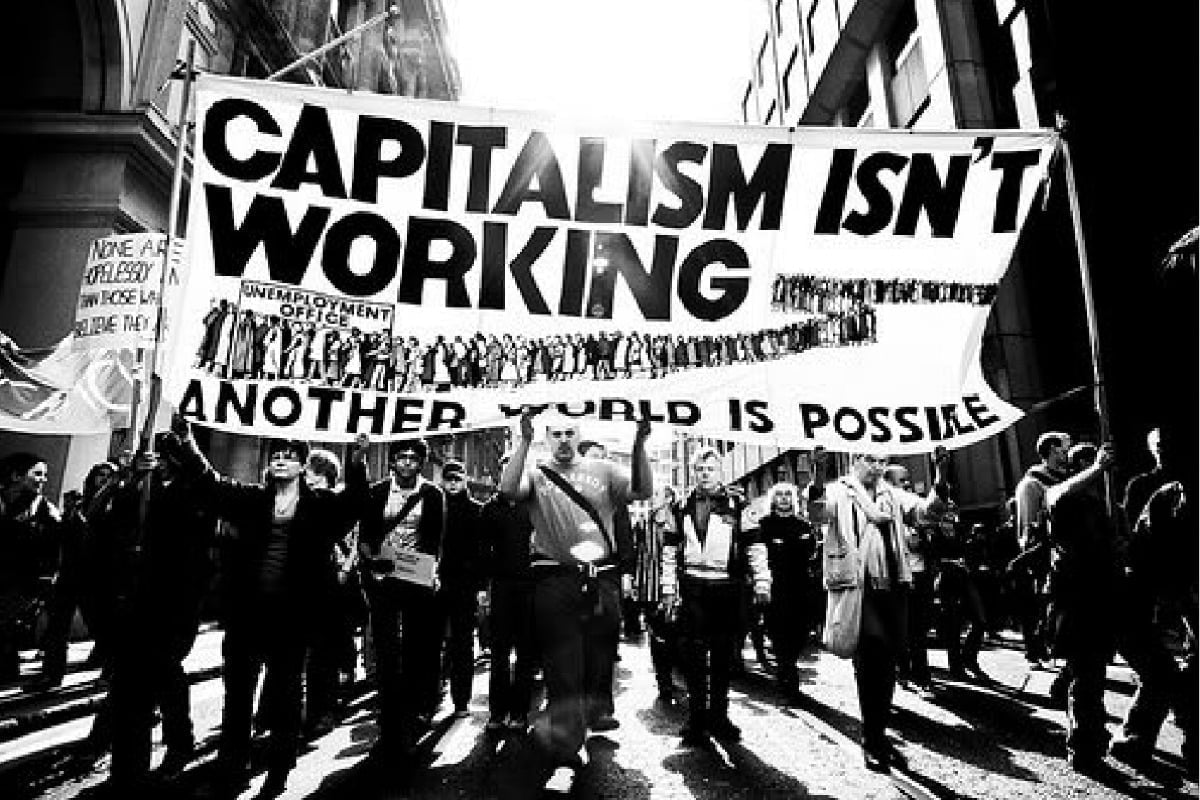

As we approach the 10th anniversary of the start of the 2007 financial crash, all the warning signs point towards the onset of a new stage in the world crisis of capitalism. For the working class, meanwhile, the crisis never ended – it has been a decade of attacks and austerity. A socialist alternative is needed to this chaos and misery.

“Another global crisis? It will never happen again.” So says Sir John Gieve, the Bank of England’s deputy governor for financial stability, one of those who presided a decade ago over the greatest economic crash since the 1930s.

Nobody should be fooled by Sir John’s promise, however, on this tenth anniversary of the start of the 2007 financial crash. It was a time when workers lost their jobs, wages were slashed and homes were repossessed. To save the banks, Northern Rock and others were nationalised by the taxpayer. Trillions of pounds were used to bail out the capitalist system – and we are still paying the price today.

For the working class, the crisis does not seem to have ever ended, despite the huge profits now being raked in by the boss class. Now a new crisis looms.

Storms clouds gathering

Lord Alistair Darling, the former Labour chancellor, has warned that the “the lesson from ten years ago is that something that can start as apparently a small ripple in the water can become mountainous seas very quickly.”

Jack Lew, the former US Treasury secretary, adds, “We all know that crises will come in the future, what we don’t know is when and how.”

But the “when and how” are now playing out before our very eyes. The build up to the coming crash is eerily similar to the last.

Consider this scenario. A wall of cheap credit chasing profitable investments. Bankers and financiers determined to boost their profits by buy up billions of dollars of risky loans and repackage them into complex investments with multiple layers of debt. Credit rating agencies such as Moody’s and S&P classify them as triple “A”. Capital chased around the world, forming speculative bubbles wherever it goes.

This is not a description of events in 2006 or 2007. This is today.

“Financial weapons of mass destruction”

This is the view reached by the Financial Times – hardly a Bolshevik newspaper – in an article called ‘Sequel to the Global Financial Crisis’. The article reveals how financial regulators have been flouting the law for years – and still are – and that all the factors are now present to usher in a new crisis.

This is the view reached by the Financial Times – hardly a Bolshevik newspaper – in an article called ‘Sequel to the Global Financial Crisis’. The article reveals how financial regulators have been flouting the law for years – and still are – and that all the factors are now present to usher in a new crisis.

Instead of putting their money into buildings, factories, machines and the employing of workers, the bankers and capitalists are investing their money into profitable bits of paper, with strange names like Collateralised Loan Obligations.

These fancy pieces of paper are simply bundled together loans of dubious quality. Most are of “junk” status, as was the case prior to 2007. Yet the risk is deliberately played down and they are officially given a triple “A” stamp of approval by the credit agencies. The greater the risk, the greater the returns! Or in the words of the Financial Times, the more “opaque” the “more profitable.”

In May, there were two Collateralised Loan Obligation (CLO) deals worth more than $1bn each and it is estimated that $75bn worth of CLOs will be agreed by the end of the year. Antares Capital recently closed a $2.1bn CLO deal which was the largest in the US since 2006 and the third-largest in history.

In the end, however, these financial instruments will become toxic and worthless. In the words of Warren Buffet, the hedge fund billionaire, they are nothing more than “financial weapons of mass destruction”.

Speculation and gambling

But do the speculators care? Why halt the merry-go-round when everyone is making so much? Recently, Ashish Shah, a managing director of Madison Capital Funding, a subsidiary of New York Life, told a panel of CLO experts they should not worry too much about defaults. “The appetite for assets is ferocious,” he said.

This at least is true. With interest rates historically low, pension funds, insurance companies and other institutions are eager for such lucrative high rates of return. However, this is all market speculation, simple gambling albeit at a very high level.

Legal restraints like the Dodd-Frank law in the US were supposed to put a stop to all this after the last crash but whatever the laws say, the capitalists and financiers have simply got around it. In fact, the financial authorities have deliberately allowed the credit agencies to circumvent the law. Nothing is allowed to get in the way of making money, no matter what the consequences might be. In anycase, as 2007 showed, the state will be made to bail out any losses…for the very rich only of course.

House of cards

Once again the cracks are beginning to show. We are told it will all be OK this time round. However, this is not going to be the case. Similar promises were made about the mounting risks during the early 2000s, just before they started spreading like a virus to the major banks and finance houses like AIG and the markets begun to spiral out of control, contributing to the biggest economic slump since the 1930s.

Once again the cracks are beginning to show. We are told it will all be OK this time round. However, this is not going to be the case. Similar promises were made about the mounting risks during the early 2000s, just before they started spreading like a virus to the major banks and finance houses like AIG and the markets begun to spiral out of control, contributing to the biggest economic slump since the 1930s.

In fact, the situation is far more serious this time round as the world economy is already in a parlous state. Any sudden shock to the system could bring the whole edifice crashing down around the feet of the bankers and financial speculators, leading to another Great Depression.

Virtually every class of US debt — sovereign, corporate, unsecured household/personal, auto loans and student debt — is at record highs. Americans now owe $1tn in credit card debt, and a roughly equivalent amount of student loans and auto-loans which, like the subprime mortgage quality that set off the 2008 financial crisis, are of mainly low credit quality (and therefore high risk). Today, total public and private debt obligations estimated at 350 per cent of the US gross domestic product.

The system is broken

But this is not just a US problem. Globally, the picture is similarly precarious, with debt stubbornly high in Europe, rising in Asia and surging across broader emerging markets. “A decade on from the beginning of the financial crisis, the world has the makings of a fresh debt crisis”, warns the Financial Times.

But this is not just a US problem. Globally, the picture is similarly precarious, with debt stubbornly high in Europe, rising in Asia and surging across broader emerging markets. “A decade on from the beginning of the financial crisis, the world has the makings of a fresh debt crisis”, warns the Financial Times.

With world trade slowing and protectionism on the rise, the contradictions of the capitalist system will inevitably break through this wobbling economic scaffolding.

In the final analysis, all this anarchic system can now produce is crisis, austerity cuts, wage freezes, job losses and falling living standards for working class people. As Marx explained long ago, the profit system means growing wealth at one end and growing misery at the other.

It is time we put the socialist transformation of society back on the political agenda. The ending of this crisis-ridden system once and for all is long overdue. This could be achieved by a Labour government, armed with socialist policies, taking over the banks and major companies that dominate the economy, without compensation. To ensure accountability, these should be run under democratic workers’ control and management.

This would allow us to plan the economy and use its resources to rapidly increase living standards for all. No more handouts to the rich and the bankers, these people have sponged off the working class long enough. We could use modern technology and automation (this time working for us not against us) to dramatically cut the working week, end unemployment and provide people with the time to involve themselves in the running of society.

Socialism can open up a bright and prosperous future for humankind, cleansed of war, hunger and oppression. Join us in fighting for it.