The world economy continues to stall and sputter. Despite the best efforts of bourgeois economists, academics, and politicians, none of them seem to be able to come up with a plan to solve the world crisis of capitalism.

In amongst all the confusion and panic of the capitalist class, a handful of extreme right-wing economists have begun arguing for a return to the gold standard as a way of solving the economic crisis. The reality is that the contradictions of capitalism cannot be solved by measures taken within the capitalist system. Those who argue otherwise are ignoring reality.

This is as true in relation to the gold standard as it is to Keynesian spending policies, as can be seen by the history of the gold standard, as well as the situation in which the world economy finds itself today.

Why gold?

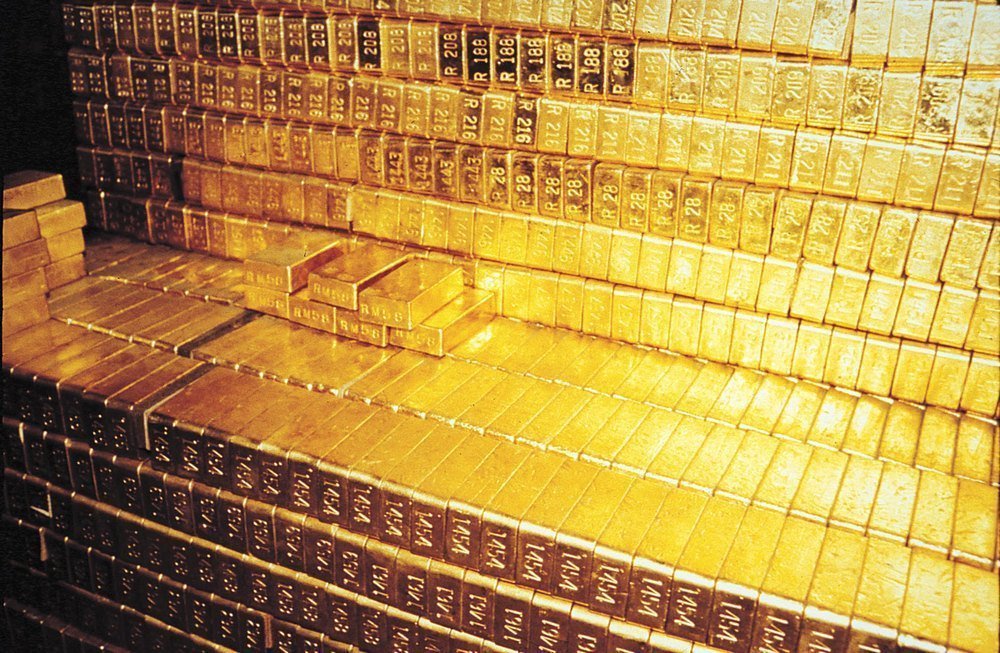

There is nothing mystical about gold. Its value as a commodity and as a currency is thanks only to its basic physical properties. Gold is relatively difficult to find and takes a lot of effort to extract from the earth, meaning that even a small amount of gold is very valuable. As well as being a good store of value, gold has the added properties of being inert and therefore highly durable, as well as being relatively easy to divide into small coins or merge into bigger bars.

This is why, historically, gold was used as currency and then later as a standard against which currency could be pegged. It is also why a handful of bourgeois economists today are arguing for a return to the gold standard as a solution to the world’s economic problems.

Why a gold standard?

The theory behind a gold standard for currency in the 19th century made sense. Money, as a means of exchange, must be linked to the total price of all the commodities circulating around the economy at a given time, as well as being linked to the speed at which these commodities circulate – i.e. the pace at which transactions take place.

Given that there was a relatively limited and stable amount of gold circulating around the world at that time, pegging currencies to this commodity would lead to a stable currency and a reliable standard of prices. When discussing the question of money in Capital Marx says “the less the unit of measurement [in this case gold] is subject to variation, the better the standard of price fulfils its office”.

In practical terms, this should have meant that a gold standard limits inflation and provides financial stability on an international scale. By using currency backed by gold, central banks were supposed to be able to adjust economic policy according to whether gold was flowing in or out of the country. Adjustments in terms of employment, wages, tariffs and so on would all affect the cost of imports and exports. In this way, by having all countries working off the same gold standard, global stability in balance of payments terms could be maintained.

The gold standard before 1914

Before 1914, Britain and many other countries used a gold standard for their currency, based on the theory outlined above. But the reality of this gold standard bore little resemblance to the theory. The adjustments that were supposed to take place in response to gold flowing in and out of a country were not implemented.

Part of the reason for this was that it was colonial countries or dependent agricultural economies that suffered if adjustments were not implemented (i.e. their imports would get more expensive). The ruling class in imperialist countries like France and Britain were willing and able to allow their dependent and subjugated nations to suffer periods of economic crisis so as to spare their own economies potentially difficult or painful adjustments.

But if the required adjustments were not being implemented, that begs the question of how economic stability was being maintained prior to 1914. There are many reasons for this, but the most significant is that Britain had the predominant position in world trade.

Underpinning this global economic order, at root, was the dominance of the British Empire. The UK had begun adopting the gold standard in the early 19th Century, in the wake of the Napoleonic Wars, as a means of combatting war-induced inflation. And as the Empire spread, this gold standard spread also, through international trade.

Throughout this historical period Britain was the main long-term overseas lender. This meant that in a period of crisis Britain’s exports declined much more than her imports. While imports were almost entirely of indispensable necessities, exports tended to be of capital goods, financed by long-term loans, which would dry up during a crisis.

Overall, a crisis would put Britain’s balance of payments into surplus due to less overseas lending, but this would be balanced out by a tendency towards a balance of payments deficit caused by a faster decline in exports than in imports. Thus overall stability would be maintained.

In other words, the stability of the British economy was almost nothing to do with the gold standard. Rather it was a question of confidence in the monetary system itself and the British political system that kept it running – a confidence which was based on Britain’s dominant imperialist position in world trade. For this reason it would be more accurate to describe this monetary system as based on a sterling exchange, rather than a gold standard.

The gold standard after the war

The situation was dramatically different after the First World War, for a number of reasons. The “Great” War had forced many countries, such as Britain, to come off the gold standard, with war spending leading to rampant inflation.

The situation was dramatically different after the First World War, for a number of reasons. The “Great” War had forced many countries, such as Britain, to come off the gold standard, with war spending leading to rampant inflation.

In Britain there was an attempt to reintroduce the gold standard in the 1920s, which failed miserably.

By that time the USA had arrived as a dominant force in the world economy. But the British ruling class failed to appreciate the changed balance of forces. They tried to reintroduce the gold standard at the same price as before, despite having doubled the money supply to finance the war. Inevitably this created a highly deflationary situation, with prices and wages falling rapidly as the economy tried to readjust to a pre-war monetary system in post-war conditions.

The only way that the desired sterling-gold exchange rate could be achieved whilst maintaining international economic competitiveness was through a process of “internal devaluation” – that is, attacks on workers’ wages and conditions. But this, in turn, meant an intensification and sharpening of the class struggle, as reflected in the 1926 general strike in Britain.

After stumbling on, the British ruling class effectively accepted defeat, coming off the gold standard once-and-for-all in 1931 as a result of the Great Depression.

There were also political factors involved. A loss of gold from a country’s economy should indicate that contractionary policies are needed to rebalance the cost of imports and exports. But such policies would have meant bankruptcies and unemployment in a very turbulent political situation. Rather than risk public fury, politicians broke the rules of the gold standard to try to keep the people happy. This turbulence was added to by the fiasco of German reparations payments and all the disruption to post-war economies across Europe.

In addition, the USA, by then a key economy in the world, drastically cut overseas lending during the depression but still ran a balance of payments surplus. This therefore put an enormous balance of payments burden on the rest of the world, which in turn put big pressure on the ability of many currencies to maintain a currency pegged to the gold standard.

It was for these reasons that the post-WWI gold standard failed. In other words, it was not because of regulatory failures or theoretical misunderstanding that the gold standard did not work: it was because the material conditions that had allowed it to function before WWI were no longer present. The functioning of the gold standard is a concrete political question, not one of abstract economic theory.

The rise and fall of Bretton Woods

In 1945, the post-war Bretton Woods agreement established a system of fixed exchange rates against the dollar and against gold, with the former almost as good as the latter given that the USA controlled two-thirds of the world’s gold in Fort Knox. This system remained relatively stable during – and thanks to – the post-war boom, and was underpinned by the power and position of US imperialism (much as the dominance of the British Empire had underpinned the stability of the international gold standard in the 19th Century).

By the early 1970s a recovering Germany and Japan had cut into the USA’s share of world economic output, and the cost of being the world’s policeman – in particular, the wars in Korea and Vietnam – had taken its toll on the US economy.

As war-induced inflation took hold in America, it began to create imbalances and tensions within the world economy, through the Bretton Woods dollar-gold mechanism. Several countries moved to leave the Bretton Woods agreement, considering it advantageous to decouple themselves from the US economy.

All of these problems would manifest themselves in a recession in 1973. But before that, in 1971, President Nixon suspended the convertibility of the dollar into gold in an attempt to stabilise the US currency. This marked the end of the Bretton Woods agreement. Since then, currencies have floated freely against each other, with their relative strength determined by the strength of the national economy that backs them up.

A return to gold?

The end of Bretton Woods forced nations to find alternative ways of stabilising their economies so that inflation, deflation and other monetary problems could be avoided. By releasing economies from their currency pegs, debt and credit has been able to play this stabilising role. By borrowing extensively for the last 40 years, governments have been able to smooth over and temporarily delay the fundamental contradiction of capitalism: that of overproduction.

This has kept economies – and therefore currencies – relatively stable during this period. But inevitably the laws of capitalism will assert themselves at a certain stage. And since 2008, the last 40 years of debt addiction has been catching up with the world economy, with painful consequences.

Today there are a small number of bourgeois economists who argue that a return to the gold standard would solve the world’s economic problems. They point out that the financialisation of the economy, thanks to derivatives and other banking wizardry, has created a situation in which there is too much money sloshing around the world economy, inflating asset bubbles and creating money out of money without producing anything.

Their argument is that a return to the gold standard would bring all of this under control by constraining the money supply and preventing policies like quantitative easing, which serves to inject yet more hot money into the system. They also argue in favour of breaking up the big banks and banning derivatives as part of the same package of measures to de-financialise the economy.

A blind utopia

These economists are right in their description of the problem, but their cure is unworkable and utopian. Today the global economy is reliant on policies like quantitative easing and historically low interest rates. This cheap and easy money is the only thing preventing capitalist confidence and investment from falling off a cliff. It’s true that the current measures are having little-to-no effect on economic recovery, but the world economy is now so hooked on these policies that to cut them off would have a disastrous impact on world capitalism.

Those advocating a return to the gold standard say they want to rescue capitalism, but they seem to misunderstand both its present state and its historical laws. The financialisation of the economy is not a deformation of capitalism – it is the system’s logical endpoint. As capitalists desperately accelerate their hunt for profits, and as the market reaches the limits of what it can absorb in terms of commodities, the lure of making money from money becomes irresistible.

The result is the dominance of finance capital and the casino capitalism we have today. A return to the gold standard and a winding back of the clock – even if it were possible (which it is not) – wouldn’t get rid of this underlying process. It would rear its head again sooner or later.

Is inflation the solution?

Another argument put forward by these economists in favour of a new gold standard is that by fixing the price of gold at a certain level the government can create inflation out of nothing. This was done in the USA in 1933 and in Britain in 1931. For example, if it takes more pounds sterling to buy the same amount of gold, then the value of the pounds has decreased. This is the definition of inflation: being able to buy fewer goods for the same amount of money. And if the value of the currency is defined in relation to gold, then the price of everything else will go up as well.

Another argument put forward by these economists in favour of a new gold standard is that by fixing the price of gold at a certain level the government can create inflation out of nothing. This was done in the USA in 1933 and in Britain in 1931. For example, if it takes more pounds sterling to buy the same amount of gold, then the value of the pounds has decreased. This is the definition of inflation: being able to buy fewer goods for the same amount of money. And if the value of the currency is defined in relation to gold, then the price of everything else will go up as well.

From a capitalist point of view, inflation can be a good thing. It means that a country’s debts are cheaper to pay off, and it acts as an incentive for people to borrow money (as long as interest rates are lower than the rate of inflation) for the purposes of investment.

These bourgeois economists therefore argue that a return to the gold standard and the resulting inflation would go a long way to solving the world’s economic problems.

This sounds logical in theory. But it ignores the reality of the current capitalist crisis, which is one of overproduction. Nobody is borrowing money to invest at the moment, not because loans are too expensive (interest rates are rock bottom, or even negative in some cases), but because there is nowhere profitable to invest them due to market saturation. Increasing the rate of inflation doesn’t get around this fundamental problem, which is inherent to the capitalist system.

Even if inflation were a solution from a capitalist point of view (which it is not), from the working class’ point of view it would be a disaster. Inflation means that wages and savings fall in value, meaning that working class – and even middle class – living standards would fall also. This is not something that concerns these pro-gold economists, who, like all bourgeois advisers and representatives, are ready to sacrifice the interests of the working class to prop up capitalism.

The world balance of forces

But the conclusive argument against those bourgeois economists arguing for a return to the gold standard is that, unlike the pre-WWI period and the post-war boom, there is no one single economy that has unquestioned dominance over world markets today.

As explained in the first half of this article, the functioning of the gold standard is a political question, not one of abstract economic theory. The gold standard worked before WWI thanks to Britain’s preeminent position in world trade. The Bretton Woods agreement held together thanks to the economic dominance of the USA. Today, there is no country that has sufficient economic power to dominate and stabilise a global currency system.

This is demonstrated by the fact that the USA, the EU, China and Russia currently have the largest stocks of gold in the world and each is accumulating more gold as fast as possible, China especially. The current relative stability of the price of gold and the global monetary system is being maintained thanks to compromise between these four states. But the rush to stockpile gold instead of dollars, as used to be the case, underlines the decline of the USA as a global economic power.

Returning to a gold standard today would mean these states collectively agreeing to and enforcing new rules for a global monetary system. But in today’s conditions of world crisis, the economic competition between these states has never been sharper.

Even if such an agreement were to be reached, the pressure to protect their own national economies would, at a certain stage, force each state to abandon the agreed monetary system. We only need to look at the current crisis of the Eurozone, where the single currency faces an existential threat, to see how such a process might play out.

A barbarous relic

In conclusion, the gold standard, far from being a panacea for solving economic problems, is just a mechanism with which to regulate the economy. It has little to do with the underlying processes that take place in a capitalist economy. It can allow for a certain amount of wizardry to try to keep economies going, but it cannot solve the fundamental contradictions of capitalism.

The argument for a return to the gold standard is based on utopian beliefs and is disconnected from economic reality. In practical terms it would lead to a contraction in the money supply, with accompanying deflationary policies of austerity and attacks on the working class in order to maintain competitiveness and export the crisis elsewhere. “Beggar thy neighbour” policies would be on the order of the day. Meanwhile, we would see bankruptcies of businesses and banks, wiping out people’s jobs and savings.

The pro-gold economists are radical bourgeois thinkers who are trying to tackle one of the symptoms of capitalism in decline: the dominance of finance capital and casino capitalism. It is telling that the most out-of-the-box, radical solution that the capitalists can come up with offers only bankruptcies, job losses and misery, which would hurt a layer of the middle classes, as well as the working class. This shows the complete dead-end of bourgeois economics and the capitalist system today.

John Maynard Keynes described the gold standard as a “barbarous relic”. But really it is capitalism in its entirety that is a barbarous relic. Fiddling around with the monetary system will not solve the world crisis of capitalism. That can only be done by getting rid of the capitalist system that creates and fuels the crisis in the first place.