contraction. Such is the logic of capitalist development and its inherent barriers.

“In the decades preceding the war, crises had the character of short and not too profound interruptions, while each new upswing left the peak of the previous one far below”, explained Trotsky in 1932. “But now we must expect the opposite: profound, long and painful crises, while the upward movements are weak and short lived.” (Writings 1932, p.173) These lines could have been written today and graphically reveal the similarities between now and then.

Boom and slump have always been an inherent part of the capitalist system, similar to the breathing in and out of a living being, but the tempo is determined by age and health. The severity of the slump of 1929 and the subsequent Great Depression are characteristic of the decline of capitalism, where the accumulated contradictions burst through with unusual force.

Parallels to today

The slump of 2008-9 was the deepest since the 1930s and displayed many of its characteristics, and is a foretaste of today’s coming crisis, possibly even more destructive than we have experienced to date. After a prolonged interval, lasting some 60 years, we have again returned to the situation where the social system is in its prolonged death agony with all that means for the working class.

The slump of 2008-9 was the deepest since the 1930s and displayed many of its characteristics, and is a foretaste of today’s coming crisis, possibly even more destructive than we have experienced to date. After a prolonged interval, lasting some 60 years, we have again returned to the situation where the social system is in its prolonged death agony with all that means for the working class.

“The race to full recovery is likely to be long, hard and uncertain,” stated Martin Wolf of the Financial Times, in 2009. But that proved optimistic. We have experienced a long “recovery” but it has been the weakest in history, characterised by austerity and falling living standards.

The bourgeois economists and apologists maintained for decades that a deep crisis could never happen. They were forced to eat their words in 2008. Some are still in denial. Such was the case in 1929 also, when capitalist economist, Irving Fisher, stated that the “factors leading to the crash of the American stock market were not factors of depression but of prosperity, unexampled prosperity.”

Today, the recent economic policy debate strikingly resembles the debate after 1929. The central argument has been budgetary austerity versus fiscal stimulus, and – as in the 1930s – they tried both: quantitative easing and austerity, with little to show for it. They slashed interest rates to zero, but to no avail.

In November 1929, US President Hoover cut taxes and once again there was a further fall in interest rates. The markets reacted favourably. From New Year 1930 until April, the Dow Jones rose back to 294.07, 100 points above the November low, but still 90 points below the September peak. Nevertheless, it was a significant turnaround.

But after a short pause in June 1930 prices again fell, reaching a new low in December of that year. The trajectory was downwards after that, reaching rock bottom in July 1932, with the Dow at 41.22. While there were recoveries in 1933, the stock market remained weak throughout the rest of the decade.

It was not until 1955 that stock prices would fully recover their pre-crisis level. Many investors lost everything in the Crash, further exacerbating the panic and economic crisis. Credit became scarce. Markets collapsed, consumer demand, investment and commerce dried up and production slumped. Profits as a result were wiped out.

Offensive against labour

After the Wall Street Crash, five thousand banks closed. According to the Federal Reserve Board index, manufacturing production declined by almost 50%. The total value of all finished commodities at current prices had fallen even further – from $38bn to $17.5bn. Private construction crashed from $7.5bn to a pitiful $1.5bn.

After the Wall Street Crash, five thousand banks closed. According to the Federal Reserve Board index, manufacturing production declined by almost 50%. The total value of all finished commodities at current prices had fallen even further – from $38bn to $17.5bn. Private construction crashed from $7.5bn to a pitiful $1.5bn.

Unemployment climbed to about 15 million, although there were no official records. The Ford Motor Company, which in the spring of 1929 employed 128,000 workers, had reduced its labour force down to 37,000 by August 1931. The slump meant an all-out offensive against labour, as wages were cut and hours increased. Sweatshops were springing up everywhere. Child labour was returning. Women were forced to work nightshifts. The Pennsylvania Department of Labour and Industry warned that half the women in the clothing and textile industries were earning less than $6.58 a week, with 20% earning less than $5. In Fall River, Massachusetts, more than half the employees in the garment trade were getting 15 cents an hour or less.

Farmers were being thrown off their land when the banks foreclosed their farm mortgages, leading to widespread violence and rebellion. In January 1933, Edward A. O’Neal, head of the Farm Bureau Federation, warned a Senate committee: “Unless something is done for the American farmer we will have revolution in the countryside within less than twelve months.”

Warehouses were full of clothing, but people could not afford to buy them. Empty houses were common sights, as people could not afford the rent. There were numerous struggles against eviction. Many now lived in shacks that became “Hoovervilles” built on rubbish dumps.

“They say there is overproduction, that crops must be reduced,” said Milo Reno. “As long as there are twenty-five million hungry people in this country, there’s no overproduction. For the government to destroy food and reduce crops at such a time is wicked. The payments Washington proposes to make to the farmers are nothing but a dole. The scheme won’t work, and it would be wrong if it did.”

Many began to sense that the whole thing was irrational. The glaring contradiction of destitution amongst plenty, as many people saw it.

The newly-elected President Franklin D. Roosevelt (who had defeated Hoover) had no alternative but to act. He reorganised the banking system and introduced the “New Deal”, a programme of reform legislation that was an attempt to rescue capitalism from itself.

Global implications

The slump had global implications, where 70% of world production was concentrated in the United States, Britain, Germany and France. In June 1930, the Smoot-Hawley Act was introduced to protect US agriculture. All other countries responded by raising tariff barriers, the introduction of beggar-thy-neighbour policies. World trade collapsed as a consequence. The consequence in countries such as Germany would be shattering with mass unemployment and valueless currencies. Britain too would see millions on the dole alongside pay cuts and misery for the masses – all demanded by a capitalist class trying to save themselves.

In the US, production did not return to 1929 levels until 1941, when unemployment was still over 17 per cent. It was not Roosevelt’s “New Deal”, but war production and the global destruction of World War Two that served to rescue capitalism from its state of chronic overproduction, through the destruction of material goods and values.

A new world slump

Today, 1929 still haunts the strategists of capital. The slump of 2008-9 was an alarming wake-up call. “Unless you were alive and trading in 1929, you have never seen anything like this.” said a hedge fund trader, quoted in the FT, in September 2008. The dreams of capitalist stability and progress had gone up in smoke once again.

Today, 1929 still haunts the strategists of capital. The slump of 2008-9 was an alarming wake-up call. “Unless you were alive and trading in 1929, you have never seen anything like this.” said a hedge fund trader, quoted in the FT, in September 2008. The dreams of capitalist stability and progress had gone up in smoke once again.

Today, the world economy is rapidly slowing down. Everything points to a new world slump, which threatens to be deeper even than 2008. The strategists of capital are fretting that they have run out of ammunition to deal with the next crisis. In 2008, due to the expansion of China, they managed to avoid a Depression. Now China is in a trade war with the United States and is also contracting. UK productivity has suffered its worst fall for five years.

A new slump will drive millions out of work and into a new despair. The capitalist system has reached its limits and is threatening to drag society down with it.

Only the overthrow of capitalism and the introduction of a rationally-planned economy, based upon a democratically nationalised system of production, can offer a way out of this nightmare of capitalist crisis. If not, humankind will face another 1929 and another great depression. That is something we cannot afford or permit. We need socialism.