This article was

originally written on the occasion of the seventieth anniversary of the 1929 Wall Street

Crash. It was not intended purely as a commemorative or historical piece. It

was written because, to Marxists, all the signs were then apparent that another

stock price ‘correction’ was in preparation. In 1998 Long Term Capital

Management had collapsed, losing $4.6 billion in four months. LTCM was a hedge

fund. The details of their activities were arcane, but what they were engaged

in was essentially the same practice as was called ‘buying on the margin’ in

1929. In other words they were betting with other people’s money. They had been

much admired in high finance. Two of their operators, Myron Scholes and Robert

C. Merton, had won the Nobel prize in economics in 1997. Their economic

writings were mind-numbingly mathematical. However the fate of LTCM shows they

made scant addition to the sum of human happiness. But after all that had never

been their intention.

In the late 1990s the

world and his wife were setting up new technology schemes, the direct

equivalent of the Florida

land boom of the 1920s. Many of these dot.com firms never made a penny.

Commentators began speaking of a ‘new paradigm’ – exactly as in the 1920s

speculators said of the stock market boom, ‘This time it’s different. This time

it will go on for ever.’ To be fair, some veteran economists like Samuel

Brittan demurred. He had been there before. But the Marxists were largely alone

in insisting that nothing fundamental had changed. Under capitalism boom gives

way to slump.

So we were isolated

from the herd instinct of the columnists and enthusiasts who hastened to join

the new gold rush. They will not want their outpourings to be republished. We

have nothing to hide. We are proud of our analysis.

In 2000 the dot.com

boom duly collapsed. The ‘new paradigm’ was completely forgotten in the panic.

IT shares were only 6% of total share value even before the bubble burst. But

when it tanked it dragged down share prices across the board. Stock prices

continued to sink right through to 2003. It is also a moot point whether the

new economy collapse was the trigger for the recession in the real world

economy in 2001.

Republication of the

article is timely. In 2007 the sub-prime mortgage bubble finally burst. The

financial crisis has already had a knock-on effect on the banks through the

credit crunch. The capitalist world stands on the threshold of recession.

Marxist analysis of capitalism has been vindicated. Now the working class needs

to apply the programme of Marxism and abolish the capitalist system once and

for all.

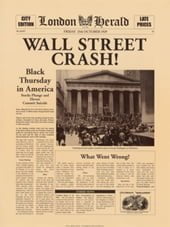

On the eve of the great 1929 stock

exchange collapse, a journalist asked a speculator how so much money was being

made on the market. This was the reply:

"One investor buys General

Motors at $100"(he meant a GM share) "sells to another at $150, who

sells it to a third at $200. Everyone makes money".

This seems pure magic, but for a

while it can work. In a ‘bull market’ as in 1925-29 nearly all share prices go

up and up. Over those years US industrial shares trebled in price!

It’s happened again. In 1982 the Dow

Jones index of American share prices hit 1,000. Now shares are yoyo-ing around

at just under 11,000. For most of that period ‘investors’ could just sit back

and watch their money grow by more than 15% a year.

At the end of 1928 outgoing

President Coolidge surveyed the American economy with undisguised complacency.

"No Congress of the US ever assembled" he intoned, "on surveying

the state of the Union, has met with a more pleasing prospect than that which

appears at the present time. In the domestic field there is tranquillity and

contentment……and the highest record of years of prosperity".

Today, as in 1929, experts are

wheeled out to assure us that ‘the market is fundamentally sound’. But Marxists

believe that what goes up must come down.

To understand the apparently

mysterious movements of the stock exchange, we must go back to basics. The

foundation of the capitalist system is the pumping of surplus value (unpaid

labour) from the working class in the production process. The capitalists own

the means of production mainly in the form of shares. A share in a company is

simply a piece of paper entitling its owner to a regular dividend. A share

dividend is simply that part of the firm’s profits that is paid out to the

shareholders. That dividend in its turn can only be a part of the unpaid labour

of the working class.

Once a company has been floated on

the stock exchange, its shares pass from hand to hand. The company in question

gets no part of the share’s selling price. If I buy a second hand Ford share,

Ford no more benefits than if I buy a second hand Ford car. Of course new

shares can be issued to finance new investment. But since the Second World War

this has been an insignificant source of investment finance, specially in the

Anglo-Saxon countries. The main funds either come from funds ploughed back, or

from bank loans. In fact in some years in this country share capital has been a

negative source of company finance – firms have actually gone out spending

money to buy back their own shares.

So shares are just pieces of

coloured paper traded on the exchanges. How do speculators assess their value?

One point of holding a share is to collect the dividend. So a share price

reflects expected future profitability. But if profits are expected to rise,

then the price of the piece of paper will rise as speculators pile into shares.

So as the bubble blows itself up, speculators gain both ways – from dividends

and the rising price of their paper asset. We get the interesting situation

where shares are going up because people are buying them – and people are

buying them because the share prices are going up.

The herd instinct of the traders can

produce rushes and panics for all manner of reasons. At root though the health

of the stock exchange is a reflection of the profitability of the real economy

– even though there can be time lags and overshooting before trends in the real

economy eventually make themselves felt on the floors of the exchanges.

Once a bull market has begun, the

‘animal spirits’ (as Keynes called them) of the entrepreneurs take over.

Everyone wants to be in on the getting while the getting is good. An orgy of

swindling is the natural result. This signals that the boom is peaking, and was

regarded as a natural stage in the cycle in Kindelberger’s classic book

‘Manias, panics and crashes’. In the 1920s the Florida land boom pushed up the price of a

plot of land from $1,500 in 1914 to $1.5 million in 1926 – even though the land

in question was a patch of swamp! (That particular plot, following the

inevitable and spectacular collapse in land prices, has still to this day not

recovered its 1926 price.)

There have been speculative booms

before and since. The capitalists who take part are not stupid. Their system is

stupid. As the Chicago Tribune pointed out in 1890, "In the ruin of all

collapsed booms is to be found the work of men who bought property at prices they

knew perfectly well were fictitious, but who were willing to pay such prices

simply because they knew that some greater fool could be depended on to take

the property off their hands and leave them with a profit". Regular

readers will recall that we have already got beyond that stage in the present

cycle, as evidenced by the bailout of the crooks at Long-Term Capital

Management, the mysterious but powerful hedge fund.

Just like the 1920s, the present

period has produced in the likes of Calvin Coolidge the illusion that the good

times will go on for ever. They are talking about a ‘new paradigm’ – a whole

era of capitalist upswing in the offing. Older hands know that when that sort

of talk starts it’s time to sell. In September 1929 the Times (which was once a

perceptive paper) commented, "It is a well-known characteristic of boom

times that the idea of their old unpleasant way is rarely recognised as

such". Samuel Brittan has written a couple of articles recently attacking

the notion of a new paradigm in the Financial Times – ‘Nonsense on stilts’ and

‘Bubbles do burst’. The economic analysis unit of the HSBC, formerly the

Midland Bank, says "Virtually all the indicators checklist are flashing

red for the US" and "When such bubbles burst soft landings never seem

to be within reach". And what is the FT hinting at when in August they

publish as part of their series on business classics Charles Mackay’s

‘Extraordinary popular delusions and the madness of crowds’?

Share manipulations and the urge to

buy shoot way beyond the ability of the real economy to deliver more and more

prosperity to the upper classes. As the share boom peaks the speculators look

like a load of Hanna and Barbera lemmings who have just run over a cliff and

are only held aloft by their own obliviousness to their real situation. But the

laws of gravity will assert themselves. What goes up must come down. The crash

brings them back to earth.

A secondary failure or hiccup can

turn boom into bust when the time is right, as we shall see. Then we have

another interesting situation where speculators sell shares because they are

going down – and shares are going down because people are selling them. The

whole film of the boom is played back in reverse.

Serious analysts have tried to

explain the Wall Street crash as being caused by Massachusetts Department of

Public Utilities forbidding Boston Edison which generated its electricity from

‘watering’ its shares by splitting them 4-1.Others have derived the Crash from

the failure of the Clarence Hatry group, which made slot-machine vending

devices, in Britain in September. If such an issue is capable of producing a

devastating depression throughout the world, leading in time to the rise of

Hitler and the Second World War, then there could be no greater indictment of

the irrationality of capitalism. But of course this was a superficial glitch

that could be shrugged off if the economy was in boom. Arguments between

capitalists over the spoils are after all a permanent feature of capitalism.

Rummaging through these explanations, Galbraith muses as to the crisis of

confidence, "What first stirred these doubts we do not know, but neither

is it very important that we know." The fact is that such incidents are at

best triggers of crisis, but not its ultimate cause.

Then there is the theory that the

crash was a manifestation of panic. Well, it was. Galbraith’s book ‘The great

crash 1929’ is mainly about Wall Street, not the real economy. He describes the

mood on the exchanges on Thursday October 24th."That day 12,894,650 shares

changed hands, many of them at prices which shattered the dreams and the hopes

of those who had owned them….The panic did not last all day. It was a

phenomenon of the morning hours….the uncertainty led more and more people to

try to sell. Others, no longer able to respond to margin calls, were sold out.

By eleven-thirty the market had surrendered to blind, relentless fear. This

indeed was panic." But the panic, as we show, was rooted in the collapsing

profits of the firms whose shares were being traded relentlessly down. Mass

psychology is often used by people who can’t explain events in any other way.

But by explaining everything, they explain nothing. The events described by

Galbraith are from the first nasty hiccup, before the meltdown of Black Tuesday

October 29th. The exchanges had already been drifting down throughout

September, and there had been a couple of panic attacks the previous year.

Animal spirits and the herd instinct can explain why share prices soar above

the objective possibilities of making money out of the working class. October

1929 showed they could also crash below. But these attitudes merely amplify the

swings in an economy based on profit-making.

Another explanation offered for the

crash was the phenomenon known as margin trading. In the 1920s it was common

for speculators to buy by putting a small fraction of the face value down in

hard cash , with the rest to follow. In a rising market, what was the harm? In

three months time the share was bound to be worth more than what it was now.

This sounds very arcane, but it’s not much different from buying from the

grocer on tick. It’s credit – borrowing. To be more exact it’s gambling with

other people’s money. It’s the equivalent of borrowing from the bank to put

money on a dog. So long as the dog wins there’s no problem paying the bank

back. But if it doesn’t…

The difference with Wall Street in

1925-29 was that all the dogs were coming in. That’s how it is on the stock

exchange in a bull market. But just to make it interesting, all of a sudden all

the dogs start to lose for no obvious reason. All shares go down in what is

called a bear market. That is what happened in October 1929.

The ‘explanation’ of margin trading

doesn’t explain the sudden reversal of trend. It helps to explain why the

reversal was so catastrophic and became so general. It explains why brokers

were found washed up in the Hudson river with

a pocket of nothing but margin calls.

Margin trading was gambling with

other people’s money. What it did was drag wider layers of people into the

rout. It spread the collapse on the stock exchange to the rest of the economy

by making a lot of people a lot poorer very suddenly. But gambling with other

people’s money is a general feature of capitalist finance. It’s called leverage

in the trade. Long-term, the hedge fund that was bailed out after near collapse

last year was doing just that. That is precisely how hedge funds make their

money, and why it matters to the rest of us when they don’t.

It would be a mistake to get dragged

too deep into the ‘explanations’ offered by the wizards of high finance.

"The difficulty with all these lines of reasoning, however, is the speed

with which the collapse of production took place, and the fact that it began well

before the stock market crash. Industrial production fell from 127 in June to

122 in September, 117 in October, 106 in November, and 99 in December.

Specifically, automobile production declined from 660,000 units in March 1929

to 440,000 in August, 416,000 in September, 319,000 in October, 169,500 in

November, and 92,500 in December.

No quantity theory of money or

autonomous shift in spending, with or without a decline in the stock market,

can account for these precipitous movements. They require an old-fashioned

theory of the instability of the credit system." This quote comes from

Kindelberger’s classic ‘Manias, panics and crashes’. He is polemicising against

the conventional monetarist and Keynesian explanations of the slump. One correction

needs to be made to his last sentence. What we need is an old-fashioned theory

of the instability of the capitalist system. And that starts with its

profit-making potential. Looking at fundamentals, we see that industrial

profits were up 156% between 1924 and 1929. But industrial shares trebled in

value over the same period. By 1929 the system had exhausted its ability to

keep pushing profits up, and the stock exchange was walking on air.

Kindelberger is right to raise the

role of credit, but he doesn’t see its wider social context. What newcomer to

marxism has not sighed in irritation as they open Capital and find an

apparently pointless discussion as to how in a commodity private labour

presents itself as its opposite – social labour. But the point Marx is making

is that there is a division of labour, but in a commodity, capitalist economy

our mutual dependence goes unrecognised. In the 1920s there was a

well-established worldwide division of labour, in which the USA produced most of the world’s cars while Malaysia

specialised in the export of tin and rubber. We need tin to make solder joints

and for various other uses in car production. Any engineer can work out how

much tin we need to make a car, and how much to make 660,000 cars (US

production in March 1929). It’s even easier to work out how much rubber goes in

a tyre. But under capitalism nobody makes those calculations – that would be

the way in a planned economy. Nobody knows how much tin or rubber or how many

cars the world needs. In a global economy dominated by commodity production

individual capitalists plough their lonely furrow, concerned only with the

making of money.

But when the car factories started

laying workers off, and by December 1929 were only churning out 92,000 cars,

that was bad news for tin and rubber workers in Malaysia. The little local

difficulty in Detroit

became a global crash. That is what credit does – it generalises local problems

as well as it generalises local prosperity. It drops us all in the same thing

together, whether we know it or not. Credit is one of the ways we are all drawn

into the world economy as cogs. It is one way a global division of labour is

established behind the backs of the participants.

We have seen that the economist

Thomas Wilson was right when he noted that the market slump "reflected in

the main the change which was already apparent in the industrial

situation". But the financial collapse in turn reacted back on the

fundamentals. By 1929 one and a half million people had been drawn in to playing

the stock market. It was these little people who were most likely to be

suckered in the wake of Black Tuesday. Of course as the ordinary folk who had

lost everything pulled their belts in so tight it almost cut them in half, then

they certainly were going to have to stop running out every year and buying a

new car. Very likely they might sell their existing model to get themselves out

of a financial hole. This nice supply of cheap nearly-new cars, of course, was

further cutting into the market for new cars, and the jobs of car workers. This

further piece of bad news would be heard soon enough in Malaysia. The

lesson of 1929 was – we’re all in this together. The crisis began in the real

economy, not on Wall Street. The crash made things worse back there in

industrial USA,

and all over the world where commodities are produced and exchanged.

The slump spiralled down, in

production, trade and money. In 1932 there were 15 million jobless in the

States, out of a labour force of 45 million. By the beginning of 1933 American

national income had fallen by a third. World trade in this year was less than a

third of its 1929 level. Germany

was particularly hard hit by the Stock Exchange crash and the subsequent

depression. If industrial production in 1929 is taken as 100, by 1932 it was

only 53. That statistic, and the failure of the workers’ leaders to respond,

led straight to the rise of Hitler.

Most people keep their money in

banks. If too many lose their money, the banks go bust. Over this period about

9,000 banks closed their doors in the States. The banks tried to hang on by

ruthlessly foreclosing on mortgages, bankrupting swathes of American farmers,

especially in the south-western states. As the banks went bust, most people who

kept their money in them lost everything. And so on.

In Austria in 1931 the Kredit Anstallt

bank, laden with debt, bowed out. The ensuing wave of bankruptcies deepened the

crisis throughout Europe.

In Britain the collapse of Kredit

Anstallt brought a speculative attack on the pound. The Treasury demanded the

minority Labour government of Ramsay MacDonald show its responsibility to the

international financiers by cuts in public spending – cuts in benefit,

teachers’ wages and servicemen’s pay. Today this would be called a Structural

Adjustment Programme. The Labour government split, was ousted and replaced by a

National Government, including Labour renegades, who came to power with a brief

to put the boot in to working people. The political repercussions of the Crash,

and the slump that followed it were huge. It changed the face of the planet.

To the question – ‘will it happen

again?’ – the answer must be not whether, but when. The bad news from 1929

about bull markets is – the bigger they come, the harder they fall.

Mick Brooks

October 1st, 1999