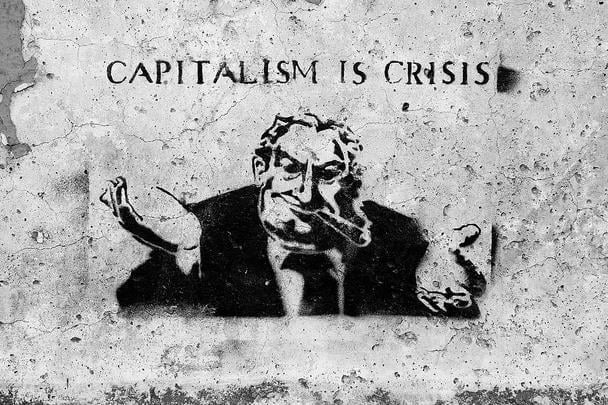

Following the shock of the Brexit vote, Britain has now joined the centre of the world crisis of capitalism. Already in a fragile state, confidence in the British economy has plummeted, prompting the Bank of England to intervene. However with the world economy still in deep crisis, the Bank’s measures will be like trying to stick a plaster over a gaping wound.

Following the shock of the Brexit vote, Britain has now joined the centre of the world crisis of capitalism. Already in a fragile state, confidence in the British economy has plummeted, prompting the Bank of England to intervene. However with the world economy still in deep crisis, the Bank’s measures will be like trying to stick a plaster over a gaping wound.

Even capitalist economists are warning that British banks are vulnerable to a fresh slump that will be even worse than 2008. The vast sums required to bail out the banks will mean even greater austerity will be served up for decades to come. That is, unless we overthrow this diseased system and replace it with socialism.

Uncertain Future

The Purchasing Managers’ Index (a respected survey of British business activity which includes output in manufacturing, construction, and services), recently fell to its lowest level since 2009 – i.e. crisis levels. This reflects the uncertainty of capitalists following the Brexit vote, who on the one hand are terrified of a tariff wall being erected between Britain and their main market, as well as the rising costs of imports.

On the other hand, investors are also worried about the fragility of the world economy, given the slowdown in China, and recession in the so-called “emerging markets”. As well as this, the Brexit vote has accelerated the on-going disintegration of the EU, which is facing increasing demands from other countries to leave. This comes on top of the existing crisis of the Euro, which in places like Greece has only been delayed, not resolved.

Bankrupt

At the forefront of the European crisis is Italy, where the banks are struggling with an estimated €360bn in bad debts. So severe is the crisis that the Euro Stoxx Banks Index (which reflects the confidence of the capitalists in the European banks) is down a dramatic 34.6% since the start of the year.

At root of the problems of the banks is a massive crisis in the underlying economy. In Italy alone, an estimated €200bn of the bad debt held by banks is composed of loans to already insolvent companies. These are a symptom of the worldwide crisis of capitalism, whereby the output of the vast productive forces is unable to be absorbed by the narrow constraints of the market.

Contagion

With the integration of the world market, a crisis in one country can quickly develop into a crisis of the whole system. Such is the tangle of investments and loans, that the collapse of the Italian banking system would rapidly affect the banks of the rest of Europe and the world.

Deutsche Bank, one of the global banks at the centre of this web, is particularly vulnerable. The bank’s share price has collapsed by over 63% in the past year, hitting its lowest level on record. It was was recently identified by the International Monetary Fund as being the most dangerous “globally significant bank”. However, the troubles at Deutsche Bank are simply the visible tip of one many icebergs in the very chilly waters of the world economy.

Stressed out

The ruling class is aware of such dangers, but is powerless to avoid them. For example, the Bank of England’s (BoE’s) “stress tests” of the British Banking sector were dismissed as “worse than useless” by Kevin Dowd, a professor of finance and economics at Durham University.

In his report, published by the pro free-market Adam Smith Institute, he notes that if the BoE had included the more rigorous standards of the US Federal Reserve, then all eight of Britain’s main banks would have failed the tests.

According to Professor Dowd: “By these higher and much more reasonable standards, the UK banking system comes out of the 2014 stress tests not so much underwater as stuck as the bottom of the ocean.” Since the tests in 2014, the economic situation has deteriorated even further, as reflected in the recent sell off of shares in banks across Britain and the rest of Europe.

Diseased

In 1938, Trotsky commented that the ruling class was “tobogganing towards catastrophe” with its eyes closed. Now they are on course for disaster with their eyes open. But as before, they have no idea of how to avert this crisis, as no such miracle cure exists. It is one thing to plead to the banks to shore up their balance sheets, but when resting on top of a diseased world economy, there is no way for them to stop the rot from spreading to the entire financial system.

In acknowledging the sickness of the economy, the BoE has slashed its official growth forecasts by 2.5% over three years. The reality is likely to be much worse, since such predictions fail to grasp the crisis prone nature of the world economy, and are thus routinely downgraded.

The desperation of the ruling class is evidenced by the recent measures by the BoE to stem the tide of the crisis. The Bank’s benchmark interest rate, already at its lowest levels ever, has been cut even further to 0.25% in the hope that this will encourage investment. In addition, the Bank is extending its quantitative easing (i.e. printing of money) by £60bn, and is proposing to provide £100bn to British banks to “help them to lend”.

However, as reported by the Financial Times, evidence suggests that the problem is not one of the banks being unwilling to lend, but that there is little demand for credit in the first place. This should come as no surprise to Marxists, who recognise the problem as a crisis of overproduction. British industry is running at only 80% capacity – one of the higher rates for the advanced capitalist countries. Much of the world is facing stagnation or recession. Therefore why would capitalists wish to invest in more production, when they can’t even sell what they can already produce? The BoE’s measures are therefore like trying to treat a cancer patient with aspirin – it may remove some of the pain, but cannot address the fundamental illness.

Job cuts

Rather than increase production, the capitalists are slashing jobs, wages, and terms and conditions. Surveys from the Recruitment and Employment Confederation reported that the British labour market went into “freefall” in July, with the sharpest drop in permanent job positions since 2009.

One the one hand, this reflects the capitalists lack of confidence in the future of the British economy, for the reasons explained above. On the other hand, they are seizing the opportunity to force workers into casualised contracts, with low pay and little to no benefits and job security. This is their only real answer to the crisis, and exposes the bankruptcy of their entire system.

As always, the ruling class push the burden of their crises onto the shoulders of the working class. Although some capitalists may lose a few million pounds here and there, they will barely notice the pinch from their luxury flats and yachts. It is millions of workers and youth who will lose their jobs, their homes, their access to education, and all the other things that give us a semi-civilised standard of living.

One thing is for sure, that sooner or later another deep slump will shake the world economy to its foundations. The workers will be asked to continue to foot the bill through decades of austerity. It is time we said enough is enough – lets make the rich pay through the introduction of a socialist planned economy where the giant banks and industries are owned and run by the working class! We therefore call on a Corbyn led Labour Party to break with the market, and fight on a bold socialist programme to change not just Britain, but the world.